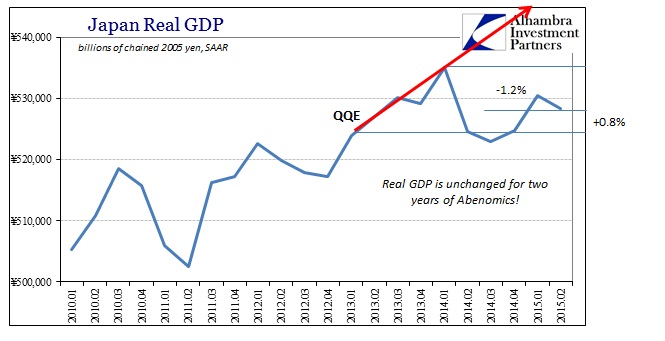

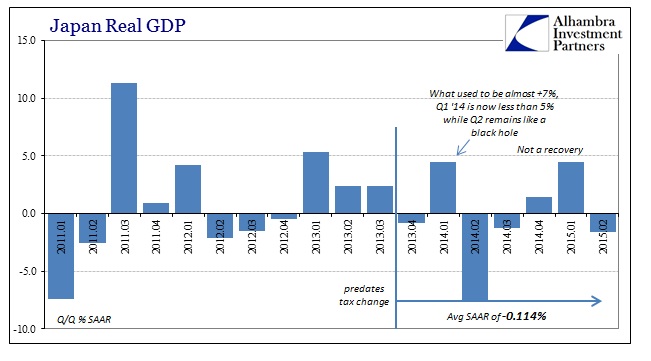

The Japanese economy sank yet again, more than suggesting there is no recovery from the “inflation”-led recession that began six months before any tax change. Almost right from the start of QQE, Q4 2013, Japan’s GDP has either been contracting or barely rising. The net result is the monetary hole left behind by so many flawed theories. Primary among them, as Q2 2015 lays bare, is that currency “stimulus” isn’t much of one (a fact that China is undoubtedly aware).

Despite two waves of yen devaluation, exports fell at 16.5% annualized rate in Q2 (Q/Q) which is worse than feared. Much of that decline was auto activity and general flow to China. With the entire world in an economic funk (and maybe already recession/ongoing depression) what sense does it make to intentionally intervene negatively upon internal pricing? Orthodox economics always assumes that this stuff works, and so in the middle of 2013 QQE was thought to be delivered into the prime glory of global monetarism everywhere else.

The numbers are simply staggering and should end all nonsense about monetarism as “stimulus”, but observation and science have no place in this purely political discussion.

Japan’s economy shrank at an annualized pace of 1.6 percent in April-June as exports slumped and consumers cut back spending, adding pressure on Prime Minister Shinzo Abe to step up his policy drive to lift the economy out of decades of deflation.

China’s economic slowdown and its impact on its Asian neighbors has also heightened the chance that any rebound in growth in July-September will be modest, analysts say.

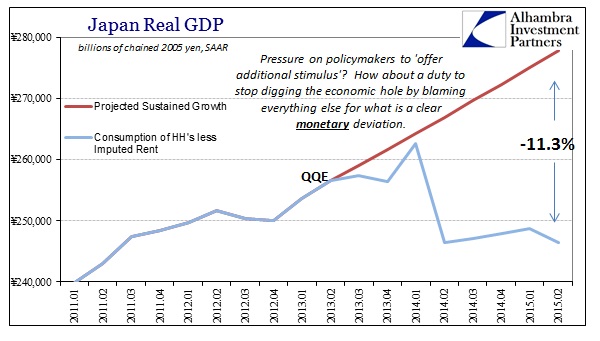

The gloomy data adds to signs that Japan’s economy is at a standstill and heightens pressure on policymakers to offer additional monetary or fiscal stimulus later this year.

The last thing Japan needs right now is more of the same, but like the rest of the world there is no choice given but some form or another of statist command. Even those most ideologically committed to monetarism expected the tax hike to have a negative effect, but one that was more modest and most especially temporary. According to these latest GDP figures, there was a much smaller upside prior to the tax change and a much larger downside thereafter (now only +4.5% in Q1 2014 but -7.5% in Q2). While that is significantly worse than anticipated, the latest quarter reveals that there has been no growth since; in many cases, economic levels are actually below that assumed trough of last year. Japan’s economy was pushed into a hole and has not, despite all assurances otherwise, come out. There is no way to classify that condition except upon QQE has at best destabilized Japan’s economy and, at worst, pushed it all into even greater impoverishment.

