Very few people are against the concept of free trade, and those who are aren’t worth listening to. As a matter of economics (small “e”), free trade was established as a universal good that benefits all sides in one of the first scholarly debates that in the early 19th century helped turn political economics into a separate study meriting its own discipline. Trade has marked the upward surge of humanity out of the dark ages and feudalism toward republican democracy and dignity.

What people all over the world are objecting to today is the economic criminality that has masqueraded as the supposed benefits of free trade. The open borders for the flow of goods has been turned on its ear; it is now just open borders for the flow of finance. This is not in any way associated with free trade, though the reality of it has yet to reach the economics profession.

On Sunday in the New York Times, Harvard economist N. Gregory Mankiw wrote what is truly a remarkable piece of self-denial, extraordinary in that his contempt for anyone not an (elite) economist is scarcely cloaked in favor of his own self-regard. He writes:

Voters clearly aren’t listening to economists. In a recent poll, an overwhelming number of leading economists agreed that Brexit would most likely lower incomes both in Britain and in the rest of the European Union.

This statement can be taken two ways: that economists have some explaining to do, or economists shouldn’t bother explaining themselves. Mankiw chooses the latter.

In the long run, therefore, there is reason for optimism. As society slowly becomes more educated from generation to generation, the general public’s attitudes toward globalization should move toward the experts’.

The short run in which we find ourselves now, however, is another story.

In the days before the internet, media dissemination was forced through narrow bottlenecks. The hazards of Journalism (capital “J”) meant an emphasis on standards of information and the people giving it, not all of which was negative. Editorial pressure meant verification, but that was a double-edged sword. If an economist from Harvard makes claims that are at odds with everything around him, they are more likely to be published anyway because he has checked all the editorial boxes for big “J” journalism. If some unknown blogger chooses to disagree and point out all the ways in which he is utterly contemptible, that never saw the light of day.

In this new media environment the bottlenecks are much more easily overcome; the public is desperate for answers from people who aren’t full of it. We don’t need the New York Times or CBS News to go out and “filter” what is and what is not; Google is now the editorial method of choice, and it opens up the possibilities that to the elite are frightening.

This democratization of information is a direct challenge to particularly economists in 2016 because the economy in 2016 is nothing like what they promised several years ago or even last year. Rather than confront their own shortcomings, economists lash out at the “barbarians” attempting to destroy their beautiful “science.” Thus, their immutable devotion is to their sense of their own beauty, not the science.

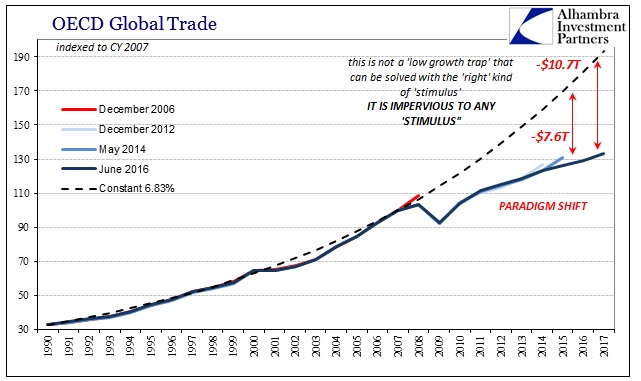

The barbarians are not pounding at the gates of economic science; the barbarians are those already inside them. It is the knock of civilization and knowledge that now pushes their considerable defenses. We can only hope that the siege will not go on much longer, before $10 trillion in lost (forever) economy turns to $15 trillion and then $20 trillion. There is a very different world waiting for us at -$20 trillion, a projection that -$10 trillion already establishes.

Voters around the world now see the -$20 trillion coming just as they sense the -$10 trillion already upon us; Greg Mankiw will be left wondering why the unsophisticated masses aren’t ecstatic that the “unexpected” -$20 trillion wasn’t -$21 trillion.

