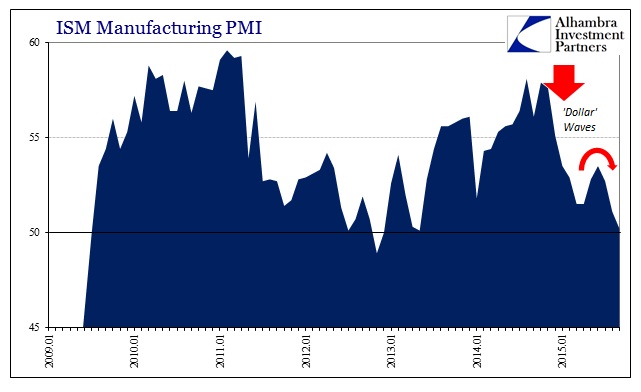

The ISM Manufacturing PMI was “unexpectedly” weak yet again in September. Continuing the theme spelled out by the regional manufacturing surveys (the Fed’s and the Chicago BBI), economic momentum has clearly stalled right where the “dollar” said it would. The pattern is blindingly obvious, with a huge slowdown to start the year (coincident to the first “dollar” disruptions including crude oil prices), a pause around May/June (with the “dollar” much quieter after the March FOMC) and then a pickup in August and now more dramatic deceleration in September (after the July start to the latest “run”).

At just 50.2, the headline ISM estimate was the lowest since May 2013. New orders fell sharply from 51.7 in August (which was a multi-year low) to just 50.1. While most fixate on the assumed 50 level as an actual dividing line between growth and contraction, these sentiment surveys aren’t nearly that precise and at most offer relative interpretations about the economic direction, trends and the perhaps even the strength of those directions and trends.

With such ugly numbers everywhere, the mainstream is rushing to reassure:

The September numbers are the latest in a string of mixed reports for U.S. factories. The ISM index shows manufacturing activity has expanded for 33 straight months, though the pace has slowed markedly from last summer when it touched 58.1.

Other gauges have been weaker, with the Federal Reserve’s measure of manufacturing output down in August and a recent Commerce Department report showing a drop in exports of autos and consumer goods.

There was absolutely nothing “mixed” about factory reports in September unless you succumb to the allure of the false precision; everything is trending down and more importantly being rather quick about it. But even that is not purportedly anything to be concerned about because economists are certain that the problem lies only elsewhere:

The figures showed export demand matched the weakest since July 2012 as economies from China to the euro area struggle to improve. While resilient spending by U.S. consumers is helping underpin manufacturing, the stronger dollar is making it more expensive for foreign buyers to purchase made-in-America merchandise.

As if taken directly from Janet Yellen’s September press conference, particularly where she made a point of emphasizing the “strong” US economy (before reciting all the evidence that denies any such qualification), we are led to believe if not for that dollar the economy, manufacturing with it, would be booming.

