Clichés are clichés for a reason, largely because their meaning no longer requires precision in order to communicate information. Because of that, their use is usually limited to cultural exchanges, being largely shunned in areas when technical proficiency requires a high level of exactitude. Economics and finance in more recent years, really since August 2007, seemed to have shifted more toward imprecision in language, forgoing what used to be solid meaning of certain terms and concepts.

The primary example, in my view, has been “strong consumer.” It’s a term that has blanketed coverage of the economy in inverse proportion to the prevalence of the conditions where it might actually apply. The words have lost all meaning in the economic context because the media will simply describe consumers or their spending as strong whether it is or not.

Relatedly, in trying to explain currency problems in EM’s, the mainstream has fallen back upon another idiom that doesn’t actually stand up to the slightest scrutiny. Currencies are falling against the dollar, supposedly, because interest rates in the US are rising. It is shorthand “rule” that at first seems totally plausible and logical, therefore it survives and lingers in popular imagination long past it being disproven. As described yesterday, here is another example in Bloomberg once again today:

“What’s driving the weakness in Asian currencies are the higher U.S. bond yields,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group Ltd. in Singapore. “Higher U.S. yields tend to be negative for capital flows in the region. On top of that there’s also a general uncertainty about Trump and his administration’s foreign policy toward Asia, China in particular.”

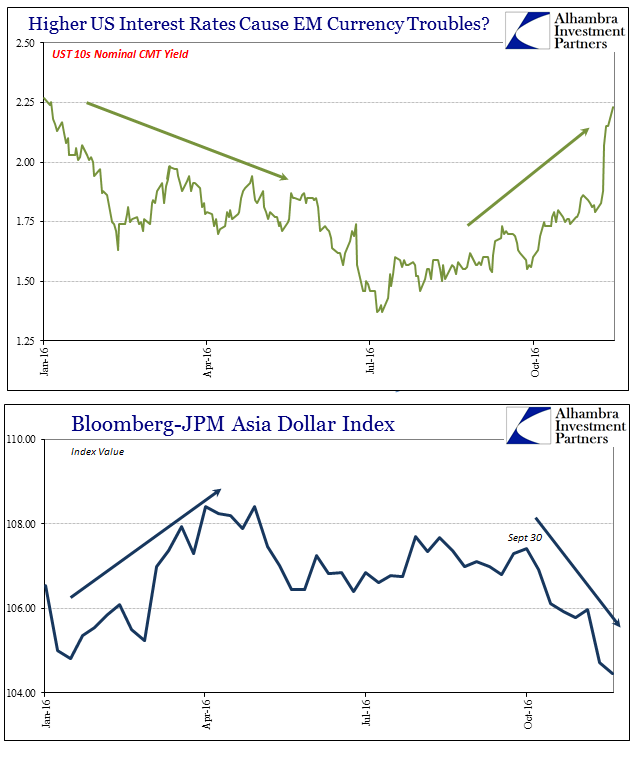

In the narrowest context of just this year, there does seem to be a relationship as described in the quote. Interest rates have surely gone up in recent weeks, just as they were going down to start the year. Against those two bond moves, Asian currencies, as described by the Bloomberg-JP Morgan Asia Dollar Index (ADXY), have/had behaved largely inversely.

ADXY is a trade-weighted index more than 40% distributed to the Chinese yuan, so there is heavy influence in that currency but not solely Chinese in its movements. The weightings for the South Korean won are almost 14% at the last reset, with more than 9% each of the Indian rupee and Singapore dollar. As of the latest index value, it is at a new multi-year low just barely above the bottom for the index in 2009; lower than even in January when the “rising dollar” needed little explanation.