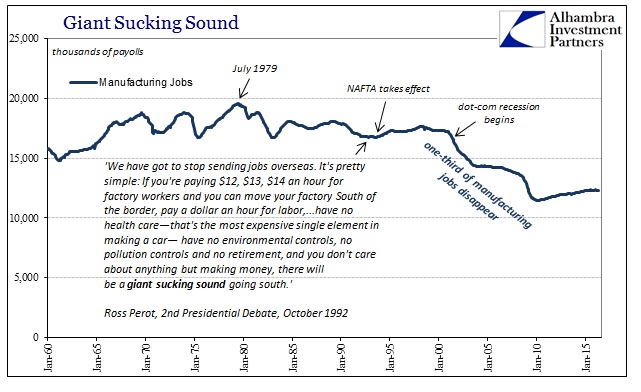

Americans know very well the score of what has been called “free trade.” Ross Perot was right about NAFTA and that “giant sucking sound” of jobs headed south to Mexico and then West across the Pacific. Economists are quick to counter with the industrial revolution and the past transformation of the US economy from its agrarian roots; and they are not wrong to bring that into the conversation. However, it is a huge mistake to simply write off those who disagree with the current flow of especially manufacturing jobs as the 21st century equivalent of economically displaced farm workers forced to move to the cities and work in factories.

The general idea of late 20th century free trade is a similar revolutionary advance, where now industrial jobs are of such low quality and value-added they are “right” to be moved to low cost, low value offshore locations. In their place is the Information (capital “I”) Age (capital “A”), where once the unskilled could work in factories they now must become somewhat skilled and educated in order to work in the corporate bullpens (or now the free-flowing open spaces) of Silicon Valley wannabes.

Thus, those complaining and objecting to free trade are those who are being stubbornly exiled by it, not recognizing that society and economic advance are all at once depending upon it. This is how economists see it, leaving these people outside the revolution as an impediment to the vast, great future before us; and the spread of their disassociation a direct harm to the “greater good.”

But is this really what happened?

We know without fail the first part did; manufacturing jobs left the United States and we began to import an inordinate amount of goods at the margin especially from China. While Ross Perot was a little off in his timing, the “giant sucking sound” did materialize once the dot-com recession got underway in 2001. For such a mild recession overall, the reaction in domestic manufacturing was clearly way out of proportion.

Total manufacturing jobs in absolute and relative terms peaked in late 1979. By the time of the 1992 Presidential election, taking place during the first undeclared “jobless recovery” (“it’s the economy stupid”) after the 1990-91 recession, the loss of jobs in the industry was just a trickle and more so in proportion to growth being attained elsewhere. In other words, it does seem as if the information age was leading in the direction of free trade as an overwhelming benefit, perhaps leaving Mr. Perot as the William Jennings Bryan of the computer revolution.

The economy of the 1980’s and into the 1990’s was inarguably supported by the technological advances in both computers and electronic communication; the innovations of the fifties, sixties, and seventies all coming to fruition at once. The loss of low-skilled manufacturing work in favor of higher-skilled tech jobs would be a net economic gain not just for the US but for the entire global economy. It is a difficult and challenging prospect if you are someone caught up in the messiness of these kinds of market-based economics, just as all those farm workers (and family farm owners) were searching for relief from, and lashing out at, the industrial revolution nearly a century before.

But the last great technology wave was not the universal adoption of the personal computer and its connection to the internet, it was a derivative branch of telecom and computing power that offered an even bigger potential transformation. While the world wide web was built out of technology pioneered largely 1979 and before, innovation did not cease at the outset of the 1980’s. The economy of the 2000’s was built up in the revolution of the 1980’s and really 1990’s, a timing that led to confusing conflation between the beneficial realization of the computer age and what immediately followed it.

