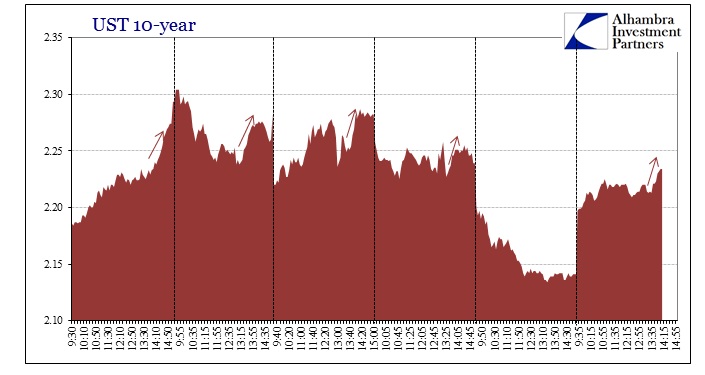

Another day, another day of volatility in UST trading with the 10s trading up 9 bps in yield from Friday’s close. It is, so far, an almost exact carbon copy of the start to last week, including the 13:30 selloff. Repetition is indicative of systemic factor(s) rather than some kind of random variation (or a minor factor indistinguishable from a random variation). I still think that funding issues are the central case here, and that continued pressure there, whatever the “dollar” is doing, is making UST trading that much more uneven.

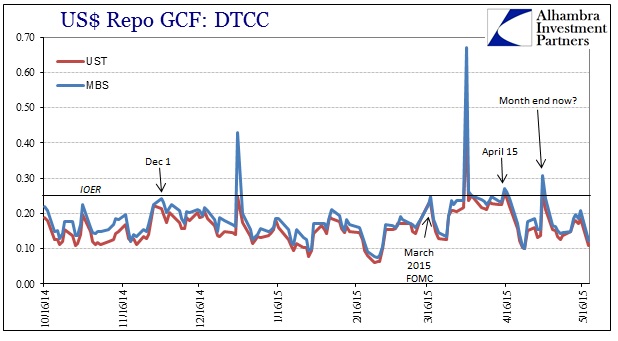

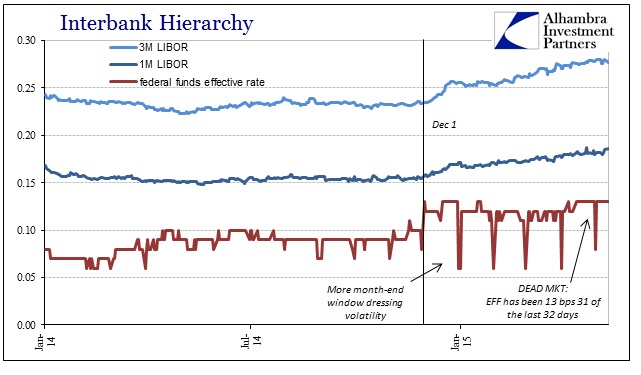

That view extends, as it has throughout May, to the repo markets and even eurodollar trading on the unsecured bases (in whatever volume might be offered). You could even make the case that the disappearance of federal funds offered (as distinct from the structural decline post-2007) is itself related to these much drier liquidity conditions. Altogether, it tells a tale of fewer options for taking and maintaining positions both within and without the dealer network.

