Top News Headlines

- Paul Ryan running for Speaker of the House.

- Old tech blows out earnings estimates; GOOGL, AMZN and MSFT lead the way.

- Huge hurricane heads for Mexico.

- Hillary testifies, Republicans look stupid…..again.

- Mets sweep the Cubs; my friend Jim sighs.

Economic News

- ECB hints at more QE; stocks soar.

- China cuts interest rates and reserve requirements; stocks soar.

- US existing and new home sales continue their uptrend; stocks rise.

- Leading indicators dip on housing permits and stocks; stocks rise.

- Chicago Fed National Activity Index negative again; stocks go higher.

- Stock rise.

Random Thought Of The Week

Stocks reacted strongly to the Draghi hint of more QE to come in Europe and one can’t help but wonder why. It isn’t as if QE has been definitively positive for economic growth where it has been tried. Indeed, the evidence would appear to point in the opposite direction; where it has been tried, growth has stagnated. Of course, we can’t say that for sure since we don’t know what growth would have been without it but if it has worked, the transmission mechanism can only be the portfolio balance effect Bernanke talked about long ago. So QE causes stocks to rise because higher stock prices produce better growth which validates the rise in stocks.

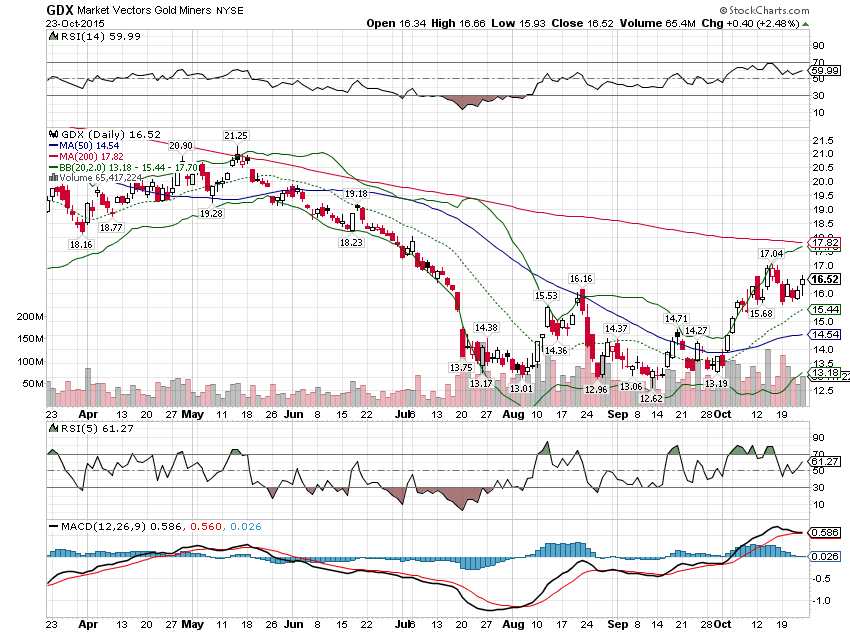

Chart Of The Week

Gold stocks fly under the radar of most investors but they’ve been on fire lately. They were up last week despite a big rally in the dollar index.

