What happened in the period between 2007 and 2011 was the same that happened in 1930 and really 1931. The monetary “miracle” of the 1920’s was predicated on the same sets of inequalities and imbalances; revealed afterward in not just the crash that unwound the core processes but really in the lack of recovery that followed. We need only turn to the father of monetarism, Milton Friedman, to describe the systemic impairment:

During the five months [Aug 1931 to Dec 1931] when highpowered money rose by $330 million, currency held by the public increased by $720 million. The extra $390 million had to come from bank reserves. Since banks were unwilling and unable to draw down reserves relative to their deposits, the $390 million, amounting to 12 per cent of their total reserves in August 1931, could be freed for currency use only by a multiple contraction of deposits. The multiple worked out to roughly 14, so deposits fell by $5,727 million or by 15 per cent of their level in August 1931. It was the necessity of reducing deposits by $14 in order to make $1 available for the public to hold as currency that made the loss of confidence in banks so disastrous. Here was the famous multiple expansion process of the banking system in vicious reverse. That phenomenon, too, explains how seemingly minor measures had such major effects. [emphasis added]

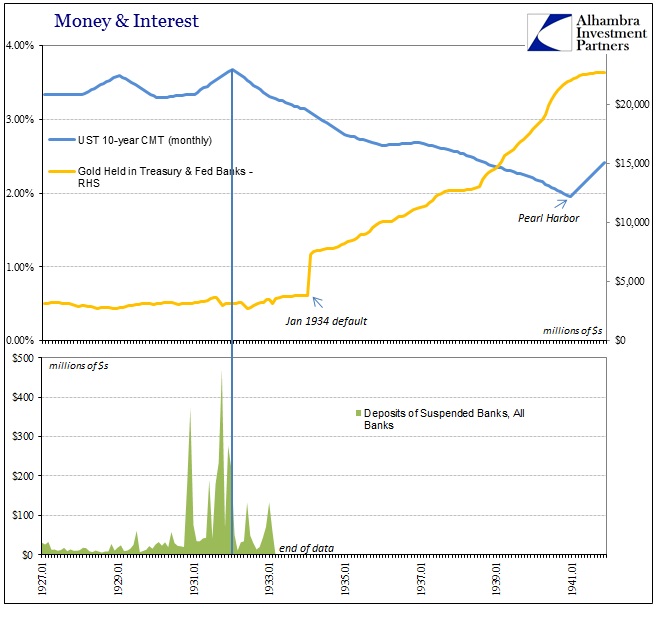

It had been the basis of monetary expansion since the early 1900’s; the US public came to hold more deposit balances and far less currency than at any point in prior history. The “prosperity” of the 1920’s had accelerated the process as it appeared to be a low risk systemic shift. Thus, the waves of bank panics but especially the second in late 1931 was not just relevant to the unfolding crash but really as a lingering monetary impact on the entire Great Depression.

In general terms, the money multiplier was broken because the public became openly suspicious of banking in general where nobody answered for the mistakes of the 1920’s; instead, what happened were top-down “solutions” that only addressed, at most, the core “money supply” but leaving in place the shrinking deposit-currency ratio. Mistrust was never turned back into full trust so that the world before 1929 would be rebuilt. Banking had become less efficient to a degree of impairment in expanding fractional lending that no amount of gold or other “high powered money” could overcome.

I pointed out this point of no return last week; the 10-year UST yield began falling at the end of that second wave of bank panics in late 1931 and didn’t stop until Pearl Harbor. The Great Depression would be from that point forward characterized as a recovery that never actually led to recovery.

The methods, operations, and appearances of the eurodollar/wholesale system may seem unrecognizable to the traditional banking format of the 1920’s and 1930’s, but in reality money is money and will act like it in whatever form because it is human tool. While the global “dollar short” is the modern, often confusing incarnation, it is really not much different than the deposit fraction. Every bank that issued a passbook balance for customer deposits was in every way (synthetically) “short” the dollar just as wholesale banks are now. The difference is the place in which that short originated and was/is sustained; interbank (now) vs. depositors (then).

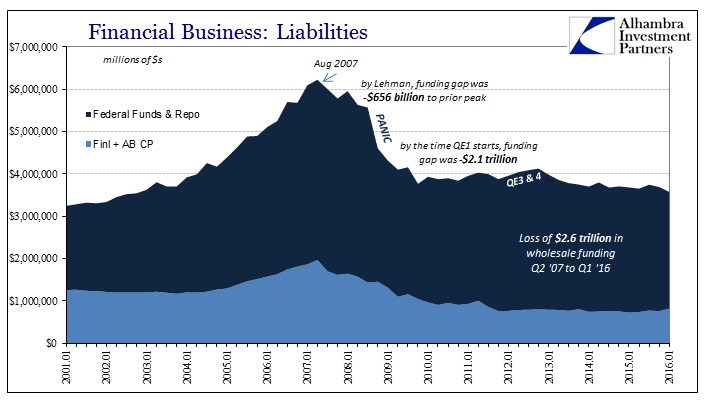

The “run” on repo (collateral haircuts and repudiation) and credit default swaps was really no different in behavior as the bank runs that precipitated the failures of 1930’s. Thus, like the 1930’s, the scale of the monetary “hole” was as enormous if not more so than what Friedman described for late 1931 – it just had nothing to do with bank reserves. As I calculated here, funding gap in just federal funds, repo, and commercial paper (all wholesale categories) was $656 billion by the time of Lehman, jumping to an unthinkable $2.1 trillion by the start of QE1. And that was just the domestic part of the eurodollar that was measured, leaving uncounted both the further quantitative eurodollar destruction and the likely more important qualitative contraction beside, all unseen but certainly not unfelt.

