Written Tuesday Oct 27

Even though oil production inside the United States has declined over the summer, it’s as if oil supply is all that continues to matter. With oil prices down significantly today, as well as since mid-October, the incessant appeal of oil supply blooms yet further even though there is so much more than that to take into account. If prices fall as they have, you find nothing but “overhang” and “glut”, but when they rise it is far more of the perky and hopeful variety. This isn’t to say that oil supply is unimportant or unrelated, only that oil is clearly far more than that being especially driven financially.

“It continues to show excess (supply) in the market in this quarter and going forward … it’s only really in the last quarter of next year when we could potentially see some rebalancing of the market,” Natixis commodity strategist Abhishek Deshpande said.

“What markets don’t tend to realise is the overhang of crude, which has been developing since September last year, will go into the end of next year,” he said.

U.S. production cuts — from a peak of around 9.6 million barrels a day to around 9.1 million — and optimism over demand have failed to translate into higher prices, said Ric Spooner, chief market analyst at Sydney’s CMC Markets.

If lower actual supply and “optimism over demand” aren’t pushing the great expected rebound, then that leaves oil commentary in the same place as economic commentary looking for transactions and activity that just aren’t there; nor likely to be. In other words, “optimism over demand” is very different than actual demand, a dichotomy as old as this “recovery” but with quite renewed emphasis about 2015. As noted last week, oil stocks (inventory) are rising again, along with distillates, even though stocks remain close to record levels (almost a third greater than a year ago). That strikes directly against consistency:

Oil prices fell a third straight session on Tuesday, with Brent crude touching a six-week low on the persistent global supply glut ahead of U.S. data expected to show another increase in crude inventories.

Crude futures felt pressure from analyst expectations that U.S. crude inventories rose last week, a fifth consecutive build after gaining 22 million barrels in a four-week span.

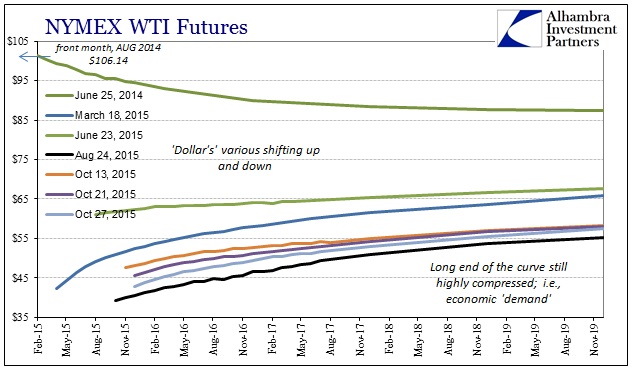

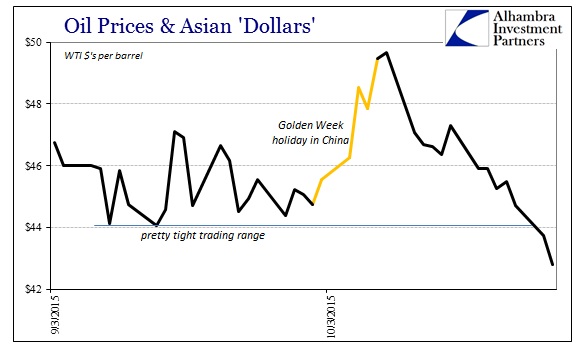

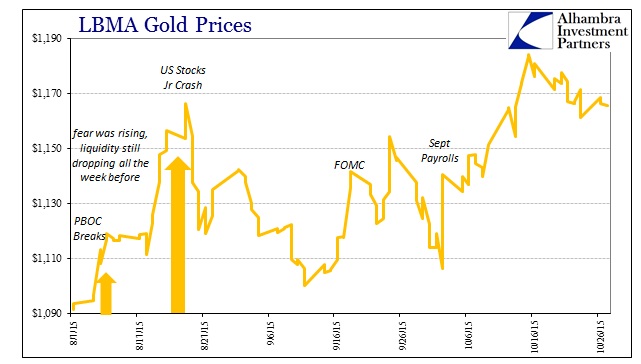

Again, that would indicate far more than simply oil supply, especially as supply has been cut. That leaves the “dollar” firmly implanted on the oil price curve, and almost alone in that position, particularly the front months where most volatility resides. As distinguished by the spot price alone, the imprint of the October “dollar” could not be clearer:

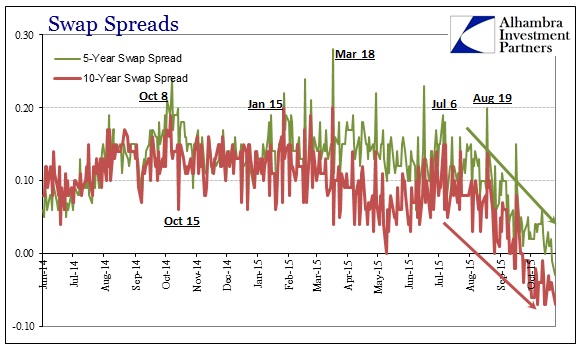

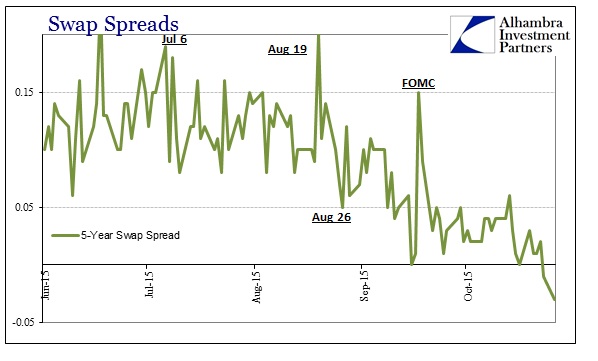

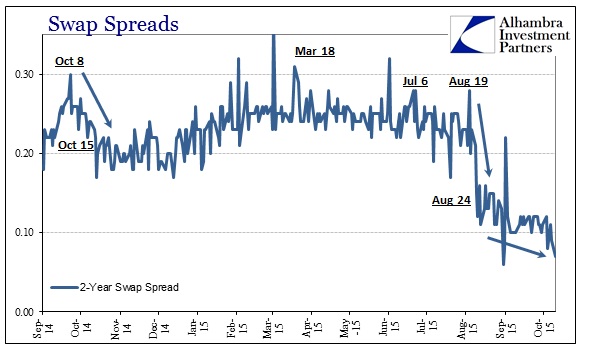

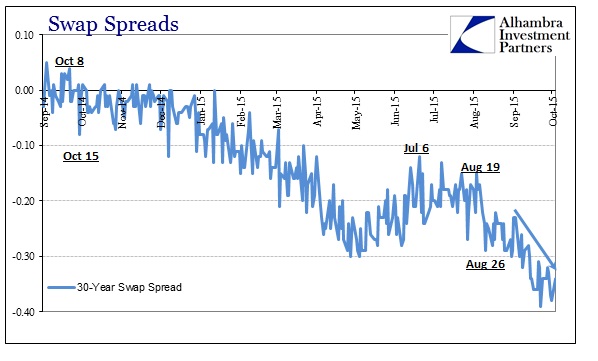

Outwardly, the “dollar” appears to be benign if not somehow irrelevant especially as stock prices suggest a potential end to the August furor spilled into September. Underneath, however, the “dollar” remains quite disturbed. The meandering in eurodollar futures over the past week is one such indication, though trading today has seen a remarkably flatter eurodollar curve (which would suggest the “dollar” intrusion upon oil prices). Beyond that, swap spreads continue to propose far more than the usual financial retreat. Just in the past few trading days, swap spreads have dipped yet again marking what would be very consistent territory for oil prices to fall regardless of “gluts” and “overhangs.”

It is notable that the 5-year spread is now negative alongside 7s, 10s and 30s. The 2-year spread, after trading sideways upon the last FOMC non-action in September, has now broke below 10 bps and seems heading (as of this moment) toward the mythical zero lower bound. This coordinated compression in spreads, especially those getting and already negative, is nothing but a financial warning of dark leverage removal upon eurodollar “supply.”

