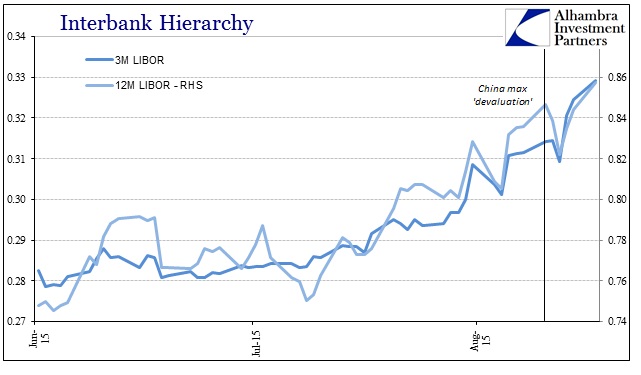

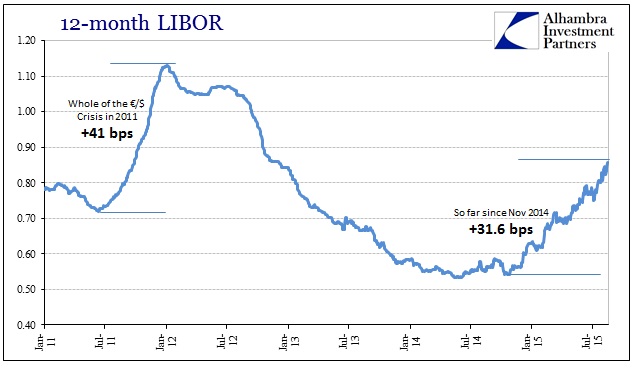

Three-month LIBOR has just this month risen by a little more than 3 bps. That sounds like nothing more than a rounding error, beyond trivial, but considering it had only risen 3 bps prior going back to March the comparison of acceleration is what clearly matters. Up until August, the upward variability in LIBOR had been limited toward the longer maturities, particularly at the 12-month tenor. Clearly, there was shift in interbank regimes for eurodollar trading in the past month.

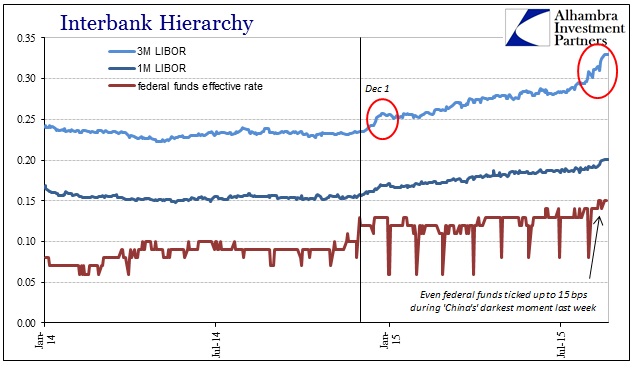

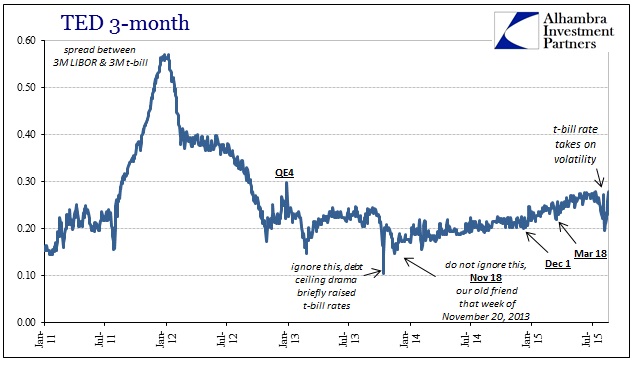

To see 3-month LIBOR join 12-month LIBOR in more rapid ascension would be an indication that “whatever” is disruptive had become far more so. Even the rather dead and meaningless federal funds market effective rate found 15 bps for the first time since April 2013 starting August 11.

That was, of course, China’s great “devaluation” and it matches our observations in repo and elsewhere of a “dollar” run. There is certainly a connection from interbank eurodollar trading to China’s PBOC getting pummeled about the yuan which extends internally within China, meaning that all this is linked. And it continues to be.

