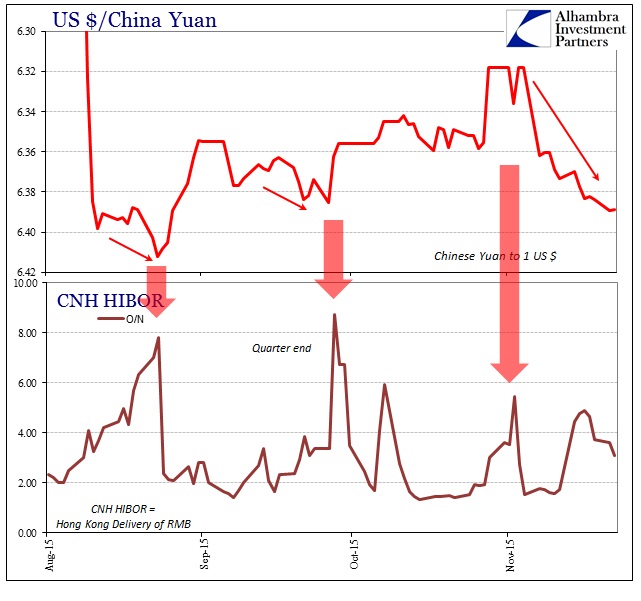

Very quietly, the PBOC has been fixing its middle exchange rate against the dollar higher and higher (in dollar terms). Today’s reference rate was 6.3895, up from 6.378 a week ago, with the CNY exchange coming close to 6.40 again for the first time since the disastrous period in late September. Unlike August, there has not been the flood of scolding “currency war” rhetoric, perhaps suggesting that there is now wider recognition that this world isn’t quite so simple. Not surprisingly, aside from geopolitics today, commodities have been nothing but sinking (copper futures almost traded below $2 yesterday) as have other “dollar” indications like gold and even Swiss francs (which continues to flirt with 1.02).

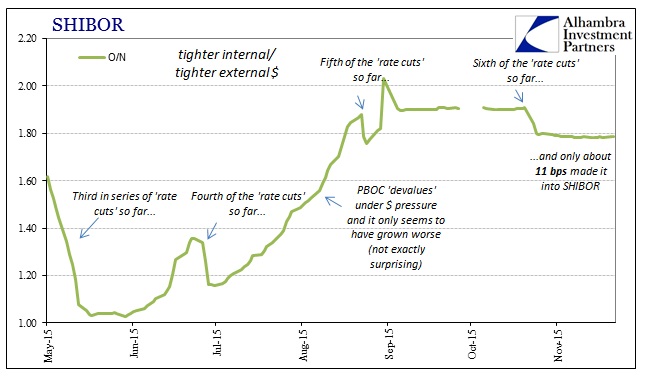

Against that backdrop, volatility in offshore CNH liquidity remains at best spotty. More likely the intermittent surges in CNH HIBOR are closer to troubling than just plain curiosity, thus circling the loop of “dollar” and PBOC actions. For its part, the PBOC remains committed to its SHIBOR peg as the overnight rate fluctuates in only the smallest increments.

In the wholesale context, the exchange rate of CNY is one element of the wholesale cost of “dollar” funding, thus it isn’t surprising to see a relationship between CNH liquidity (offshore RMB) and this “dollar” proxy. The reason for that is the PBOC itself, in a rather unique position as a global central bank. The financial requirements of maintaining a steady relationship with the dollar (and, historically speaking, “gaining” “dollar” volume by result) place great emphasis on this dynamic.

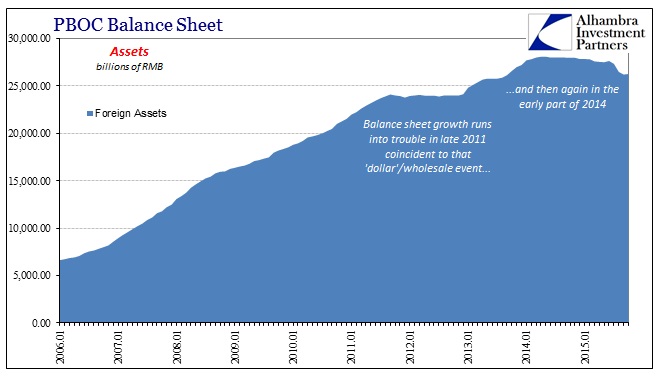

In the first place, the PBOC’s main balance sheet asset is “foreign assets” comprising all sorts of securities and accounts spread across the global banking system. The exact nature of these foreign “reserves” is unknown, but for these purposes that is a secondary consideration. For the most part, given the economic relationship of China’s trade needs and the eurodollar system that finances them, the PBOC’s reserve “assets” on the balance sheet are essentially another wholesale proxy but this time in volume rather than price.

