The “rising dollar” has been much less disruptive since February 11. In terms of the real economy, since “rising dollar” is a euphemism for “dollar” shortage we would expect trade and especially international trade to be most affected by it where “dollars” are the primary global currency. A pause in “dollar” disruption, at least outwardly as direct disorder, should allow some retracement in some parts of the trade system.

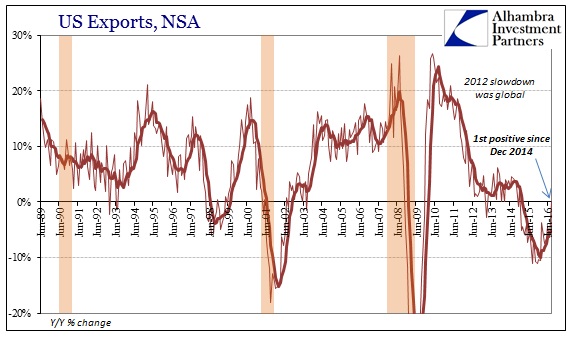

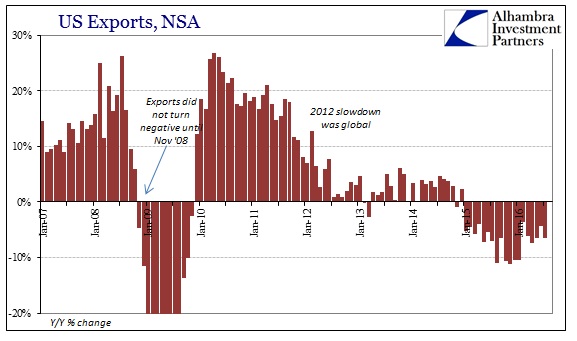

That may be what we are seeing in US exports at least. For the first time since December 2014, exports didn’t contract year-over-year (NSA). Managing the smallest possible gain in August, +0.1%, US outbound trade for one month seems to be less concerning. It is, however, only one month as in July US exports had fallen sharply by 6.4% and may do so again next month. For now, however, the possibility has been presented that if the global monetary system can for some significant amount of time appear stable then there might be less contraction pressure. Money matters.

This does not mean that all is well, recovery and growth now slated as the new baseline; far from it. There are still a great many economic issues caused by “global turmoil” that will affect economic performance for some time. Exports may have finally found a positive number, but like China that may only mean an end to the straight contraction, giving way to further unevenness and volatility rather than growth as the best case. There are still great risks of more contraction should the “rising dollar” turn to “global turmoil” yet again.

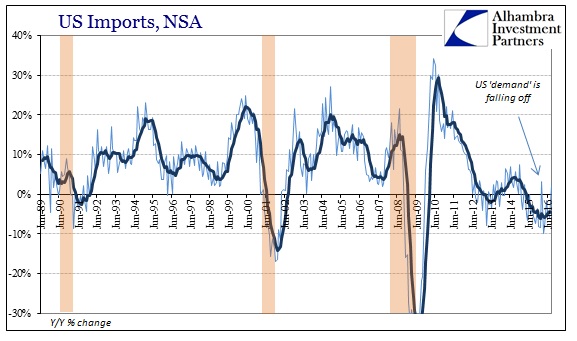

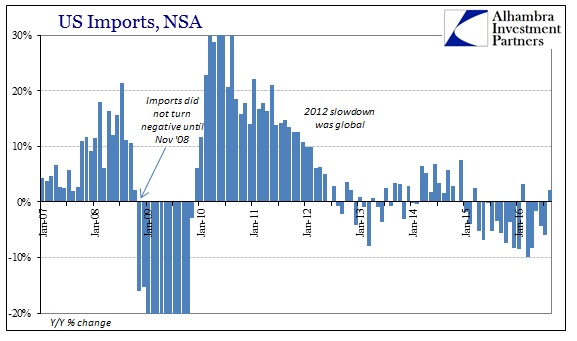

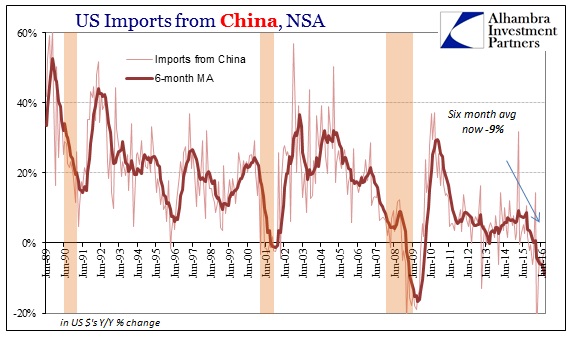

We see very clearly those economic pressures on the other side of US trade – imports. Year-over-year imports rose 2.2% in August reversing only some of July’s large 8.6% decline. In February 2016, imports rose 3.2% (with the aid of an extra leap year day) also only partially rebounding from a sharp decline in January, only to see an even bigger contraction in March. In what usually underscores this perhaps base condition of US “demand”, imports from China fell 2%, the sixth consecutive negative and tenth out of the last eleven months.

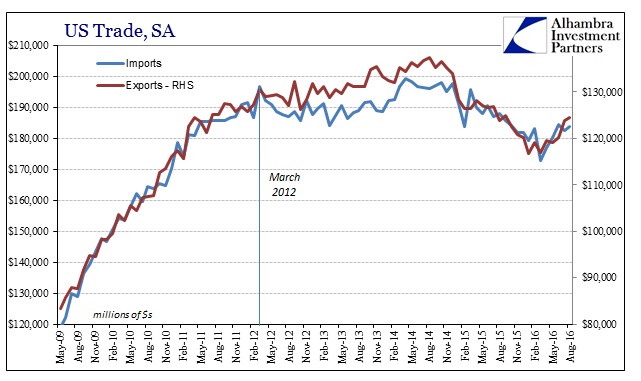

Seasonally-adjusted, imports at $183.7 billion are still down almost 8% from the high in 2014, a figure equivalent still to the middle of 2011. That indicates both the level of how much US demand may be depressed as well as the huge (and growing) cost of time to the global economy. In terms of US exports, seasonally-adjusted they have rebounded from a low of $116.7 billion in February to $124.5 billion in August, but that is still 9.4% less than the $137.5 billion at the peak exactly two years prior.

Whether we see renewed contraction in trade or whether it remains stuck in seasonality or volatility is likely going to be determined by the “dollar.” With renewed pressure building through late summer it isn’t a positive indication for the rest of the year, factoring similar lags from money to economy. That might be what has already been indicated elsewhere including within the far more dire outlook on overall global trade issued by the IMF and WTO earlier this month.

Stay In Touch