As the monetary world prepares for the monetary equivalent of D-Day, it bears reminiscing about the true lack of confidence that permeates away from the direct public front of the central bank. Yellen has declared that monetary policy will be “data dependent” but that isn’t truly the case. Any such data will be filtered into the Fed’s models, which are notoriously unreliable in any timeframe. After all, the reason we haven’t seen the end of ZIRP in America already is that very fact – staked out as “inflation” due to oil prices having become something entirely different than modeled “transitory.”

In other words, the models are already wrong about “inflation” which is a good deal more important to the monetarist than any member of the public. The fact that the FOMC has not been able to push “inflation” to its 2% target in more than three years is not something they brush aside, as it only furthers and compounds economic mysteries that abound.

There are reasons to doubt conventional economic theory. Many economists predicted a spiral of falling prices when the U.S. jobless rate soared during the crisis and then thought inflation would rise when unemployment plunged. Neither happened, though Yellen has maintained this year that the Fed was on course for rate increases, which would be “data dependent,” likely gradual, and with no pre-set path.

Any unbiased examination would at least consider the fact that the models are wrong, full stop, right at the start and quite possibly inappropriate for the modern times given just the errors in “inflation” forecasting alone. Throw in an economy that is substandard by every historical comparison and far too many relativistic patterns, and that would seem perhaps the most likely explanation given the ease of logic within the inquiry. But it isn’t even considered, or at least much considered, by economists:

This shows Yellen “is grounded in traditional modeling but she is well aware that there is uncertainty,” said Randall Kroszner, who served with Yellen as a Fed governor between 2006 and 2009.

“It is possible, though unlikely, the traditional models are just all wrong (and) we’re in a whole new world. But she’s not going to fly by the seat of her pants,” Kroszner said. [emphasis added]

Why unlikely? Economists continue to dance around the subject as if it were hidden within some impenetrable safe far beyond anyone’s reach. As each and everything fails to live up to the hype, the expectations and all predictions, why is it so difficult to suggest that the premises are at fault rather than the economy itself (of the financial system that is supposed to be the one inarguable success)?

San Francisco Fed President John Williams performed the same kind of operation as thinking in such simple terms drew him close to self-reflection before he curiously retreated back into the comfortable, if wrong and mysteriously so, confines of orthodox understanding.

“I see this as more of a warning, a red flag that there’s something going on here that isn’t in the models, that we maybe don’t understand as well as we think, and we should dig down deep deeper and try to figure this out better,” he said during a panel discussion at the Brookings Institute in Washington.

Even Ben Bernanke, the former Fed Chair who has been, to this point, the most unrepentant, defending himself to the point of absurdity, calls question to the fact and then himself just moving on to what he might plausibly characterize as his own highly diminished standards.

MarketWatch: You never imagined zero rates would last so long.

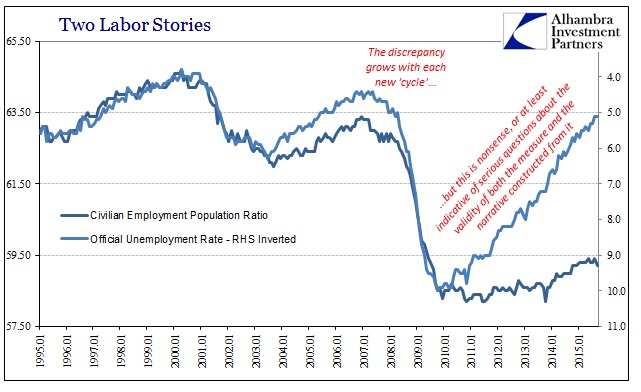

Bernanke: No we didn’t. We were over-optimistic about the pace of growth in large part because we didn’t anticipate the slowdown in productivity growth that we’ve seen. However, from a cyclical perspective, the economy has recovered in fact more quickly than we anticipated in that the unemployment rate has fallen more quickly than we thought it would, indicating that we have moved back towards something approaching full employment. Over the last three years, the unemployment rate has fallen about 3 percentage points which is relatively rapid, so, in that respect, the economy has actually done a little better than we have anticipated but in terms of overall growth it’s been less good.

