When the Fed is revered as it is in certain circles, its superstitions afford unwavering faith and even straight up desire. It is much, much easier and comforting to believe in a benevolent guiding spirit, an all-powerful force of good that removes all the nightmares. The cultivation of that ideal started in the 1980’s but reached its apex in the 1990’s when respected news outlets took to calling Alan Greenspan “maestro.” It left the world’s stock investors shocked that there was this thing, a stock bubble that just showed up out of nowhere.

That was never really the case, however, as the bubble had been building for at least half a decade before its end; with signs of excess increasingly abundant and even loud about it. Nobody noticed because their brokers told them to invest with both hands and feet, any downside the maestro would simply underwrite with otherworldly speed and precognition. If the dot-com bubble was an impenetrable cloud of rationalization, the seed for it was this Great “Moderation”-style implicit faith in the Federal Reserve.

Maybe because there wasn’t much choice in 2002 and 2003, but somehow, though dented, exponential faith was reissued just in time for the last of the housing bubble. It was either get to the dirty and serious work of financial and economic reconstruction or give the FOMC one last try. The former was a fully depressing contemplation while the latter, as all bubbles are on the way up, just too much fun. What there wasn’t, however, was a lot of actual and sustainable “demand” in the middle 2000’s, just a lot of what looked like prosperity and only from just the right angle. At the very moment Bernanke and Greenspan were declaring their “global savings glut” the whiff of economics about it all just dissipated and floated away like some unwelcome, lurid smelling emission from a garbage dump. Panic. Global and great recession.

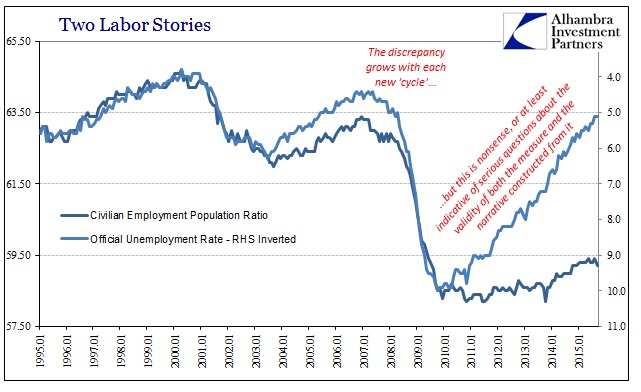

And still the faithful came back, though much more hesitant this last time. In the serial bubbles of the past two decades we went from bubbles doing a good job mimicking a sustainable economic advance (dot-com) to bubbles only faintly replicating the same kinds of effects of a true recovery (housing) to now just hoping that bubbles at some point in the not-too-distant future actually produce even a small trace of economic positivity. Monetarism dies hard, but it does so out in the open for anyone to appreciate.

Part of the reason for the divergence is that many traders find the selloff hard to explain, according to Russ Koesterich, global chief investment strategist for New York-based BlackRock Inc., which manages $4.5 trillion. Particularly baffling is the spell oil has cast on stocks, with some of the biggest equity selloffs of the last two week’s coming as Brent crude flirted with $30 a barrel.

“It’s not obvious why oil is driving the market and I think everyone is trying to understand that,” Koesterich said. “If commodities are falling this rapidly, are they the canary in the coal mine, and what do they tell us about the U.S. economy? But the drop in oil is completely driven by excess supply.”

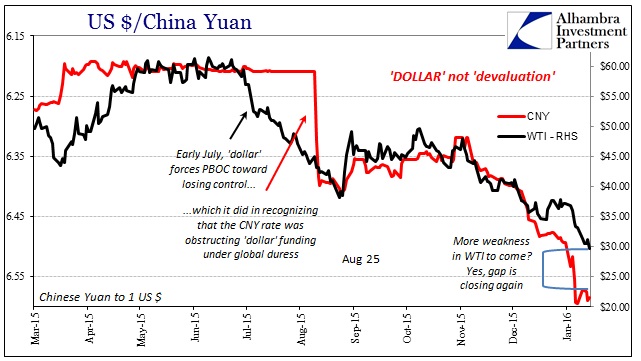

Excess supply. From the world’s largest asset manager; nothing in oil but excess supply. Not even the slightest potential the world has finally awakened from monetary slumber to finally begin appreciating the greatest con? The supply of yuan must be similarly in great excess or else we might be forced to reckon with the whole weight of global finance. Everything about that quote abounds in the obtuse; particularly after recognizing commodities in the very sentence before.

Even the maestro has moved on. He no longer projects the same omniscient qualities, as Greenspan himself has taken to puzzle about secular stagnation. Now the upside for these unrepentant monetarists has been whittled down to almost nothing, a poignant description of the economic trajectory under serial asset bubbles. They come on like some new economic discovery, that the maestro has found the secret to a “new normal.” By the end, even the ever-faithful are left wondering how much the “new normal” will end up costing in lost time and redistribution while still patiently awaiting that fruitful turn they are so sure is bound to come if only given yet one more try.

We are supposed to just ignore all this doubt and pessimism, even in stocks alarmingly, since this oil and commodity collapse signals not the end of monetarism’s promises, you see, it is just more deferred success. If there is indeed excess supply, then it is only the amount of time allotted for faithfulness.

Stay In Touch