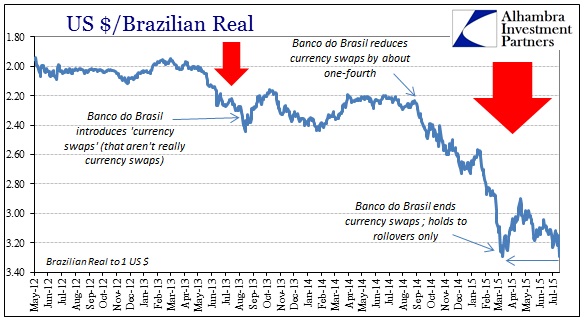

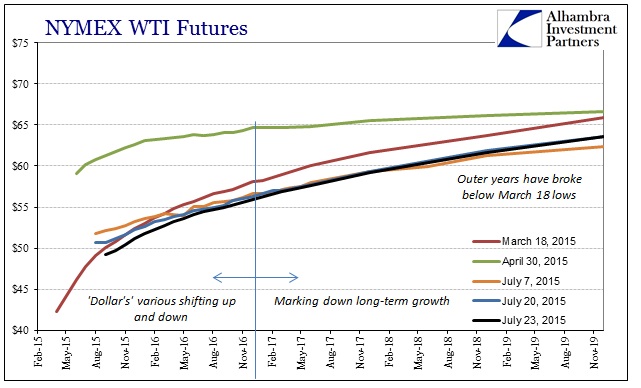

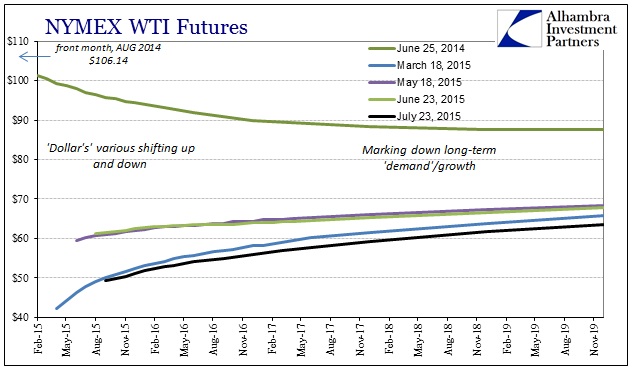

If there is something different about the “dollar” in July it is that it has been in widespread pressure on funding. From early May to the beginning of July, the “dollar” was more hit and miss with only regional or limited disruption. Crude prices, for example, rising since the March FOMC, stopped but then traded sideways rather than appreciably lower. That all changed in early July though the exact catalyst isn’t quite clear (we rarely know for sure exact causation; March 18 and that FOMC meeting being the obvious exception).

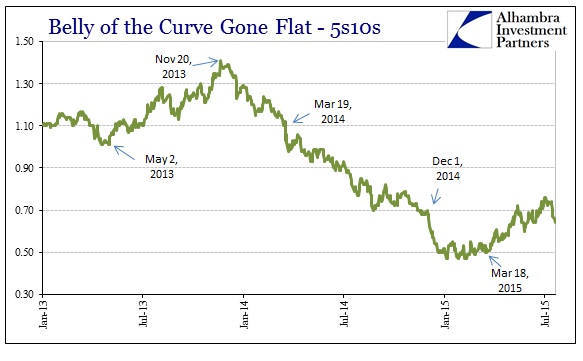

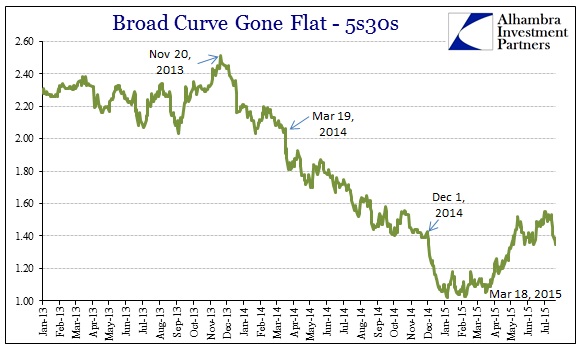

Not only have commodities sold off dramatically in the past few weeks but even the treasury curve has rediscovered its bearish bias. The benchmark parts of the curve, in the belly, have flattened significantly since about July 3.

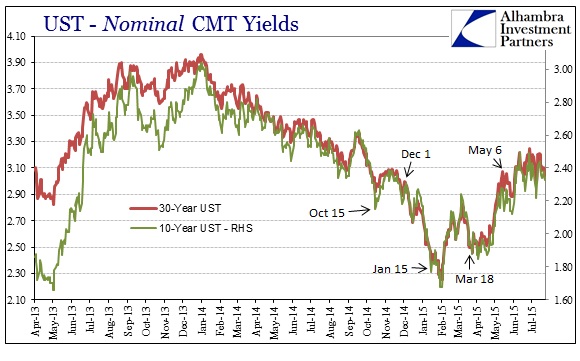

Nominal rates have been steady to lower at the long end while the shorter maturities have risen. Like the eurodollar curve, it appears that the treasury market is interpreting the Fed’s intentions as making a bad situation worse.