He didn’t anticipate the “slowdown in productivity growth” which is nothing more than GDP math for highly deficient output. In short, the economy vastly underperformed everything he said about QE and what it was going to do, but at least the unemployment rate dropped quickly – as if noticing that disparity between output and employment weren’t actually required in something like reasonable analysis. In fact, unwittingly, Bernanke reveals perhaps the most obvious way with which to measure all these combined short-comings:

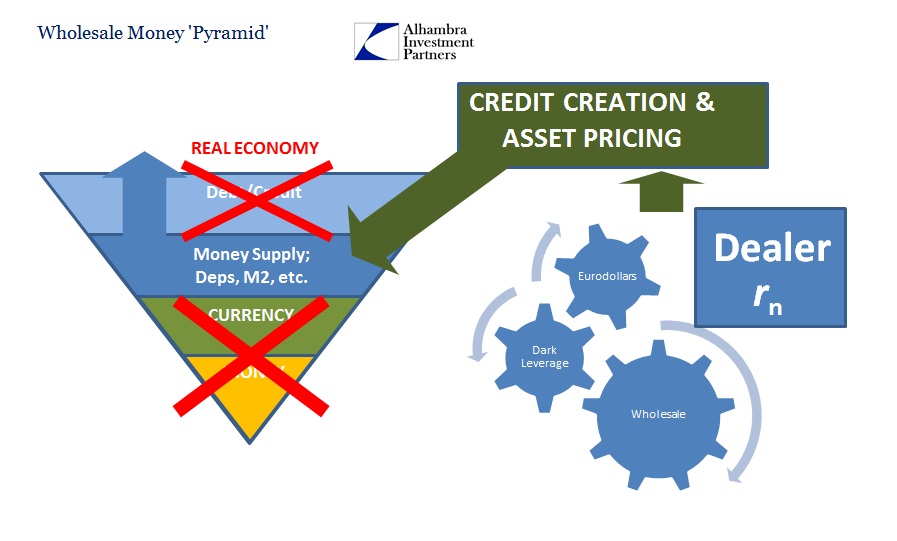

The monetary behavior of the United States and world economy has been highly and durably contrary to all established, orthodox convention. QE, ZIRP, Twist, whatever, none of them have performed even close to the design characteristics and specifications. They all know this is a problem, and more than that, monetary behavior has been an issue for decades now – long past Bernanke’s and Alan Greenspan’s “global savings glut” and the discontinuation of M3 in 2006 to the vast changes in the 1990’s that, like right now, caught but a brief moment in the “Maestro’s” attention before falling out into negligent history.

That was the essence of what I have called the Fed’s 1979 warning; that monetary character and banking itself was changing and in ways that were worried not, ultimately, predictable. And by 1996, Alan Greenspan was in high disregard for how money suddenly wasn’t acting predictably (specifically, that economic and money correlations weren’t holding). As if to extend that line from 1979 through 1996 all the way to 2015, sewing up 2008 along with it, San Francisco Fed President John Williams expressed Friday the same wonderment with apparently decreasing understanding. In other words, the Fed knew somewhat of eurodollars in 1979 and has been growing only more ignorant as time has passed.