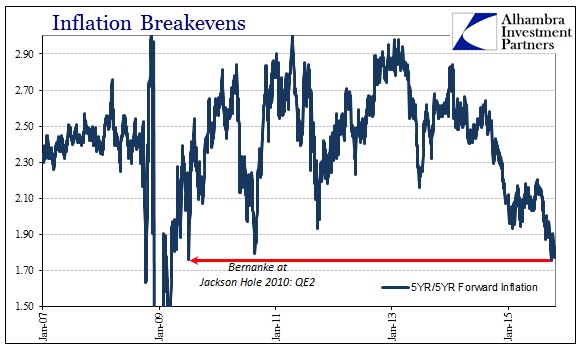

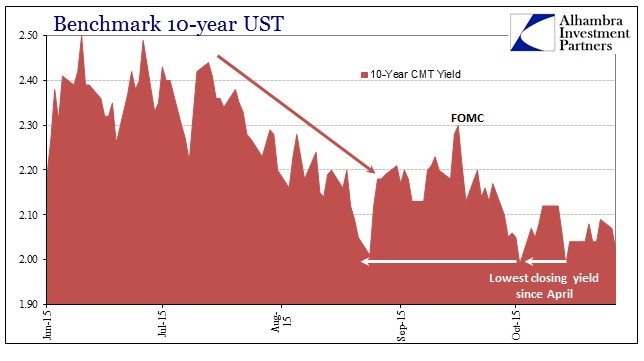

At the same time, “inflation” expectations continue to be depressed while traditional safe haven bidding is consistent. None of those would have much to do with oil supply factors, but are quite corroborative of both the “dollar” view and the future direction of oil demand (and likely economic demand with it).

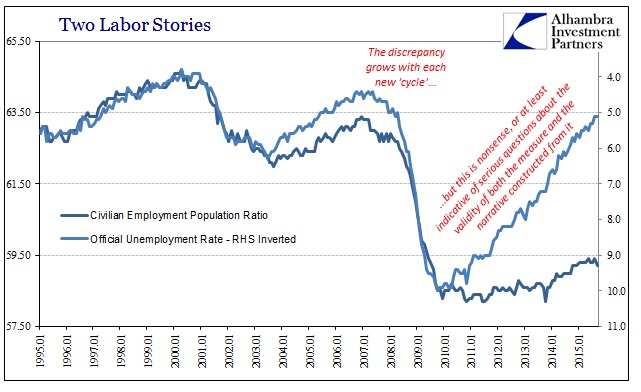

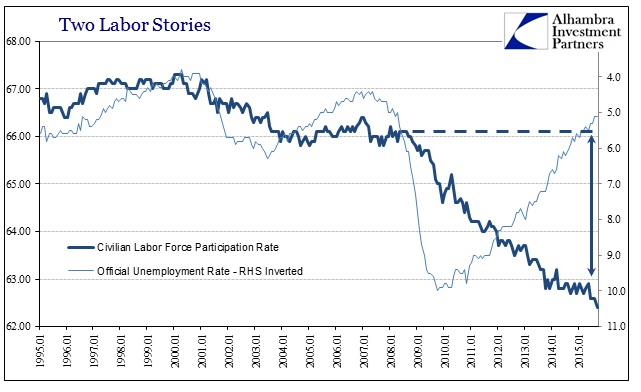

So the confusion about oil prices remains of the same source as “unexpected” economic “headwinds.” Financial markets are utterly aligned against any idea of “optimism over demand” but economists cannot remove themselves from the unemployment rate, and thus that is given priority even though it is quite alone in its interpretations of the current (and future) economic state. That would be a problem even where the main labor market indicator was covered by a broader agreement among payroll statistics, as payrolls and jobs are a lagging indicator upon future economic direction; the unemployment rate was 4.4% as late as May 2007, and had only risen to 4.7% just as the Great Recession began.

Then, as now, financial irregularities were dismissed by all the “right” people and economists, especially the FOMC, despite what was clearly taking place right in front of them. In short, financial markets, especially dark leverage and the wholesale “dollar”, were well out in front of what was coming only to be ignored until too late. Rather than learn that lesson, economists and the media remain grounded to not just lagging metrics but those that no longer even agree with the rest of their series.

What I was getting at yesterday also applies here, namely that the “dollar” and related markets are thoroughly disabused of the unemployment rate as relevant to real expectations for actual economic demand. Oil prices act as the medium between this financial view and the opening pathology of real economic circumstances. Gluts and overhangs make for a good and comforting story, but nobody is truly buying it.

Stay In Touch