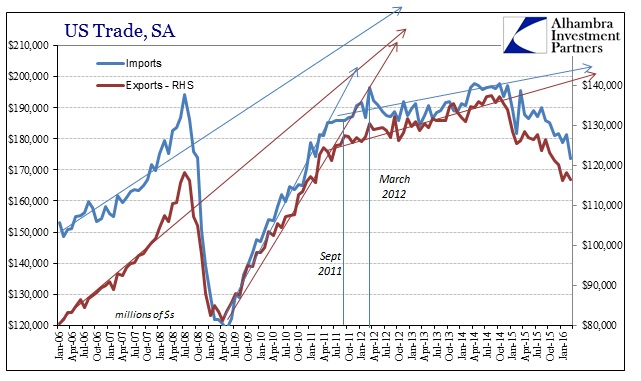

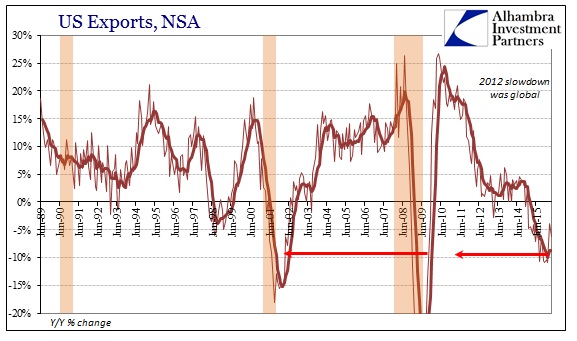

When commenting on any weakness in the US economy, it has become common even shorthand for any outlet or author to affix the conventional explanation. Suspiciously low growth rates and far too many outright contractions, especially in manufacturing and industry, are blamed on overseas weakness and the dollar as if absent that foreign interference all would be sailing along right into Janet Yellen’s predictions. This is perplexing to businesses outside the US because when they survey their own economic state they see responsibility squarely upon US consumers. This has been the case for some time now, as even in 2014 when the FOMC was most assured in its declarations of burgeoning US strength, the global economy was wondering what Janet Yellen was talking about. It just didn’t compute with actual levels of trade growth and now collapse.

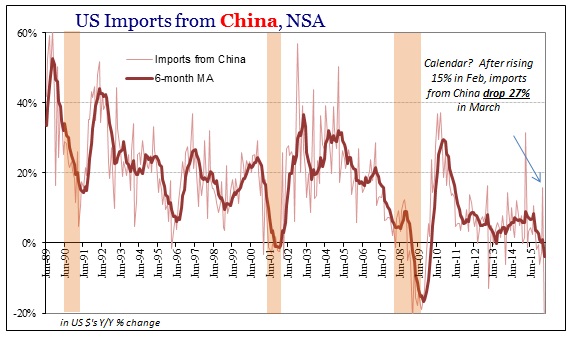

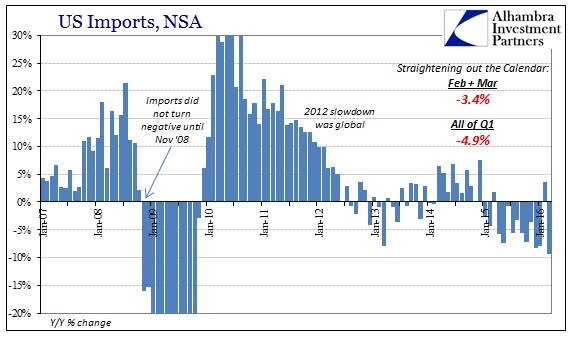

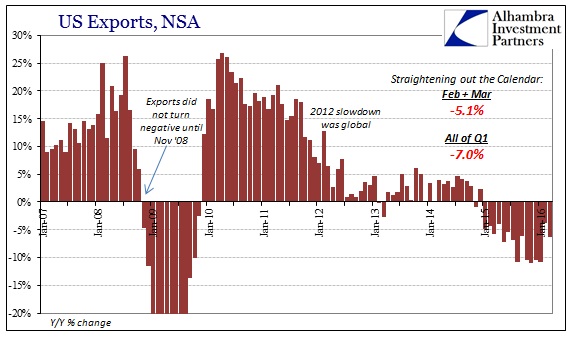

This blindness is more evident in China, where the Chinese have been steadfastly reminded that US economists are off in a world of their own. On that side of the Pacific, they have been reporting uneven but unmistakably declining exports while on this side the US Census Bureau’s estimates for imports finds only the same. Of late, there have been calendar effects to consider as the US had a 29th day in February, while China is always prone to variability surrounding its Lunar New Year. With March figures in hand, the calendar fades in importance.

