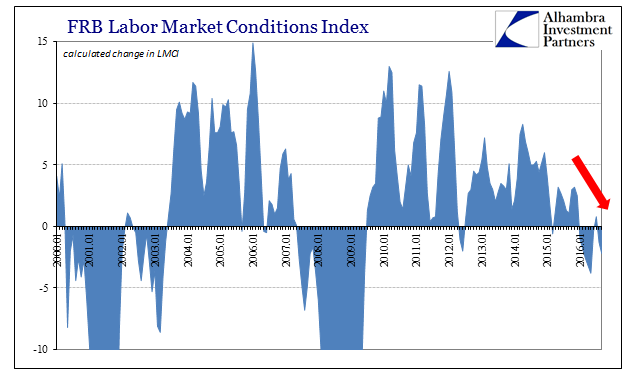

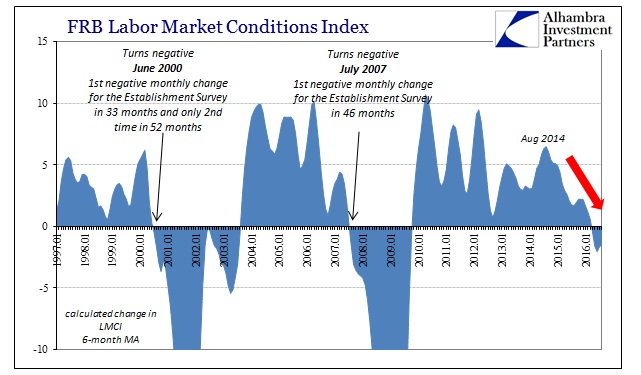

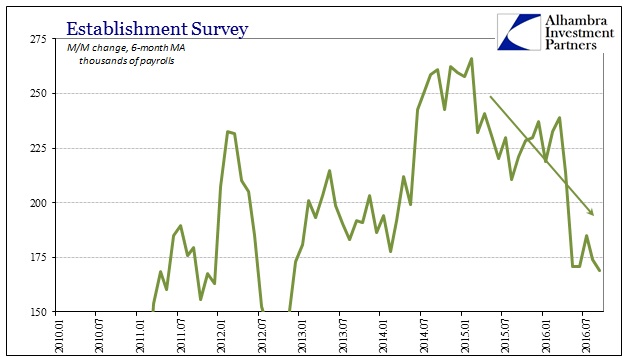

The Federal Reserve’s Labor Market Conditions Index (LMCI) fell back -2.2 in September. Revisions to the last few months were also downward, suggesting once again that there is no positive economic momentum this year. Apart from a positive change in July, the LMCI declined in every other month of 2016.

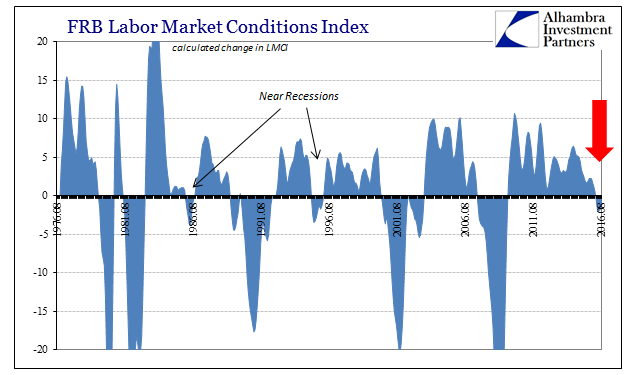

With increasing negatives after July, it appears that any hopes for an actual rebound from the horrid start to the year have faded into summer. Though there has been in the past a correlation between especially the average LMCI and the Establishment Survey picking up recession, so far the current circumstances appear much closer to the near-recessions in 1986 and 1995.