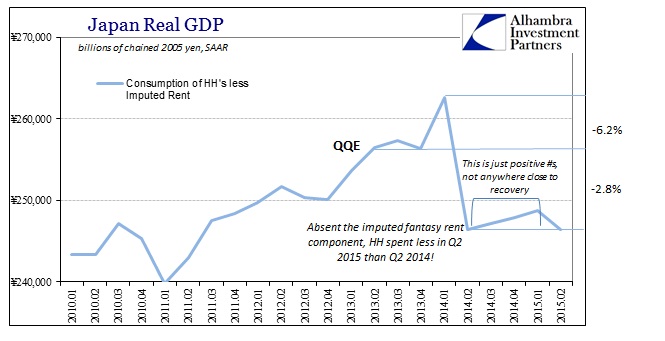

In many ways, these comparisons are actually quite charitable to the mainstream assertion. The reduced standard of comparing to last year actually conflates the true measure of the decline and QQE-induced decay; monetarism promised (not suggested; not hoped) an actual recovery once “inflation” was unleashed by a quadrillion (idle) reserves. Therefore, the true measure of decline is Japan’s wretched growth path compared to where it “should” have been had QQE followed sound economic principles instead of faith-based, subjective regressions.

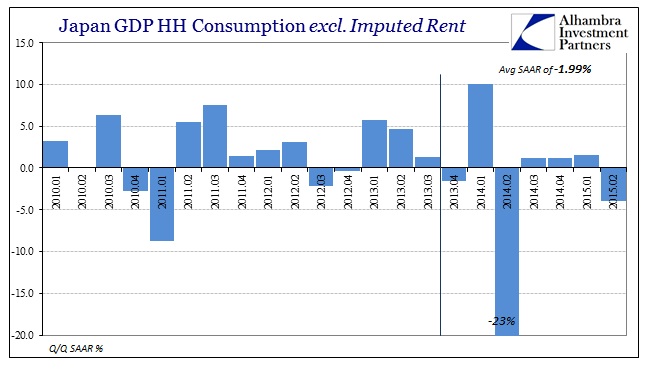

By that measure, one of very real and disastrous opportunity cost, the Japanese economy has been seriously taken back by QQE with Japanese households bearing the full brunt of the missteps with only a promise that it has been and will be, eventually at some unknown day in the future, for their own good. Japan may be beset by economic problems of all kinds, but to argue that they need more “stimulus” of this kind is willful ignorance of the highest order; QQE has instead amplified all those problems into what can only be categorized as unnecessary economic torture.

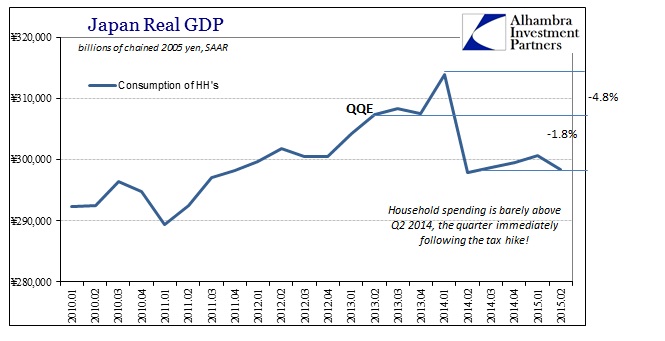

Out of the last seven quarters, four have been negative and one of those deeply so. The net of all that is a negative growth path, but since only once did two negative quarters connect the mainstream reports as if there is no ongoing recession – only a mild one in past tense and thus a “recovery” underway. This trick of a technical definition (which is really stripped of all actual meaning) makes QQE and Abenomics seem still plausible whereas in actual context they are clearly and heavily depressive. Household spending fell almost 23% in Q2 2014 before “recovering” by just 1.2%, 1.2%, and 1.5% in the following three quarters before declining 3.9% once more in the latest. There are more positive numbers than negative in that catalogue but that isn’t even close to the most relevant feature as has been in economic commentary surrounding QQE. There is a world of difference between real recession and the technical appearance that purportedly keeps the country out, as Japan is a pure demonstration of what monetarism really looks like with no true upside and a very real secular decline.

The joke about Japan in terms of its fiscalism prior to QQE has been that there isn’t a riverbank on any of the islands that hasn’t been paved or turned into some park. Every small town has a major museum or tourist “attraction” all paid and constructed by the federal government’s continued “stimulus.” It is no surprise, given the Krugmanism that has crept back into all this obvious failure, that such old and miscarried ideas are new again:

Monday’s figures weren’t a surprise, but they are likely to prompt more talk about what Mr. Abe’s government can do to prop up the economy. Among the ideas are an economic stimulus package worth $20 billion or more. The rise in corporate profits has pushed up tax revenue, but Japan still has a giant public debt that worries credit-rating agencies.

These GDP figures were only “expected” by the media because of the warning issued a few weeks ago in the “unexpected” collapse of exports. If two years ago Japan was told that all QQE would bring is a 3% decline in real household spending and an export collapse to boot, and that at the end of all that there would only be the same fiscal “stimulus” ideas carried out continuously for more than two decades, I seriously doubt Abenomics would have gone anywhere. Now they need more of it?

Japan is an unflinching disaster from QQE and Abenomics, but the appearance of some positive numbers untouched by the relevant context has given it, as the rest, remaining plausibility. Einstein’s definition of insanity doesn’t even cover the madness here, as it can only be traced to political apathy on the part of the Japanese. That much is demonstrated by what has come, and stands as a warning to the rest of us about the global path that is really only a decade and a half behind (at best).

Stay In Touch