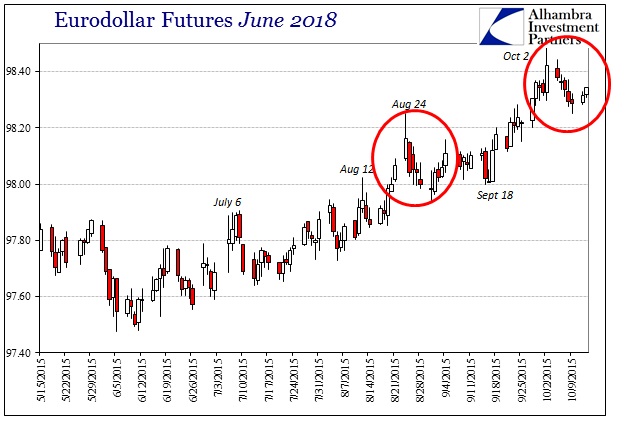

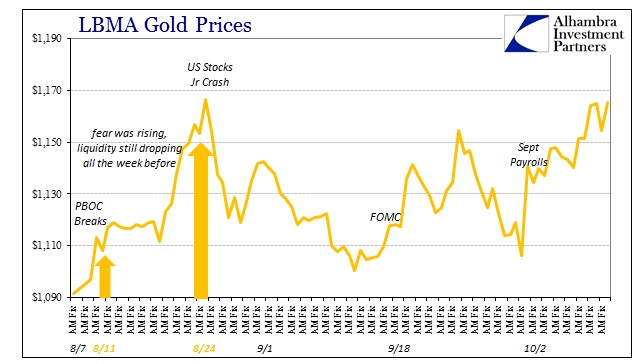

With Chinese trade figures for September threatening a further reset, it is worth noting (yet again) that “dollar” funding isn’t much changed in October. In fact, there are several additional references to resuming the downward slide. Gold has been steadily bid since the September payroll report on October 2, while the eurodollar futures curve behaves much as it did (almost identical) in the immediate aftermath of August 24. Both of those would suggest at least the same elevated pressure and uncertain sentiment departing from the Golden Week optimism in stocks and commodities.

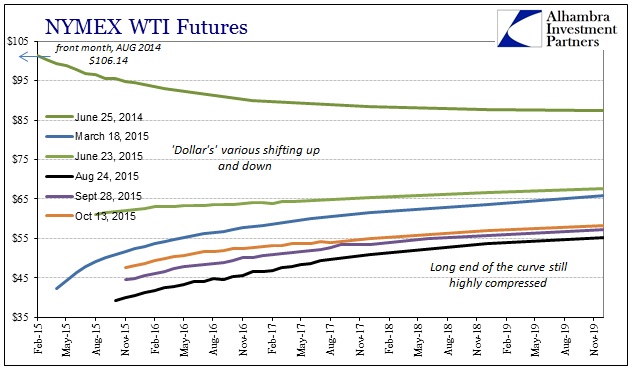

But even commodities have run into “something” in the past few days since China re-opened. After surging from an intraday low of $43.88 on October 2 (payrolls), WTI futures (November delivery) hit an intraday high of $50.99 last Friday; November futures are currently trading back at $47.52 (with the long end still stuck below $58.50). Similarly, copper, which had traded as low as $2.24 in late September, wound up to nearly $2.44 last week before falling back to $2.393 in recent trading.

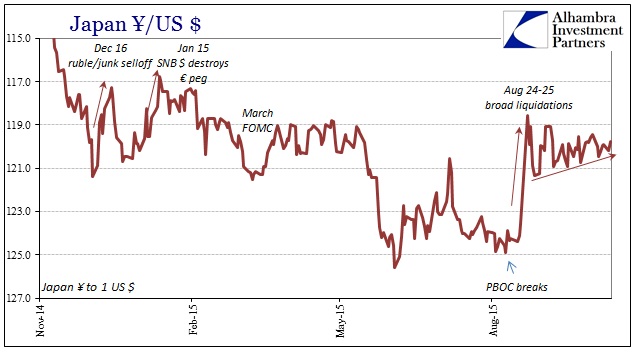

But where secondary currencies like the real and rupee have continued on their reversals of the past week, other funding currencies have not. The yen, for example, continues to list lazily upward seemingly attached at around 120 while attracted more toward 119.

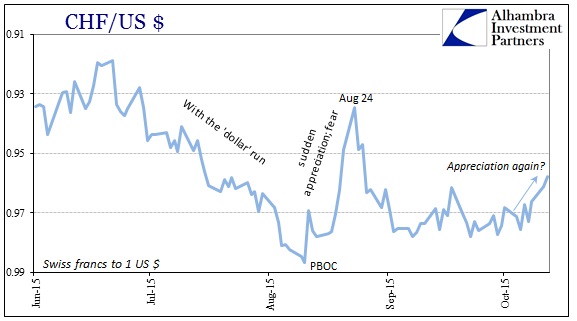

It is the franc, however, that is trading in a potential signal. The Swiss currency this week suddenly departed from its own trading range that dominated for most of September. This same upward shoot was taking place into the FOMC meeting on September 18, where the Fed’s non-decision seemed to have quieted the franc for the rest of the month.

It was a microcosm of the same unusual turn that visited the franc after the PBOC broke under the “dollar” run of early August. Before then, the franc was trading lower just as almost every other currency and the same as it had prior to the January 15 SNB “dollar” break. Once the fear was unleashed over China’s “devaluation”, the franc began acting safe haven again, forgetting its depreciation to nearly 0.99 and shooting as high as 0.932 by the August 24 liquidation. If we are seeing something similar again just now forming this week, that would fit with the reversals in commodities as well as the continued elevation of gold and eurodollar prices.

Obviously, it is too early to make any solid conclusions about renewed funding difficulties even though all the ingredients remain largely in place. That noted, the change in the franc warrants dutiful attention in that regard. While there isn’t any outward indication that it would be related to Credit Suisse’s “sudden” capital needs, it can’t be dismissed either (and would, pardon the pun, frankly fit within the governing dynamic of eurodollar decay in just such acute episodes).

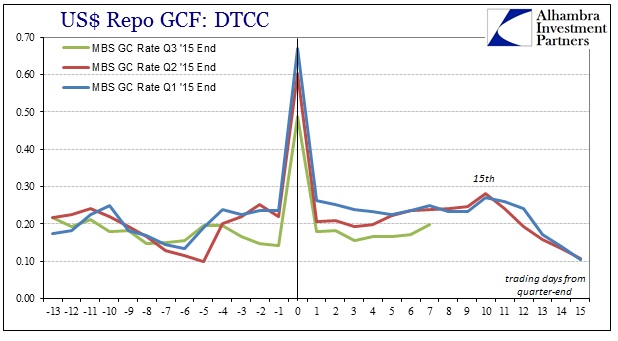

At least the repo market has been less of an identical cycle, so maybe that performs mitigation or counterbalance; then again, there is still more than a passing resemblance of the same quarter-end pattern, so maybe not.

Stay In Touch