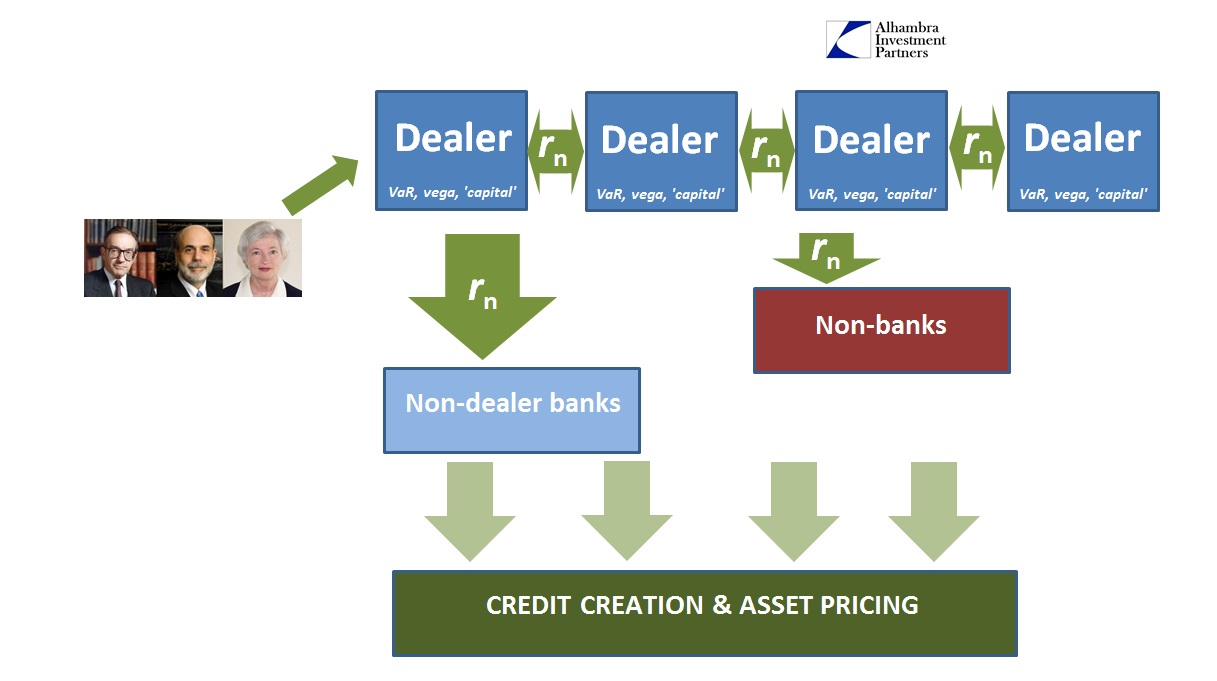

They keep referring to it over and over and over again, as if they are forced to at least distinguish the problem but faced with death should they dare speak its name. Everybody knows very well that the models don’t match the real world, but to blame the real world for not matching the models is just plain irrationality. The basic premise contained within those models are a central role, a central pivot of control, for central banks running from money into banking then credit into the real economy. If the models that think that way can’t match real conditions, and they are more often than not not even close, starting from the very beginning is demanded.

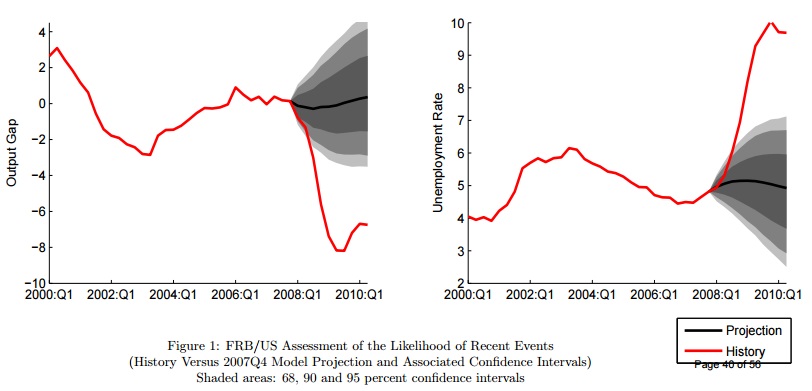

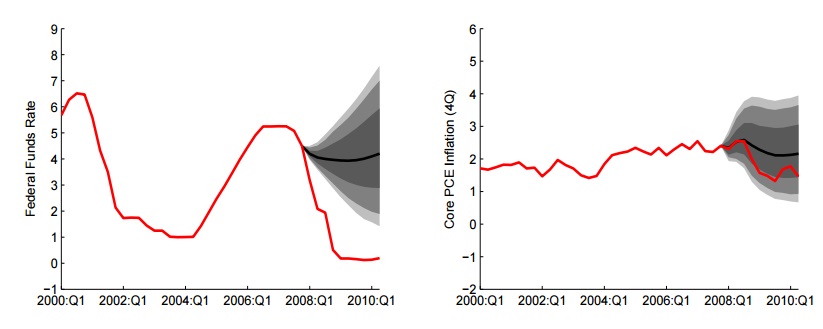

In 2008, this monetary modeling, placing the central bank as the primary monetary agent, took to catastrophic results as even the Fed has admitted. In January 2011, the San Francisco Fed, with John Williams as co-author, published a paper that demolishes the Fed’s own models in every possible aspect. They could not have possibly been more wrong, as what actually occurred in 2008 and early 2009 was calculated in early 2008 as six sigma events – statistically impossible. Ironically, the only economic factor that remained in the predicted track was “core PCE inflation”, though that fact, too, only demonstrates further that orthodox monetary understanding is highly, highly flawed all around.

The modeled projections for the unemployment rate using ferbus (FRB/US, the Fed’s core policy model) was 95% certain that by Q1 2010 it would be between 2.5% and 7%; the official rate, not even the fuller measures, was instead over 10% by early 2010. They estimated the federal funds rate, the useless, volumeless policy lever that Janet Yellen is supposed to wield tomorrow, as potentially as high as 8% by 2010 and no lower than 1.75%. The probability of a ZLB (zero lower bound) event lasting eight quarters before 2012 was thought to be trivial by the EDO and SW models, and less than 1 in 100 via the LW and TVP-VAR approaches.

The GARCH model was “closest” in that it judged a 3% chance of an eight-quarter ZLB before 2012. For the record, as of today, the ZLB has persisted for twenty-eight quarters. The probability was never modeled for a seven-year “event” because the two-year event was already believed impossible.

If Janet Yellen wishes again to test her models in reality I have little doubt she will be surprised yet once more. Any model that thought the federal funds rate might be, even in the smallest and farthest reaches of the probability distribution, 8% in 2010 isn’t worth the computer space within which it resides – and that means all of them. The difference between 8% (or even 2%) and 28 straight quarters of not just ZIRP but four additional QE’s is so vast as to be incalculable; it is a literally fundamental misreading of how economy, finance and, yes, money all work together (or don’t). Yet, it is with that misunderstanding that provides tomorrow’s foundation.

They really don’t know what they are doing. What’s worse, they, on some level, know it but prevent themselves from accessing it.

Stay In Touch