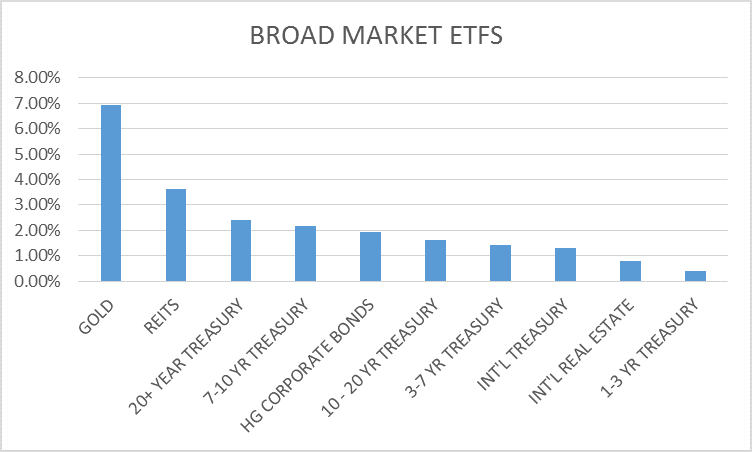

Broad Market Top 10 – 3 Month Returns

MOMENTUM ASSET ALLOCATION MODEL

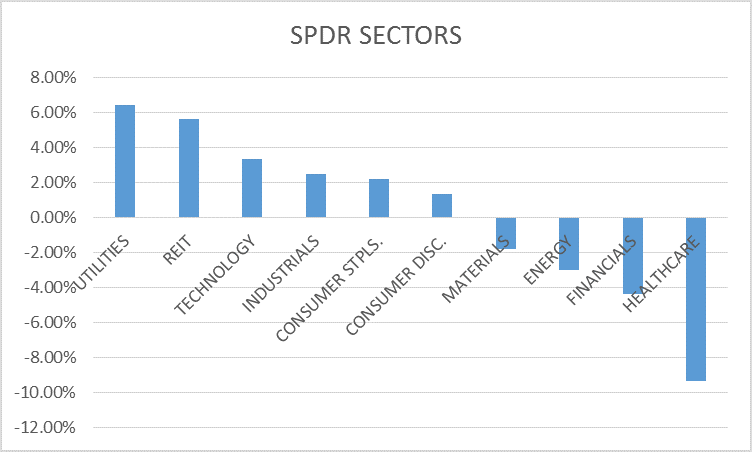

SPDR Sector Returns – 3 Month Returns

SPDR SECTOR ROTATION MODEL

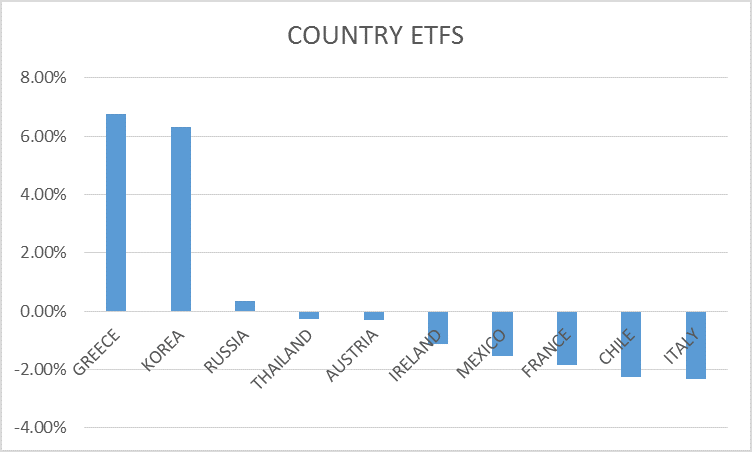

Country Returns Top 10 – 3 Month Returns

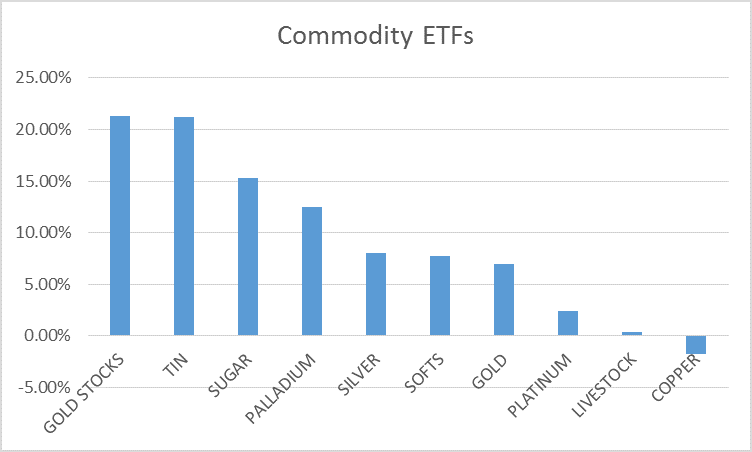

Commodity Returns Top 10 – 3 Month Returns

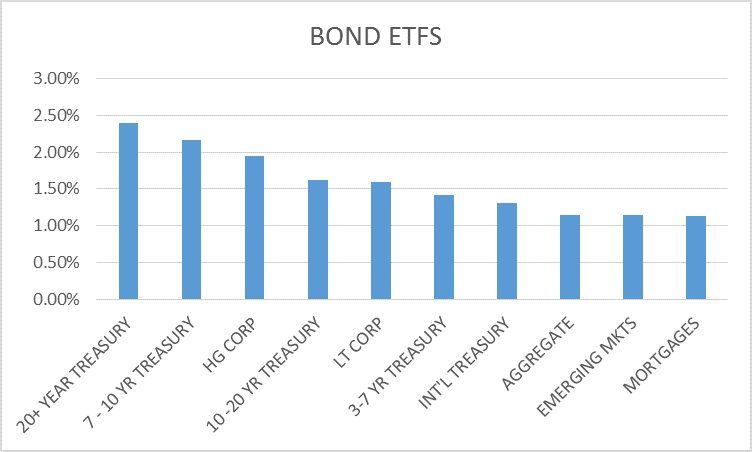

Bond Returns Top 10 – 3 Month Returns

Stock Valuation Update

Stay In Touch