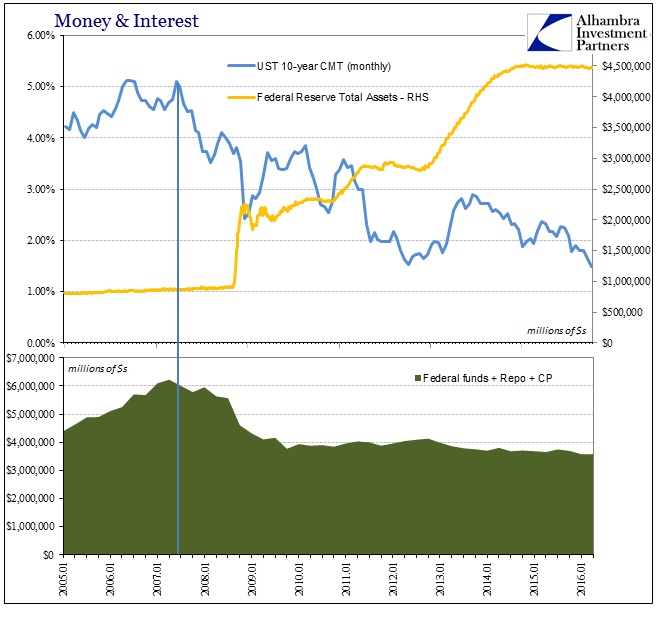

The difference 2010’s from 1930’s was that the second wave then was part of the initial collapse while in 2011 it served instead to end all hope of monetary recovery. In Krugman terms, the “deflationary vortex” got started in August 2007 but was partially set aside in 2009 and 2010 in a burst of cyclical hopes placed in Bernanke and central bankers. The events of 2011 dispelled them, revived the vortex to where banks have been forced to accept what all that really means (all risk, no reward; no return to exponential growth).

The original fall of the eurodollar, as described by the 10-year UST CMT yield (again, the interest rate fallacy where lower yields equal “tight” money in the real economy, not “stimulus”), began in the middle of 2007. The collapse in wholesale “money” had the same effect as the collapse in the deposit-currency ratio. It knocked the financial world into panic and then the real economy into the Great Recession (which looks less and less like a recession every month or year).

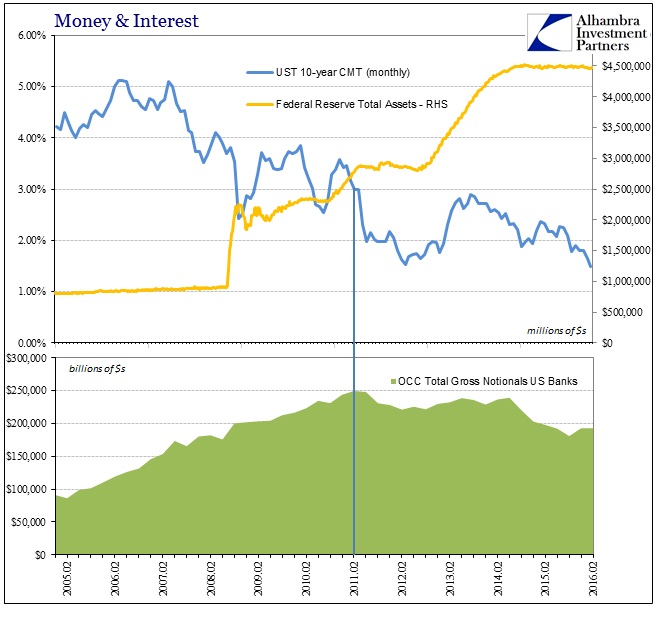

What was so destructive about 2011 was the unbelievable contrast (to the point of open contradiction) between expectations and what actually happened; between monetary policy in QE-led expansion of the Fed balance sheet, and thus what “everyone” believe of money supply, and only weeks after QE2’s end another round of global illiquidity and dangerous “dollar” imbalance. As I wrote in March, none of the numbers added up:

Obviously we are missing “something.” M1 money supply, which includes all of M0 “base money” like bank reserves at the Fed, had grown from $1.767 trillion at the start of QE2 in November 2010 to $2.11 trillion when two undisclosed European banks were suddenly and again near the brink. Which was more monetary: bank reserves that increased as the SFA declined, or the SFA collateral in repo?

Some of the eurodollar plumbing and capacity was rebuilt or kept performing after 2009, but none of it did after 2011. And like the 1930’s, base money or high-powered money this time in the form of bank reserves (expanded as a byproduct of QE and other monetary programs) was a complete nonfactor the whole time. The systemic impairment is once again beyond the reach of monetary policy and so the economy suffers for it year after year.

Krugman cannot in 2014 commend Bernanke for doing QE and keeping the US from the precipice of his “deflationary vortex” and then admit later the entire world has been gripped by monetary decay and thus depression, all based on a global dollar which is supposed to have been his jurisdiction. Likewise, Larry Summers advises all the standard monetary means by which to combat the symptoms of his “secular stagnation” and is therefore prevented by his own “logic” from recognizing the monetary disease itself. Brad DeLong, so far as I have seen, rightly calls it a depression without ever telling us why it happened. For all, it is a mystery because the monetary question was settled in 1963 when Friedman with Anna Schwartz published the monetarist’s “bible.”

We are left to repeating history because economists have consistently believed it is still 1963 and we are still dealing with 1930’s banking; if the deposit fraction in 2017 starts to contract again, they are quite likely very prepared for it (all it really takes is the FDIC, but that’s another story). If the wholesale “fraction” of dark leverage derivatives and money supply far outside any of the “M’s” does instead, as it so clearly is, it’s not just that they aren’t prepared they don’t even think it monetary. Like the bond market, the depression is all a riddle because central bankers don’t know the first thing about modern money even when it acts exactly like in all their textbooks.

Stay In Touch