K.I.S.S. – Keep It Simple Stupid – An acronym used in the US military; a design principle; unnecessary complexity should be avoided.

The acronym KISS is just another way of expressing Occam’s Razor or maybe Einstein’s admonition that everything should be as simple as possible but no simpler. That the simplest answer is usually the most correct is an adage that investors would be wise to commit to memory. That applies to the design of your investment program as well as your explanation for the market’s movements. The explanations I’ve been hearing recently for why the stock market is weak do not meet the criteria for KISS. Oil is falling! The Saudis are selling! The Norwegians are selling! The Chinese are selling reserves! Some other emerging market I can’t find on a map is selling! I’m selling my mutual fund!

All of these are variations on a theme, the mysterious seller who is driving the stock market down for no reason. These Rube Goldberg explanations require a map to trace the connection between a rising US Dollar, Chinese capital flight, PBOC reserve liquidation, falling oil prices, emerging market monetary policies, oil producer sovereign wealth fund liquidation, the US stock market and a shadowy figure on the grassy knoll. The contradictions are confounding and it is impossible to disentangle cause and effect. Is the US Dollar rising because the Chinese capital flight is landing here? If the capital flight means the PBOC has to defend the Yuan by selling reserves doesn’t that mean they have to sell Treasuries? Then why are Treasury prices rising? Same with the Saudis. If they are liquidating their sovereign wealth fund to make up the difference between $100 oil and $30 oil doesn’t that mean they too would be selling Treasuries? Who the heck is buying all these Treasuries?

It is impossible to figure out all the flows back and forth and discover anything useful for most investors. I suppose there may be a hedge fund with a bunch of nerds who think they can figure it out and maybe they can but even they are probably wasting their time. There is an easy answer for all this that doesn’t require that you know the inner workings of emerging market reserve management. The easy answer is the one that everyone seems to want to avoid, that no one wants to believe, least of all the Fed – the US economy is slowing and has been for at least a year.

The slowdown means corporate earnings are falling and if the 4th quarter comes in negative – which it is so far – that will make three consecutive quarters of year over year decline. And that explains the drop in stock prices pretty simply. You can say it is all because of energy and materials but those stocks are part of the S&P 500 too and they count every bit as much as Google or Apple. A US slowdown also means the Fed will probably not be hiking rates this year as previously anticipated which explains the drop in the 10 year yield to below 2% as short rates fall back to reflect the longer runway – or U-turn – for rates. A US slowdown means real growth, now at just 1.8% year over year, could easily fall into negative territory which explains the recent drop in real yields.

It is often the case that the reasons things happen aren’t all that important anyway unless you have to come up with a way to change them. If you are a policymaker, if you are the Chairman of the Federal Reserve, it would probably be helpful for you to know how the global financial system works. In fact, I’ll just state that as a fact. It would be really helpful if Janet Yellen had a clue how the global financial system or the US economy works. But if you just want to make sure your retirement fund doesn’t go kaflooey, well you really don’t need that information.