Because of central banking accounting, that established forex relationship provides the “thrust” in balance sheet expansion that comes out the liability side as internal currency and liquidity. The offshore CNH market is tangentially related as the PBOC allowed offshore trading in order to establish a deeper global market for the currency in absence of “reserve status.” But the banks offering CNH are those being affected by internal dynamics, and thus trade as another link between “dollar” and RMB.

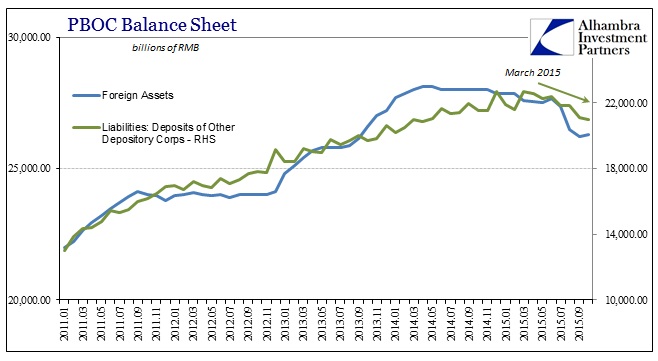

Like the Fed perpetrating an almost perpetual QE, the PBOC is “forced” to expand its balance sheet to accumulate “excess” dollar and foreign assets in order to manage the exchange rate. From about RMB6.6 trillion at the start of 2006, the PBOC’s balance under “foreign assets” peaked at RMB28.1 trillion in May 2014 – meaning that the “dollar’s” rise starting in June 2014 has clearly undercut the main engine of Chinese central bank monetary expansion. That had occurred once before, not coincidentally starting in the middle of 2011 with the euro crisis (that was really a wholesale and “dollar” re-crisis).

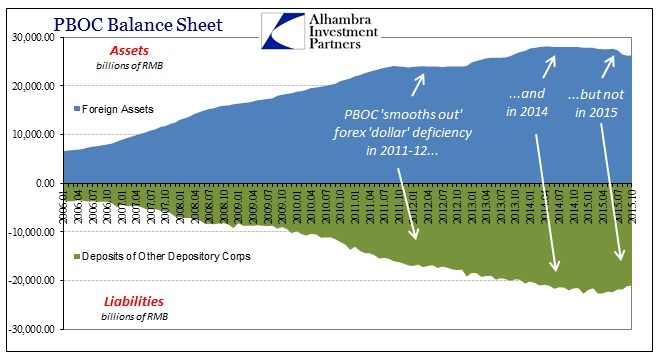

Again, central bank accounting flows from that asset expansion to liability expansion which is the business end (in more traditional banking regimes) of monetary occurrence. China’s forex assets are not the only source of liability balance, of course (more on that below), but given that they are the vast majority of the PBOC’s assets the consignments in them are going to be primary monetary considerations. That establishes a rather durable and quite visible relationship between those central bank assets and the Chinese version of bank reserves, “deposits of other depository corporations” (essentially bank deposit balances at the central bank, analogous to US bank deposit balances at the Federal Reserve that grow in byproduct from QE purchasing).

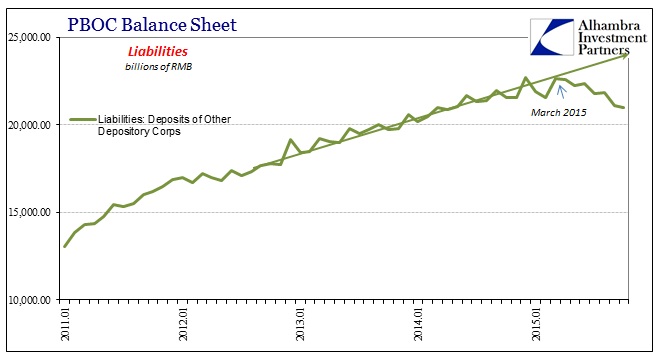

What is important to note about this flow from asset to liability is that in 2011-12, despite the sustained “dollar” difficulty for the PBOC’s asset side, there was very little interruption in the accumulation of Chinese reserve balances (RMB liquidity). The same was true in 2014 even after the peak in forex accumulation; only in 2015 has Chinese bank deposits at the PBOC reversed. The significance of that simple accounting cannot be overstated.

