If we go by the track of the “dollar” in setting economic expectations, we would expect to have seen a noticeable drop in economic activity in the first part of the year followed by a very tepid rebound lasting only a few months (“rebound” is too charitable of a qualifier, more like “not getting directly worse”). The ugly appearance of the “dollar” run starting in July and really working over August suggests renewed slump ahead, fully taking down any notions of “transitory” “aberrations.” Several data points have already followed that line, including Gallup’s view of consumer spending.

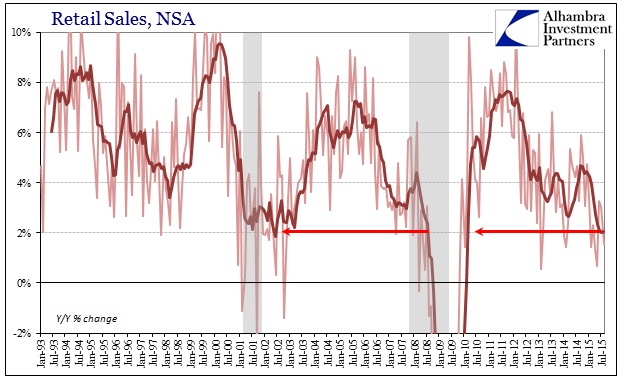

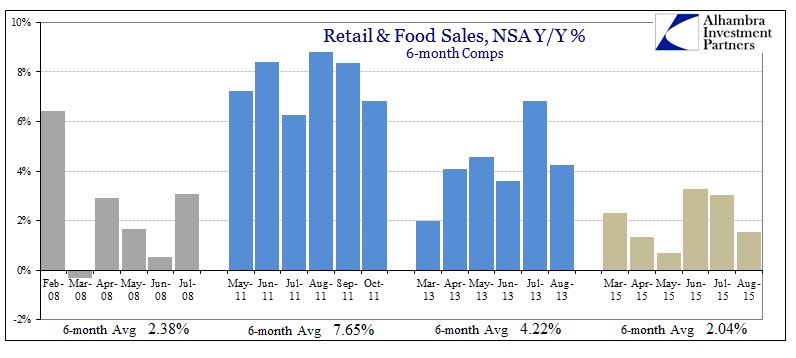

This morning’s retail sales report, expectedly, conformed. Overall retail sales, including the artificial contributions of the auto sector, had dropped to recessionary growth rates below 2% from February to May (1.44%, 2.32%, 1.35% and 0.69%, respectively) before “rebounding” in the early summer (3.28% and 3.04%, June and July). The mainstream narrative took that as the end of the slump and a renewed, resilient and boosted (by energy savings, of course) consumer. But August retail sales were instead back under 2% (at just 1.55%) and once more recessionary.

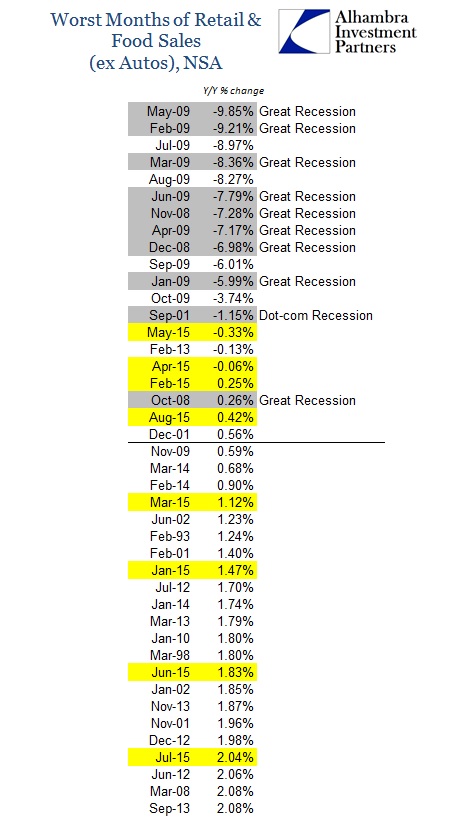

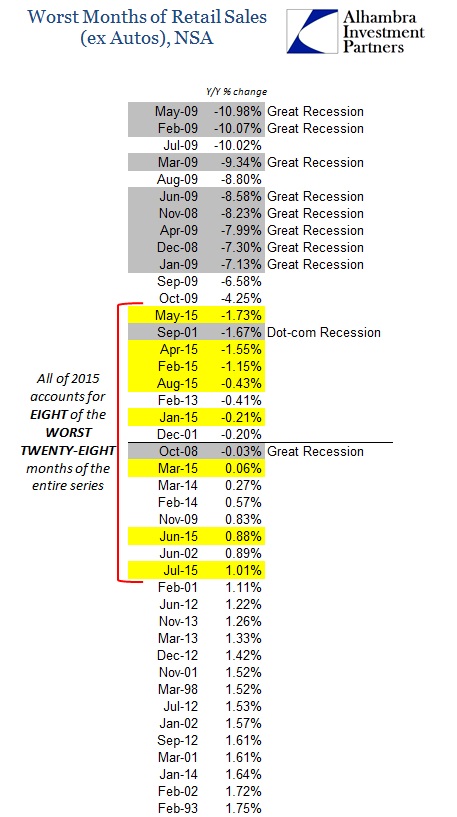

Ex Autos, of course, the consumer looks much, much worse. August retail sales ex autos were flat at just 0.42% while ex autos ex food retail sales contracted for the fifth time out of the eight months of 2015 so far. In other words, August was far more March than June; not transitory.

