At his last news conference on June 3, ECB chief Mario Draghi issued his list of successes so far with QE in Europe. The program was only announced four and a half months ago, being operational only for two, but he was positive that it was already having its intended effects.

“Our monetary policy measures have contributed to a broad-based easing in financial conditions, a recovery in inflation expectations and more favourable borrowing conditions for firms and households,” he insisted.

“The effects of these measures are working their way through to the economy and are contributing to economic growth, a reduction in economic slack, and money and credit expansion,” Draghi said.

Whenever a central banker appeals to “easing in financial conditions” you know straight away that there is little concrete that he/she can point to and take direct credit for (more favorable borrowing “conditions”). “Easing” is a word in this context that has lost all meaning, particularly as some kind of standard as if in a world awash with major QE’s and total ZIRP that we should be grateful there is not an in-progress panic at this moment. That point is made all the more plain by the fact the “easing” phrase accompanies every single monetary program rollout. If easing were the object of monetary policy, there would be so much success by now there wouldn’t be any room to put it all.

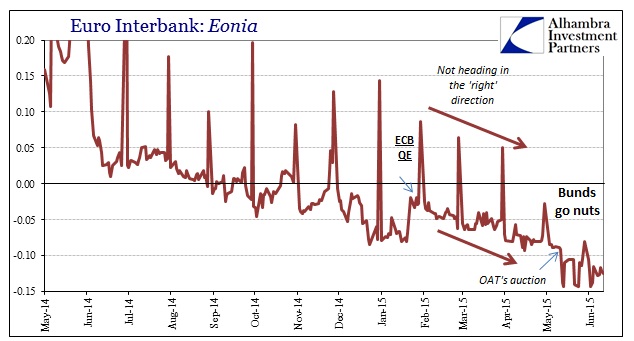

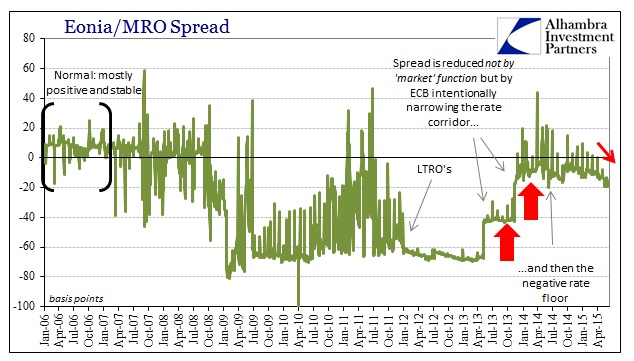

European financialism has “progressed” now to the point where it may actually be more fruitful to ask if there has been too much. Judging by everything from Eonia to German bunds, there is a very good case to be made that the ECB is just easing for the sake of easing. Clearly, central bankers expect that trend to turn into something useful, but there is no suggestion of that anywhere in all this financial negativity (nominal rates and all).

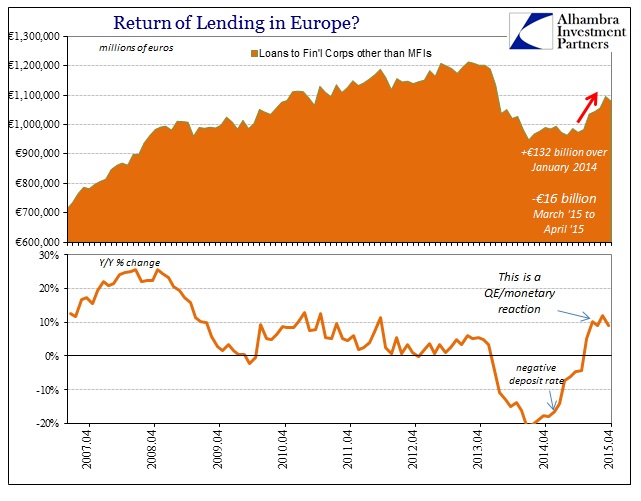

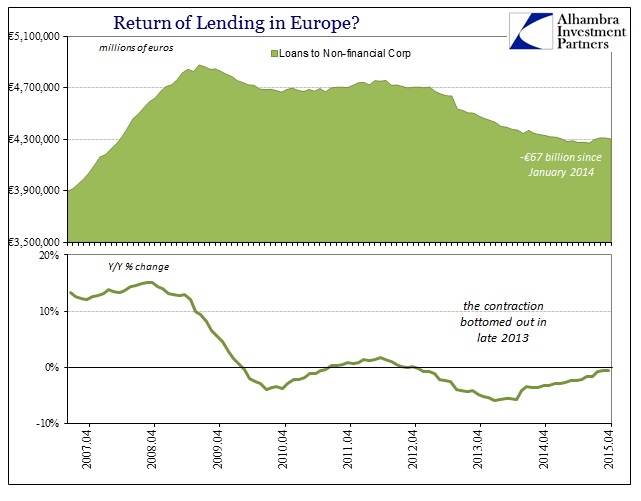

The most direct translation of liquidity into something useful is, of course, lending. Overall lending has risen somewhat of late, which the ECB and mainstream commentary have taken credit for QE, but almost all of that has been limited to rejiggering within the financial system in what looks like bank repositioning to take advantage of what the ECB was going to be “buying.” The category listed as “Loans to Financial Corps Other Than MFI’s” roughly translates into non-bank financial firms and balance sheet-related entities (think of the SIV’s of old), and it was here that lending started to rise last summer.

Last month when the estimates for March 2015 were shown, loans to non-MFI’s had risen almost €150 billion in the year and a quarter from the start of 2014. For April 2015, however, there was a €16 billion decline. Because there hasn’t really been much lending to any of the real economy, overall lending in Europe declined by €17 billion from March to April, leading to a very quick pendulum and more than a little hyperbolic panic in the commentary:

Lending throughout the euro zone failed to grow in April after a promising uptick a month earlier, a slip that tempers hopes for a rapid turnaround in borrowing to boost the economy.

European Central Bank data showed on Friday that overall lending growth to households and firms was unchanged in the month, despite the recent launch of a massive money-printing programme to bolster the 19 countries in the euro bloc.

That’s the problem with taking credit for every little variation; you are forced to the other side when the inevitable dip shows up. For European QE, that there was any appreciable effect on lending in March was being highly charitable, but commentary being what it is there is a bi-polar nature to the entire affair.

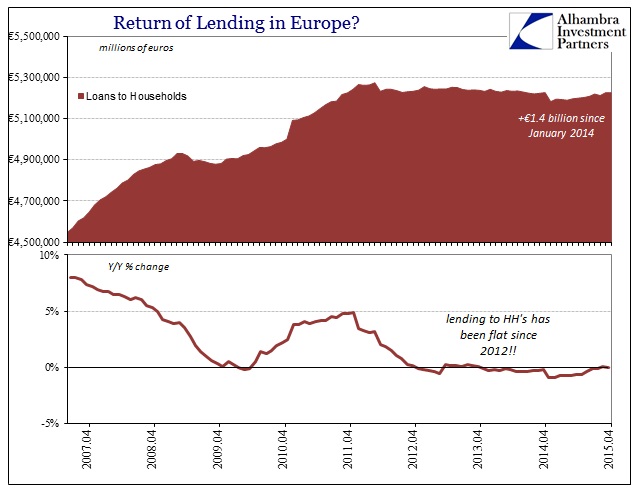

In reality, the bigger problem has nothing to do with monthly variation and everything to do with the fact that the ECB’s unending series of “easing” strategies have produced exactly nothing in lending (in the real economy, anyway, where all this is supposed to be aimed). You can take that critique back to the massive LTRO’s of late 2011/early 2012 that are all but forgotten now. Even the flurry of “aid” put out and promised in the second half of last year has left no imprint on lending to the real economy – either households or NFC’s (non-financial corporations). It is abundantly clear, across more than five years now (did anyone in Europe or even at the ECB remember to celebrate the fifth anniversary of the first SMP’s?), that financial easing and real economic activity are no longer related.

Lending to households has been flat or very nearly so consistently since March 2012, which was, incidentally, the last settlement of the LTRO’s. Lending to the European business sector is actually worse than that.

This is not to say that financial easing has been totally devoid of outward appearance; not at all. Since the middle of 2012, European stocks and bonds have been bid in an almost straight angle upward – pretty much proving there is a much more direct relationship between systemic liquidity and asset inflation wholly apart from economic lending, consumer inflation and general real economy activity. Like the US, the central bank can almost underwrite asset bubbles, but to what intended effect? As Janet Yellen and a very good chunk of orthodox economics propose now, asset bubbles are supposed to be means to an end, not the end in and of themselves.

The timing of these moves actually could add up to the opposite case, as in all this monetary easing may, in fact, be having negative, perverse effects. That was more obvious in the case of the sovereign debt market especially after Draghi’s “promise” in July 2012, where the LTRO’s certainly provided a funding outlet for the sustained bid in PIIGS and other bonds. What the lending figures show is that the bond frenzy just may have come at the expense of increases in marginal lending, meaning that the ECB was perhaps funding negative economic pressure this whole time.

It was already more than a little self-serving for the ECB to take credit for the slightest upward tick in lending in March, with QE just having gotten underway, so there is perhaps a natural balance here with lending falling back in April and all that unbridled optimism sharply turned around. In reality, neither of those extreme, polar positions are likely consistent with economic reality in Europe. Lending has lost any connection with liquidity more generally because it isn’t really liquidity in any meaningful form; it’s just balance sheet re-jurisdiction that accomplishes a lot of speculation, but as with so many other places activity for the sake of activity, or transactions for the sake of transactions, holds no magic power. The European economy is beset by its own inertia separate from the ECB’s limited reach; at least on the positive side

Stay In Touch