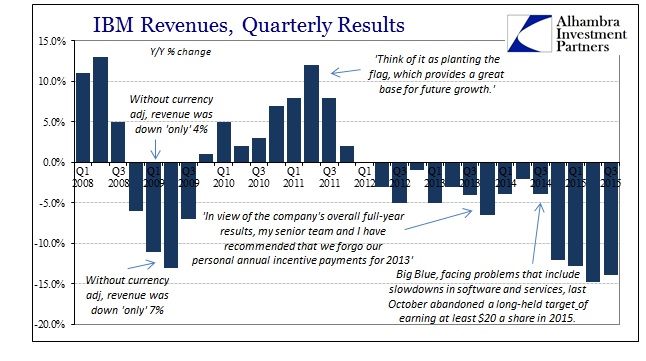

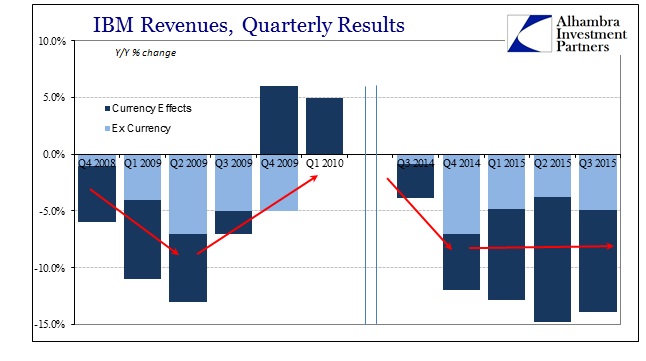

IBM reported yesterday yet another disastrous quarter. Revenues declined by nearly 14%, marking the fourth consecutive quarter of at least -12% revenue. That level and accumulation of shrinking has already surpassed the worst of the Great Recession for the company. That comparison holds whether you exclude currency or not, as currency “effects” in 2009 were just as strong and depressive.

While all that remains plain, it is largely ignored or dismissed. That starts with the primary assessment of currency effects as if the dollar’s translation in IBM’s corporate structure can simply be stripped out. Translating overseas revenue is not just an accounting problem.

The trajectory is the company’s main enemy at this point, both with and denying the dollar’s effects. Revenue during the worst of the Great Recession followed the typical recession pattern, forming the expected “V” of sharp decline and then sharp recovery. In 2015, IBM’s contraction is something altogether different. The optimists claim that is nothing more than a mature technology company behind the industry revolution toward the cloud.

International Business Machines Corp (IBM.N) posted a bigger-than-expected drop in revenue and cut its full-year profit forecast, as a stronger U.S. dollar accentuated weakness in demand from China and emerging markets…

“This is another example of the massive headwinds that large-cap traditional tech stalwarts are seeing in this ever-changing environment, as more customers move to the cloud,” FBR Capital Markets analyst Daniel Ives said.

IBM itself encourages this view in its press releases and public statements; and why not? Blaming the dollar is easy and relatively pain free. And at least in terms of an industry undergoing radical alterations management can point to their increasing efforts to redefine the business yet again. There is far less hope and positive expectations to be “gained” from admitting a serious economic downturn, particularly one that is just unrelenting.

But IBM started to do just that; from IBM’s Q3 2014 quarterly press release:

“We are disappointed in our performance. We saw a marked slowdown in September in client buying behavior, and our results also point to the unprecedented pace of change in our industry. While we did not produce the results we expected to achieve, we again performed well in our strategic growth areas – cloud, data and analytics, security, social and mobile – where we continue to shift our business. We will accelerate this transformation,” said Ginni Rometty, IBM chairman, president and chief executive officer.

Analysts and media commentary about IBM have focused exclusively on the back end of that quote without ever identifying the significance of the front end: “We saw a marked slowdown in September in client buying behavior.” You could interpret that as another sudden inflection away from mainstreams and IBM service products, but that would still raise the same economic issues. At that point, IBM was modeling no further dollar impact for the first half of 2015, which means that IBM itself didn’t appreciate the potential significance of that result (which may explain why they included it in their mainline press release). As Yellen, at that point actually recognizing a macro shift wasn’t so damaging or dangerous since it was surely to be “transitory.”

Given what we have seen of the global economy in the year since that statement was written and released, it is far more likely that IBM picked up, as the dollar and the “dollar”, the gathering downward, depressive impulse. In fact, that would be the second time the company has done so; the first dating back to the original inflection in 2012.

Again, whether or not you feel the cloud transformation responsible, even that would align to a renewed emphasis on client cost cutting that took place in early 2012 – exactly as the global economy fell off. And while internet-services-as-client-solutions may have been part of it, I think it rather more reasonable that IBM’s revenue trajectory follows the course of global capex spending overall. It started to depress in 2012, in close relation to “demand”, with weakness lingering and confounding everyone (including management) that expected only a minor and temporary deviation. Instead, the company, as the global economy, only gets worse by the quarter.

Thus, the “dollar’s” amplification in the middle of 2014 was as confirmation of the real business and revenue shift as well as a frenzied gesture for its growing seriousness. If Q3 2014 “We saw a marked slowdown in… client buying behavior” then IBM’s results thereafter have only confirmed that plus its downward and persistent extension. That would imply on a relative basis something potentially far worse than the Great Recession, at least in terms of global capex in technology.

“They’ve been talking about their growth businesses and how they’ve been growing at 20% or 30%, but the important thing is moving the needle for the company overall, because some of those solutions are effectively cannibalizing their old businesses,” saidToni Sacconaghi, an analyst with financial services firm Sanford C. Bernstein & Co. He also called the company’s lowered outlook “an incremental step down.”

These revenue changes and inflections align far too closely with those in the global and domestic economy to simply dismiss it as the dollar or the cloud. In fact, both of those fit within the macro paradigm far more than they are exclusive of it.

Stay In Touch