It wasn’t supposed to be the case that China would steal all the attention from Japan. We are only a few days away from QQE’s second anniversary and all expectations were purposely set to be a full-blown revival by now. The dedication and skill with which the Japanese economy was handled was meant to conclusively demonstrate with no debate that monetarism could succeed if only when allowed to remove all “undue” constraint. That has been the excuse almost universally up until now as central banks decried how much their hands were tied by past disciplines.

Abenomics was supposed to crush any latent “deflationary” pressures through sheer force of scale. The Bank of Japan went insane, to the point you can make the case that the insanity has been literal – which I will reiterate once more here.

The most potent critique of QE in any form or any jurisdiction is that it leaves no lasting favorable impact upon the real economy. Outside of a short and artificial burst at the outset, nothing much follows from it despite the bedrock surety at which orthodox canon believes in “aggregate demand.” Spending for the sake of spending has not led to additional rounds despite all expectations which has left its practitioners with only the size variability in relief.

The latest figures out of Japan are almost assuredly disproving even that. Not only does the Japanese economy continue to wallow in redistributive pain, outside of a temporary burst “inflation” itself has now failed as the primary objective. In other words, even at an unworldly scale QQE could not impart more than a temporary diversion in the very aspect at which it was most directed.

The government said Friday the core consumer-price index hit 0%, the lowest level since May 2013 and far from the 2% target that the central bank had pledged to hit by this spring. The index excludes fresh food prices and effects of a tax increase.

The price data underscores the ongoing difficulties Prime Minister Shinzo Abe faces in pulling the world’s third-largest economy out of its long slump and eradicating the deflation that had long ailed the nation. Bank of Japan Gov. Haruhiko Kuroda insists he is still on track, albeit on a delayed timetable, to reach his price goal.

Never admitting failure is the problem here, and one reason why I believe households are retrenching in terms of spending. They know what is coming as the BoJ makes it very plain that if QQE still wasn’t big enough the next one might be. So having just survived, though now impoverished, the first of mega-scale redistribution it is far better not to follow the pleas of monetary officials and just take their word there is only a “delayed timetable” to reach actual and sustainable economic gain. The Japanese people seem amenable to observation that eludes policymaking mathematics.

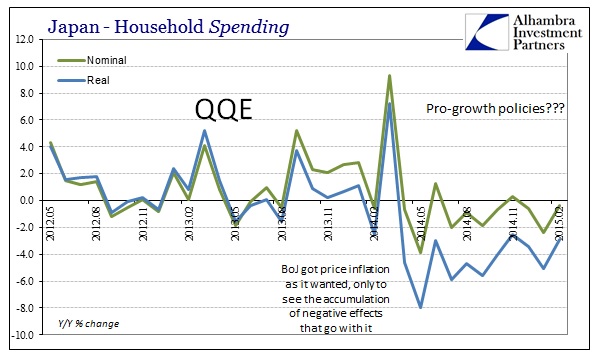

Real household spending has averaged -1.9% since April 2013; while the last eleven months have been deeply negative spending has actually been negative in 15 of the 22 months since QQE and less than 1% in four others, leaving only significant gains in just 3 months total. It’s not much better on the nominal side, either, as spending has declined in 13 out of 22 months regardless of how “inflation” is calculated.