Where US imports from China had jumped 15.8% in February, they collapsed by more than a quarter, 27.4%, in March. For the two months put together, imports from China dropped an astonishing 8.8% in total. For Q1 overall, inbound Chinese trade fell 6.7%, meaning the decline got worse as the quarter progressed and contradicting the mainstream hope-strewn idea that the worst was contained to the earliest days of the year.

It bears repeating that such contraction is bad in and of itself, but much worse in view of the historical context and the actual assumptions upon which China built itself up (via the eurodollar) and carried immense “stimulus.” In other words, -9% is awful, but -9% when your capacity infrastructure is dependent upon +20-30% is devastating.

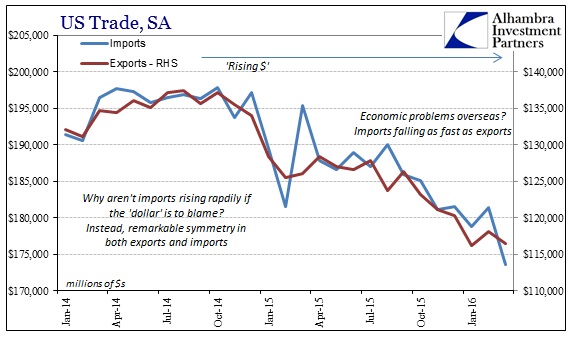

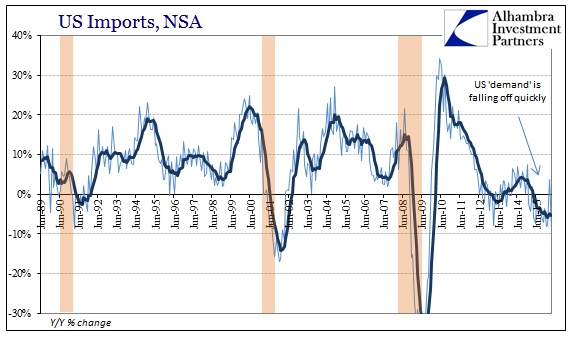

This pattern has been applied for much more than Chinese economic misfortune. Again, the world stands in wonder where the American consumer is that it might suggest to central bankers “overheating.” The weakness and now contraction is remarkable as both a contrast to the conventional economic view (weakness is only overseas or dollar) that just won’t admit data and observation, and what it suggests about where the global economy is to go from here.

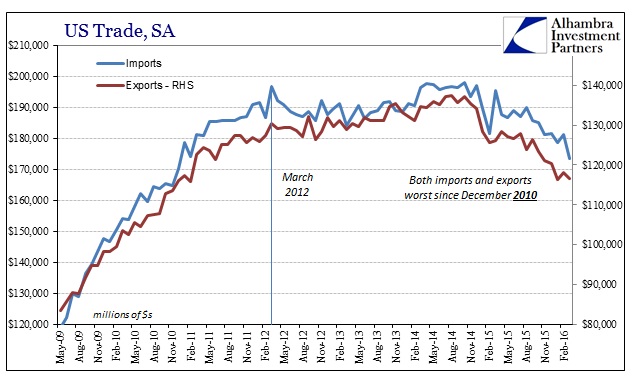

In raw dollars, US “demand” (seasonally-adjusted) is falling just as fast as overseas trouble. The March 2016 estimate contracted month-over-month by an enormous $8 billion, the largest decline since last February. What was supposed to be a “transitory” deviation has instead proved a further deceleration of the slowdown into general and more widespread contraction. The current levels of both exports and imports are equivalent to December 2010. There is no question the contraction, the only argument is about what the slope means in relation to potential cyclical matters as well as the ongoing depressive condition of the eurodollar decline. In other words, imports have declined quite significantly but inventory still remains as imbalanced as ever, therefore, like domestic manufacturing, the implication is that despite sharp declines already risks are still exclusively on the downside (cyclical) and potentially for an even further extended period (structural; potential).

Overall for Q1, exports declined 7% which is slightly better than the recent average at the end of 2015. Imports dropped 4.9%, almost right in line with recent averages, though that figure is boosted a little by petroleum. Global weakness starts in the US economy, not that it touches it only around the contours.

Stay In Touch