Despite all evidence to the contrary, an imbalanced ledger of data that grows more imbalanced by the month, commentary continues to describe QE as pro-growth stimulus. As usual, the purest form of rebuke to that sentiment can be found in Japan where QQE has performed a global service just not in the way its theorists and practitioners had envisioned. The Bank of Japan may well be proving beyond a doubt just how and why QE of any form is depressive, hopefully at some point freeing people to actually investigate alternatives (most especially stop doing more and more).

Despite GDP that was positive in Q4, there is absolutely no indication that it was anything but a positive number. Redistribution is supposed to benefit someone somewhere, but it is clear from the data that any such “winners” are not among the vast majority of Japanese people themselves. Instead, by inference, if there are Japanese enjoying QQE they are certainly located within the financial sector alone. Japanese households continue to get the QQE hammer:

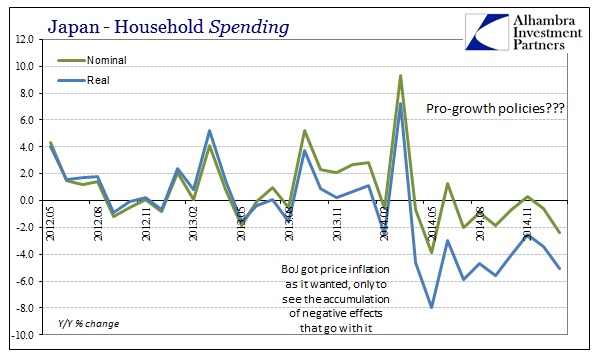

Even nominal spending in January was negative again, as it has been for most of the time since the tax increase. Disregarding what GDP may allow for interpretation about a “recovery”, January 2015 was actually the second worst showing in nominal terms since the earthquake in 2011. There is no way to spin that as due to some erroneous or overwrought inflation calculation, as nominal household spending continues to be not only negative but seriously so.

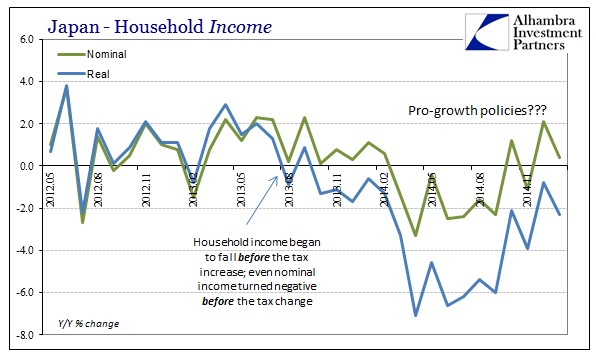

There is no mystery as to why, either, as Japan, like the US and Europe, is short of wage growth. Household income continues to shrink, a trend that obviously predates the tax issue and places emphasis squarely upon the “inflation” the BoJ still, somehow, says will lead Japan out of this. The only way that sentiment might be fulfilled is if it refers to destroying the economy completely and then rebuilding it in the central bank’s own image.

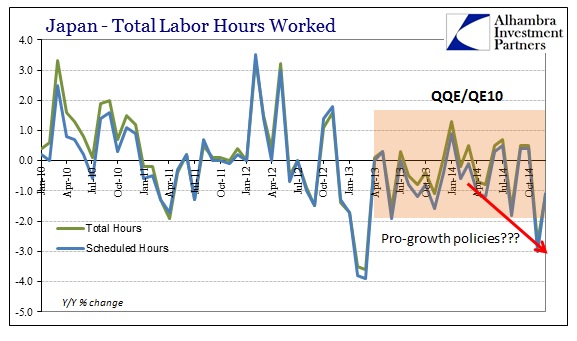

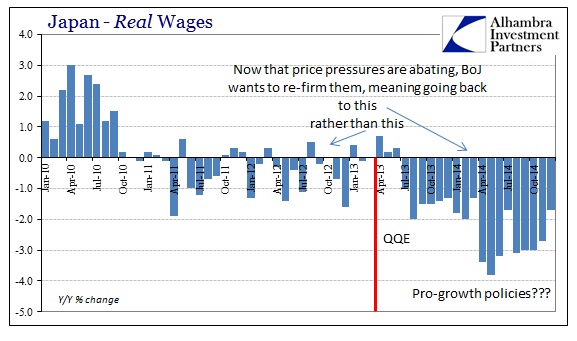

The problem with reshuffling nothing but paper currency is not just that households and workers get the short end of it, the entire economy undergoes serious attrition – which is why workers and households will remain the “losers” in all this. For all the discussion about inflation and deflation, the fact of the Japanese economy is that there is less and less labor utilization the further it goes. The unemployment rate may well have fallen, but the measure of total hours worked, just like the US, shows that actual productive activity is on the decline.

That contraction in volume has only grown worse in the past few months. Thus there is no confusion about the lack of wage growth as Japanese businesses simply don’t have anything for these workers to do regardless of any changes in nominal profitability (again, just like the US). While orthodox economists would plead with Japan Inc. to pay more for less work, their definition of broad “inflation”, most businesses are not going to willingly commit to destroying value.

Instead, they will shift as much as possible away from Japan and all this intentional instability. It has been deemed better to contract with communist China than to keep being “extorted” via the BoJ’s “inflation.”

We are rapidly approaching the second anniversary of QQE’s inauguration, and there is nary an economic improvement in sight. By most measures of Japanese households and consumers, they are still far worse for having undergone QQE regardless of inflation or deflation. Whenever approached by this downside to monetarism, Ben Bernanke always brushed it off by saying that these are the costs the economy must bear in order to gain full productive activity in the future. In other words, households have to lose in order to gain. Where are any of these gains? That question is applicable far beyond just Japan.

Stay In Touch