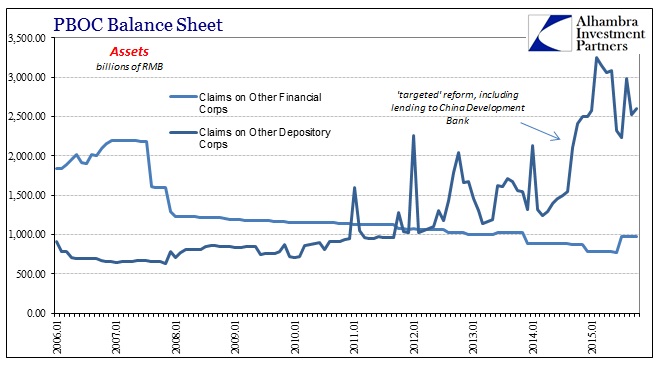

The reason for that is the other parts of the PBOC balance sheet, employed in 2011-12 and again in 2014. Last year, for example, the PBOC initiated several “targeted” measures that were mistaken for the usual indiscriminate “flooding” of monetarism. Among them were financed loans from China Development Bank, which caused the PBOC to expand its asset side instead through these kinds of local means.

Yet, even here you can see how 2015 is different. Despite those clear intentions last year, they are notably absent this year with “claims on other depository corporations” sinking rather than at least keeping level. Combined with the much amplified downward pressure from forex “assets”, the liability side of the PBOC is forced to curtail. Looking at these turns in closer proximity, the Chinese experience this year becomes much clearer:

The chart above recreates the assets vs. liabilities side, only with liabilities presented as a similarly positive number and scaled to match forex assets. As you can see, it wasn’t until March 2015 that the pressure from “dollar” in forex holdings transformed. We have no idea why or through exactly which channel as all we can observe is this distinct shift. This reflection is not in isolation, however, as it was in March that another conspicuous transformation suddenly appeared – the CNY/USD exchange itself:

Starting March 19, after a curious “appreciation” in the middle rate reference, volatility in the exchange rate was increasingly suppressed (to no avail, but still). Thus, it would appear a quite conscious decision (rather than purely mechanical) on the part of the monetary authorities in China to sacrifice internal liquidity (falling bank deposit liabilities of the PBOC) in reference to this “dollar” dynamic. Further, and perhaps more importantly, despite all the assurances in the media about the end of “capital outflows” and such, the liquidity situation has not improved since August.

The latest update from the PBOC places that liability balance in October at just RMB20.97 trillion, down another RMB150 billion from September and lower than March by almost RMB1.7 trillion. But that actually understates the severity of the reverse, as banking in China expects/demands not steady levels but the same steady growth as had been maintained all those years regardless of such external factors.

And I believe that is the capping observation to the whole affair; something changed just this year in either the PBOC’s willingness or ability to maintain internal liquidity in a manner similar to as I have described here (this is just a part of that picture as I have simplified and left out other factors to present what I feel is the biggest or “purest” elements of the overall dynamic). Given all that has been done by the PBOC this year, especially the pegging of first the exchange rate itself and now internal liquidity measures, it seems far more than a fair bet that it wasn’t the willingness of the PBOC to engage that has been altered. After all, there was enormous effort expelled in managing the CNY exchange from March through August only to see it explode anyway.

Thus, we are left with another piece of evidence, and I think a very big one, that China’s central bank faced a force larger than its accumulated ability to manage – a “dollar” run. That is the only explanation that ties all these pieces together consistent with what has actually transpired (not a “devaluation”). Further, it explains yet again why August was not the end of the affair; not even close. The continue disruption in Asian financial circumstances are present in all these indications, including the latest “devaluation” trend as it exists in close correlation and relationship to deterioration in other “dollar” proxies.

As noted yesterday, economists refuse to accept a recession scenario in the US or for the global economy without a “shock.” As with South American countries in desperate financial jeopardy already running over into chaotic economic conditions, China also shows the same unifying financial strand – the almighty “dollar.” While it may not be recognized in stock prices, other than some uncomfortable conditions in August and September, there are already parts of the domestic financial system undergoing this same restrictive pressure. Junk bonds, in particular, are that linkage between economic outlook and this global financial backwardation.

If 2008 was something new, then 2015 is an order of magnitude further along that path. Central banks may not have been prepared for what happened then, a circumstance that will eventually have to be accounted for, but they are supposed to be much better equipped and ready this time. They are, almost exhaustively, fully engaged almost everywhere – and still it comes.

Stay In Touch