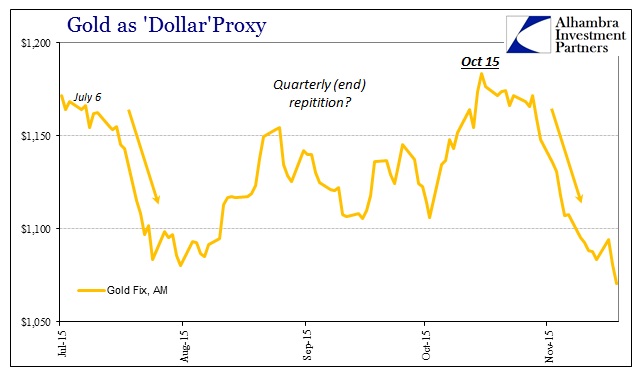

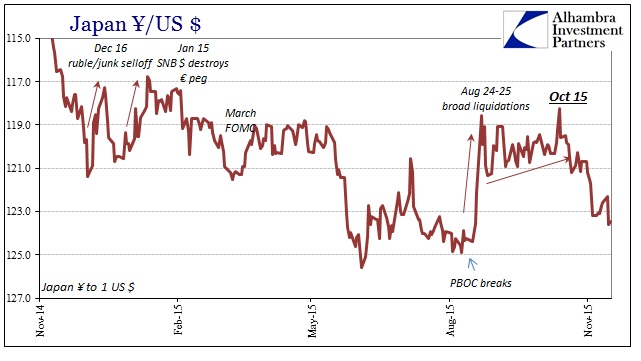

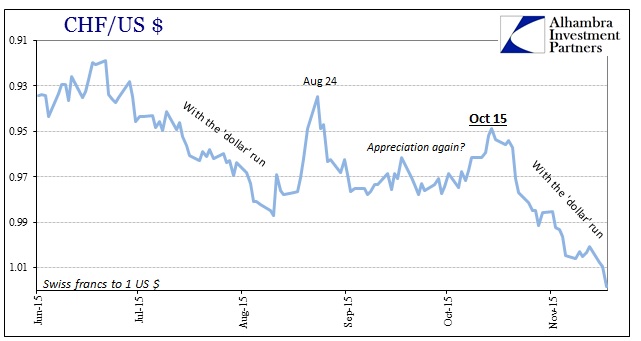

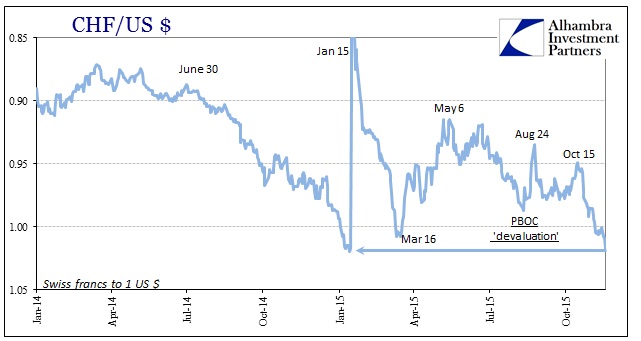

Since October 15, gold, yen and Swiss francs have all been pummeled by what increasingly looks like a “dollar” repeat from the start of Q3. It is difficult to suggest whether there is any shift in safe haven bid in all three, but I would guess, as with Q3, it may not have mattered as the “dollar” function globally has taken over marginal settings. The timing of that synchronized shift is an unambiguous financial clue, but I think it is the franc ultimately that identifies and defines, quite clearly, the “dollar.”

The downdraft in gold has been quite severe, knocking more than $110 off the price, but by relative comparison the franc displays the most nefarious comparisons. The franc has been completely hammered this morning, trading as low as 1.02 to the dollar, which would actually represent a worse exchange rate than what hit Switzerland in the days just before January 15. In reading that in wholesale terms, as China, funding costs for Swiss banks are spiking through the roof.

