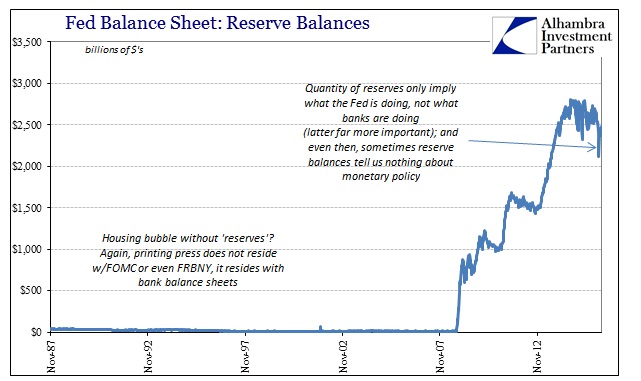

When the Federal Reserve through its Open Market Desk engages in a transaction under QE or the current balance sheet stabilization (reinvesting maturing securities) with a primary dealer, the direct effect is to increase the dealer’s account with the Fed while decreasing that dealer’s stock of securities. On the other side, absent any offsetting absorptions (either intentional or autonomous), FRBNY’s balance sheet size increases; with the newly purchased security expanding the asset side while the simultaneous reserve account increases by the matching amount. To some, this has been taken as “money printing.”

There is no money in reserves of this kind. It is nothing more than a strictly financial liability that requires further exertion on the part of the banking system in order to take usable form (money). In other words, nobody can access these reserves and use them in the real economy to obtain goods and services or to invest in real projects. They must be converted into other financial forms first, participating in the pyramid of wholesale schematics as just one liability among many, before they can actively contribute in the real economic structure. That bank “reserves” can only apply to primary dealers further suggests these kinds of limitations – that further chains of liabilities (interbank) beyond primary dealers will be necessary for that conversion from an idle and inert balance with the Fed to something actually useful.

That is the major difference between a eurodollar and bank “reserves”, as the eurodollar sits at the end of useful spectrum, acceptable as forms of payment in global trade and credit funding, while QE’s special byproducts are really quite remote. In fact, QE was never designed to be “money printing” directly, as none other than Ben Bernanke declared at the outset. From January 2009:

Our approach–which could be described as “credit easing”–resembles quantitative easing in one respect: It involves an expansion of the central bank’s balance sheet. However, in a pure QE regime, the focus of policy is the quantity of bank reserves, which are liabilities of the central bank; the composition of loans and securities on the asset side of the central bank’s balance sheet is incidental. Indeed, although the Bank of Japan’s policy approach during the QE period was quite multifaceted, the overall stance of its policy was gauged primarily in terms of its target for bank reserves. In contrast, the Federal Reserve’s credit easing approach focuses on the mix of loans and securities that it holds and on how this composition of assets affects credit conditions for households and businesses. This difference does not reflect any doctrinal disagreement with the Japanese approach, but rather the differences in financial and economic conditions between the two episodes. In particular, credit spreads are much wider and credit markets more dysfunctional in the United States today than was the case during the Japanese experiment with quantitative easing. To stimulate aggregate demand in the current environment, the Federal Reserve must focus its policies on reducing those spreads and improving the functioning of private credit markets more generally. [emphasis added]

Again in 2012 just prior to unleashing QE3:

Large-scale asset purchases can influence financial conditions and the broader economy through other channels as well. For instance, they can signal that the central bank intends to pursue a persistently more accommodative policy stance than previously thought, thereby lowering investors’ expectations for the future path of the federal funds rate and putting additional downward pressure on long-term interest rates, particularly in real terms. Such signaling can also increase household and business confidence by helping to diminish concerns about “tail” risks such as deflation. During stressful periods, asset purchases may also improve the functioning of financial markets, thereby easing credit conditions in some sectors.

