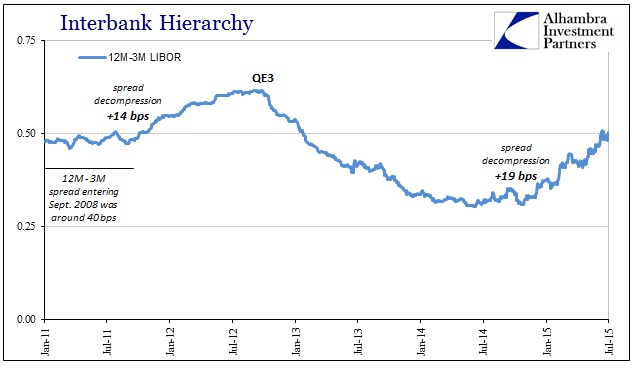

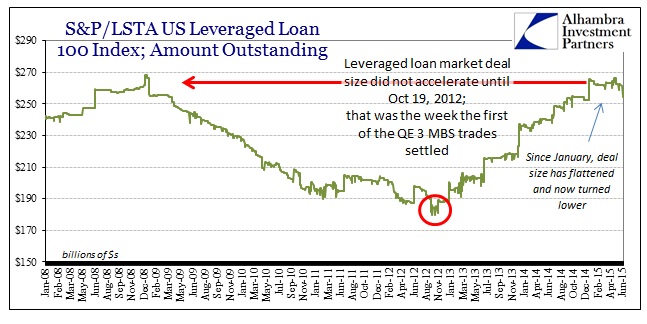

While the outward-facing pieces of the eurodollar puzzle show a little bit of Greek reference, the inward parts seem much more defined by the systemic erosion in liquidity and capacity quite apart from all that. LIBOR and other money rates continue to rise, as do risk spreads. Since the QE system was laid out roughly on liquidity as function, the lack of it directly translates into those spreads. As I noted earlier today, it is the combination of the systemic factors shown here and any trigger via uncertainty over Greece specifically and “tail risks” more broadly that suggest the downside.

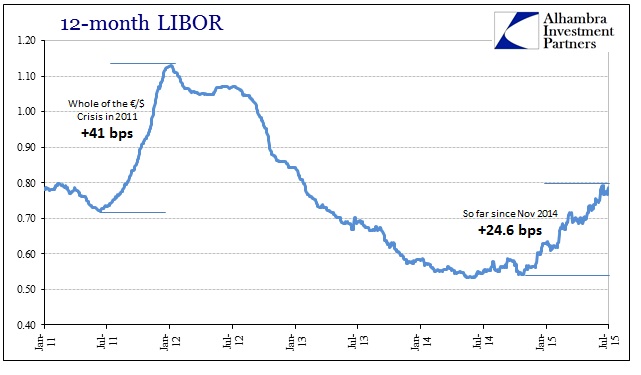

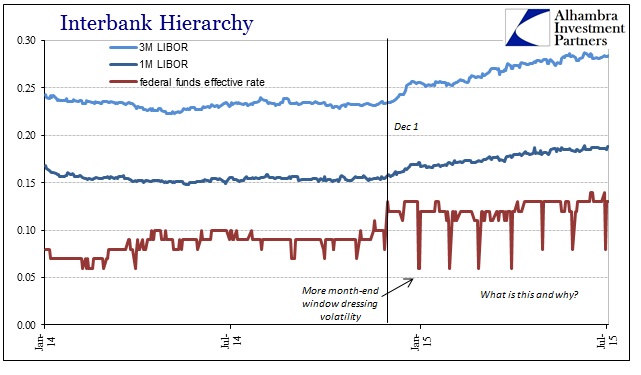

LIBOR remains on the upswing, having surged higher in late June regardless of whatever mess the FOMC tries to project in daily obfuscations. In fact, going back to December 1, LIBOR interbank rates have been rather steady in rising. There isn’t any specific trace of effects that might explain the surge in June, perhaps Greece, but like the December change there isn’t any hint of the FOMC here either; again, systemic capacity being completely divorced, and thus retreating, without any monetary policy agency either way.