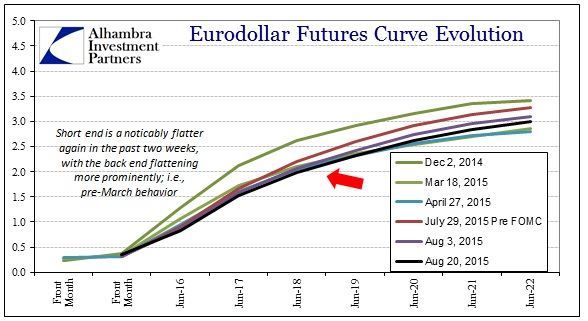

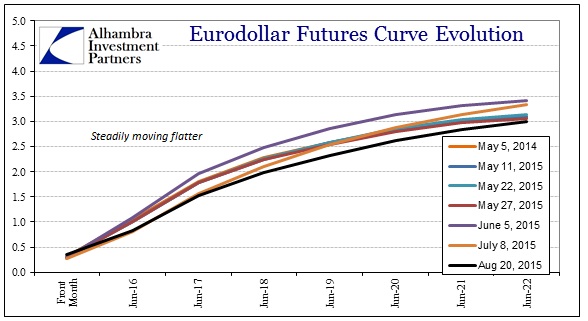

Even the 3-month bill rate in the US was rising coincident to this interbank disorder, with a relative surge in the rate to 12 bps on August 10; remaining at 10 bps during the hardest portion of China’s ordeal (so far). The eurodollar curve itself continues to sink, quickly, with much of the bids coming right after the assumed “policy window.” The front part of the curve is signaling that no matter what the Fed does the financial context thereafter grows gloomier by the session.

The financial ripples of this “unexpected” disconnect continue, as reverberation is assured by these close “dollar” connections.

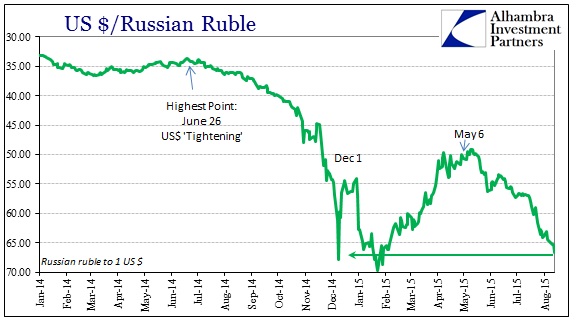

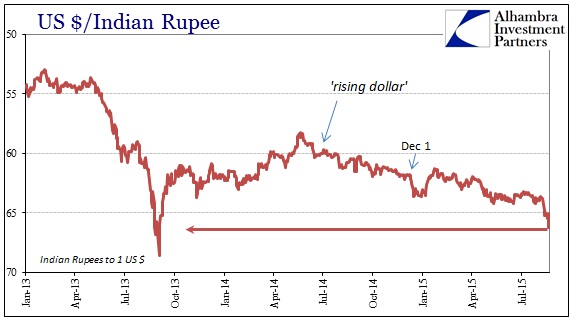

The ruble is now trading at practically the same level that forced the Central Bank of Russia to raise its repo auction rate in December from 10.5% to 17.0% and its standing facilities rates (including O/N loans and Lombard loans) from 11.5% to 18%. To the south, the Indian rupee has suddenly found itself attracted to the same troubling posture of descent.

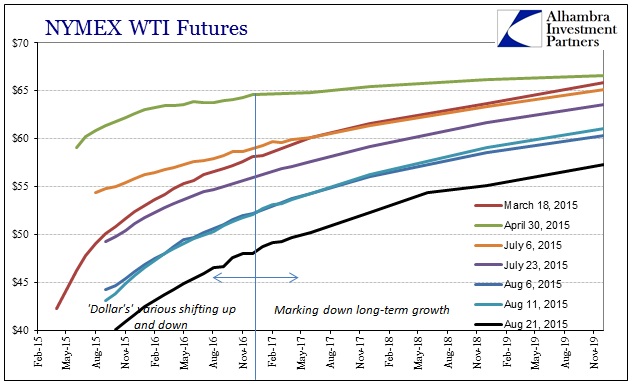

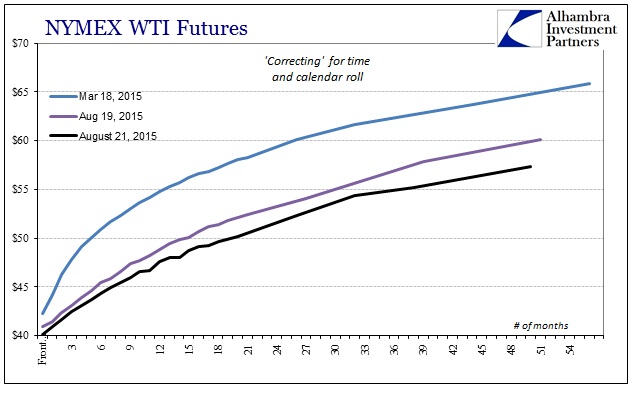

The rupee is not that much above its 2013 crisis point that unleashed a torrent of Reserve Bank of India measures that for a very long time seemed quite effective. The difference about August 2015 so far may be that what was abstract about economic danger and damage related and predicted by this financial mess has become far less so. Nowhere is that more purposeful than crude oil especially the entire futures curve for it, where less-defined pensiveness has already turned tangible and more immediate.

The front month, now October, jerked down to only a few pennies from breaking into the $30’s, but the back end is where most of the selling continues. New lows abound in the outer maturities as whatever economic optimism was built in to the curve, clearly for renewed “demand” for crude against rather knowable supply, has gone appreciably dark. The “dollar” in this context of the past year is the intersection between financial perceptions about the economy and how that is carried out into prices. The global nature of that has always suggested both widespread problems far beyond any surface “slump” or transitory weakness, but this renewed bout is, again, more like confirmation of what might fairly have been limited to just fears composing that prior first wave (to March).

Far be it for me to use sentiment surveys to address that linkage between finance and economy, but when such measures all more closely align they may take on more meaningful additions to the breadth of any economic survey or prediction. Again, widespread:

Growth in the U.S. manufacturing sector slowed to its weakest pace in almost two years in August, according to an industry report released on Friday.

Financial data firm Markit said its preliminary U.S. Manufacturing Purchasing Managers’ Index fell to 52.9 in August, its lowest since October 2013, from a final July reading of 53.8. Economists polled by Reuters had forecast the August figure would be 54.0.

A reading above 50 indicates expansion in the sector.

Job creation also slowed in August, with the index at 52.2, its weakest since July 2014, down from a final July reading of 53.8.

That weakness was overshadowed, though rightfully incorporated, by China’s PMI:

In particular, fresh data released earlier in the session exacerbated these worries, after the flash Caixin/Markit China Manufacturing Purchasing Managers’ Index (PMI) dropped to 47.1 in August, marking a six-and-a-half-year low. The reading beat a Reuters poll of 47.7, but was lower than July’s final reading of 47.8.

But it didn’t end there, as though Germany’s PMI was a bit better the similarly situated UK found more difficulty in its connection to “global growth”:

U.K. factories saw export demand fall for a fourth month in July, restraining growth in the manufacturing industry.

A Purchasing Managers’ Index increased to 51.9 from 51.4 in June, which was the lowest in more than two years, Markit Economics said on Monday. Economists in a Bloomberg survey had forecast 51.5. Export orders fell, with euro-area demand hit by the pound’s strength, according to the report.

Markit said the gauge points to weak growth after manufacturing shrank in the second quarter. U.K. factories are struggling as sterling’s advance and weakness in the euro region weigh on foreign demand.

It’s easy to simply blame sterling for the weakness in UK manufacturing, but as part of this more comprehensive examination it falls into place not of currency but currency-predicted economy. We have come a very long way in only a short few months, from when global growth, on the US recovery no less, was a bedrock assurance to this:

US stocks were stung for a fourth straight day after lacklustre Chinese and American manufacturing data sent investors barrelling into haven assets as concerns intensified that global growth is cooling.

It’s as much of a fitting statement from the mainstream except that the tense may be wrong; “has cooled” (or worse) rather than “is cooling.” Economists waved off the first “dollar” event as transitory or limited, but a second is far, far more difficult to subvert with nothing more than the same promises – especially when those are all talk.

Stay In Touch