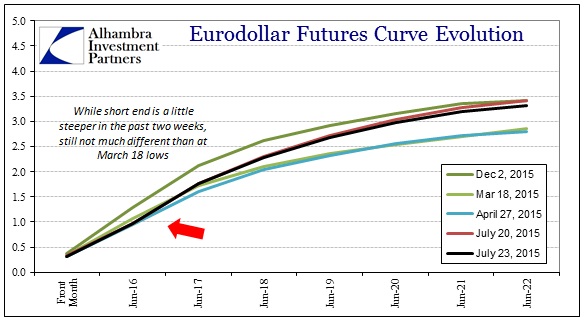

The eurodollar curve itself has been bid at the longer end in sympathy, with it flattening there while holding at the short end.

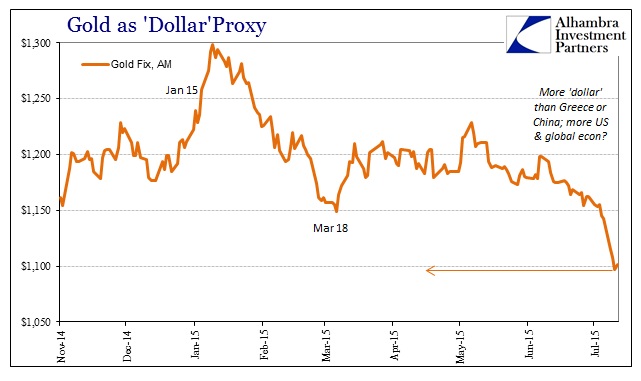

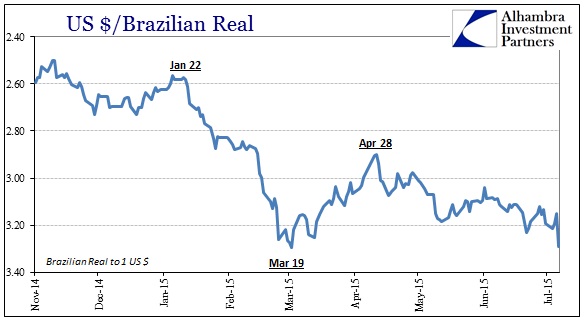

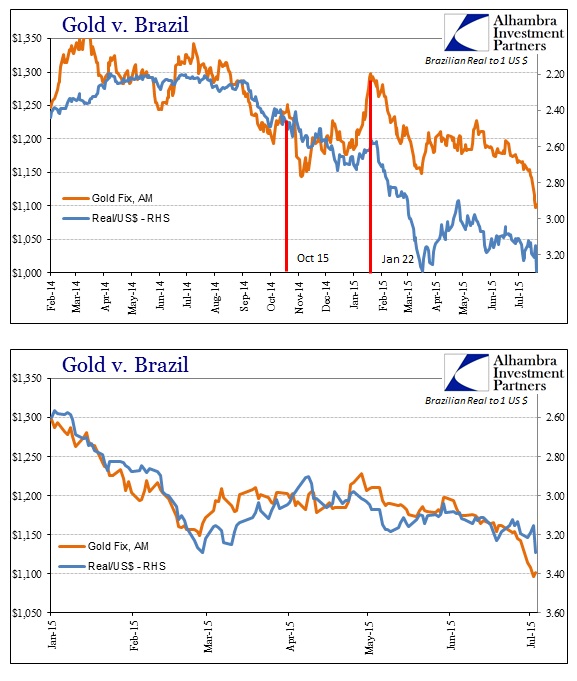

With such broad bearishness it isn’t surprising to see the “dollar” so active and negative on almost everything (with the very notable and continuing “exemption” of China and its yuan). Gold fell below $1,100, with yesterday’s PM fix in London at just $1,088.60. The precipitous decline there was followed by a slam in the real this morning, with the Brazilian currency trading down to its March low.

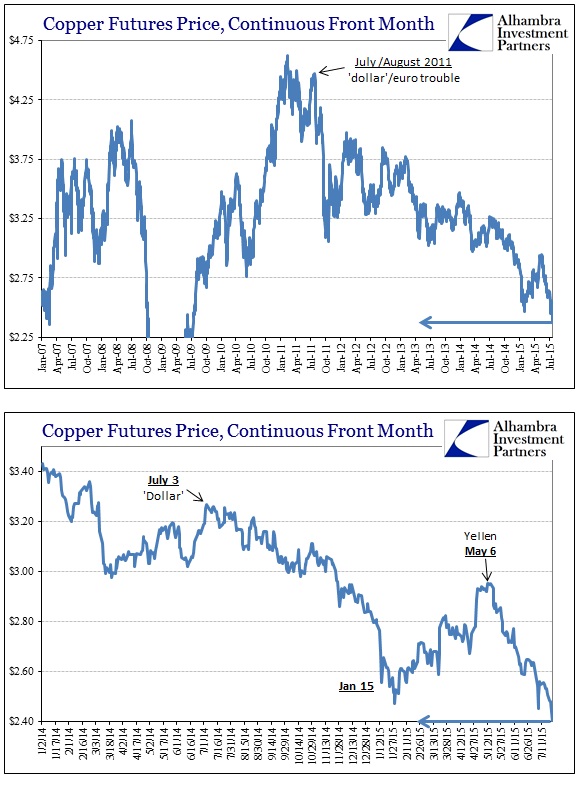

Copper and crude have also tumbled by proxy, with copper even this morning being sold hard. The front month futures (July 2015 still) is trading (as of this writing) at $2.3935, by far a new cycle low.

There is no mistaking this broad-based “dollar” shift which so far has July positioning very different from May and June. In other words, the prevailing sentiments from late 2014, especially after December 1, seem to have returned.

Stay In Touch