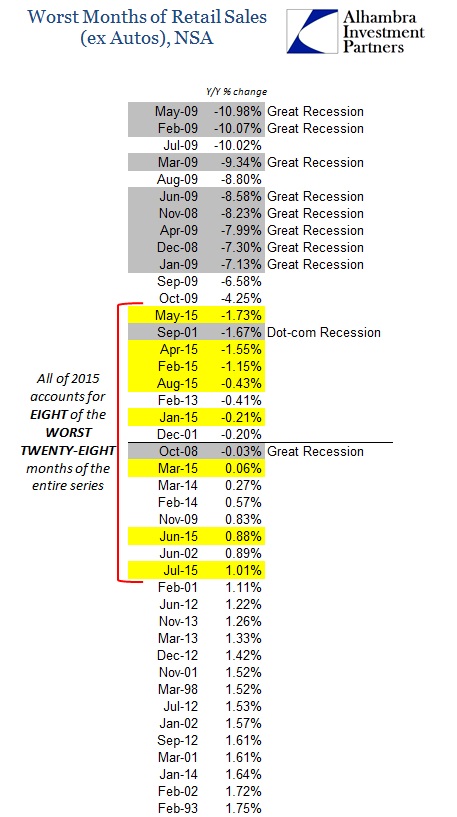

By all actual counts, if there is a resiliency being shown by US consumers and the consumer economy it has a particularly peculiar way of hiding itself. If the word “strong” was applicable beyond the simple fact it is repeated over and over by economists, consumer spending would show it somewhere. Instead, examining the catalog of consumer indications demonstrates quite the opposite. Starting with retail sales, where August counted still among the worst of the entire series, there is far, far more recession than resilience. Worse, retail sales figures across-the-board in August were more of the early-2015 variety of weakness than the less alarm of the middle of the year, following, too, the “dollar’s” path.

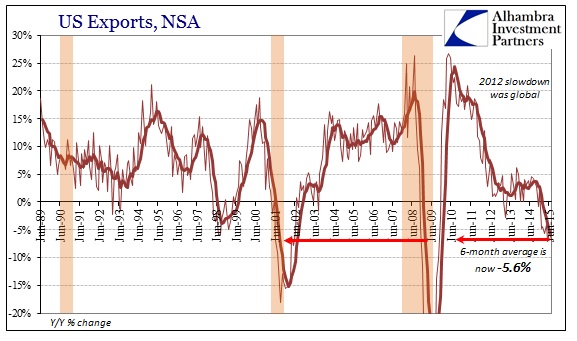

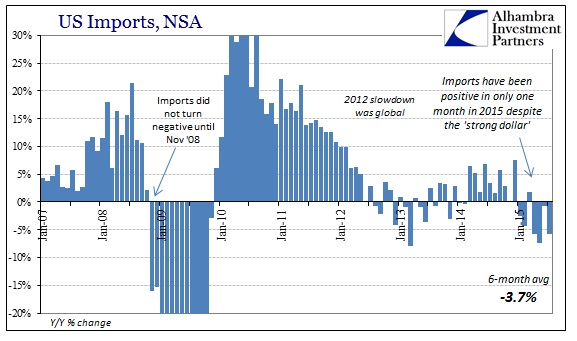

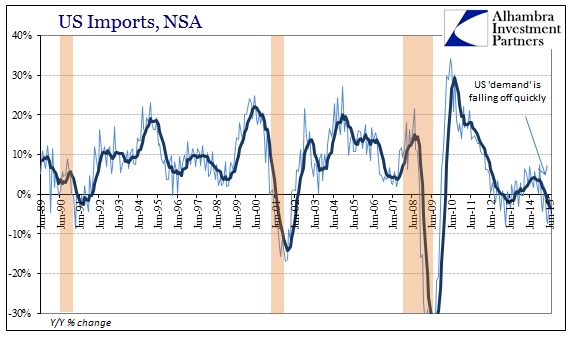

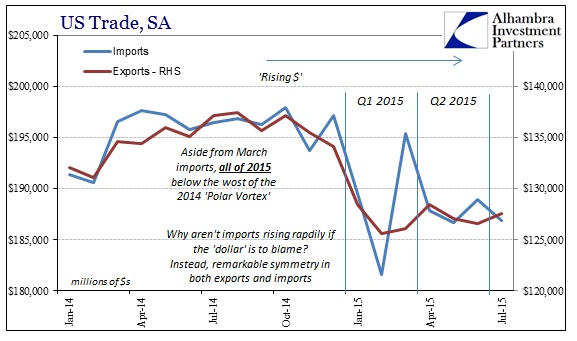

The mainstream “strong” narrative really falls apart, however, exactly where economists and the media suggest it shouldn’t. If the dollar were truly the sole animating factor in the shocking manufacturing decline, meaning overseas weakness exclusively, then how are we supposed to reconcile imports? In other words, if this was simply the dollar making US exports “more expensive”, as is repeated blindly, and overseas economies alone in their distress, why isn’t the “strong” US consumer buying anything and everything from foreign producers? If the dollar makes exports difficult, the opposite is presumably true for imports where US consumers are flush with at least the unemployment rate.