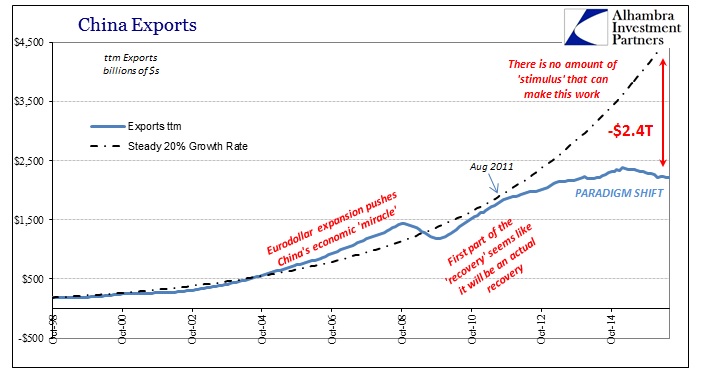

The last great pulse of economic evolution was finance. In many ways, open borders had been the great spur in this wave of change, accounting for first the appearance and then great unchecked spread of the eurodollar. The contribution of the 1980’s was in amplification and multiplication in its formats and qualities that allowed by the middle 1990’s its unthinkable volume and reach. Paired with something like NAFTA, it meant open borders for goods and the vast amount of “money” needed to finance the mobility.

Even in these general terms, however, it is not perfectly clear that this arrangement of “free trade” is entirely bad. Theoretically, it may have been a net positive for all the disruption, even factoring in the massive financial distortion of the housing bubble and its aftermath. But the burden of proof is on the other side; it resides with Mankiw and economists who claim that the obvious and evident global disorder all caused by their proffered theories was worth it.

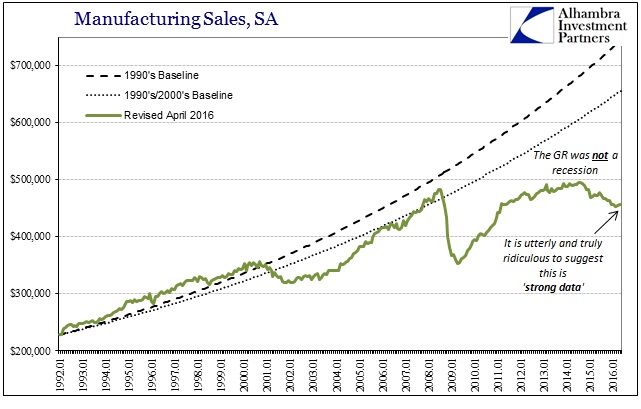

Instead, they only offer insults to the clear economic injury. The economy of the 21st century is nothing like the economy of the early 20th century. The computer and internet revolution may have offered a fruitful path of transformation away from an industrial base, as free trade theory presumes, but there is only evidence pointing out that is not how it all turned out. The financial revolution co-opted or even just plain overran the technology revolution and left the global economy with increasing depression pressure; first in bursting asset bubbles and then in whatever someone may call the economy of the last seven years (depression suffices in my view).

