Speaking yesterday in Reno, Nevada, San Francisco Fed President (and CEO) John C. Williams delivered remarks on the normalization of monetary policy. So as not to put the cart before the horse, Williams noted that first the economy must do so before the FOMC can even consider the same for their self-assigned tasks.

I’ll start with a quick overview of the U.S. economic outlook and what it means for monetary policy. Spoiler alert: The punch line is that the economy has climbed back to full strength, and it therefore makes sense to move monetary policy gradually back to normal…

Consumer spending is strong, the labor market is running apace, and household balance sheets are improving. All in all, I see a solid domestic economy with good momentum going forward.

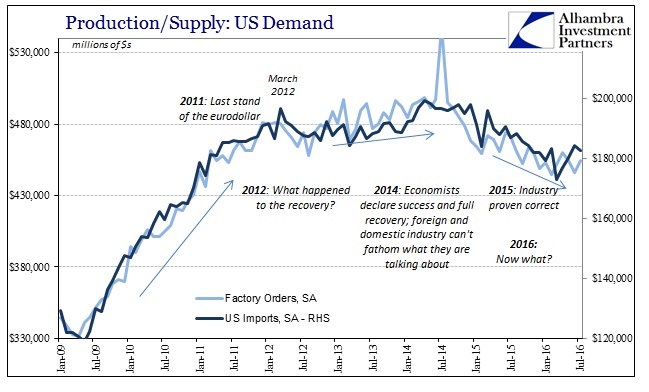

You really have to wonder what it is these economists are talking about. As noted yesterday, US factory orders, for example, have been contracting for more than two years now. Since that includes both durable and non-durable goods, such persisting weakness spills over into the services sector straight away since so many services depend upon at least managing, moving, and selling goods (not to mention serving them in prepared fashion). Contraction in US manufacturing is a warning to expect further and more widespread negativity, not “good momentum going forward.”

Perhaps his speech was written and polished before all of yesterday’s data, including the ISM Non-manufacturing PMI, but even Reuters in writing a summary of William’s conjecture questioned his premise. It really isn’t a good sign for an economist/policymaker to have Reuters point out your inconsistencies (if only because they are now just that obvious):

A top Federal Reserve official on Tuesday repeated his call for gradual interest rate hikes, evidently unfazed by a slowdown in U.S. job gains and sluggishness in the services sector that now has traders betting against any rate hike at all this year…

In his prepared remarks Williams did not address the release of data on Tuesday that showed activity in the U.S. services sector had hit a six-and-a-half-year low, or government data last Friday that showed U.S. employers added fewer jobs than expected in August.

To further complete the contradiction, foreign manufacturers have by now completely tuned out “experts” like John Williams and Janet Yellen no matter how impressive sounding their credentials. To anyone in manufacturing and industry anywhere on Earth, it is absolutely clear by now that these economists know very little about the economy.

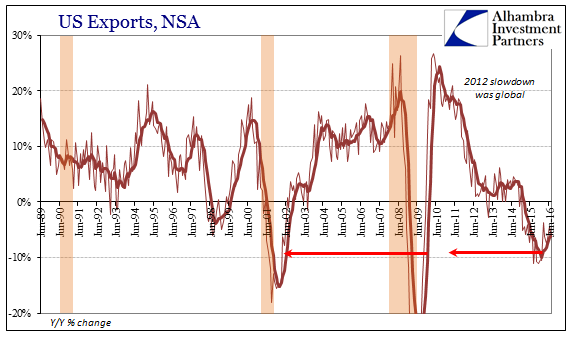

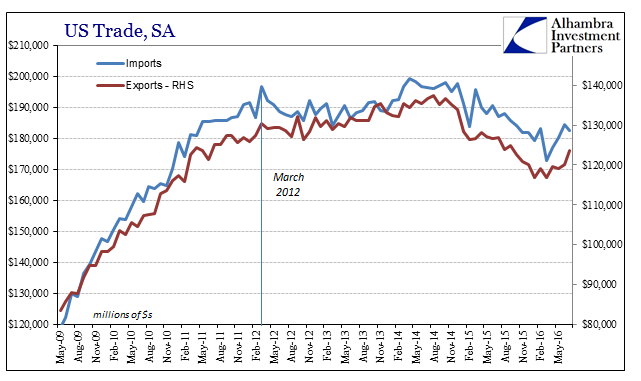

While some media commentary maintains that it is overseas problems that explain the US factory data, that idea had been disproved long ago by US trade figures. In fact, the Census Bureau estimates for exports and imports actually go a long way to explain the overseas turmoil; as US manufacturing, there is a curious and shocking lack of further “demand” from the US economy, primarily but not limited to US consumer retrenchment (casting a pall around inventory balances).

