On September 21, 2008, Goldman Sachs announced its intention to become the then-fourth largest bank holding company, bringing it under the Federal Reserve’s regulatory umbrella. The timing of the change makes perfect sense, a week after Lehman triggered an ongoing panic, but in the perspective of wider systemic arrangements it was an odd attempt at resolution. With Merrill Lynch cold-fused with Bank of America and Lehman being torn by the wolves of insolvency and bankruptcy, there weren’t to be any investment banks left.

In one sense, that seems perfectly appropriate as it was the wholesale model of banking, to which investment banks applied, that failed so spectacularly in 2008. There were no depositor scares apart from a few extremely minor incidents like Northern Rock in September 2007 and IndyMac the following summer, the entire breakdown was taking place deep in the recesses of this modern version of banking provisions. But taking the last of them into the depository umbrella did not suggest that wholesale failure, but instead flipped everything back around so that the depository framework would instead support the wholesale turnaround.

If ever there were a time to re-engineer a more appropriate schematic for global finance, that was it. Instead, regulators, caught as usual so far behind events, were simply trying to put out fires without ever understanding why they were there (and spreading uncontrollably) in the first place. The entire history of the 2008 FOMC transcripts prove that beyond a doubt, but then-Chairman Ben Bernanke so very ably sums that ignorance succinctly, referring to the question of failures and resolutions, in a conference call in January 2009:

Well, speaking for myself, I am not going to draw the line somewhere that involves the failure of a firm the size of Bank of America. But that said, we need to find better solutions to this problem, and the new team—Geithner, Summers, and Christina Romer—is very focused on trying to use the available TARP money, which of course was just approved yesterday, plus other funding and other authorities, to develop a more systematic and more comprehensive approach to the banking crisis…

So let me just say that I know President Lacker was uncomfortable with this [Bank of America’s ML transaction] arrangement. I am certainly very uncomfortable with it. But for whatever reason, our system is not working the way it should in order to address the crisis in a quick and timely way. Until the reinforcements arrive, I don’t think we have much choice but to try to work with other parts of the government to prevent a financial meltdown. [emphasis added]

The meaning of that is very plain, especially in context; they were going to use the usable parts of the banking system in order to arrest the “meltdown.” Maybe it wasn’t the exact time to examine where these “too big to fail” came from in the first place, but certainly in the six years that the system has traversed since that statement the topic might have been revisited. The fact that there are no longer any investment banks but only depository institutions enshrines the cobbled and unsuitable nature of where TBTF came from.

That such a system continues on more than suggests that outside of dire panic the FOMC is more or less happy with the outcome. Other than Dodd-Frank, which continues to be litigated and defined five years later, banking regulations are all unceremoniously moving on. TBTF has grown worse over that time, and there is every reason to believe that systemic function and capacity has as well; “they” are still trying to figure out how a computer introduction might have flash crashed the treasury market only recently.

Wholesale banking was meant as a replacement for the depository foundation that had existed for centuries. The 1960’s evolution in monetarism was to use the purported causes of the Great Depression in order to circumvent the very real restrictions imposed by having people’s actual money. The monetarists were always looking for greater flexibility of control in finance, thereby, so they argued, attaining more economic control, and the wholesale system is the perfect embodiment of that effort. Or almost perfect.

When the S&L’s failed in the late 1990’s, the wholesale system took off and over. There was no longer any marginal attachment to actual savings and deposits in order to create credit from nothing. Indeed, even the thrifts themselves, or a good many of them, became very attached to this wholesale flexibility – with disastrous results in what can only be taken as a precursor to the 2008 amplification. And the “lessons” learned in the cleanup of the S&L debacle were being applied once more in 2008 and 2009 without appreciation for the repetition of pattern and template.

The problem is one of deposits as they are taken, in the post-Great Depression monetary academy, as essentially a “public good.” Given that status, banks that hold them are likewise placed into a special category and thus provided with the pathway to “too big to fail.” The wholesale system was the means for explosion in size, so that the combination of the two is the basis for this systemic flaw revealed starting in August 2007.

In order to make that ad hoc association work, especially after the S&L crisis, regulation was attended toward “defining” risk – and thus banks were to attribute their own portfolios with this in mind. The idea was this “public good” of deposits so that banks would be forced to reveal any deviations through Basel’s risk bucket approach. Inferred from all that is apparently that banks, owing to the presence of deposits, must never be risky, or be only risky to some minimal extent.

What we ended up with is a system that favored the incredibly risky but with an intense “necessity” to cover that up. That was the worst of all worlds, as wholesale banks, contrary to Basel’s stated intent, were imbalanced and incredibly risky anyway but without market prices reflecting much of reality or about systemic risk and building asymmetries. There was no honest trade in wholesale funding, a fact that we can speak to through the simple pathology of what went wrong from August 2007 onward.

I covered that background in a detailed, two-part article here, so I wanted in this space to develop the alternative further. At issue is the meaning of money and its central role in economic function. Even a cursory scan of the Great Depression reveals that, and even provides a good measure of concurrence for the monetarists’ emphasis on it. But even that does not obviously suggest further entanglement of basic monetary function in greater and more complex finance.

In the early 1930’s, the problem of banking and money (and very real deflation) was that the shortage of usable currency was the very transmission into prices, and thus the great contraction. People did not just lose their life savings in deposit accounts of depository institutions that failed (both solvent and insolvent, via liquidity problems) they no longer possessed the modern means by which they could obtain even the basic necessities of life. So many were out of work, meaning no income, but then were deprived of any further savings in the waves of failure – there was a desperate shortage of actual currency not so much as in banks but in the actual function of economic transactions.

As such, currency in short supply meant the economy devolved into a quasi-barter state: people sold off real belongings in order to obtain currency. That created so many backflowing disincentives to true function, and thus a negative price spiral, by placing a great premium on those who could obtain currency, keeping it out of circulation – creating a negative feedback loop overall. That meant there were two separate issues in the spark of the Great Depression, the shortage of jobs and thus income owing to “cyclical” imbalances, and then a shortage of currency in which to carry out basic transactions.

The modern monetary theory assigns both the same solution, as if they are substitutes when in fact they are clearly separate processes. Again, in 2008 there was no obvious shortage of currency anywhere, only a growing shortage of jobs and incomes which is never solved by artificially increasing the most simple idea of the “money supply.” Yet, the FOMC and global central banks have been reacting ever since as if there were both. Serious deflation, of the Great Depression kind, would have been evident and visible with long lines at the ATM’s, not with Merrill Lynch seeking the comfort of Bank of America’s yawning depository links and “capital.” The former argues for separating out the payment function from finance.

The entire idea of “public good” is derived from that function. If payment balances, such as ApplePay or Paypal, were completely untethered from banks then there is far less reason to sustain individual firms at the expense of everything else. That, I think, is what should be naturally proposed as a means to end the banking rigidities imposed onto a system that does actually hold great promise and invention.

The gold standard worked well because it was a melding of supply and demand forces for both sides of the equation – money and finance. That meant true discipline would act upon both money and finance while at the same time being mostly open architecture fostering innovation. It makes sense to try to re-attain those properties, but there is no solvable means by which to do it in the 21st century (a dastardly outcome). By that I mean that the gold standard has been too degraded and the dollar too devalued by which to offer a reasonable re-institution regime.

Further, it is not plainly obvious that there is nothing offered by the wholesale system which would by definition become similarly (artificially) restricted under gold. In other words, we want to find a way to incorporate the best features of both arrangements; flexibility of design and adaption in wholesale finance with the strict discipline through the adaptive and decentralized power structure of gold.

