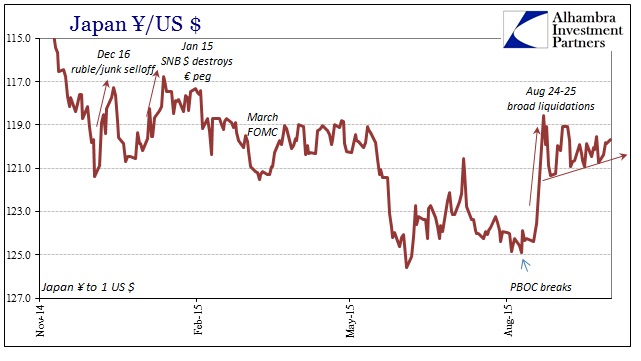

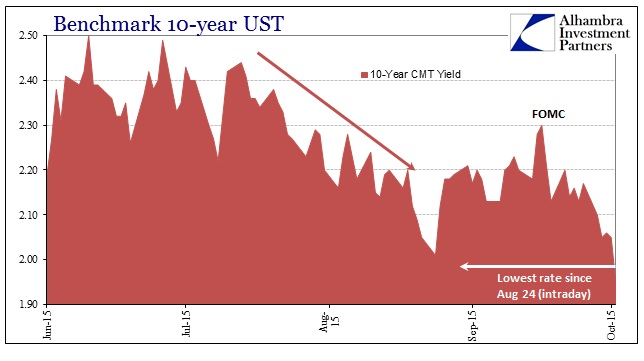

The doubts about the payroll report were taken as no doubts at all in “dollar” trading. The three indications I gave yesterday in terms of representing liquidity were all pushed farther after the jobs data essentially confirmed the direction where this is all likely heading. While the yen may have been more muted, and the “shock” wearing off in later morning trading, treasuries were heavily bid higher (price) bringing intraday yields back to the lows of August 24.

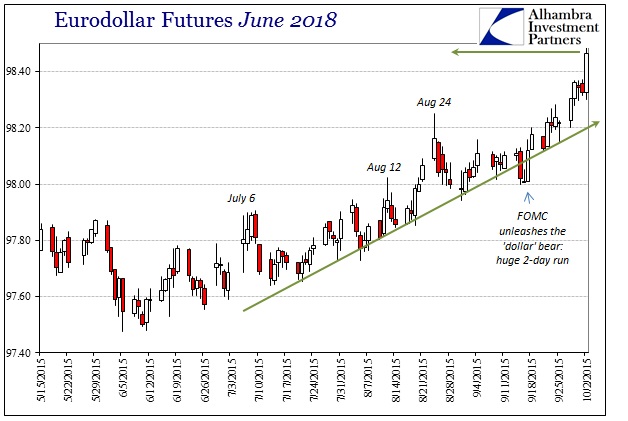

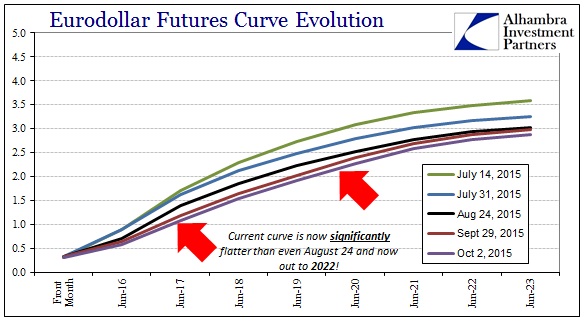

Meanwhile, eurodollars just exploded, the entire curve withering significantly yet again.

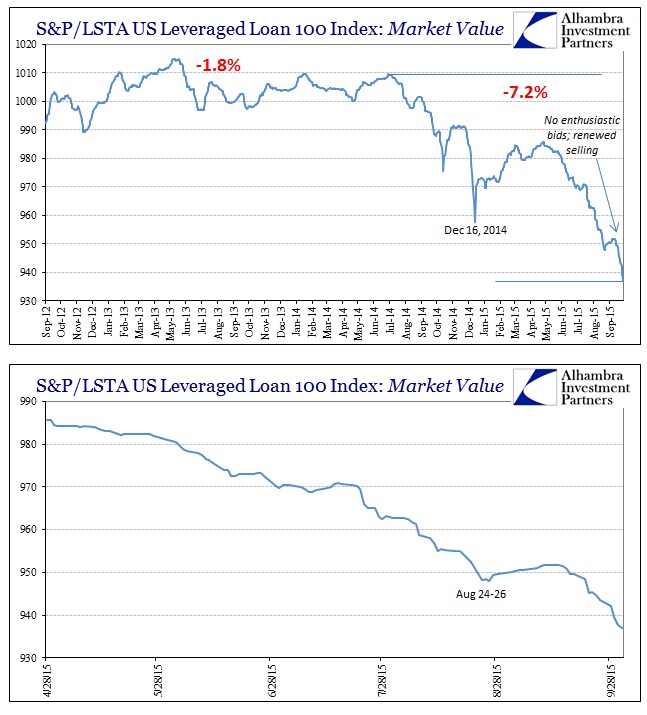

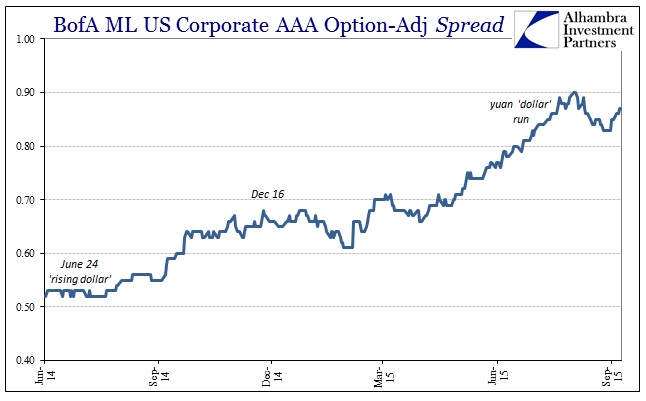

With corporate bubble prices further teetering yesterday, any updates for trading today are at high risk especially heading into what is shaping up as a dour weekend. The downside to the corporate bubble is acceleration (and these prices/yields only upated through yesterday). Even investment grade and AAA spreads are creeping up again.

Stay In Touch