This week’s chart was produced by our own Jeff Snider just a little while ago for this post.

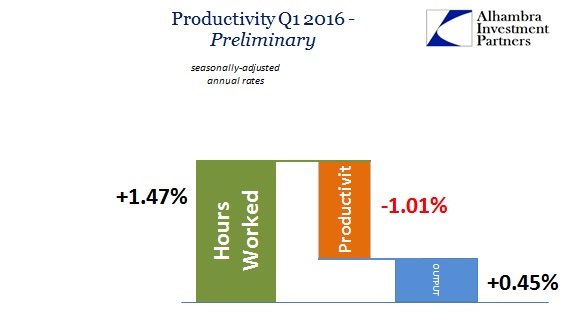

As Jeff points out last quarter saw another drop in US worker productivity. Since there are only two ways for overall GDP to grow – either more work or smarter work – the lack of output growth coupled with more hours worked means that productivity must be falling. Jeff finds this a bit hard to swallow and posits that the more likely explanation is that the BLS’s employment numbers are somehow incorrect. That’s certainly possible since the employment numbers we get each month, the numbers by which so many investment and trading decisions are made, are to a large degree just a WAG. According to the BLS, the confidence level around that monthly jobs figure is plus or minus 115,000. And frankly, I think that is optimistic.

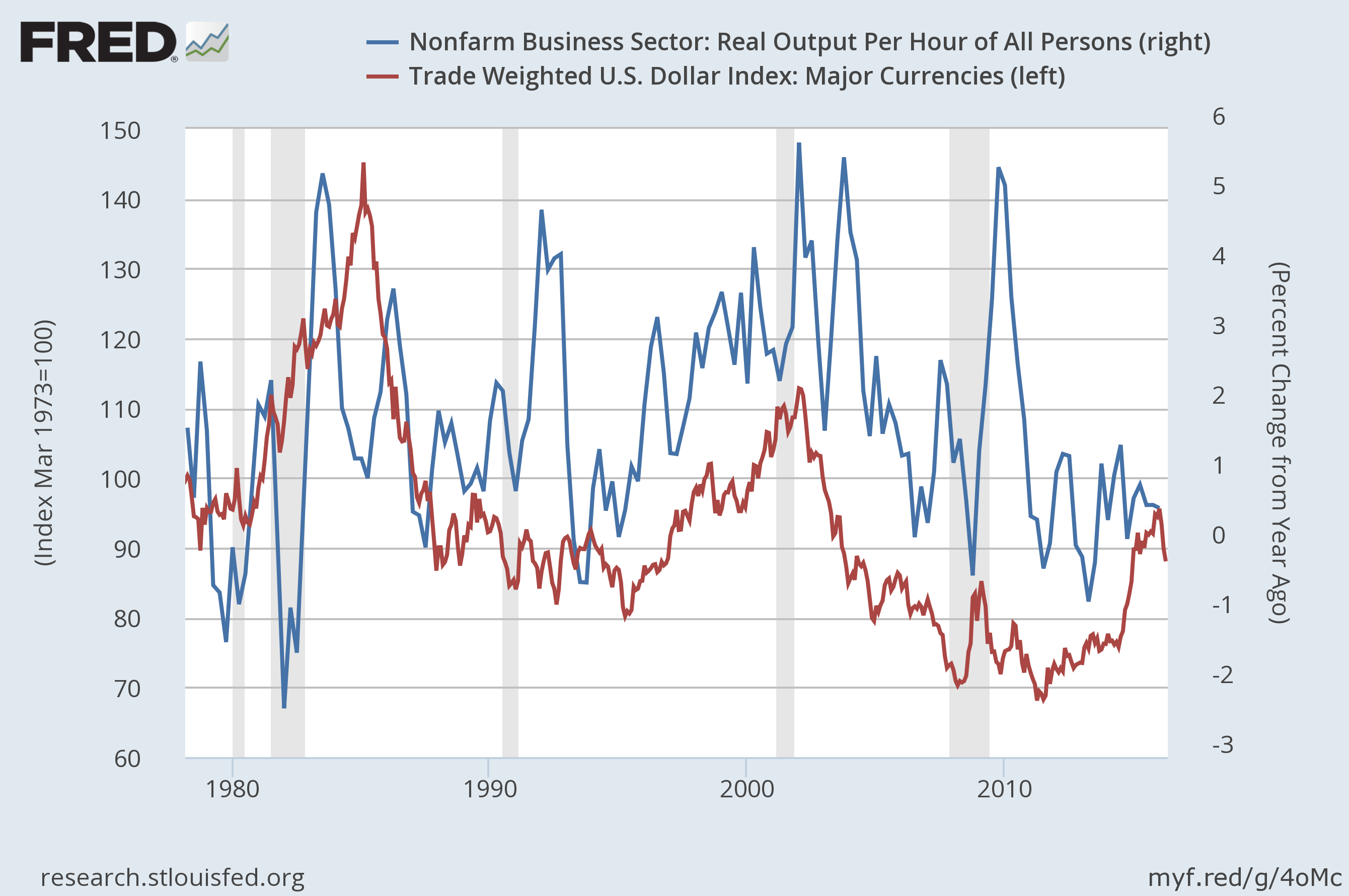

Jeff may indeed be right, but there is another explanation. I’m certainly not defending the BLS; Jeff is probably right and they are screwing up the numbers in real time. But that is only a short term phenomenon. If we take a longer view there is another explanation. Productivity is a function of investment and we haven’t been doing enough of it. Just as important is that we haven’t been investing in things that enhance productivity. Way too much of our investment capital in the early part of the decade went into houses. And more recently, we probably invested too much in oil wells that are now not profitable. So what causes us to misallocate capital into things that don’t enhance our productivity? Hmmmm

Okay, I’ll be the first to admit that correlation doesn’t equal causation. It could be that when we are more productive, foreigners want to invest here and capital inflows push up the dollar. But it is also true that “investing” in drilling holes in the ground or putting up houses is not going to have the same impact on our productivity as, say, the internet or computers or smart phones. So maybe a weak dollar only explains part of the productivity puzzle. But it sure is interesting, isn’t it?

Stay In Touch