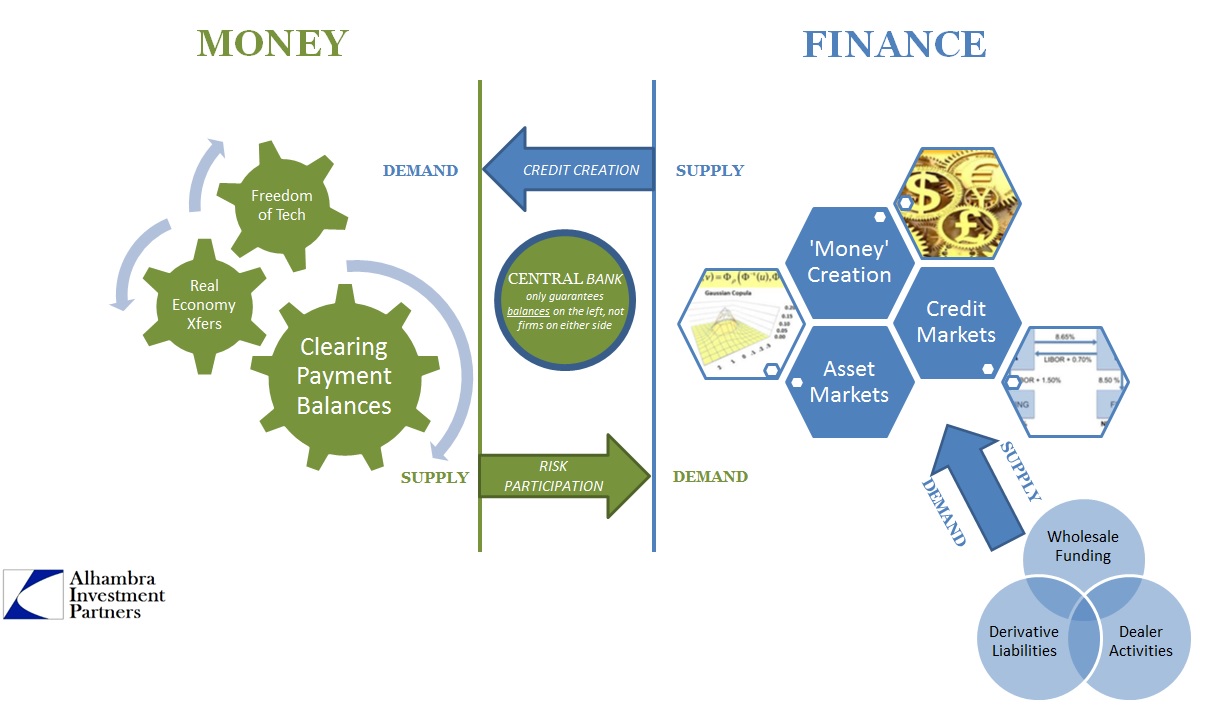

I think that technology has advanced to the point where this is not only realistic but already, in some ways, taking place. The central bank becomes truly mechanical in that it acts much like the FDIC, guaranteeing not firms but payment balances (or money). If ApplePay gets into trouble, then the FOMC gets involved only in unwinding ApplePay and taking on, temporarily, those payment balances without loss. On the Finance side, everything is defined by risk and loss with no guarantees anywhere to anything.

If the stock market crashes and bonds become unnegotiable, that is certainly an economic problem but it will not translate into true deflation because the payment system is utterly preserved. Since banks no longer have that special privilege, that eliminates the “necessity” to prop up each and every one regardless of cost. Honest trade occurs as markets regulate the risks in each participant as priced without the Basel template that prefers hiding everything. And the end of interest rate repression brings with it a diminished repression of bank incentives away from the natural business of banking (thus alleviating this serial tendency toward crash in the first place).

It sounds like a major overhaul, but I think it is relatively simple and easy to accomplish. Finance remains finance involved only in the creation, by market forces, and maintenance of credit (whose demand is attained not by central bank decree but by actual economic demand working through the payment system). Further, there is no expectations for perfection, or even for lack of volatility, which itself performs actual governance in a manner that no written legislation could ever dream of.

All our problems relate to this mis-marriage of the ancient deposit thinking to wholesale modern banking. I have thought years about how to get the former back to the latter (gold standard updates) and have come to the irreversible conclusion that it’s just not possible; further, it may not even be desirable since there are a lot of very good features about wholesale money. The problem is we have developed a system that is half-in/half-out; half modern/half ancient; half market/half gov’t, etc. Even the central bank seeks to impose its will, through massive and intrusive forces, but only to a predetermined point; and from there the “market” is supposed to do the rest.

It should be very clear by now that regulators and central banks are fine with that, even especially as they don’t really understand and appreciate the wholesale side much at all. That is the essence of why Goldman Sachs became a bank in September 2008, and it should be very troubling to anyone with an interest in finance in this dominant position (read: everyone). In the most simple of terms, modern technology has provided a window toward simplification and addressing these now-dormant shortfalls, most especially TBTF. If you take away the deposit privilege from even the largest banks they become just another hedge fund. Everything else falls into place from there.

Stay In Touch