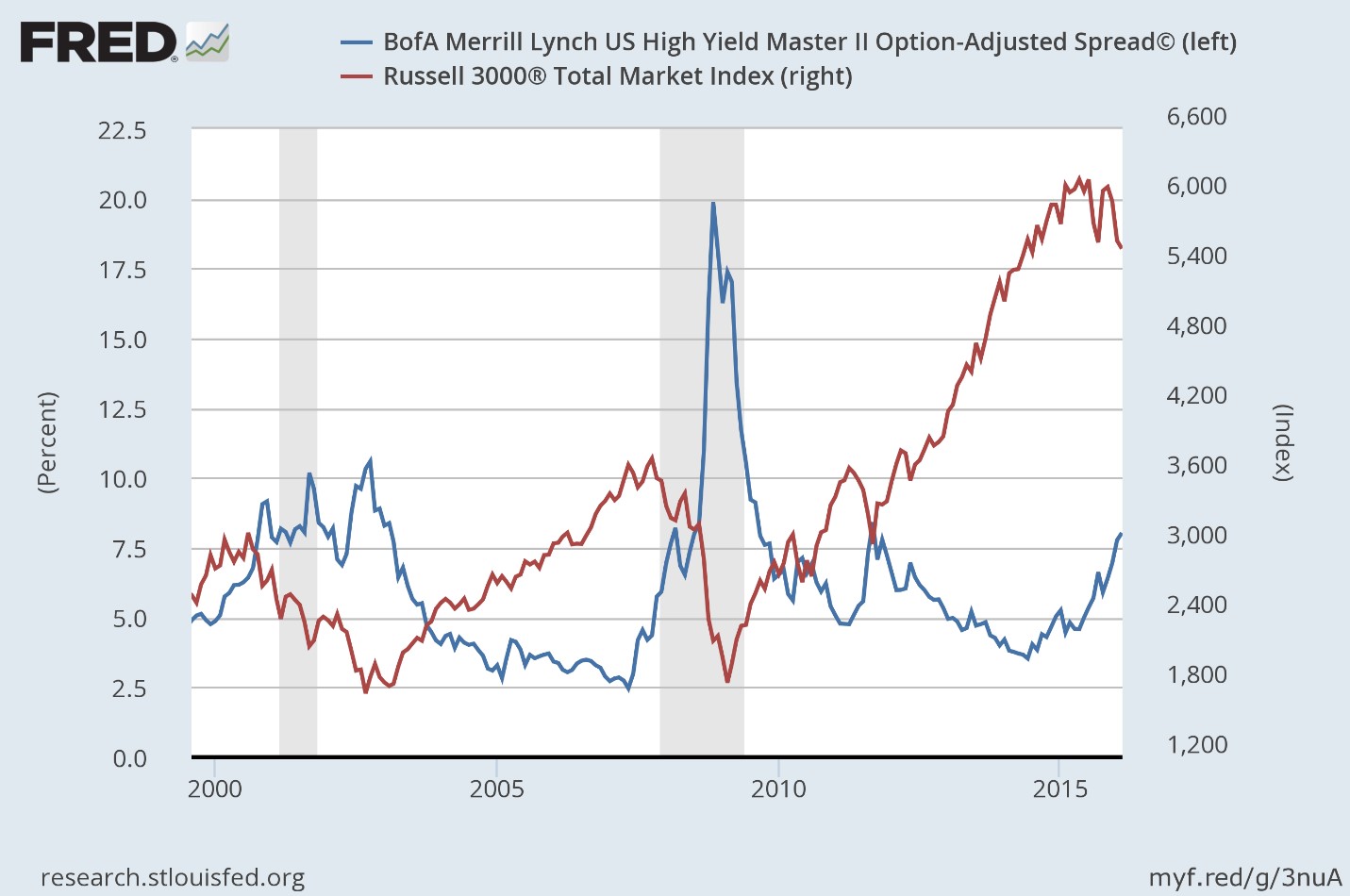

There is a lot of information available today about global finance that was only available to a select few in the past. But just because it is available doesn’t mean it is useful for everyone. For most, it is just a distraction from the few things that really matter. One of the first things I learned in this business many years ago is that if you own stocks you better pay attention to the bond market. And the bond markets have been telling everyone for quite a while now that risk is rising. High yield credit spreads hit bottom in the summer of 2014 and have been rising pretty steadily ever since. You’ve had 18 months to recognize that spreads were widening and reduce your equity exposure. Why? Here’s why:

Credit spreads are both cause and effect in a sense. Spreads start to widen as market participants anticipate credit problems or maybe react to the beginning of credit problems. A more conservative investor reduces his risk by selling junk bonds. As spreads widen they cause problems for marginal firms that can’t afford the new higher rates. As those problems emerge – a company can’t refinance a bond – a new less conservative investor reduces his risk by selling junk bonds pushing spreads wider still, making the problem worse. That’s essentially George Soros’ theory of reflexivity in action. Investors’ actions in the market have an economic effect; causation runs from the market to the economy as much as from the economy to the market.

The incoming economic data right now is trending down and has been for quite a while. Last week’s data was almost uniformly negative. Incomes were up but spending was not as individuals upped their savings rate again. The ISM manufacturing index came in below 50 for the second straight month while the non-manufacturing version fell more than expected (but still above 50). Construction spending was up just 0.1% and the year over year rate of change is falling. Challenger reported a big jump in layoffs. Jobless claims were higher than expected and appear to have hit their nadir. 4th quarter productivity was down 3% with the year on year rate at just 0.3% and that is not a new trend. Factory orders were awful and inventories are still too high so that probably isn’t going to improve soon. The trade report showed exports down again and imports barely rising.

And then there was the employment report, 151,000 jobs and quite a bit short of expectations. The hiring rate has been falling for a while now, the number of hires this January down over 30% from last year’s 221,000. The unemployment rate was down to 4.9% and the participation rate was actually a bit higher but when the data is on a negative trend the market will focus on the negatives. The workweek is unchanged over the last year while average hourly earnings are up 2.5% which actually isn’t terrible. Overall, not an awful report but worse than expected and a continuation of the trend to weaker growth and fewer – if any – Fed rate hikes.

The markets are reacting to the weaker economic data just as common sense would dictate. The US dollar peaked nearly a year ago and is on the verge of breaking support; growth expectations drive currency values. Long term interest rates are falling no matter what the Fed might want, a conundrum of their own making returning with a vengeance. Real interest rates are falling and gold is rising. It has taken longer this cycle I think because of the Fed’s influence but this is exactly what one would expect from the market in an economic slowdown.

We don’t know yet whether this will turn into a recession. We saw spreads spike higher than today in 2011 during the Euro crisis and we avoided recession. Of course, we hadn’t yet heard “whatever it takes” and we hadn’t seen negative interest rates yet and I’m not sure there is another rabbit in Mario Draghi’s hat, but still, we may yet avoid recession. If we do, the markets will tell you long before you figure out why China’s reserves are going up or down and what the impact might be on the price of wheat in Kansas. KISS

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch