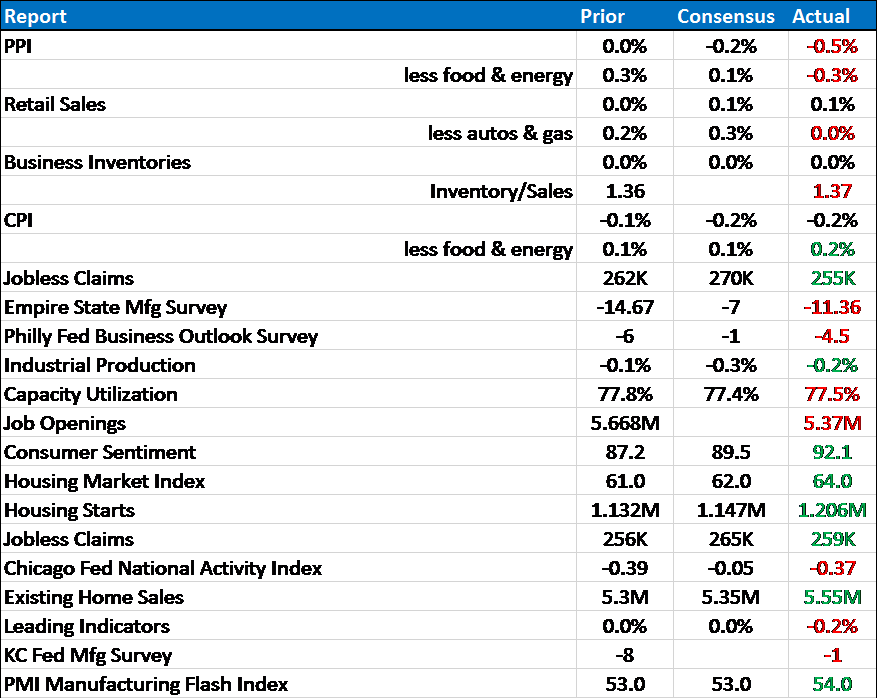

Economic Reports Scorecard – 10/12/15 to 10/24/15

The bifurcated nature of the economy is on display for all to see in the economic data from the last two weeks. Manufacturing continues to struggle as shown by the Fed surveys, the CFNAI, IP and inventories. Meanwhile, housing continues to improve in both the existing home and new home side of the equation. Those metrics are still quite a ways from “normal” but they have been steadily improving over the last few years and the trend continues. The service sector just keeps plugging along.

Jobless claims have pushed to new lows for the cycle, to levels last seen in the early 70s when we had a lot smaller workforce. That probably explains the consumer sentiment numbers which improved. The consumer may be confident but he isn’t stretching much on the spending side as retail sales shows.

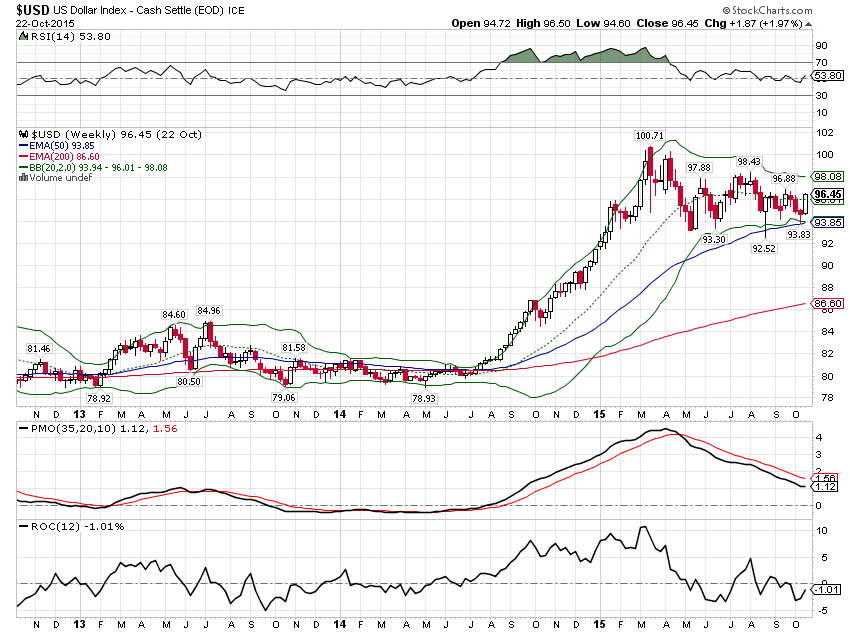

Overall, the economic data continues quite mixed but I think it is noteworthy that the troubles seem to be centered in the international/trade sector. The domestic economy isn’t booming by any stretch of the imagination but neither is it falling off a cliff. Unfortunately, the hint of more easing from the ECB and the Chinese rate cuts mean the dollar is back on the rise and that was the catalyst for the turmoil of August/September. I don’t think the rest of the world has had time yet to adjust to a steadily rising dollar so one might expect some stress to return if it resumes its previous trajectory. Multinational corporations’ earnings, which have been hit hard by a strong dollar, aren’t going to like it either and the recent rally off the lows was led by those same large cap stocks.

The market reaction to the data and to the signs of new monetary easing has been interesting to say the least. Everyone pays attention to stocks and they certainly provided a positive reaction to the news and the data. And, as mentioned, the dollar rallied right on cue technically:

Both those moves make sense if the ECB is going to try and push the Euro lower (which to me is what QE is all about). At the margin one would expect that to push capital toward the US markets. As for the China rate cut, it doesn’t seem that wealthy Chinese need an excuse to continue moving capital out of the country but a rate cut probably won’t reverse the tide.

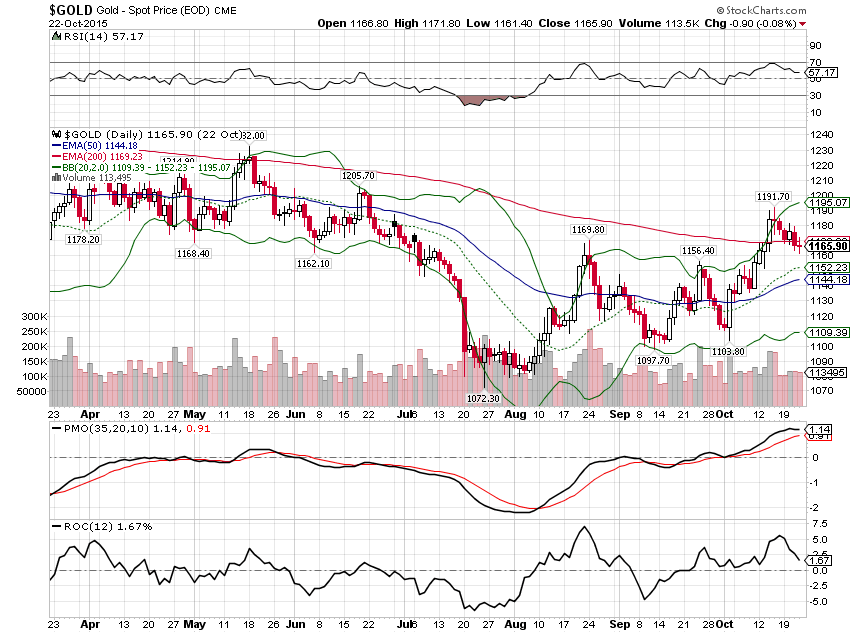

What doesn’t make much sense considering the move in the dollar is the action in gold which was muted. The emerging uptrend in gold was not disturbed by the ECB’s machinations.

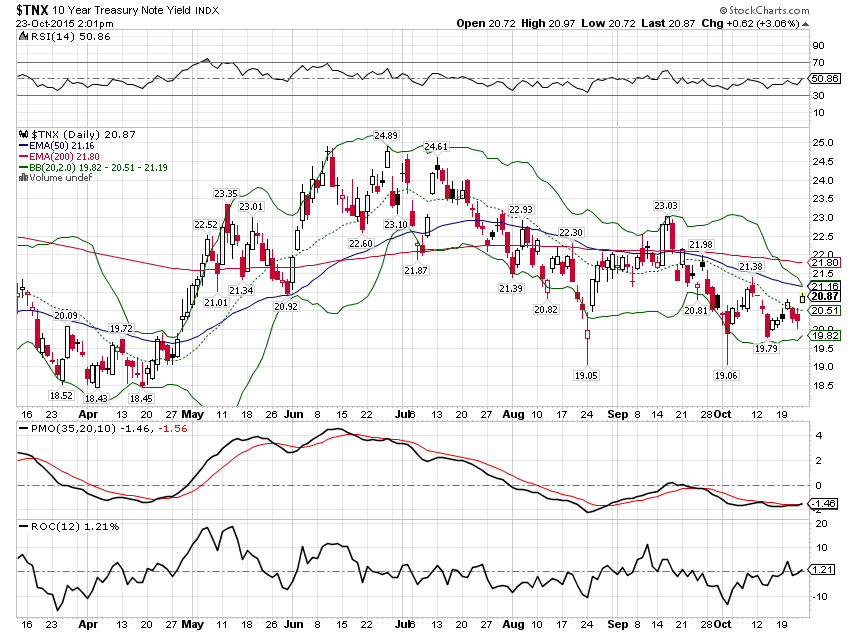

The strong up move in stocks would seem to indicate that there is a belief that the additional easing from the ECB will result in more growth but the bond market isn’t buying that notion. The 10 year Treasury yield ticked up only slightly:

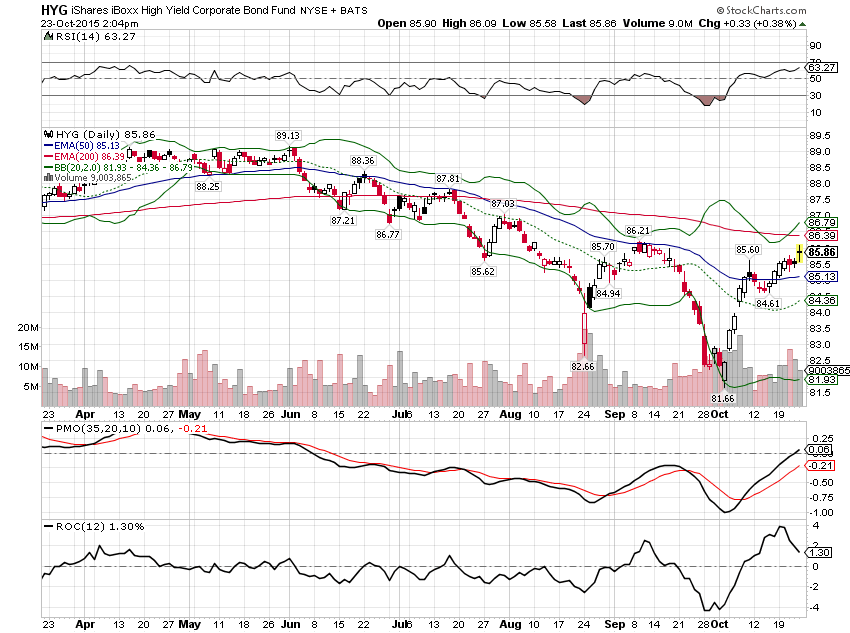

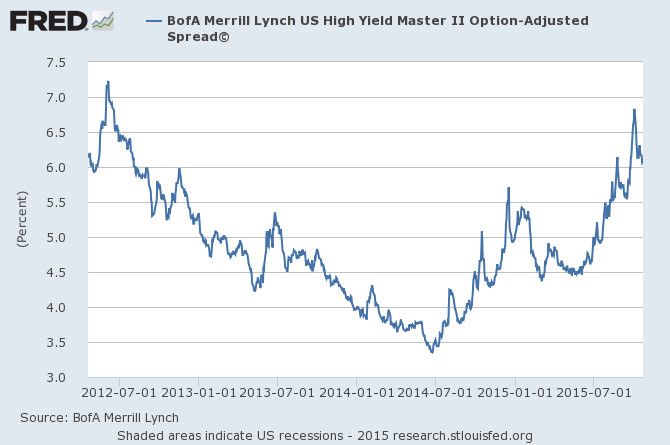

High yield bonds didn’t do all that much either although credit spreads have improved a bit since the beginning of the month:

Overall, the economic picture hasn’t changed that much. The global economy is still slowing and there is little evidence that what the ECB is doing will change that much. The China rate cut might have more effect but like most emerging markets China is more affected by capital flows which continue in the wrong direction. Latin America is a basket case without rising China demand for their commodities and Brazil appears on the cusp of a political crisis, not their first and surely not their last. Australia and Canada continue to struggle with the Chinese slowdown, Canada so much they elected an empty suit – a quite handsome one according to my wife – as Prime Minister.

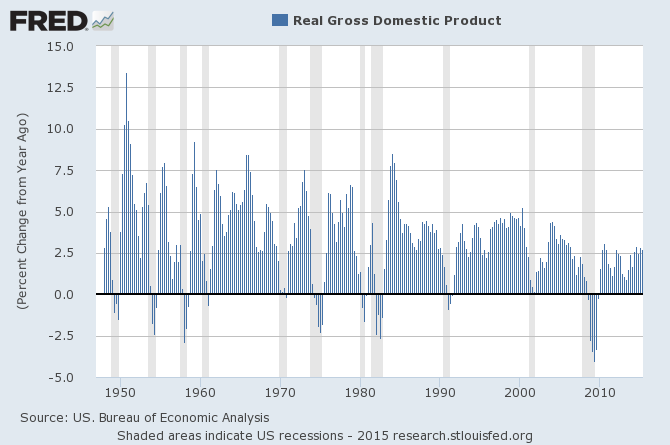

US economic growth has been stuck at about 2.5% year over year for the last few years. I see nothing in the data or in policy that seems likely to change that. As I’ve said many times, growing at that rate means that it wouldn’t take much of a shock to knock us into recession. But so far – knock on wood – we’ve been able to avoid that shock.