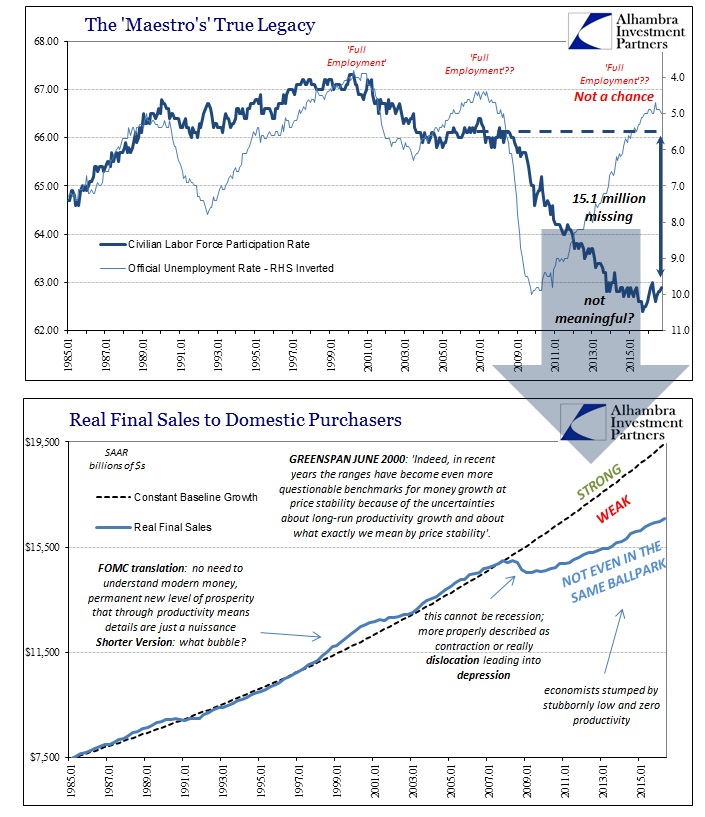

Those are significantly negative comparisons given the current economy’s status. To start with, this year was supposed to feature significant acceleration more befitting the “full employment” rhetoric. The labor market potentially being compared, at best, to 1986 or 1995 is the opposite of favorable. During those periods the prior recovery slowed but only temporarily before taking off again (bubble or not). In 2016, there was no recovery from which to slow, only a slowing itself belying these kinds of cyclical interpretations. In other words, what is truly significant is that it does appear as if the economy slowed further after being merely bad to start with.

Thus, the relevance of being compared to 1986 or 1995 is to estimate the possible degree to which the labor market, therefore economy, may have slowed. If this was all just normal cyclical mechanics, we might further assume that for whatever serious but temporary deceleration has occurred, it has perhaps passed and the economy can now resume its prior growth trend. In this depression economy, however, it just doesn’t work that way.

Instead, what we find is that for each of these varying (monetary) “blows” the economy emerges from it only slower and smaller still; starting with the Great “Recession” itself. After the dramatic dislocation especially in late 2008 and early 2009, the economy rather than recovering as it would in a business cycle emerged as if permanently stunted (economic depression is more often about the behavior of the economy after the collapse than the collapse itself). We see that again here in just the labor market statistics of 2016, suggesting that the economy did absorb another monetary impact which further negatively affected its trend.

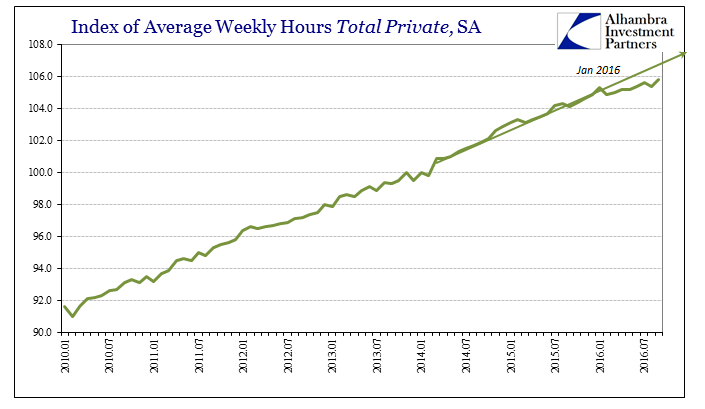

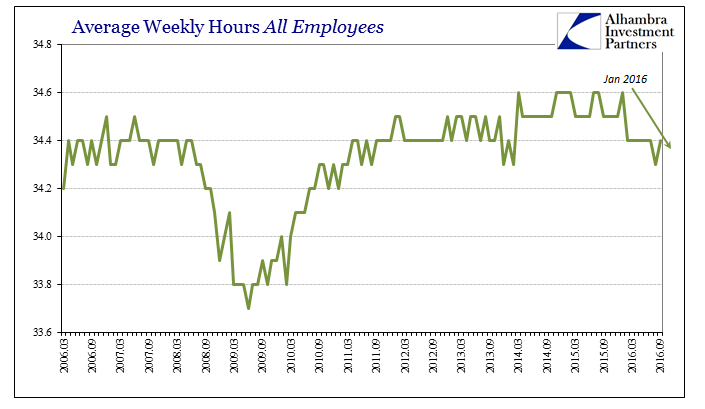

It is yet another case where positive numbers are misleading, even more so given our economic state preceding all this. It suggests, strongly in my view, that the “global turmoil” caused by the “rising dollar” of the past few years was significant enough so as to seriously impact the labor market (whatever the accuracy of these statistics); which had been viewed in the mainstream at one point not long ago as the primary, unimpeachable set of statistics arguing in favor of Yellen’s mainstream recovery view. For “global turmoil” to have registered as something like a near-recession in the LMCI and elsewhere in BLS accounts is compelling evidence that the “rising dollar” (as the 2011 crisis) did have broad and lasting effects similar if miniature to the Great “Recession” itself.

For the QE-view to have been valid despite the “dollar” would have meant literally transitory factors holding back the economy of full employment and with it the inflation and liftoff that everyone expected. In simple calendar terms it meant that though 2015 was lost 2016 was to be the year. With labor statistics at best now only questionable, at worst suggesting even smaller and slower than 2015, it is clear that especially central bankers don’t understand the economy and especially monetary economics.

Stay In Touch