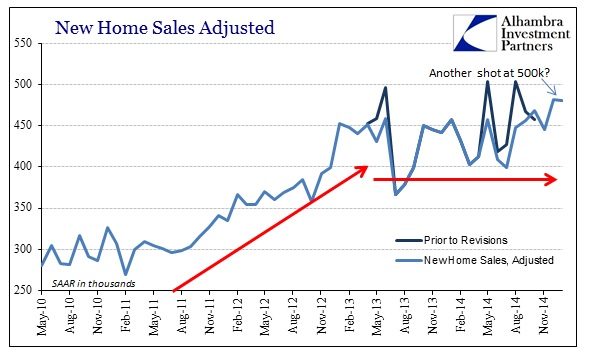

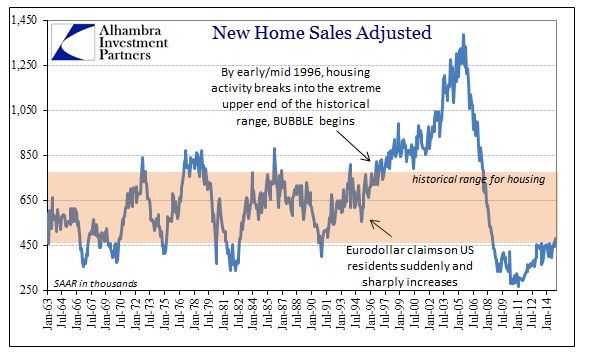

The pace of new home sales continues to be stuck right below that 500k SAAR, a flattening of activity that dates back really to January 2013. The data has at times peaked above 500k only to be revised subsequently lower, which does not provide a whole lot of confidence about recent months. January’s level was slightly below December, but volatility (including revisions) prevents any kind of interpretation about the shortest term.

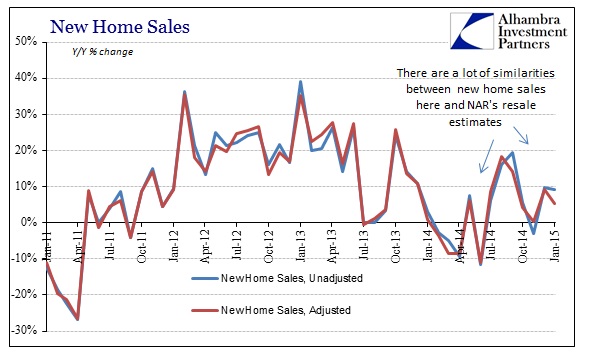

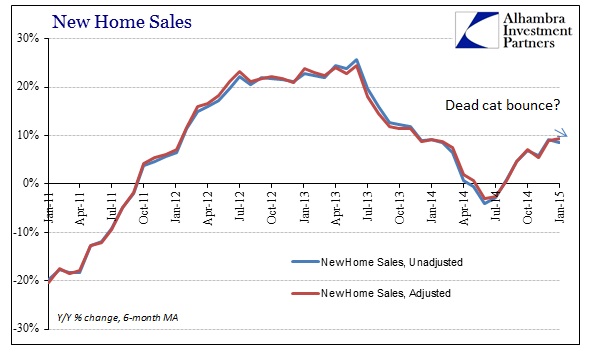

Looking at it year-over-year, it is clear that the trend in sales matches closely the NAR’s version of resales. Existing home sales there nearly collapsed last winter before rebounding through the summer; only to fall back again this winter. New home sales seem to confirm that interpretation of the housing “market”, as there was certainly an initial decline, temporary rebound and what looks like a resumption of “winter.”

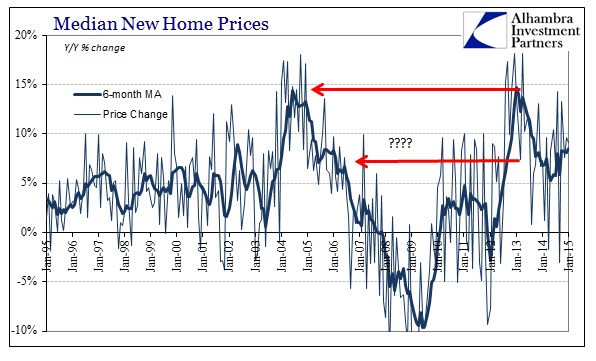

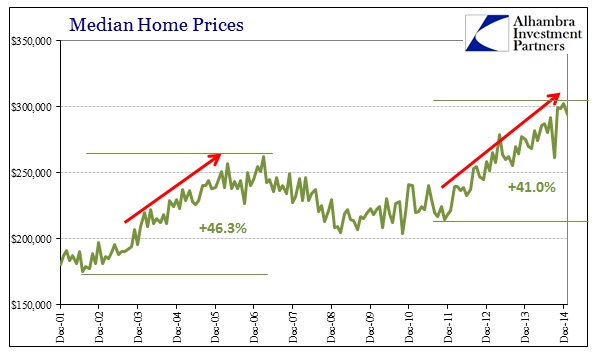

I think more important than the pace of sales is the estimate for median sale prices. The trend is still upward, but more destabilized than it had been during the big run in 2012 and the first half of 2013. However, whatever the actual pace of sales, new home prices are still rising likely being drawn upward by the upper tiers. If it were anything other than such bubble behavior, sharply rising prices would be pulling up construction activity precipitously as it had done in the mania phase of the housing bubble after the dot-com recession.

In other words, prices are rising sharply for new builds, but on one-third the volume.

It is emblematic of the overall economy, as those doing well accessing asset inflation are doing well everywhere. Unfortunately, economic theory about such “aggregate demand” is not proving to be anything other than academic, as there is no positive spillover for the rest increasingly left behind. Regardless, the current move in prices is no less dramatic and confirms the fact that this latest housing “market” experienced nothing less than its own bubble, mini as it may have been.

The problem with bubbles is that they grow narrow closer to the top, meaning that they leave too many behind in order to be sustainable. In this case, wages just haven’t kept up with prices, and so the real estate “market” starts to become unstable – as we have seen in both new home building and sales as well as resales. With activity looking to be on the slowing side again, there isn’t much here to suggest a rebirth of construction activity beyond providing what can only be described as a niche service to the asset inflationists. For the broader economy, there isn’t much participation at all with continually depressed levels of activity, which is made worse by the fact that there may be far more downside risks here than upside to “aggregate demand.”

Stay In Touch