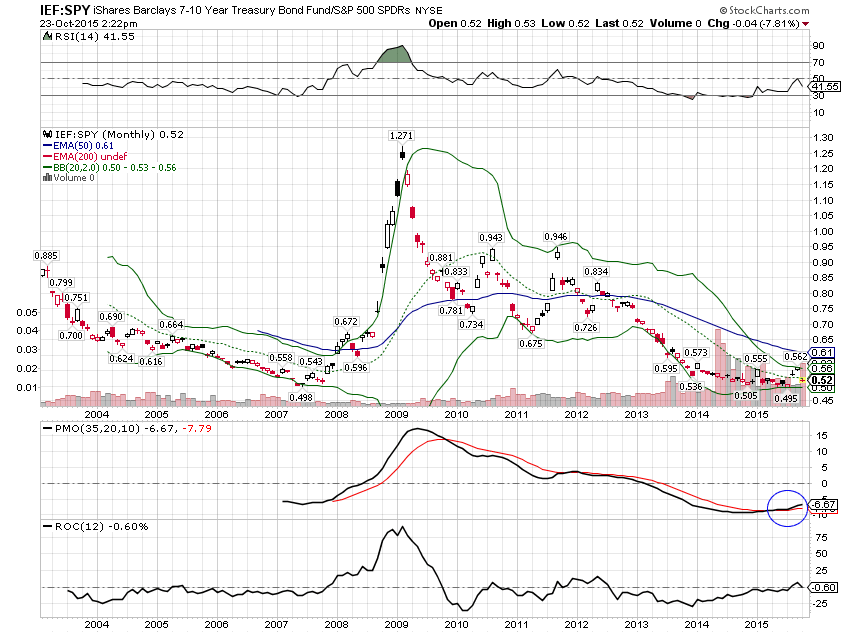

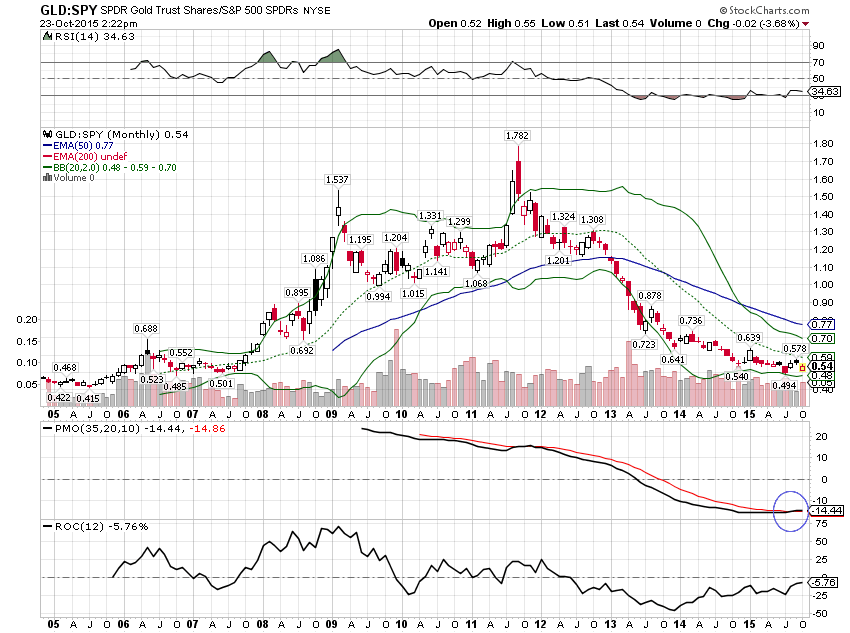

Markets, however, tend to anticipate changes, the crowd more accurate than the individual. I have been tracking a potential change in relative trend for the last couple of months, away from stocks to bonds and gold. The last two weeks of market action hasn’t changed that and I think one has to respect the signals the market is sending. Caution is still warranted despite the big stock rally this month:

Stay In Touch