While the slide in US manufacturing is being interpreted far differently as nothing to worry about, overseas the recessionary implications are forthrightly described. The contradiction is amazing simply because the same pattern is given such different interpretation even where they are closely synchronized and both given amorphous “global” growth connotations. In Japan, contraction in industry due to “global growth” is great danger; in the US it’s supposed to be nothing to get concerned about.

The difference, we are led to believe, is that manufacturing in the US is an aberration to orthodox interpretation about the rest of the economy while in Japan manufacturing is perfectly consistent. At some point, these “unexpected” setbacks in different locations synced to the same timeframe will dent that US view, especially as the trajectory is really self-revealing even in the nature of the commentary. If Japan isn’t producing goods because China isn’t buying them, and China isn’t producing goods because nobody is buying them, that doesn’t lead back to a “strong” US economy with a minor manufacturing problem – the issue is, and has remained, “demand.”

Japanese industrial output fell unexpectedly for the second straight month in August, raising the possibility that the world’s third-largest economy will fall into a recession for the second time in as many years and adding to fears about global growth.

The disappointing result strengthens the view held by some economists that Prime Minister Shinzo Abe’s administration and the Bank of Japan will take action to prop up a sputtering economy that is showing few signs of the kind of growth promised by Mr. Abe’s ambitious economic revitalization program.

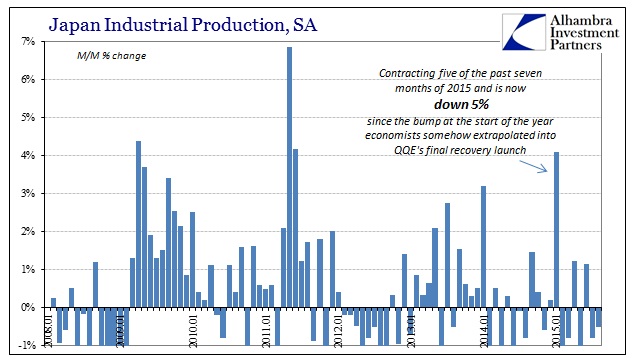

The contraction was only “unexpected” because economists had projected +1% month-over-month (instead of the -0.5% estimate), while the Japanese government itself was expecting almost +3%! The fact that Japanese IP contracted for the second straight month actually understates the degree of deficiency this year. Aside from April and June, IP has contracted in every other month. What is truly astounding about this year’s slide, however, is that last year’s bump toward the end (and into January) has not just “unexpectedly” disappeared where economists were sure it was at long last the recovery, IP is actually down a rather sharp 5% from that January level.

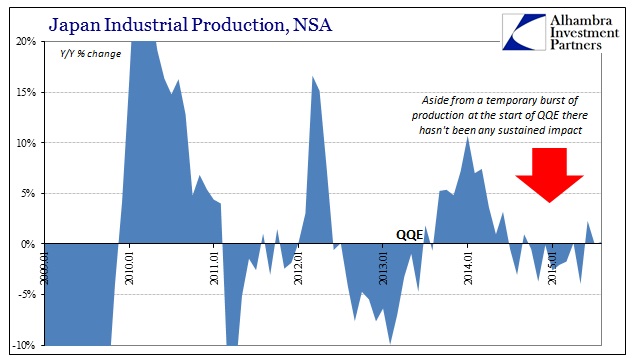

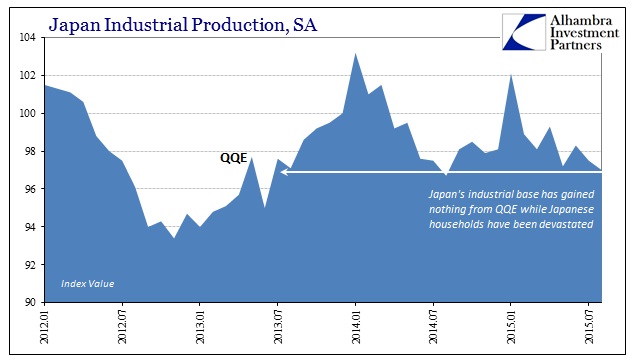

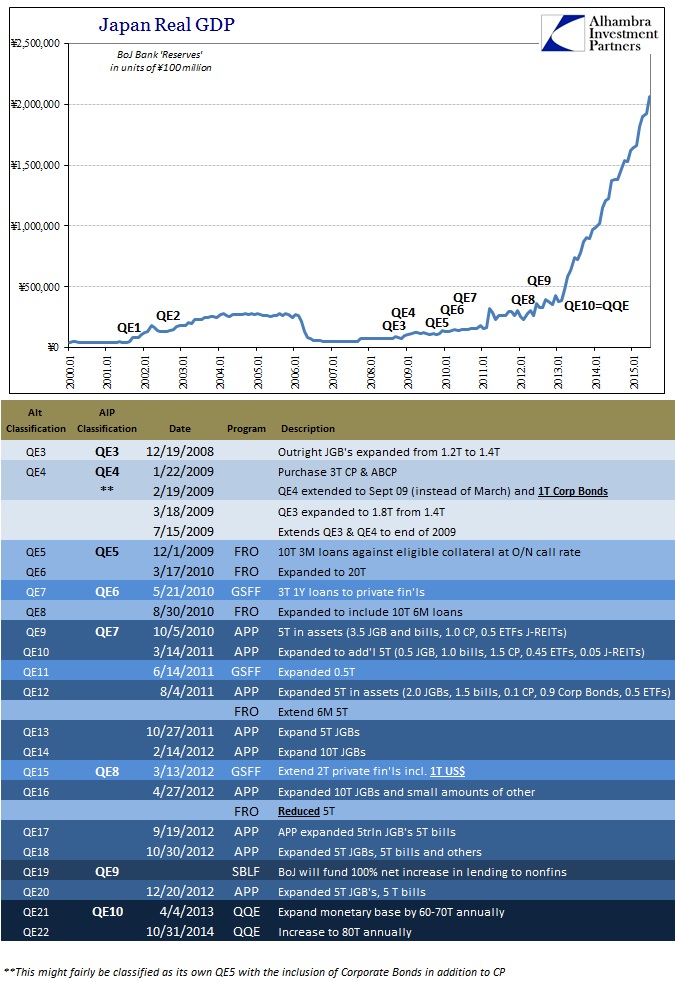

Through exports and yen-driven “inflation”, QQE was supposed to drive Japan Inc. back into business. Instead, apart from a temporary surge at the start in late 2013, industrial activity shows very little response to all that massive monetary interference.

