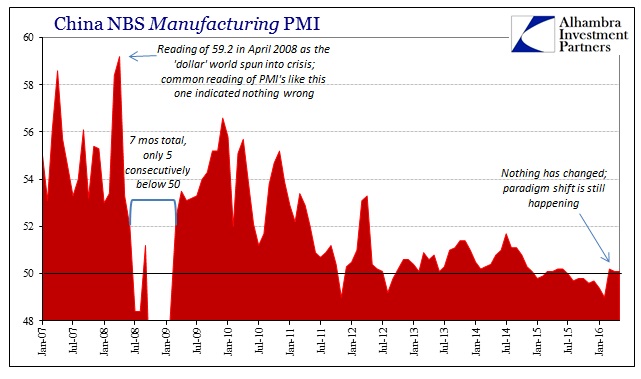

China’s official manufacturing PMI was unchanged at 50.1 in May. As such, the media doesn’t know what to make of it. It’s slightly less than the 50.2 “rebound” in March, but still more than the drastic low of 49 in February. Because the index value is above 50, commentary is generally of cautious optimism.

We have seen this before, several times. China’s manufacturing PMI “unexpectedly” fell below 50 in January and February 2015, only to similarly “rebound” to 50.1 in both March and April, and then 50.2 in May and June. The narrative then was as it is now, one of guarded confidence that though the PMI wasn’t rising quickly it was at least on the good side of 50. We know what happened shortly thereafter.

The focus on 50 or not 50 is entirely misplaced; something that bears constant repetition. The ups and downs at the start of 2015 did not indicate a material change in the overall economic trend in China, so the shift from less than 50 to above 50 didn’t indicate anything other than that March and April 2015 were likely somewhat better than January and February; “better” being the operative term. Not quite bad as bad doesn’t equal good no matter which side of 50 the index falls.

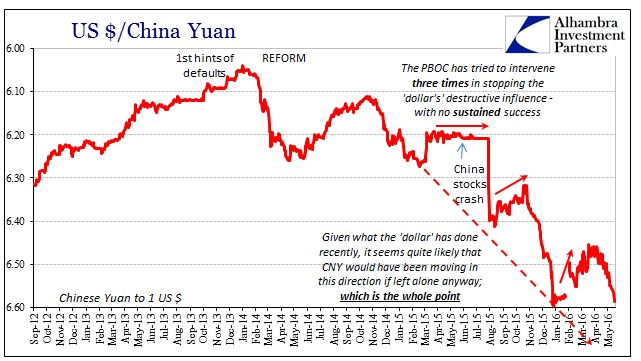

What we see of 2016 has only reinforced the relativity that is sentiment surveys. January and the first part of February this year were subject to intense financial disruption in China more so than perhaps anywhere else. There can be no doubt that that created a direct economic effect of at least delaying some activities that would take place no matter what. Once the liquidations were ended (by the “dollar” hand of the PBOC), those projects could resume. The result was only that March and perhaps some of April was not nearly as bad as January and February, but overall not a meaningful change in overall condition.

Expecting the jump in March to be anything other than that was a (continued) fundamental misreading of the PMI data (or any other).

A rebound in March had raised hopes that China’s economy was reviving, breathing life into global financial and commodity markets, but analysts said the soggy activity readings and weak April data suggest no quick recovery is in sight.

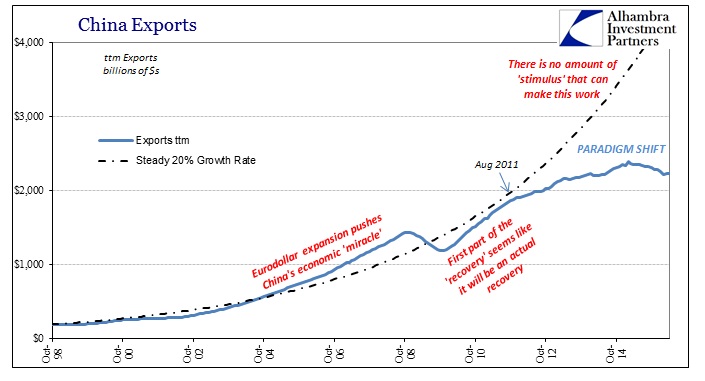

The reality of these liquidation events leaves no room for “quick recovery” or even recovery. As some projects (those more crucial) are only delayed by the financial disruption, others are canceled outright. Like a tightening monetary noose, there can be only one general direction so long as financial (“dollar”) imbalance continues. In broader terms, the fact that China’s manufacturing PMI continues in this condition only indicates that nothing has changed; the slowdown at least continues just as it has for years.

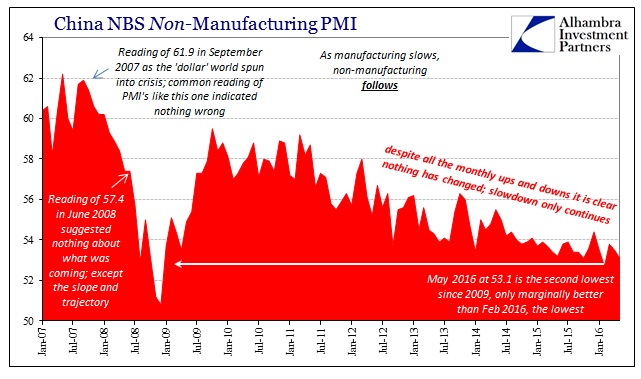

Other PMI data for the month of May weren’t so kind. The Caixin/Markit version of private manufacturing business fell to 49.2, below April’s “unexpected” relapse to 49.4. The official non-manufacturing PMI also declined, registering 53.1, down from 53.5 in April. That was the second lowest reading since December 2008, only marginally above February’s 52.7. During the Great Recession, China’s non-manufacturing PMI only recorded three months total (August, November, and December 2008) less than 53.

That suggests the services sectors in China are slowing right along with manufacturing. The unevenness of the decline is the same, leaving China’s economy not quite in recession but nowhere near a rebound and recovery. It indicates only the same slowdown, which is really a long, slow paradigm economic shift. That is the only meaningful interpretation of the PMI’s individually and collectively, that nothing has really changed with the economic decline still quite intact.

It’s bad news for China but really the global economy that Chinese (mis)fortunes reflect. The continued devolution of economic circumstances points to further problems ahead both in the long and short run. In intermediate terms, we don’t know what the end of this paradigm shift will look like because this is all unprecedented; though there may be some clues in the short run of these repeated liquidation cycles. In other words, with PMI’s suggesting the same negative fundamental properties in 2016 that is also of immediate concern with CNY right on schedule and now well into the plus side of zero hour. Tick, tick, tick.

Stay In Touch