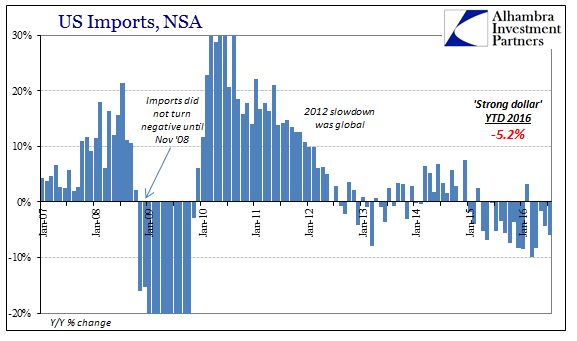

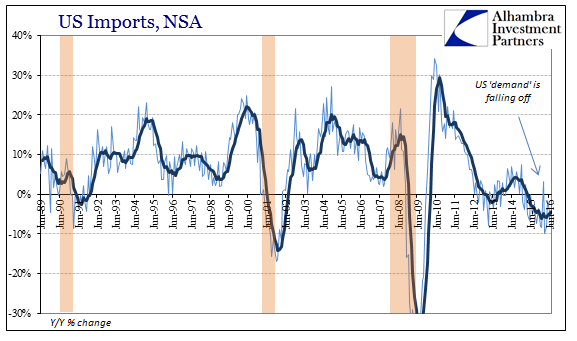

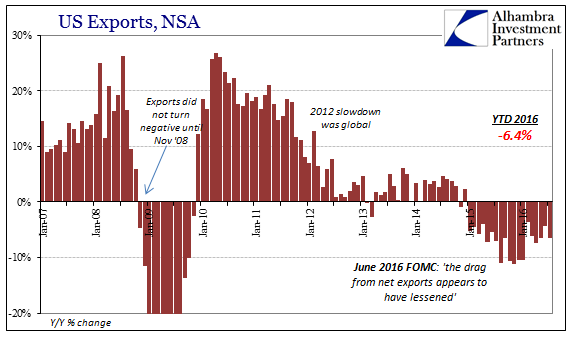

Exports fell 6.5% in July 2016 year-over-year, but imports into the US also fell by 6.0%. Year-to-date for the seven months including July, imports are down 5.2% from the same seven months in 2015. Worse, because imports to start 2015 were less than imports in 2014, YTD US imports are now a little more than 8% less than they were two years ago. These time dimensions remove any possibility of statistical anomaly, and really further except any kind of explanation that isn’t macro.