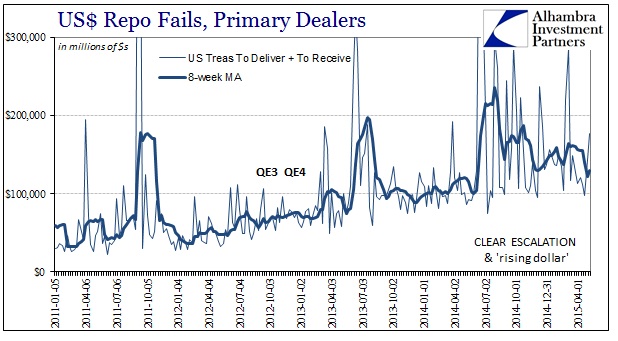

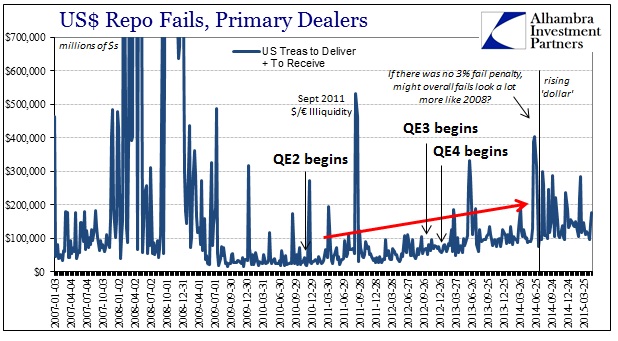

As more information comes in, filling in the past few weeks, the first week in May saw a notable increase in repo fails in UST (though not in MBS). That may be related to this more recent tendency toward shorting, especially in concert with German bunds and European peripheral fixed income angst, but the persistence of short positions in UST has been an almost constant feature going back to November 2013 (and really May 2013). I don’t want to discount the role of an increase or decrease in short appetites in straining collateral chains, but the trajectory of repo fails at least overall has been very consistent as it relates to being a proxy for funding stress in general.

The jump in fails starting at the end of April actually punctuated a more placid period of repo market collateral that traced back to early March. In many ways, given what is taking place in UST trading now, the recent increase in fails isn’t really surprising as it is presented after-the-fact.

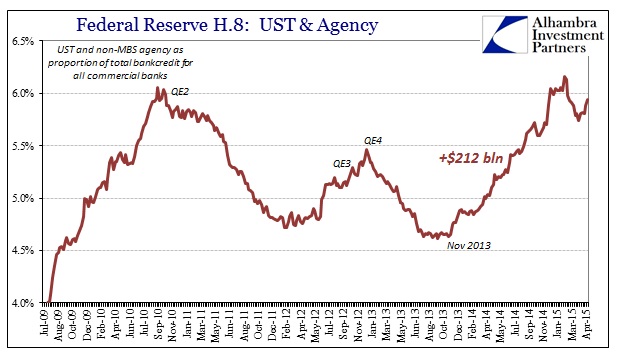

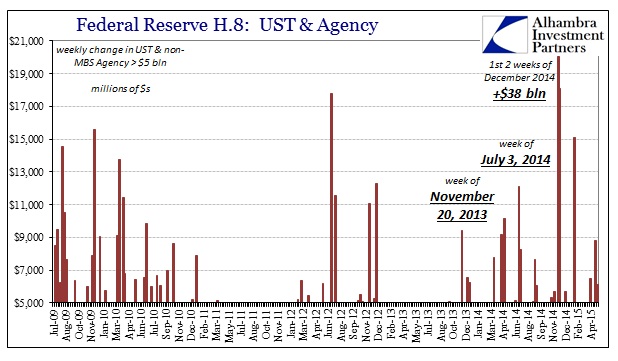

That is confirmed by the fact that, up to the first week in May, banks have been getting back to buying UST’s once again. Some of that is undoubtedly related to those collateral chains but it would be a mistake to discount how much of just a general liquidity/volatility calculation or “rules” approach might be driving that. High levels of UST buying among financial firms are typically associated with funding market stress and related volatility – the rising “dollar.”

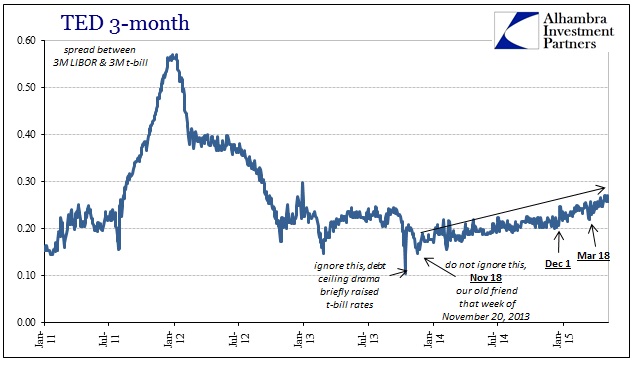

So, as opposed to the view of the short end of the WTI curve, there are indications here of a still-reverting state in at least some vital parts of wholesale finance. That may be why as the “dollar” has paused since the FOMC relented it hasn’t really meant a wholesale change – no sharp and unquestionable retracement back toward more benign overall conditions. Oil investors have taken “advantage” to rebid especially the spot market back toward a more pleasing scenario (if only more mistaken impressions about supply) but funding markets look no different after March 18 as before that date. In some ways, the screws are still tightening and I think that is the important point in particular as the “dollar” starts looking less and less benign of late.

Stay In Touch