One of the curiosities of the commodity collapse since the end of last June has been how various financial derivatives have been thrown off. I’m not speaking of credit default swaps of small businesses that provide sand to fracking rigs or “products” like that, but something far more basic. The price of commodities should, you might think, provide a basis to evaluate companies that are equally basic to the actual economy.

Here I am referring to materials businesses, an industry that is broad enough to incorporate chemical synthesis alongside more earthen endeavors like mining. With that kind of business foundation, you would at least expect some decent correlation with commodity prices in general if not specifically to each’s individual references. And where commodity prices are acting in full and complete concert, you might even expect that materials businesses in general would closely follow suit.

In this age of financialism for the sake of financialism, maybe that is not as straightforward as it sounds (setting aside whether it should be). There is, in fact, a yawning rift between the stocks of materials businesses and commodity prices.

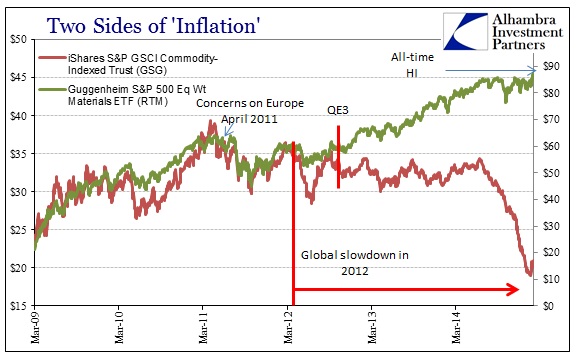

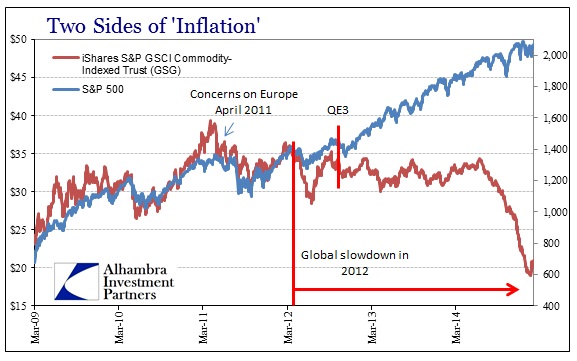

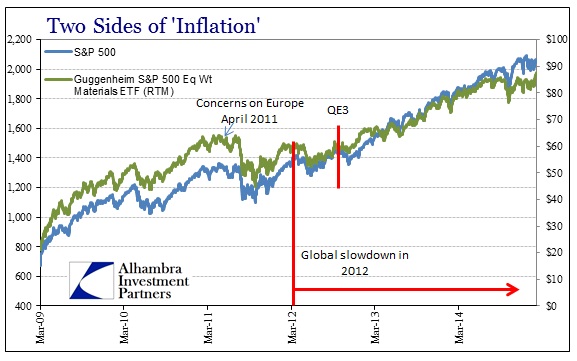

The Guggenheim Materials ETF (RTM) is at an all-time high just recently despite the crash in commodity prices, where that ETF (GSG) plumbs new depths. But this isn’t just a recent development, as there was a clear break between the two sometime around 2012 – either when the global and US economy slowed or at the moment of QE3 instigation. If that divergence sounds especially familiar, that is because it is almost exactly replicated by the broader S&P 500 index itself.

It’s actually quite amazing in how the combined stock performance of the materials industry breaks so free of basic commodities yet conforms so well to the rest of the stock “market.”

The immediate question raised is whether this should matter at all. Materials firms are certainly exposed to commodity prices and thus price risk on their revenue lines, but commodities also factor as an input cost. So it may not be a straightforward interpretation; but then again the only aspect that is so obvious is the very close correlation with stocks that bear no resemblance other than price activity.

The materials index itself, and the holdings of the ETF which seeks to mimic it, are replete with the names you would expect given the nature of the industry.

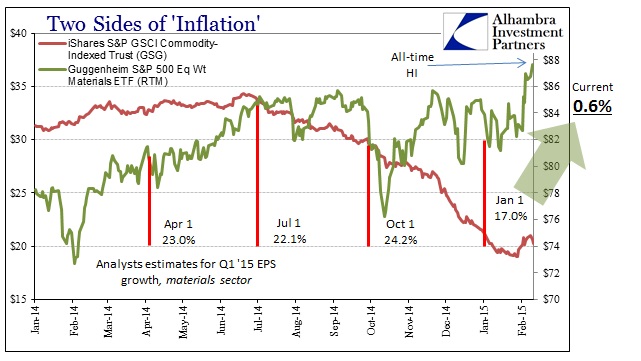

To my eye, the majority of the names would seem to fare poorly under collapsing commodity prices vs. an unaltered price regime. And that seems to be the case as demonstrated by earnings trends for the entire materials (not limited to the companies in this ETF) sector in the as-yet unfinished Q1 2015 quarter.

According to analysis by Thomson Reuters I/B/E/S via ZeroHedge, earnings for the materials sector of the S&P 500 have by and large collapsed with commodity prices (with a delay, as analysts are typically slow to count disappointment as opposed to anything that might excite).

As late as October, estimates for Q1 2015 were +24.2% EPS growth, and even +17% just a month and a half ago. Currently, estimates are basically zero, having sunk as quickly as commodity prices. Again, at the same time earnings have dropped off stock prices have done the opposite.

None of this is a hard suggestion that commodity prices are the dominant factor in setting earnings and revenue growth in the materials sector; indeed I would actually add the “dollar” as a method of reduction here. But in that sense it is not at all separable from commodity prices as they both mean the same thing. The “rising dollar” is global “tightening” financially, typically as a result of financial perceptions about actual business conditions. Commodity prices are pretty much the same without the need to gain too much financialism, especially since commodities need to be physically cleared of supply and demand imbalance.

So it is highly interesting, especially to those that might discount the idea of a stock bubble, that materials businesses would cling so closely to the rest of the homogeneous equity “market” without taking much notice of either commodities or the “dollar” even when it hits them squarely in the bottom line almost all at once. Of course, stock investors may be simply overlooking one quarter’s trouble and viewing the longer-term picture, but I don’t know of anybody that actually believes that of stock “discounting” anymore. Besides, the number and degree of revenue and earnings warnings are not being limited to just Q1.

I may be oversimplifying too much here to make my point, but I think it will withstand scrutiny well under these more extreme conditions – circumstances that I think are beginning to reveal imbalance far easier than at any point maybe since QE3 started. Again, there may be good reason for this divergence, but certainly not to the extreme where stock prices of materials businesses follow almost exactly the overall S&P 500 in total disregard for commodities, especially when it is harder now to argue that commodity prices (or the relation of the “dollar”) don’t much matter to materials businesses.

Stay In Touch