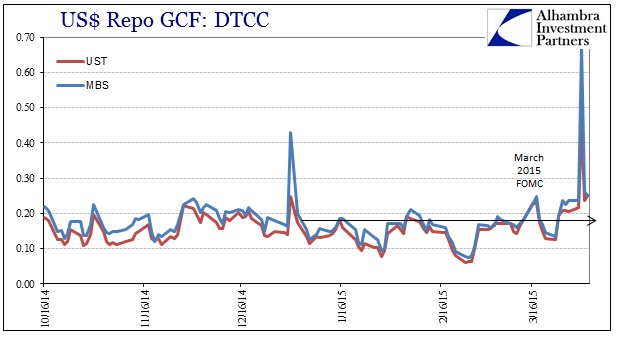

From a purely, detached analytical perspective it is highly fascinating the possibility of observing a liquidity “development” in almost realtime whether one develops or not. If past patterns hold, and there isn’t any specific expectation for that other than heightened probability due to systemic recurrence, then April 15 is a target point for the next one in the series. This is due to the apparent quarter-end processes, like balance sheet window-dressing, stressed against a very poor structural foundation, which were undoubtedly building into the actual quarter turn. A few days ago, everything seemed to be in place including an astounding surge in repo rates, particularly MBS.

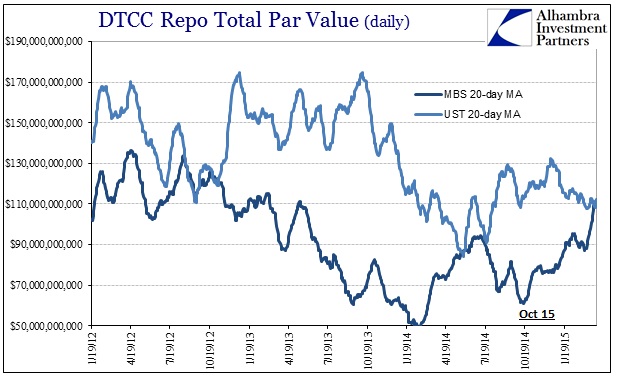

So far in April, the dollar has “dumped” taking other stressed indications with it – suggesting the opposite of a potential liquidity problem. However, UST nominal, the yield curve and eurdollar curve all remain unperturbed and thus quite bearish still. In other words, after two trading sessions on the other side of the quarter break, there isn’t much to really suggest either direction yet. I would point out, however, that repo rates (GC) remain conspicuously elevated as are repo volumes (especially MBS).

Typically after quarter end surges, repo rates re-align the very next trading day. In this case, repo rates for both MBS and UST (and you can even throw in the more minor agency repo) have not drawn back down to what would be consistent with immediately prior experience (something less than 18 bps or so). Both MBS and UST repo (again, GC without any indication as to specials depths and quantities) were published at almost exactly 25 bps – right at IOER.

I couldn’t begin to tell you if that is consistent with what to expect as there is no way to form any solid expectations about much of anything. Because true liquidity is infinitely unobservable (mathematical pun intended) we have no prior understanding of how to even establish anything more than general and non-specific expectations; which is why these two weeks are so fascinating in purely experimental terms. There is always something lost when working backward after-the-fact, so the potential of observing as it occurs offers a great opportunity to learn.

That being said, even if nothing happens it will not have been a total loss (in more than one respect). Liquidity, properly defined, is the systemic ability to absorb changes in behavior. In this specific context, that would mean an increase in selling in risk assets balanced against the complicated interweaving of all asset prices and leverage supplied within those realms. To this point, liquidity has been thought poor but under relatively benign conditions, only increasing the relevance of study here.

A comparable and relevant context is Europe. With Greece threatening exit and “dollar” liquidity perhaps as bad or worse than 2011, European asset prices are starkly undisturbed by all of it – though they were by the October 15 version. Record stock prices and remaining low yields across the continent are in sharp contrast to that prior experience (both October 15 and 2011). Thus, liquidity itself is not a direct factor in setting asset prices, and I would assert the reasons for that are no determined shift toward selling. In that respect, I think the ECB has engineered what it wanted, except hugely deficient in that record asset prices do not translate as directly into economic gains.

But what would happen if “something” were to challenge that perspective, and the “wisdom” of holding such assets at such imbalanced prices were to be dissolved by, say, a serious global recession? That is the point at which we are most interested, where we can reasonably infer a determined shift in investor behavior and the systemic liquidity with which to contain, funnel or, in the worst case, amplify it. We are, in essence, watching and observing in order to form better judgments about the pathology and processes once the selling starts. Like storm chasers, better understanding can lead to, hopefully, better warnings.

Stay In Touch