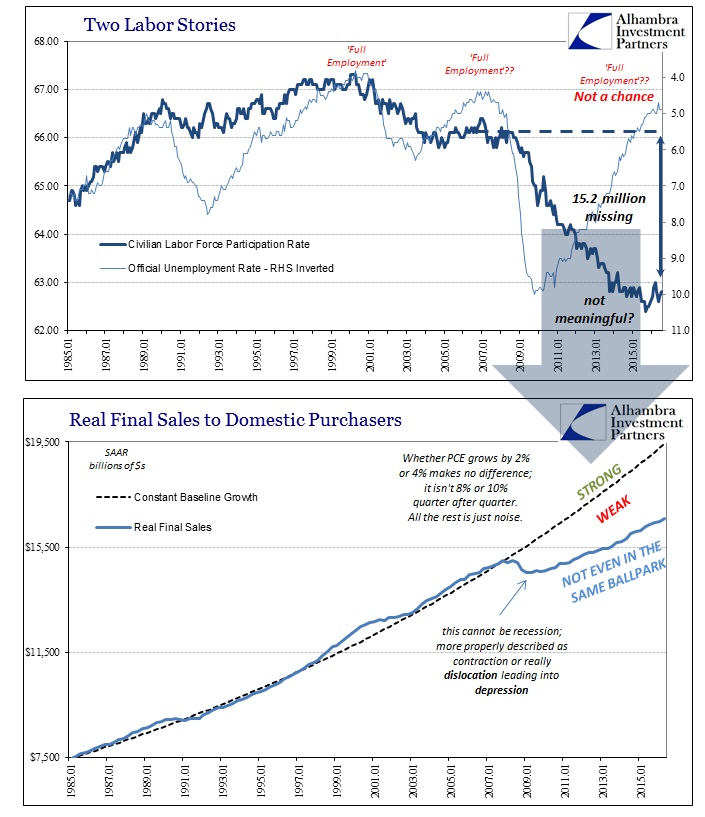

An 8% decline is itself enormous but stretched out over two years it calls into question the ability of policymakers like John Williams to make any kind of statement about how “consumer spending is strong.” Almost two years ago I wrote that policymakers would remain fixed on what “should be” rather than what actually is because they are not experts in anything but mathematics and statistics. Even by November 2014 it was becoming clearer (especially in credit and funding markets where failure is most certainly an option) that monetary policy was nothing more than a legend because there was no functional money in it.

If you actually study the behavior and details, what has transpired in the past six months in particular is a case study in ideological blindness. Credit and wholesale markets have been warning for some time that “resilience” is a myth, further that QE played a direct role in diminishing systemic capacity to which the reverse repo was supposed to alleviate, and by extension the recovery idea is not just an illusion but one which has lost its capacity for anesthetizing good sense.

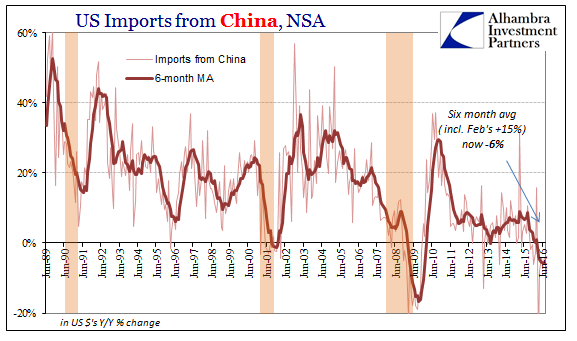

Since that time, the US and global economy have gotten worse in alarmingly synchronized fashion as the US trade data spells out in the most open and unambiguous manner. The “rising dollar” was a warning (quite frankly an obvious one) and now we are living it. The rest of the current report was similarly grim in all the same places. Imports from China fell more than 4% in July, the fifth consecutive month of contraction and when combining February and March makes for an astounding ten straight. More than anywhere else in the world, the Chinese take great and now dangerous issue with these so-called economists.

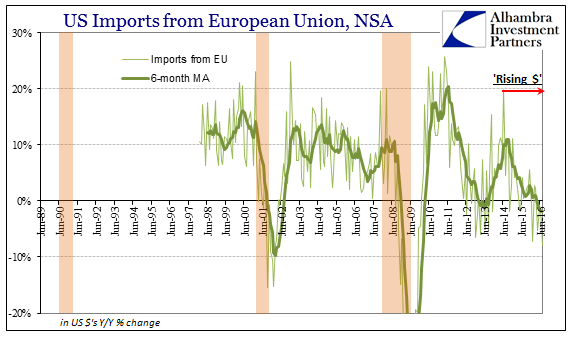

It wasn’t just the Chinese feeling the distinct absence of US consumers as imports from Europe fell 8% in this update. That is the worst contraction since October 2009, and it comes at a time when European economic fortunes are even more precarious than those here.

Central bankers are supposed to be experts about money and by extension economy. Instead, they are left to just use words and hope that nobody bothers to check their usage as appropriate. There are no “strong consumers” indicated here or really anywhere in the US economy. It is, in fact, the lack of demand from the US that is fueling even greater concern about everything from monetary policy to whether or not this was ever truly a business cycle going back to at least 2007. These doubts were apparent in 2014 and now they are no longer doubts.

Alan Greenspan admitted in June 2000 that the Federal Reserve truly had no idea how to even define money. If they don’t know money they can’t possibly know economy; as if we needed any more evidence to prove that fact. John Williams and Janet Yellen can only deliver meaningless, unhelpful noise, whether by speech or actual monetary policy.

Stay In Touch