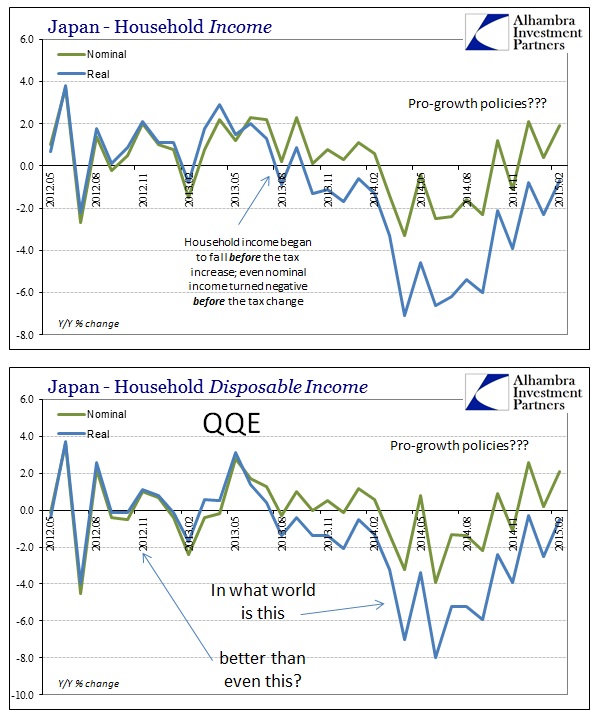

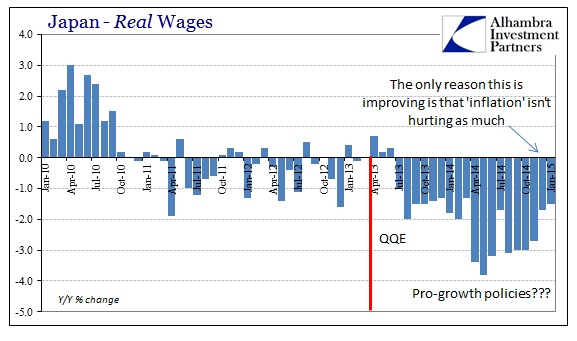

The income side has been better of late, but only because the “inflation” rate has lessened some of the depressive pressure. And that is precisely the point about a monetary program that somehow sees fit to depress household activity in order to make a full and sustained economic trend. That is, again, true of all QE’s but it is most obvious and purely evident in Japan.

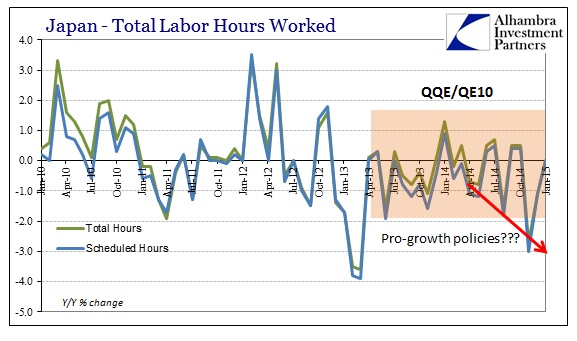

Nominally, there are more yen existing outside the household sector but that is not at all the same as actually providing a pathway to beneficial activity. Instead, labor utilization continues to decline, though in February the initial estimate is at least just zero (until it is revised lower as per usual). Where hours fall, unemployment does as well producing another strange divergence.

The Japanese government and BoJ officials can change their standards all they want, but the reality is that this is not a neutral proposition. The longer they take to finally realize their plans amount to nothing (at best) the worse off Japan will be having undergone the effort, and thus negative transformation. Japanese households are being punished by ritual QE incantation as if more yen were the solution to a problem with too much yen to begin with. The island of Japan is drowning in yen, to the point they are into quadrillions for basic measurements, so increasing the quantity can only “work” at this point by sheer dumb luck, and it’s already been a quarter-century wait. Circulation is a matter of wealth and profit not “money supply” and central planning illusions, and redistribution has a peculiar tendency to destroy wealth and distort profit.

It is interesting in how the very presence of active and large QE and monetary intrusions act in almost the same manner upon actual activity no matter where they are located.

As a shrinking working-age population and growth in construction work—in part fed by fiscal stimulus—tighten the labor market, the jobless rate fell to 3.5% in February from 3.6% in January, while the jobs-to-applicants ratio rose to 1.15, its highest level since March 1992. That means there were 115 jobs available for every 100 job seekers.

That, however, hasn’t translated into more spending by consumers. Household spending fell 2.9% from a year earlier in February, marking the 13th consecutive decline. Retail sales fell 1.8% from a year earlier.

Yet another instance of a “hot” job market that produces no wages and no spending, leaving reflections upon what constitutes “hot” payrolls anymore. That is a curious and persistent theme for QE to take as global constant, almost as if the theories underpinning monetary motives are flawed as are the statistics – the quantity of jobs rises but actual total work and spending do not, a dichotomy that should not at least persist nor exist in every location that QE is tried (adding Europe to that list as we speak).

But I did promise insanity, and if the above listing were not enough then Governor Kuroda will fully oblige:

“The BOJ’s easing has been exerting its intended effects and it seems safe to say that the measure works both in theory and practice,” Mr. Kuroda said at a news conference on March 20.

Like Janet Yellen, it appears the destiny of central bank chiefs to go down with the ship screaming “but the payroll report” all the way. Unfortunately, without real reform we all still reside on that economic ship.

Stay In Touch