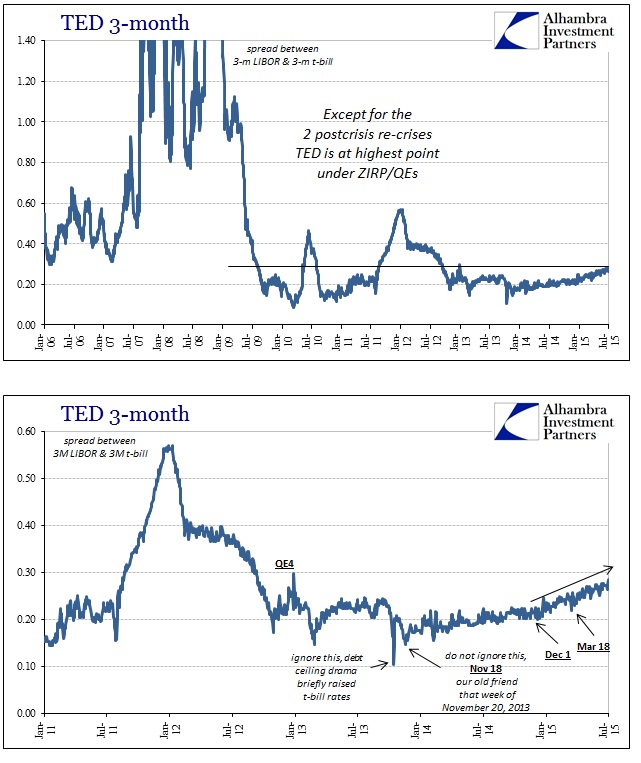

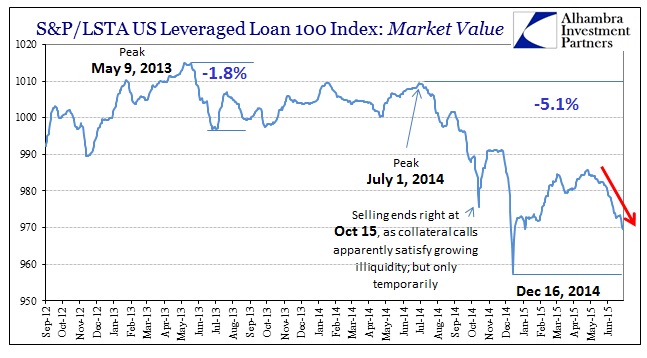

With t-bills still “pinned” right at the zero lower bound (collateral pressure?), the TED spread is now at a high, by far, not seen since 2012 and the operational startup of QE4 (the UST part of what is conventionally taken as a singular QE3; the differences between them are not small, which is why I maintain the numerical distinctions). With the direction in risk spreads still indicating increasing risk wariness, it is clearly acting on proclivities to take on and advance credit and liquidity risk in the broader credit markets themselves.

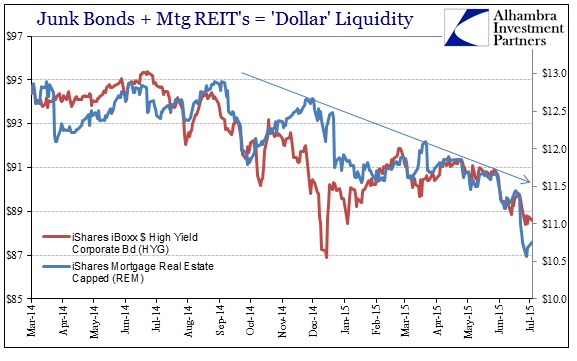

Corporate bubble prices suggest as much, with junk proxies strained going back to the recent liquidity events in October and December last year (I include REM, a mortgage REIT, below as a proxy for “dollar” liquidity in a more extended credit situation).

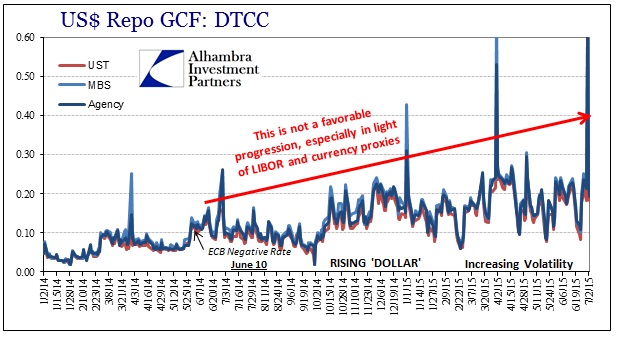

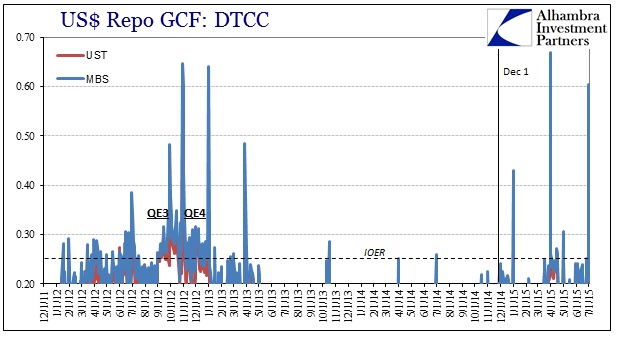

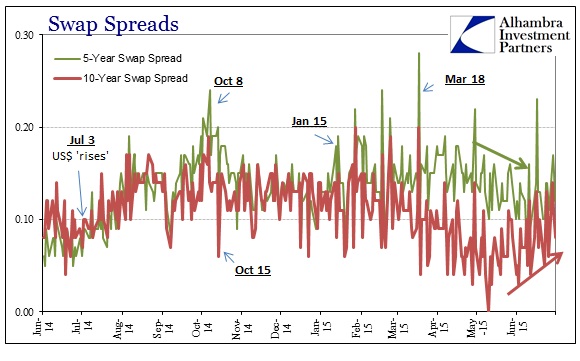

Even repo rates have become notably more volatile in the past few months, with the quarter-end surge just completed nearly as severe as that on March 31. The change in pattern in the repo market in comparison to the first half of 2014 is nothing short of remarkable, as is the obvious stages leading up to the most recent variations. There is a clear acceleration, both in terms of rising rates and volatility of those rates, marked first by the ECB’s negative deposit move, then the months between the October 15 and January 15 “events”, finally the huge volatility since the March 18 FOMC meeting. In other words, the tremors have only grown larger over time; from placid and orderly to increasingly not, directly left to right. There is simply no better demonstration of the liquidity and “dollar” transformation.

Even swap spreads have shifted back in the other direction, with the 10-year spread moving back upward. Taken together with the eurodollar curve, it may suggest further wariness (no QE5 to “save” everyone) as part of the overall inflection in the “dollar” all over.

I hesitate to bring up the liquidity pattern of two weeks after quarter end since April 15 was essentially nothing, but all the elements are again aligned – this time with the added uncertainty about Greece already pressuring the “dollar” broadly and no March FOMC replica to forestall marginal negativity internally this time around. Riskier proxies are already seeing sustained (if still orderly) selling which was the other way around three months ago. In other words, be mindful of July 15 as liquidity bottlenecks are going to be increasingly important settings.

Stay In Touch