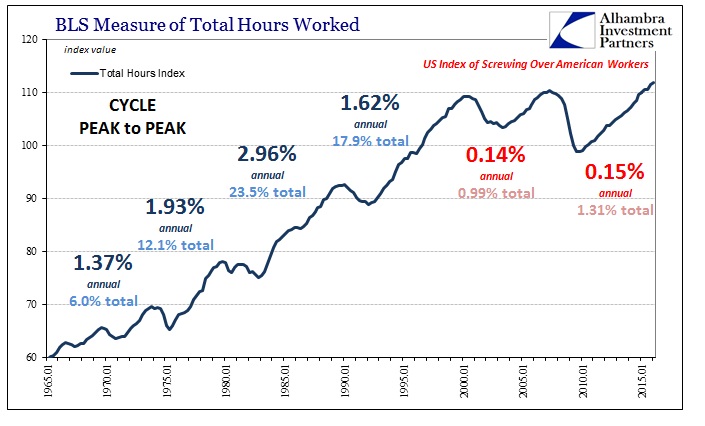

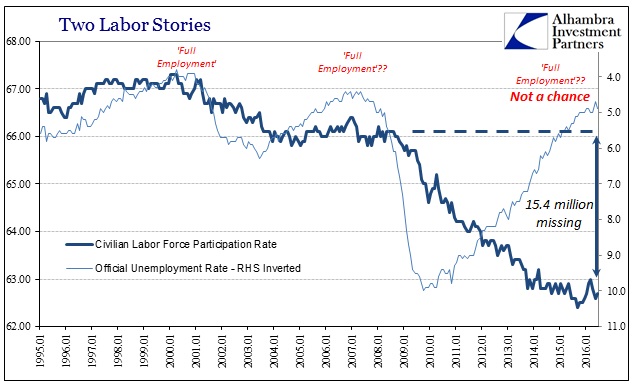

Rather than find evidence of free trade, we find only the results of “free trade” as a eurodollar component. Just as the manufacturing industry began to seriously move capacity offshore at the start of the dot-com recession, we find that these jobs were replaced not be new tech jobs but with only finance in the form of debt. As manufacturing moved out, labor utilization has only dwindled – and alarmingly so.

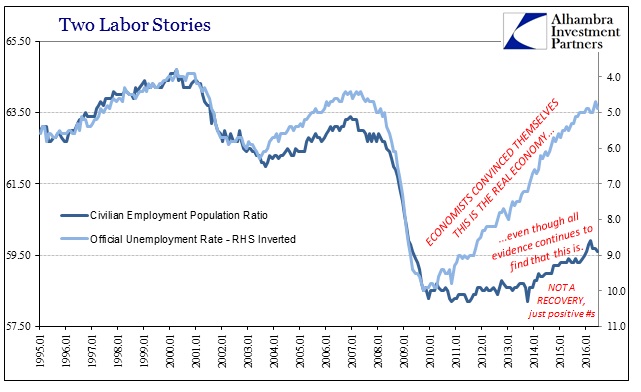

The intrusion of finance into manufacturing and really everywhere else in the global economy accounts for both the Great Recession and its lingering aftermath – an obvious lack of recovery that proves it was never a recession to begin with. This is the part where economists like Mankiw truly distinguish themselves in the worst possible way, as they tell us over and over again that this is and has been a recovery and therefore complaints about it should be immediately dismissed. In other words, economists see those voting for Trump, Sanders, or Brexit as just the slavish people being left behind by the Information Economy as it eventually, somewhere in the future kicks into high gear. In reality, the whole global economy has been left behind and it is only economists and policymakers who have been (so far) shielded from the effects of the still-unfolding disaster.

Ross Perot was right, eventually, and for reasons that he truly didn’t comprehend, but it is a logical fallacy to assert that because you get one thing wrong you are wrong about everything. In 21st century economics, that has been turned entirely around in favor of the economists; they can get everything wrong so long as the theory is “right.” This is a betrayal on so many levels, but at the very least starting with positive economics itself – the very core of econometrics that economists like Greg Mankiw rely upon to insult our intelligence. The fact that he creates and utilizes the most elegant statistics is meaningful only to him and others like him; to the real world and to positive economics as defined by none other than Milton Friedman, it is hollow and worthless without prediction.

To get to this point, Friedman claims a hypothesis must be “important”, by which he defines as, “if it ‘explains’ much by little, that is, if it abstracts the common and crucial elements from the mass of complex and detailed circumstances surrounding the phenomena to be explained and permits valid predictions on the basis of them alone.” In statistical usage, this is justification for ignoring the “error” terms so long as the few independent variables supply sufficient predictive capacity.

There is simply no way to reconcile Mankiw’s obsession with “free trade” as if it were actually free trade. What was promised is not what was received; economists’ predictions all failed. Even though Ross Perot was “more wrong” about why, his prediction actually proved correct. The eurodollar system was the imminent factor that none of them perceived, and many if not most still do not appreciate.

The difference between 1992 and 2016 is that we are no longer forced to listen to the Mankiw’s of the world exclusively. The opening of the internet means that people can get useful information from someone who never set foot inside Harvard, MIT, or Princeton, where credentials matter much less if not at all; and that upsets them on a personal level as economists’ own failures come back to haunt them as they increasingly lose their grasp on the population at large. Economists own this depression and the populace is finally starting to realize it as an empirical, established fact of evidence entered outside the legacy media in rejection of “free trade” theories.

“Voters clearly aren’t listening to economists.” If only the internet had been born a few decades earlier.

Stay In Touch