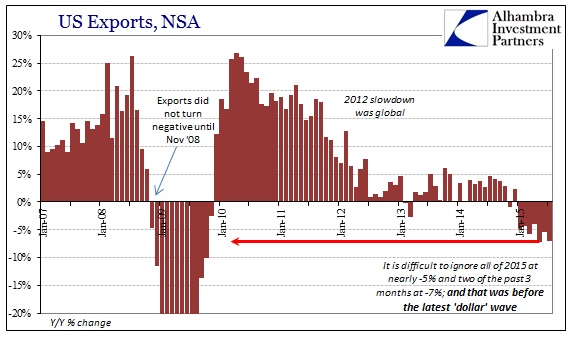

The export figures for July (the latest update) do follow that exchange rate suggestion. Exports collapsed yet again, down a stunning 7% for the second time in the last three months of the release. Export declines didn’t reach that level in the Great Recession until December 2008, but whereas that was a singular impulse, in 2015 exports so far have contracted steadily at or near that rate.

So if the dollar exchange is the problem, combined with foreign economic deficiencies, then imports are surely surging or at the very least growing at a “strong” and steady rate.

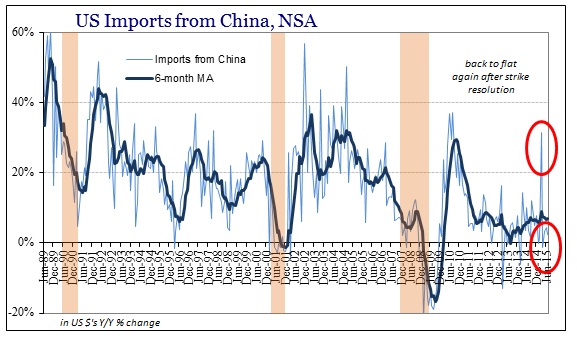

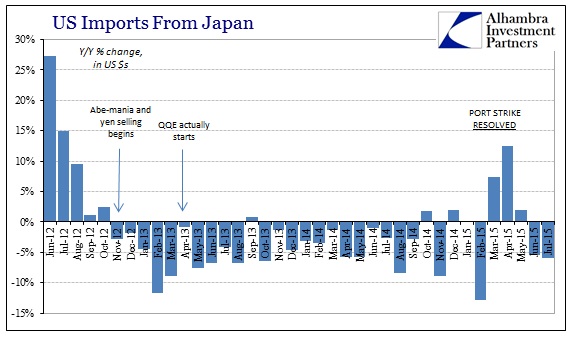

Imports from both Europe and China were flat in July, while imports from Japan, where the yen had been “devalued” a second time, dropped 6% after falling 5.5% in June. US demand seems to be shrinking at the same exact time foreign economies are stalling and plunging. That may just be a damned statistical oddity, or, more simply, the global economy is uniformly dropping with the US as a full part of that decline (“dollar”, after all).

In fact, by count of even the seasonally-adjusted figures, imports are following exports a little too closely to believe that the looming (or formed) global recession is portionable or discretely separated. The harmony between them strongly suggests instead a uniformity that can only be caused by a singular (financial) force.

US consumer demand is strong, except everywhere you look to actually find it. Instead, what I think those who actually believe the mainstream narrative mean to proclaim is that there should be strong consumer demand given derivative assumptions about the Establishment Survey and unemployment rate. That is why we have been handed this cascading progression of downplaying each stage. Therefore, the only significance of these diminishing expectations is that they are clearly diminishing; and the acceleration of that deterioration might be extrapolated from the increasing intensity and quality of the nonsense meant to deny it.

As noted yesterday, this is already well-descended the slippery slope of denial, plus one more rung:

1. Dollar doesn’t matter, indicates strong economy relative to the world

2. Dollar matters for oil, but lower oil prices mean stronger consumer

3. Manufacturing slump doesn’t matter, only temporary

4. Manufacturing declines are consumer spending, but only a small part

5. Manufacturing declines are becoming serious, but only from overseas

6. …

Stay In Touch