The 6-month year-over-year average for retail sales remained at 2%, which is equivalent to July 2008 as well as the bottom of the dot-com recession. Ex autos, again, the comparisons are much worse. In fact, August results are uncomfortably far up the lists of the worst months of retail sales in the entire series going back to 1992 (with Y/Y comparisons starting in 1993).

With August far closer to the beginning of the year and all that snow and ice, the real economic problem is reasserted – time. You would even think that the fact the entire year so far is in the upper tiers of the worst stretches of consumerism would be far more appreciated both for what it already suggests about now and the potential next step or trends. The longer this goes the less likely that businesses will hold on to their inventory and production levels. Production, for its part, has already been pared back and still inventory accumulates which means at some point, when “transitory” no longer hypnotizes, the true reversal might begin. That is the real implication of all this, as the economy already looks bad, recessionary bad, without yet the full weight of recession.

You wouldn’t get any sense of that, however, in most of the mainstream media. As I noted earlier this year, this can only be willing obtuseness or intentional misdirection:

Retail sales figures can be volatile and have wavered from month to month this year. Overall, however, the numbers suggest consumers have been upping their spending in the spring and summer as they begin to feel more confident about their circumstances.

Jesse Hurwitz, U.S. economist at Barclays, described U.S. consumers as “buoyant” and predicted spending would remain strong.

“We expect the consumer to remain the dominant force behind U.S. economic growth,” he wrote in a note to clients.

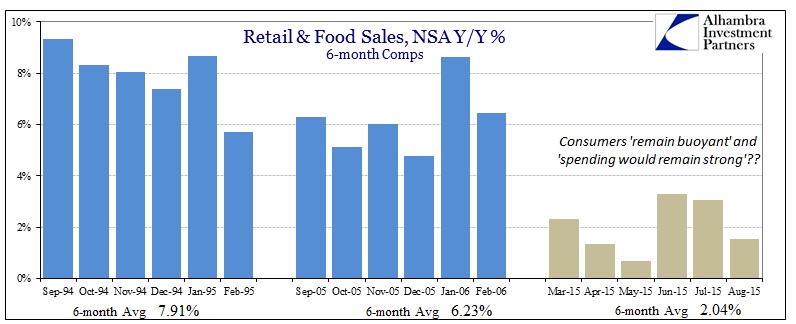

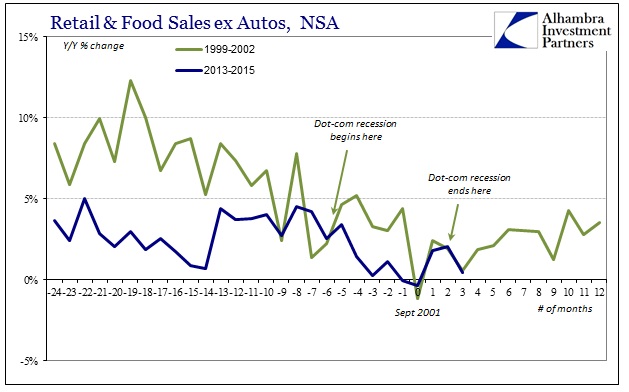

There is simply no way to describe consumer spending in any of those glowing terms, seasonally-adjusted or no. Take the idea of “remain strong” as the dutiful economist suggests for the Journal. That word loses all its meaning when applied to retail sales in 2015 (including the “rebound”). If the consumer was indeed spending in that fashion, we would expect to see favorable comparisons to time periods where consumer spending was far more inarguable in its standing; such as the artificial boosts from the later housing bubble or even the middle 1990’s before all this financialism really got started.

The 6-month average of retail sales (with autos) at just 2% truly looks recessionary when stood against those earlier times. The “strong consumer” of this year is spending at less than one-third the pace of the months just prior to the housing apex and but one-quarter of the growth in the middle 90’s. Even looking at consumer spending just in the context of the current “cycle” fails to find anything remotely positive about this year.

Retail sales are growing at nothing like 2011 just prior to the eurodollar’s renewed descent into 2012. Consumer spending, again, with autos, isn’t even half of what it was just two year ago when the “taper” drama was threatening to upset everything further (which, in this more disciplined context, it clearly has). If there is any similarity at all to any other point in the cycle, it would be the first part of the Great Recession far more than anything of recovery or growth.

I think that point is most evident in comparing the last 6-months (excluding, generously, January and February) with the dot-com recession itself. By this standard, this year is already worse in terms of consumer spending than that actual and declared recession; a recession where even the Establishment Survey was “allowed” to show job losses.

Even if you aren’t in any way inclined to think of 2015 so far in contractionary terms, it is easily observable that the economy here is far more that than “strong” or even “buoyant.” When the closest associations are recessions themselves there must be at least a re-assessment of interpretations. You can at least appreciate why the media and economists seem unable to perform as rational analysis demands because it deeply offends their sense of economic propriety stemming from their total faith and belief in orthodox economics, especially “stimulus” and Janet Yellen’s constant pleading to ignore anything bad as “transitory.” Thus every positive number is “strong” and everything else is worth no more than setting completely aside. Like a child covering his eyes and softly wishing the opposite to himself, the world and its economy doesn’t work that way.

By all these counts, the economy is in truly rough shape and not just in its current appearance. To reiterate again, consumers already look exhausted and the true turn has yet to be made. Time now is the great enemy; the longer the sales environment remains in this lowly state the more likely (increasing exponentially with each passing month) that “turn” hits the weakened economic and financial framework with possibly devastating effect.

Stay In Touch