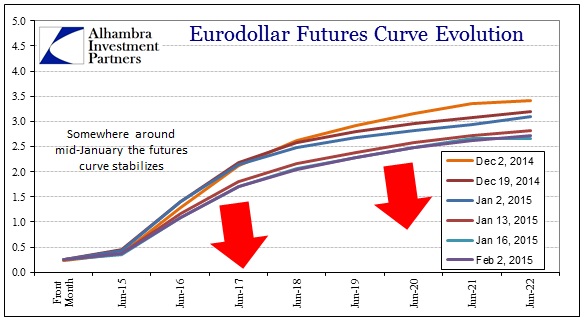

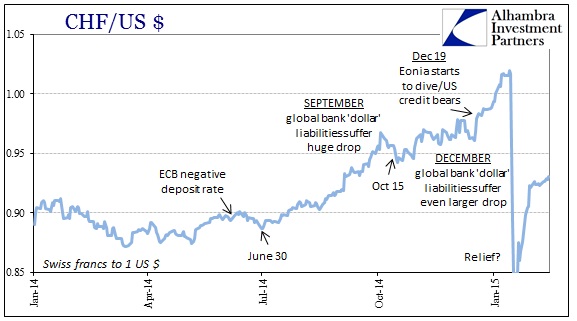

I continue to believe that the Swiss National Bank’s action on January 15 opened a “release valve” of sorts inside the world of the global “dollar.” Prior to that day, heightened bearishness all throughout dollar-denominated credit dominated trading. That included funding markets, especially eurodollars. The eurodollar curve itself ignored almost everything else, including the FOMC switch to “patience” in December, running quite dramatically and contrarily to any idea of an end to ZIRP.

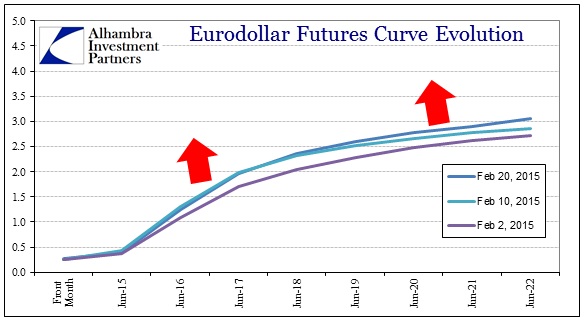

The curve stabilized sometime between January 15 and February 2. Granted, there was a lot that happened in those few weeks so I would not hold it against anyone who viewed the ECB’s QE or even the lack of Greek finality with the new election results as being the primary factor, but I think the timing of a lot of this relates to that Swiss pressure in and out of the “dollar.” After February 2, the eurodollar curve started to act more aligned with mainstream outlook for monetary policy (or what the FOMC wants everyone to believe).

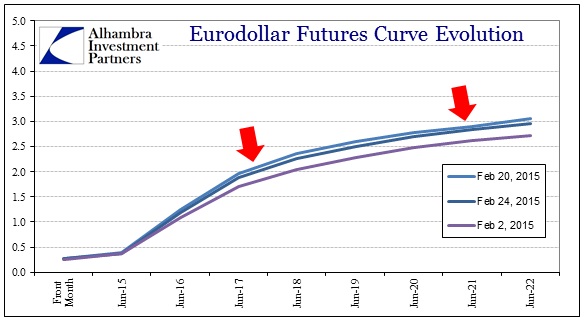

Obviously, there are daily variations in between these generalized moves, but for the most part between the beginning of February and last Friday the eurodollar curve was commonly moving upward. Trading this week so far has seen the largest and most sustained countertrend (once more alike the Dec-mid Jan move). That might suggest an end to the “reprieve” that was offered at least starting with the SNB’s peg removal on January 15.

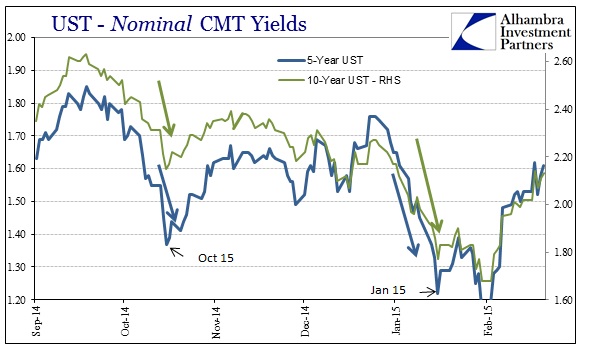

Nominal yields in UST markets would seem to concur. The 10-year rate had seen heavy buying right up into January 15. The yield would go slightly lower to the end of January, but there is little doubt about what looks to be a second period of high illiquidity and frantic, almost panic buying in UST (uncertainty) on par with October 15; all ending with the SNB’s peg removal.