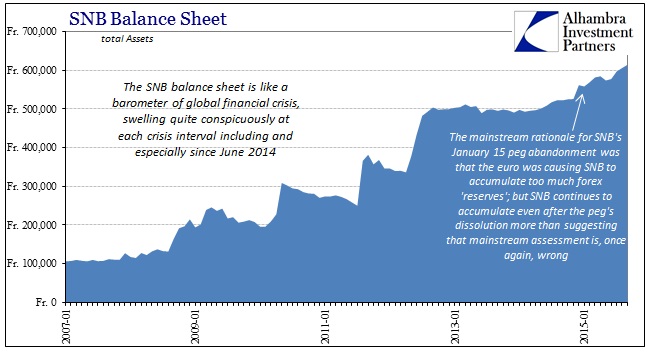

If this were some relatively minor, out-of-the-way financial connection to the eurodollar world it would still be significant and troubling. But Switzerland remains a serious “dollar” hub, not only transiting between currencies but also in terms of balance sheet resource supply. When the SNB broke the euro peg back in January, the mainstream view was that the Swiss could not afford any more ECB mania intruding in the form of euro “flows.” Convention held, and remains, that the swelling of the SNB’s balance sheet by response to the euro, trying to mitigate the ECB’s internal dissention, was the ultimate trigger. Thus, if this was the case, breaking the euro peg should have arrested, or at least greatly slowed, the SNB’s recently rapid extension.

The SNB, for its part, coyly denied that was the case and was quite open that their view was a dollar one. Since that doesn’t compute in orthodox understanding, the SNB narrative remains squarely in the euro box despite everything you see above. With the passage of time, though, we can see yet again how the accepted view has been completely wrong, and, more importantly, why that matters.

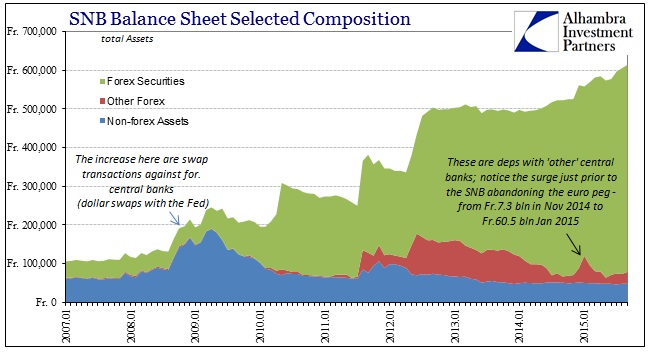

In the first place, the SNB’s balance sheet has continued to swell far beyond the January 15 “redline.” The latest update through September shows the SNB’s asset side increasing another Fr.8 billion to Fr. 614 billion; that is an increase of Fr.56 billion since the end of January, or another 10% in expansion just in those eight months afterward. Of that total, more than the whole, Fr.58.3 billion, was “bought” in the form of additional forex “reserves.”

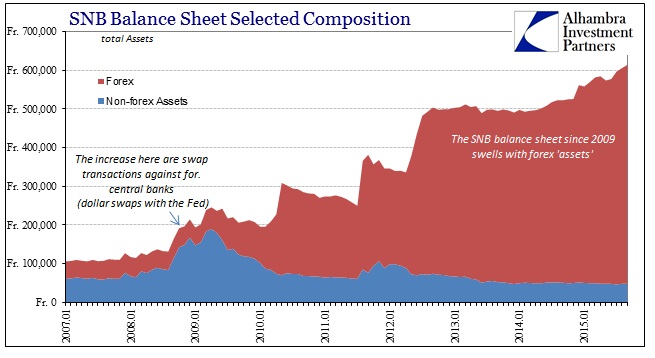

The composition of any central bank’s reserves is at least as important as the total, though, again, mainstream views on “reserves” tend to be monolithically anachronistic. In other words, there are various ways in which assets (and liabilities) are recorded and each provides its own interpretive conditions. For instance, when the SNB first expanded later in the 2008 crisis, September 2008, that came in the form not of forex but central bank swap agreements; in that case, the Federal Reserve’s long overdue re-education about eurodollars.

Since then, however, the SNB has been almost exclusively active in forex; a category that is far, far more than piles of foreign currency. In fact, there is almost no currency in these figures, nor even much of deposits.

The vast majority of central bank holdings of “reserves” are foreign-denominated securities. That often causes significant confusion about what a central bank is doing as an “investor”, the incentives and conditions guiding its decisions.

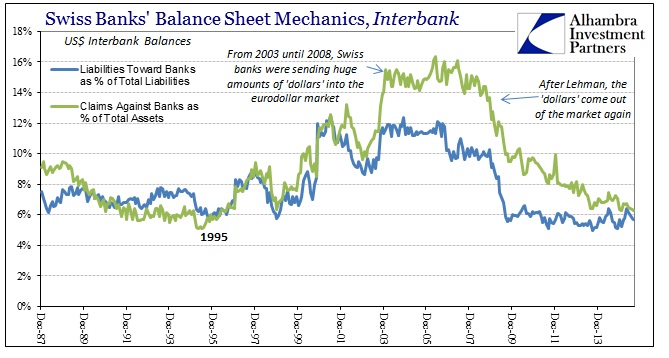

That complication extends to the nature of the Swiss banking situation within the eurodollar framework, which in its unique element only adds to the complexity here. Unlike China or Brazil, the Swiss system is a provider of “dollars” rather than in perpetual short; or at least it had been prior to 2015. As you can see easily below, the Swiss, again unlike China, Brazil or other “dollar” connections, were heavy suppliers of “dollars” to the rest of the world’s global “dollar” short. In interbank markets, the Swiss banks may have actually been, at one point not too long ago, cumulatively the largest single source.

What is also apparent is that, since September 2008, they no longer wish to be. Swiss banks maintain still a heavy dollar presence on their balance sheet, but in terms of interbank money dealing they are clearly exiting (to clarify the chart above, “claims against banks” are interbank, money dealing loans of some form and maturity; “liabilities toward banks” are borrowing interbank by Swiss firms; thus, more “claims” than “liabilities” mean Swiss banks were net suppliers of interbank “dollar” liquidity and to an enormous extent especially by 2008). At the end of 2014, the cumulative Swiss “long dollar” position was essentially extinguished; at least to now where it is a minimal advance into eurodollar markets.

For the SNB, then, that in many ways “flips” the mechanics of trying to manage such a withdrawal. The Swiss central bank, contrary to what the Chinese central bank has done, would not be “selling” UST’s or dollar-denominated securities so much as offering its balance sheet as cover for Swiss money dealers to get out; thus, the SNB continues to expand as the eurodollar system “tightens.” As they do so, and especially since the “dollar long” has been extinguished, the franc becomes more and more relevant as funding cost for the remaining positions and intentions. In other words, getting out of the “dollar” is far more difficult and fraught with imbalance and disorder then getting in; some of that, obviously, relates to the condition of the world when the Swiss started in this direction compared to now, but which is the economic chicken and which is the “dollar” egg?

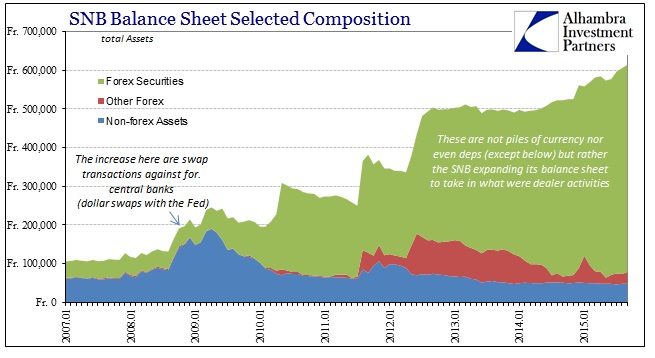

By adding forex securities to its balance sheet especially after the January 15 nod to the wholesale “dollar”, the SNB is becoming, like the Fed in 2008 and really 2009, the “market of last resort” for at least the Swiss corner of wholesale markets and vital money dealing function. I have focused on the “dollar” end of wholesale, but I should point out that euroeuros (“euro” simply referring to offshore funding in a particular currency, leaving euroeuros as just offshore wholesale funding in euros) relevant here, too. Some of that is undoubtedly the more greatly unified structure of wholesale banking especially in dark leverage functions.

The definitive evidence in support of these wholesale interpretations is contained also within the SNB’s forex breakdown. In addition to securities, there are other assets as stated above, usually of trivial balances. However, as you can see on the chart immediately above in the red, there have been a few episodes where the SNB balance sheet bulge occurs in something other than securities “buying.” In both of those instances, starting in 2011 and then repeating at the end of 2014, the SNB indicated a surge in “total currency and deposits with other central banks, ECB, BIS and IMF.” They provide no more specific detail than that, so all we know is that the SNB, especially starting in December 2014, was “forced” into some kind of non-derivative (not swaps, that would have been a separate category) central bank currency or deposit balance.

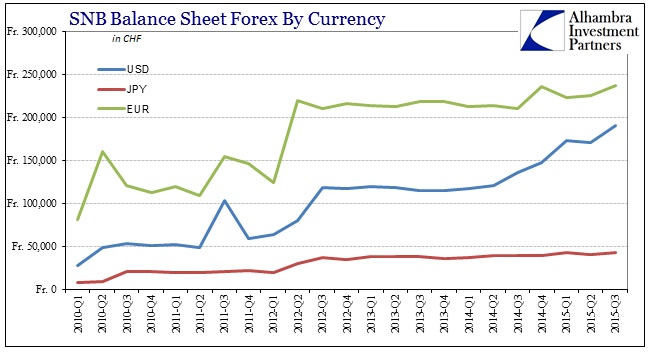

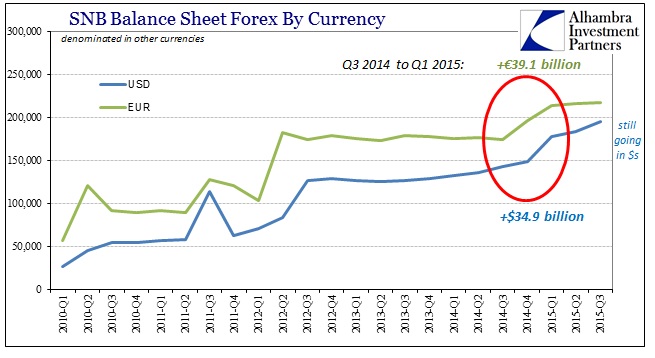

Further, that issue lasted until, as you can easily guess, January 2015 – meaning, unequivocally, that the peg’s removal quieted the huge and gaining imbalance. While we cannot know which central bank(s) was on the other end of that arrangement (and it may have been one that you might not expect, cough PBOC cough, “dealing” in a currency not their own) we do know that during those months the SNB reported large increases in only dollars and euros among its forex assets.

To be sure this wasn’t just a currency translation issue, the “rising dollar” after all, the same reported figures in foreign denomination confirms the increase in “volume.”

In short, just as the SNB declared back on January 15, the Swiss banking and financial system is dealing with the wholesale “dollar” as both a run and a local transformation out of being a eurodollar supplier. Thus, what we see here only emphasizes what we see in individual Swiss bank reporting (dark leverage). Unfortunately for the rest of the “dollar” world, those two factors have become self-reinforcing; the negligent “dollar” conditions clearly amplify and hurry the tendency of Swiss money dealers to further withdraw, causing an even larger run, and so on. I believe that is why the SNB continues to hold a major expansion course, to try to cushion the Swiss end of the “dollar” as best it can during any appearance of run within this mighty structural shift, while the franc visits, somewhat on two occasions now, the territory held by the real and yuan.

Stay In Touch