As noted in GDP and elsewhere, Japan’s post-QQE recession did not begin with the tax hike. Given industrial data such as this, you can make a quite reasonable case that QQE hasn’t had any imprint whatsoever in forestalling an almost perpetual recession. That count is clear in the IP index, even in the seasonally-adjusted version, where the index level for August 2015 is actually slightly below August 2013 and even May 2013 just after QQE began.

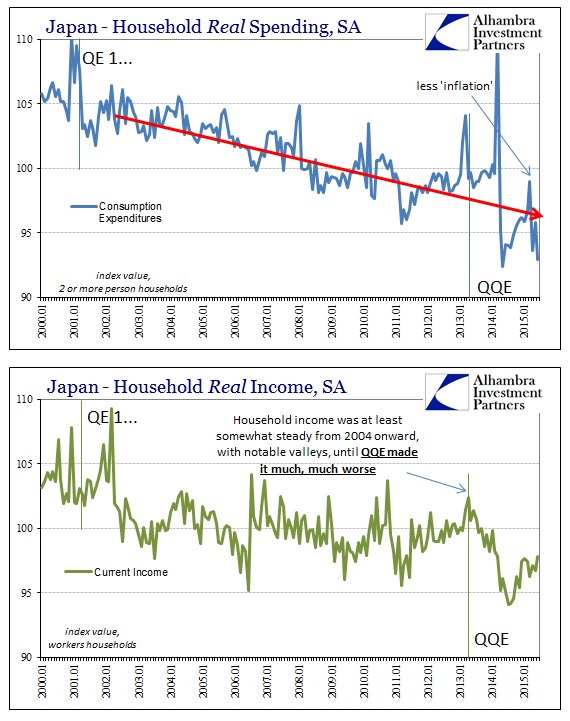

The problem of that is neutrality, or the distinct lack of it. If Japan’s industry didn’t respond to raw, naked financial aggression and forced imbalance and that was the end of it then the economic problem would be limited to the financial end. However, Japanese households have been utterly devastated by QQE’s redistribution channels and that burst of “inflation” such that the entire Japanese economy has been impoverished by the effort – to no actual gain. It is, as I referred to it of its European relation, all risk and no reward. The fact that this asymmetry appears everywhere it has been tried suggests the problem lies with QE as a theory rather than how it has been carried out by various jurisdictions and central bank specifics.

That, obviously, leads to a great incongruity in how it is described. And by “it” I mean both (Q)QE itself and the economy that results (or doesn’t).

Falling prices, weak consumer spending and a slowdown in key export market China are weighing on Japanese businesses, which are holding back investment and building up inventories in warehouses.

You have to marvel at that paragraph as a perfect encapsulation of everything wrong with monetary economics and how that is projected as official narrative. “Falling prices, weak consumer spending and a slowdown in key export market China” are all facets of the Japanese economy that QQE was supposed to (in fact, it was given official certainty if you go back and review BoJ’s publications from April 2013) address – even China at least via the weakened yen to increase market share from exchange “competitiveness.” That paragraph, then, rightfully should read, stripped of its equivocation,

QQE’s failures in a range of economic processes are weighing on Japanese businesses, which are holding back investment and building up inventories in warehouses.

As per usual, the “unexpected” and “unrelated” decline in economic fortunes leads instead to more of the same:

The slump in production is likely to intensify debate on the need for Abe’s administration to increase spending and for the central bank to boost its already unprecedented monetary stimulus.

There should be no intensification of the “debate” as there should be no debate at all. QQE doesn’t work and is quite seriously harmful – there shouldn’t be more as much as it should end, immediately. At the very least, given these IP figures and trends, it could be set aside on the admission of false promises alone, with the debate instead on the degree of economic decay it has caused beside. There should be no longer any doubt on those counts as there is a more than sufficient body of evidence; if QQE doesn’t work (and may be further corrosive) then that’s it for the entire series right down to its basic theory.

If ¥200 trillion hasn’t produced, what good is a few more hundred billion yen? Further, does anyone actually believe ¥2 quadrillion or more will? How about ¥10 quadrillion? Quintillion? There is no hysteresis to be had here; no magic quantity.

Manufacturing is falling off, sharply, in Japan, China, Brazil, etc., and the US. Dismissing American fortune as distinct from the rest has no basis other than continued fantasy that all this monetarism actually accounts for something positive. Even if it were the case that there is enormous difference between the US and the rest, how much of that might be predicated not on American QE’s success directly, but rather the corporate debt bubble? Thus, how much might fall apart (or already has) as the “dollar” rampages against it?

The “dollar” says that “stimulus” flat out isn’t; and it has been that financial reality proven correct time and again this year while economists the world over continue to hold “unexpected” and “transitory” as if they were literal gospel. This was supposed to be the year of global jubilation about the unquestionable global renaissance; instead it is everywhere heading the other way and at what looks like a quickening pace. Just like the “dollar.”

Stay In Touch