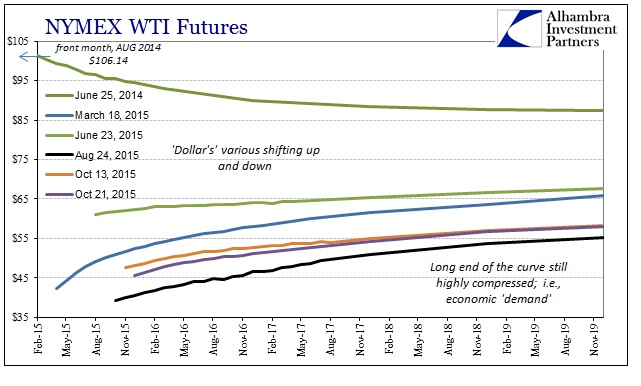

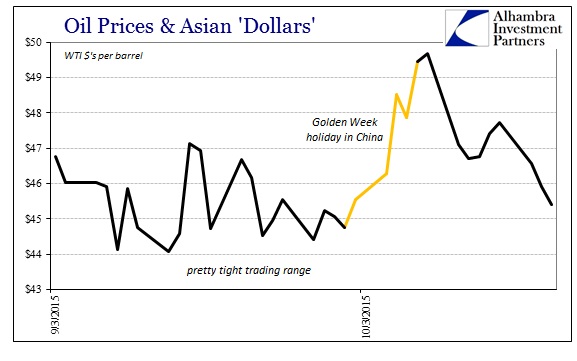

The further we get down the calendar away from China’s second biannual Golden Week the clearer the “dollar’s” influence on crude oil becomes, at least in the shorter maturities (and spot price). As usual, the “dollar” creates far more volatility at the front end than the back, where the longer maturities (recognizing more thinly traded months) tend toward economic considerations. That makes it sound as if the two sides are divorced, but in truth it is a great example of how markets make financial factors into economic ones. Thus, the “dollar’s” impression up front over time helps settle out the economic perceptions further along.

I think the futures curve’s history is reflecting exactly that, particular in influence of the two “dollar” waves of the past year or so. In the first, the rear of the curve settled closer to $65-$67 even as the front end was whittled down toward $45 and below. The interim between the waves had little effect in either direction on the back end, but the renewed turmoil in July (especially July 6 onward) has pushed the whole curve still lower again; the outer maturities now orbiting the $54-$56 range.

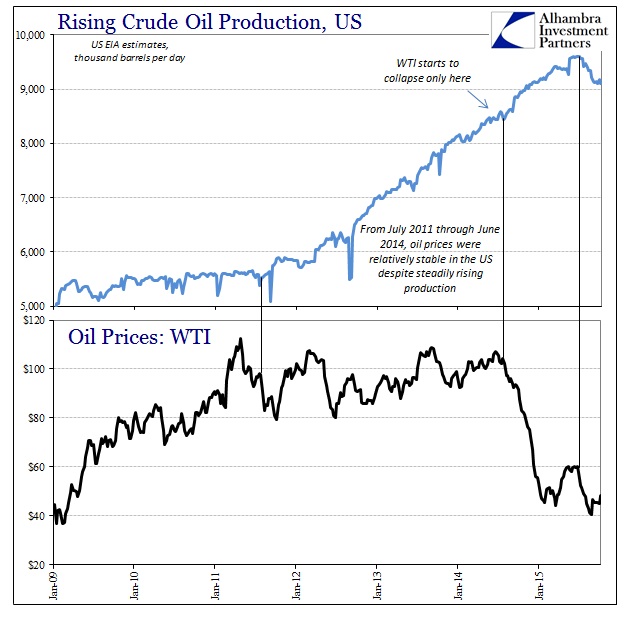

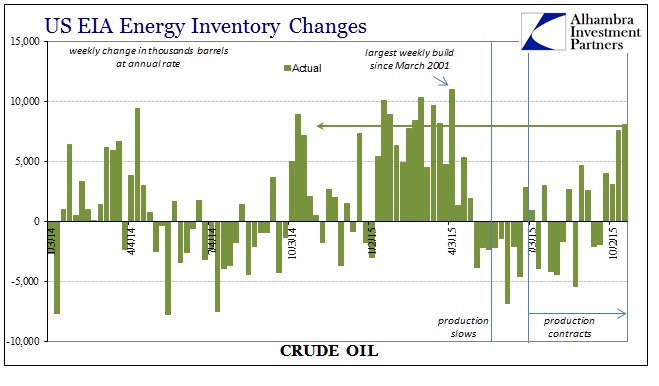

As much as that might be, again, raw financial guidance, the fundamentals of at least WTI crude mechanics have actually matched this wormy dance (no surprise; that is what markets are supposed to do). As has been well-worn through the media and economists hoping to find nothing more, oil production on the supply side had been extremely steady on an upward incline – to almost a straight line approach. Given that production curve, there was no possible way that the collapse in oil prices had anything to do with supply since it was entirely steady and predictable. That left only the “dollar” to generate such a massive change in pricing behavior, but as time wore on it became clear that the “dollar” was acting as a financial proxy for expected future behavior of “demand.” That was expressed and confirmed in the startling buildup of crude inventories not just in the US but around the world starting around January 15.

In that way, the “dollar” was acting the agent of finance upon basic economics that extend beyond WTI and even crude oil and commodities in general.

After that first wave had crested, the crude market started to adjust in a very predictable manner. Production at first slowed and has even declined more recently. After reaching 9.6 mbpd in the first week of July, US production has fallen back to just less than 9.1 mbpd.

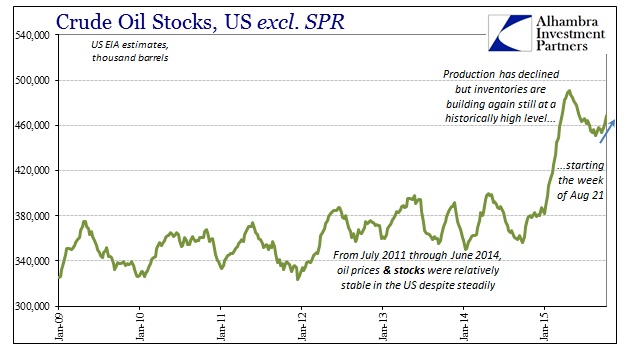

As production and supply began to slow down, inventories followed with sustained drawdowns throughout the summer months. Starting the week of August 21 (imagine that), however, inventories have reversed and have been rising once more; mimicking almost exactly the pattern from last summer into autumn.

The problem with that is obvious especially since it is these fundamental elements that were predicted by, and incorporated into, the wrangling along the futures curve in these successive “dollar” waves. That includes the rather ominous upward shift in crude oil inventories that had never fully adjusted from the last dramatic build in the first “dollar” upsurge. In fact, the drawdown during the summer was much the same tepid “rebound” that we find in the broad cross section of economic statistics populating the awakening toward the end of “transitory.” In absolute terms, the US EIA counts crude inventories as still around 460 mb or 26% above the inventory levels from one year ago (which were largely in the range of recent history).

It is this marriage of wholesale finance and real economic factors that disciplines eurodollar analysis, as well as providing specific emphasis for it. And here, too, we can appreciate how the interplay becomes self-reinforcing as first finance and then economy, even where European bank interest rate swap books might predict and define at least the contours of real economic function in crude. From there, unfortunately, the global economy is closely following.

The “dollar” and WTI futures have been suggesting another fundamental imbalance (as it continues from the earlier) and so far it seems to have arrived as scheduled.

Stay In Touch