Like eurodollars, rates have risen back up dating to February 2. Trading this week also echoes eurodollars, in that UST’s have been once again sharply bid, with the 10-year trading back below 2%. That doesn’t mean this is necessarily a continuation or likeness of the December-mid January illiquidity, but that is at least a suggestion or possibility given the size and scope so far this week.

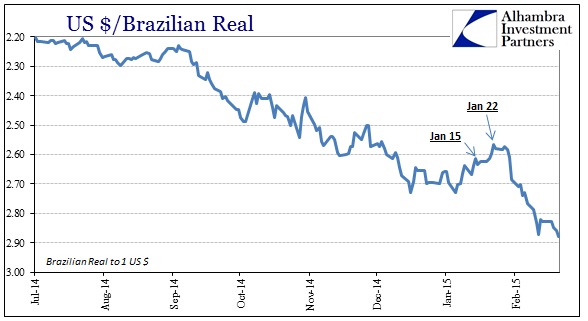

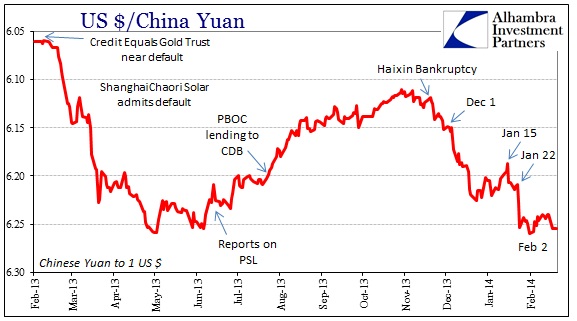

In many ways that is unsurprising, as the SNB’s “dollar” relief did not halt all “dollar” irregularities. Rather, it seems as if the action in Europe simply reminded traders of the desperate problems elsewhere. It’s almost as if the “dollar” market can only focus in one arena at a time (for now), and the end of Swiss disorder opened it back up for Brazil and even China.

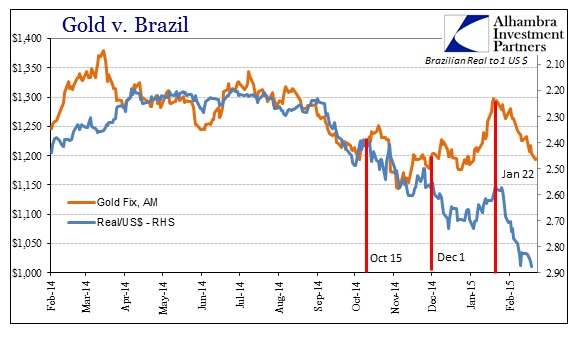

As usual with all things “dollar”, gold has been tested and pushed via collateralization back downward. This time, however, I think the behavior of gold demonstrates beautifully this pricing dichotomy, as the rising price I believe was due to Swiss problems (and gold as “tail risk” insurance) whereas the declining price fits within what we see of the real and yuan (“dollar” collateral). I had suspected that European problems, including “dollar” problems, would be the catalyst for the safety bid which is unlike anything similar of EM instability. That seems to have been the case throughout the Swiss end of all this.

As a reminder, gold’s absolute peak in September 2011 came just one week before the peg was instituted on the franc in the first place, which I think highlights yet again the central nexus of Europe as it relates to the “dollar”; Switzerland in particular. I certainly am not expecting that untying the franc from the euro means that gold is now free to fall without any further use, only that the sharpest bid tends to correlate with euro/dollar issues where the Swiss are central (as the Swiss banks are active and heavy participants in all funding currencies). Indeed, as shown above, there are still “dollar” problems out there, and the latest “reprieve” in February may actually be at its end.

Furthermore, the Swiss banks are not free of imbalance either, only the sinking anchor of the euro to heighten and amplify the distress.

Again, anyone can ascribe ECB QE or something else to behavior in these markets, but the timing and similarities to past illiquidity episodes more than suggest to me European “dollars.” The SNB likely had its hand forced by the desperation that was clearly building into mid-January, but even with that relief-valve activated and the franc free to move toward the “dollar” again that does not mean all is well and done. Like October 15, January 15 is just the next step in the process that shows “dollar” attrition – which may yet have already begun.

Stay In Touch