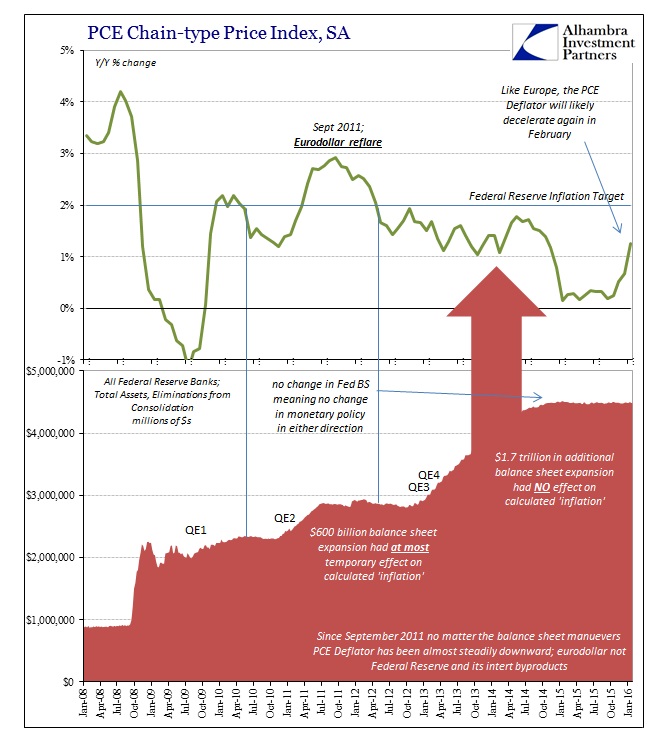

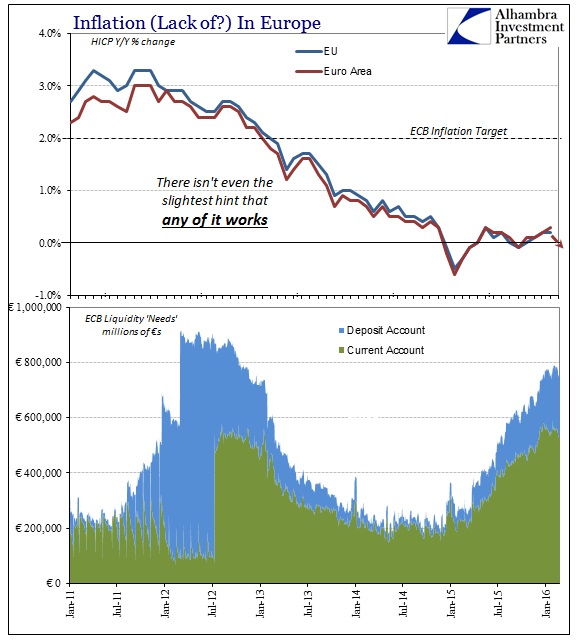

The intent is “credit conditions” even when signaling more directly to households and businesses about the “future path of the federal funds rate” and long-term interest rates, recognizing again that bank transformations are the necessary components. Where the Fed (and ECB) fails in theoretical terms is thinking that QE (or LTRO’s) will have the intended impact on offered credit; downplaying how it is that banks actually do banking. That is where the wholesale banking system and eurodollar mechanics most matter – a bank balance sheet allocation and “budget” is determined by a great many factors (math as money) that these “bank reserves” cannot sway. In other words, central banks “printed” only virtual reserves for big banks in order that they would forward them systemically(interbank) so that the banking system as a whole would “print” new credit and loan growth. It would be credit and loans that would act as “more money chasing fewer goods” to create the “virtuous” economic cycle as Keynes suggested.

Banks, obviously, have vigorously refused the license, proving that bank “reserves” can only accomplish as much as banks wish them to. This is contradictory to the theorized effects of QE in many ways, which this declaration from the St. Louis Fed in early 2011 states:

Public expectations of future inflation are also crucial in determining the path of inflation and the ultimate effect of QE. If the public trusts that the increase in the monetary base QE creates is only temporary, then they will not expect rapid inflation in the near future. These expectations collectively influence actual pricing behavior and, in turn, actual inflation. As such, the credibility of the Federal Reserve is perhaps the most important determinant of successful monetary policy.

Since “actual inflation” has only resisted the Fed’s (and ECB’s; and BoJ’s) “best” efforts at sustained 2% we can only conclude that this is all wrong. Inflation expectations are now divorced from monetary policy directly because it has been revealed through the actions of the banking system that “money printing” is far more complicated and less likely to occur so long as current conditions remain. Unless and until banks make a determined effort globally to expand and expand in serious capacity, all these bank “reserves” can only accomplish is further and deeper interference within the financial system rather than the intended effects without (recognizing further that the mess within financial conduits perhaps contributes greatly to the continued reluctance to transmit monetary policy outside banking).

From that we can reinterpret Ben Bernanke’s speeches and assertions to the bare impotence of monetary policy. In other words, he, like Mario Draghi, expected QE to be a powerful financial incentive that would easily penetrate the financial complications to turn “reserves” into credit “money”; that was the whole point of the “Q” part in QE, as referenced above, that it would be so powerful that it needed to be limited (“only temporary”) so that the public might not get too carried away in the initial awe over how much loan growth would surely result. The first two were delivered with what was thought the “right” amount of “awe” and the right amount of “restraint”; until QE3 suggested exactly these kinds of complications of turning inert and useless bank “reserves” into credit or eurodollar “money.” The third (and fourth) was left open ended, initially, because the Fed realized, belatedly, there wasn’t so much “awe” in the banking system or even appetite to undertake the transmission work especially after the events of 2011 only further called into question the usefulness of “reserves” even inside the financial system. Huge miscalculations all around owing to drastically misunderstanding the actual monetary system.

In other words, Bernanke, as Draghi, thought that banks were only missing explicit financial support of the central bank(s) through what he thought as basic but virtual bank reserves. Instead, turning “reserves” into credit money only got more complicated due to wholesale and eurodollar factors unrelated to Ben Bernanke and Mario Draghi that intensified toward further thwarting all this genius and mathematical (“Q”) “science.” Bernanke got to escape the deficiency because for a short while it looked like it just might work (as the junk market went into overdrive without need for banks and bank loans).

From this view, we can appreciate quite well just how remote monetary policy actually is even though many still believe in “money printing.” For most of the public and the media, and most economists, there was never any thought given to “how” it actually worked A to B. Even among policymakers, that is still the case. Not only are bank “reserves” not money, they are being exposed as not even a very important form of financial liability especially outside the primary dealer/big bank network (which should have been apparent in 2008; dark leverage rules). The more interesting part (dereliction) is how it all got this way without the Fed (or ECB) noticing.

Stay In Touch