China’s economy is sliding and nobody can really tell where that downturn will end (though it doesn’t stop the media from proclaiming a bottom at each individual upward variation). Brazil’s economy is in the worst shape in decades, with both volume problems coinciding with the real’s sharp devaluation hammering consumer prices. The country’s central bank has managed to make it all worse by doing what every other central bank does and has done, but will admit to nothing. Even Canada has succumbed to recession and it isn’t really about oil, though everyone’s first thought is the northern sands and tars.

Even Europe, despite all the QE hyperbole, isn’t really sure where it is right now in economic terms. They want to proclaim recovery but there isn’t actually anything that would suggest as much. Unemployment is still over 11%, broadly, and more recently fortunes appear once more to be actually dimming yet again. Beyond just the “unexpected” drop in the PMI (always the PMI), retail sales fell 0.6% in June month-over-month, gaining just 1.2% year-over-year. Worse, that negative result was mostly Germany, the assumed powerhouse to drive all this recovery action, as retail sales there fell 2.3% M/M in June alone.

The less said about Japan the better.

This year was supposed to be the bloom, the blossoming of a trillion monetary “green shoots” that have been sighted (strangely only by economists) pretty consistently for five years now. Of course, these young economic sprouts were talked about in 2008, of all times, but that is all but forgotten now as apparently QE as a global phenomenon is not only supposed to restore economic function but also to wipe away rather recent memory. In reality, QE is just the connective tissue among a diseased and dying organism.

The commonality of all these deficient results, all arrows around the world pointing down simultaneously, is monetary function. If Brazil is in deep recession, that is because China has stopped its “miracle” having been tripped up by none other than no US “demand.” The world’s central banks have conspired to create “aggregate demand” out of negative redistribution, but then wonder why they got almost none of it. There are, of course, the usual positive numbers here and there, but nothing so much as actual and useful recovery.

Monetarism as a theory makes little intuitive sense in the real world, even if it’s initial exposures sound if there is a logical basis, but the failures even more recently are much bigger and deeper than even that. QE is a psychological target, meaning that if you and I and everyone around the world “feel” better about whatever then we are expected to translate that emotion into economic activity. QE drives asset prices which affords those supposedly generous feelings, particularly as it occurs in the also-assumed “wealth effect.” By its very nature, such redistribution is highly stratifying, concentrating most, if not all, effects to upper levels (however defined). That isn’t supposed to matter as monetary benevolence through asset prices is believed to be able to trickle down.

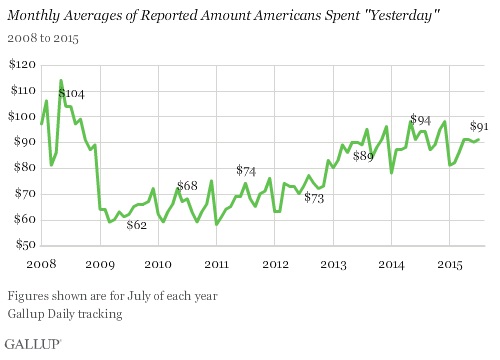

I think it more or less occurred in late 2014, in that confidence and emotion has been as high as this “cycle” has seen – and nothing intended came of it. This is as true of elsewhere as the US, as confidence in Europe has been soaring. Yet, by every measure of spending activity there is at least no growth if not something worse – looming and evident contraction. Gallup is the latest series to pick up on the “confidence” scam:

Daily tracking is lower in July 2015 than July 2014, having essentially stopped growing all the way back in the middle of 2013. That doesn’t quite align exactly with what I call the first elongated cycle inflection (March 2012), but it is close enough in timing but especially trajectory to be consistent with that. No matter the emphasis and persistence about the “greatest payroll expansion in decades” spending has not budged. No matter the constant new highs in stock prices or rush toward the junkiest credit on the lowest default rates, spending has not budged; if anything, it has trended lower despite all the confidence.

Gallup even noted this divergence:

Though gas prices remain lower than they were a year ago, which had boosted Americans’ confidence in the economy, this does not seem to have had much effect on Americans’ overall spending.

I wouldn’t attribute “confidence” solely to gas prices, but the overall meaning is the same and doesn’t really affect the conclusion; hope is not a job nor a wage. The entire theory of monetary intervention is being disproven in the past few years, even if conventional views and statistics are only just now coming to terms with the level of dysfunction.

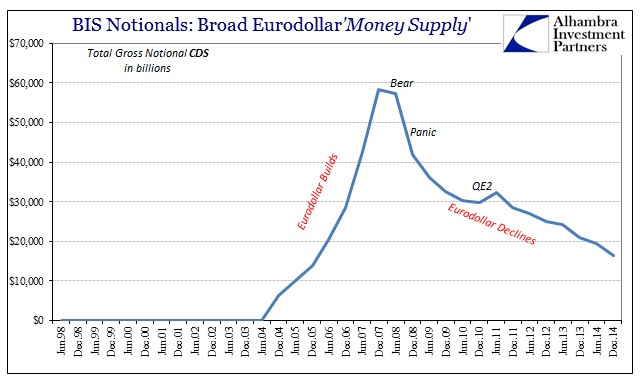

The rest of the world is finding that out, as well, facing up to the very real prospect that the recovery is not just late it is never coming. What that means, in the context of the global hole that was the Great Recession, is that the global economy, as the US, Europe and Japan, has shrunk. The structural issues in each location may be different in terms of actual expression, but the unifying feature is coming into full and obvious view. Marginal economic expansion for the global economy had been an illusion, accomplished as much by financialism as actual and sustainable activity. That is the eurodollar standard and global “dollar” short of the mid-2000’s; a factor which oriented much of global growth to that alone.

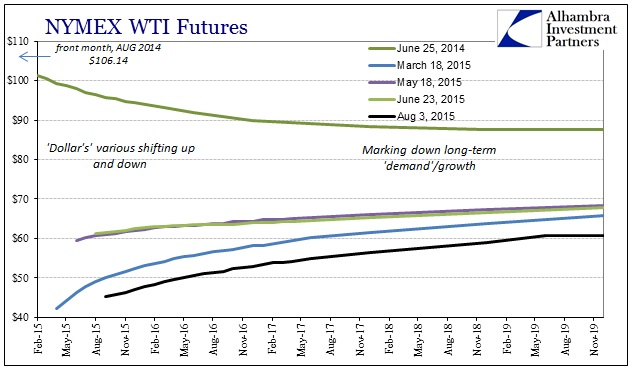

Without the same financialism now as then, central banks have only had the practical effect of staving off renewed declines but for only short spans and with very minor upturns (showing up as only some positive numbers rather than more meaningful recovery). What is different so far about 2015 is the weight of this decay, having surpassed in many ways the difficult transition in 2011 that sowed this trajectory. That was the “warning” issued by none other than the “dollar” itself starting in late June last year, reaffirmed once again just recently, that the artificial stasis of even those positive numbers was wearing too thin to be sustained much longer.

All the engineered hope in the world, no matter how much QE or how high the next serial asset bubble version, the decay is immutable to such folly. What’s missing post-2007 is the artificial growth provided by a rising, exponentially so at its apex after 2004, global financial outbreak. Starting last year and even right on into earlier this year it was common to hear how the US would “decouple” from that, providing an outlet of optimism that the US might power the global economy away from the gathering doldrums. That idea, if you haven’t noticed, is also dead and buried.

Does anyone remember last year and how it was “assured” that the FOMC would start raising rates in March, perhaps even January 2015?

From March 2014:

The U.S. Federal Reserve will probably end its massive bond-buying program this fall, and could start raising interest rates around six months later, Fed Chair Janet Yellen said on Wednesday, in a comment which sent stocks and bonds tumbling.

Yellen’s remarks at her first news conference as the head of the central bank pointed to a more aggressive path toward higher interest rates than many had anticipated, and bets in financial markets shifted accordingly.

And:

The US Federal Reserve Chair Janet Yellen has hinted that interest rates in the US could start to rise in early 2015.

Ms Yellen said the Fed could begin raising rates six months after it halts its monthly bond-buying programme.

From last August:

The big question for financial markets is whether the Fed will raise rates in March or June, it used to be Whether it would be June or September of 2015, and I think as the data gets better in the second half of the year, and QE ends in October, the timeline could be moved up even further, say January of 2015 for the first rate hike.

The dot plot suggests that the Fed may raise rates four times in 2015, from 0.25% to 1.25%. It may raise rates five times in 2016, from 1.25% to 2.75%, and it may raise rates four times in 2017, from 2.75% to 3.75%.

Also September 2014:

The U.S. Federal Reserve may start raising rates around the spring of 2015, at the earlier end of market expectations, Richard Fisher, president of the Federal Reserve Bank of Dallas said on Thursday.

“It’s assumed in the market place that we’ll start our liftoff in raising interest rates some time between the spring and the summer,” Fisher, a member of the Federal open Market Committee, the Fed’s main policy making body said at a conference in Rome.

“I won’t say what we’re saying internally, that would not be appropriate, but maybe sooner rather than later,” he said.

“What we think now is that the capital markets have it more or less right but we don’t ourselves know when we’re going to do it,” Fed Vice Chairman Stanley Fischer said in Washington.

“On the basis of our forecasts of the data … it looks like markets more or less have it right – somewhere in the middle of the year.”

Reality has been intruding upon those fantasies in 2015, uniformly so. That “confidence” economy of last year has melted into the crude, commodity collapse of the “strong dollar” (that term sure disappeared quickly too). A global economy built upon finance, with eurodollar banks right at its center, cannot withstand the sustained and intended withdrawal of finance no matter how much asset prices and hope is injected in between.

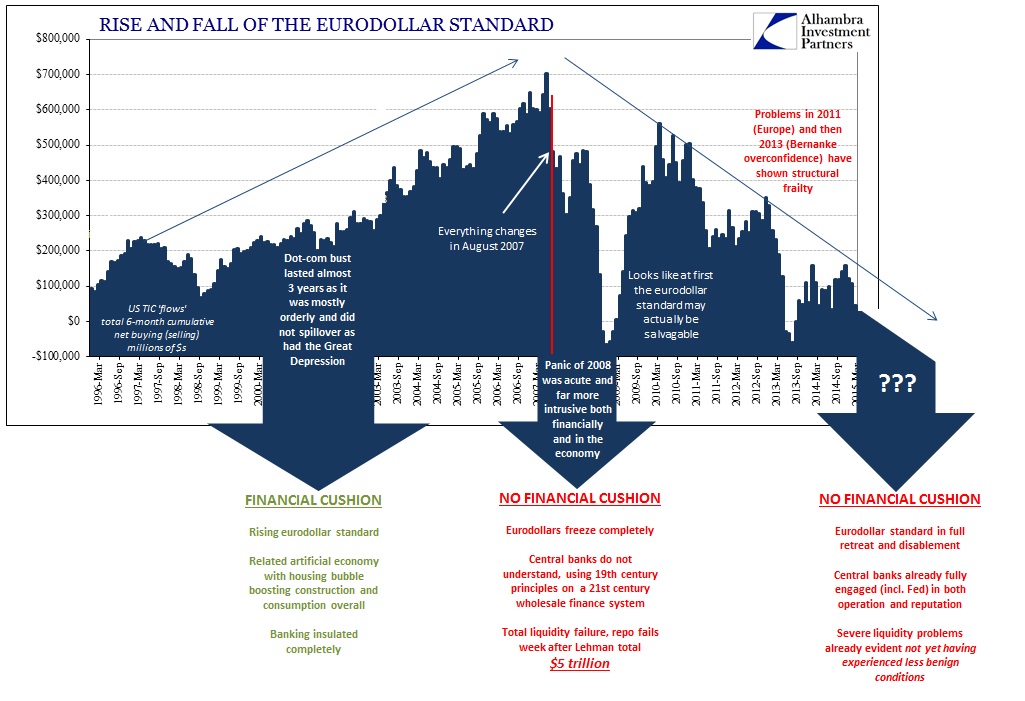

The inevitability of this can be seen as an extended time line. In other words, when the eurodollar system was building all those years in the late 1990’s and early 2000’s, the Fed did what it did thinking it was the center of genius; Alan Greenspan believed himself capable of controlling really the global economy by fine-tuning quarter point changes in the federal funds rate – a market that had been surpassed in raw volume in 1990 by reported eurodollars and quite unremarkable set against the real mechanism of Wall Street expansion, “dark leverage.” The idea is ridiculous on its face; the global economy kept expended despite Greenspan, no matter what, because bank saturation was unimpeded into serial asset bubbles.

The first clue should have been the dot-com bust, as that stock market event was really a crash only prolonged and stretched over a three-year period with only a mild (and still global) recession within it. Again, Greenspan and the FOMC took it as their own work when it was instead the continued and uninterrupted rise of eurodollar displacement, expressed domestically here as the housing bubble (dating back coincident to the stock bubble in 1995). He even tried to put the brakes on it by raising rates beginning in June 2004 – with, and this should sound familiar, very little effect (his absurd “conundrum”).

In short, generally speaking, no matter what the Fed did before August 2007 the eurodollar “economy” continued on without much deviation; the same is true, though in the opposite direction, thereafter. No matter what the Fed (and its global cousins) has tried in the years since there has been likewise so little effect (this is not to remove responsibility for the serial bubbles from the Fed’s own doorstep; quite the contrary, the Fed holds clear responsibility just not in the manner everyone seems to think).

The action, then, of 2015 carries with it more than a mild strain of inevitability, as if this was the entrenched course all along. Even the staunchest of the monetary faithful have gone weak so far this year, recognizing both the global reach of this “unexpected” misfortune and its very financial character – the “dollar’s” grand masterpiece, sketched out as a macabre work of performance art with which to disprove the whole affair dating back decades now. This has all the elements of a great tragedy; 2008 was supposed to be the hopeful climax, now perhaps revealed as nothing more than the close of the second act with unfortunately more yet to come.

The powerlessness of monetarism and the globally aligned direction can only speak to this one factor. Central banks created an economic world premised on prized liquidity, banking above all else and exponential expansion of all that wherever possible, but now even those very banks don’t want anything to do with it. The further this goes, the more that debasement, inflation properly defined, in activity retreats the deeper the scars of that financialism are revealed. The global economy had been so attuned to financial dependence that what is left as an organic foundation is a shriveled mess. Without that financial outlet, we are finding out just how shriveled and widespread.

In the end, as being revealed now, monetarism was never truly about emotion at all; only in how emotion was derived from the more basic, modern foundation of serial asset bubbles springing out of eurodollar financialism. Take away that eurodollar expansion and all that is left is just happy thoughts. That defines the 2015 global economy to its core; happy thoughts and nothing else. If there is a shift in the middle of 2015, it is only that thoughts are appreciably less happy now, realizing the bareness of the global economic landscape stripped of its past artificiality. They don’t know what they are doing, and haven’t for a very, very long time.

Stay In Touch