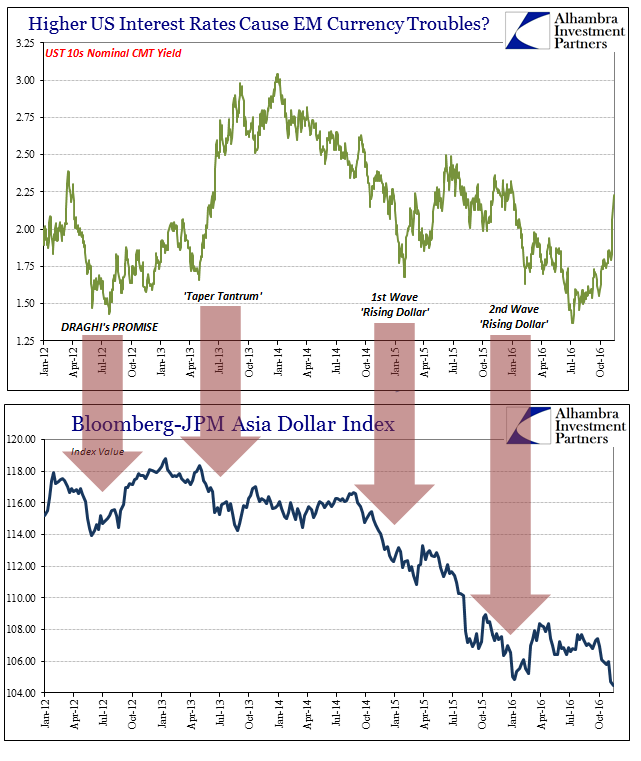

If we back up its history, however, what we find is a distinct lack of repeatable influence from US interest rates described by UST’s. There were times such as the middle of 2013 where the cliché held up, rates rise, Asian currencies fall, but more than anything else you will notice that ADXY has declined far more as UST rates fell than when they increased.

In other words, there are some times when the US bond market sells off EM currencies do, too. But there are also times when the UST market is more heavily bid where EM currencies also experience great crisis. It clearly isn’t US interest rates driving EM’s to intermittent, uneven madness.

Instead, these currency disruptions tie easily to “dollar” events that manifest differently at different times.

In 2012 and 2013, for example, the decline in ADXY is about the same in each though the circumstances in UST’s are about as opposite as you could get. In the first there was great illiquidity and perceived risk as the leftover from the 2011 crisis remained no matter how large the LTRO’s in Europe – until Draghi’s promise that summer, which apparently was enough comfort to banks so as to cease their immediate tendencies toward shrinking (lower modeled volatility because they hadn’t yet figured out that “stimulus” isn’t).

In 2013, by contrast, the world was thought to be heading toward full recovery, which meant higher rates in the US but also supposedly plentiful liquidity everywhere. Though the FOMC vehemently denied that “taper was tightening”, given the massive MBS rout here as well as the EM crisis elsewhere it remains impossible to arrive at any other conclusion. How do we reconcile where these seemingly opposite circumstances both seem to produce the same end results (in terms of currencies)?

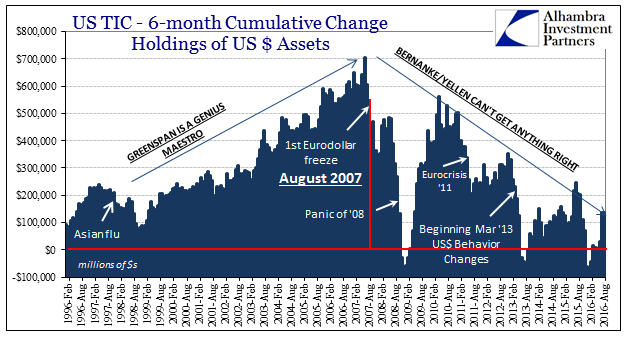

In very general and broad terms, global eurodollar banks operate on a portfolio basis that is largely governed by risk measures, where volatility is the key lynchpin. In 2011 and the first half of 2012, banks were rightly concerned about overall liquidity and were forced to model a higher future expected path for volatility that caused them to pull back on balance sheet capacity – less “dollars.” When Draghi made his promise in late July 2012, and then shortly thereafter QE3 in the US to fortify that assumption, modeled volatility could be brought back down such that balance sheets could relax if not slightly expand – more “dollars.”

In 2013, the set of circumstances seem to have been the reverse, but when re-orienting our view to bank balance sheet operations we see that they were in the end mostly the same. In other words, as a more optimistic future took hold in the bond market, the selloff there (as well as MBS) raised volatility in bond portfolios that had the same overall effect as perceived liquidity risks did the year prior. More volatility means, of course, less balance sheet capacity and therefore fewer “dollars” for Asian banks short of them (forcing them to “pay more” in rollovers for the shrinking supply via a lower local currency rate).

The problem is that overall through these episodes, especially those following 2011, banks have been pulling back anyway. Individually, each of these different circumstances raised modeled volatility (and other risk governors) not in a vacuum but under already tight “dollar” constraints. This is low liquidity for global “dollar” capacity no matter where it ultimately manifests. It is very much like a damned if you do/damned if you don’t scenario, as no matter which way the financial system turns it leads to the same nasty consequences anyway. As the world will appear to get worse, as in 2012: less “dollars.” The world may seem to get better, as in 2013; less “dollars.” The world again turns toward the worse, as in 2015; much less “dollars.” The world seems to get a little better, as in late 2016; less “dollars” all over again.

The resulting liquidations for each of those different episodes is different at each time, but the context in which those liquidations occurs is always “less dollars.” These are the symptoms of a system contained within a very narrow range for marginal operational efficacy. In other words, as long as there is very little going on in either direction, it all seems fine. But the moment the system steps just a little in one direction or the other, less “dollars.” What is driving EM currencies, and not just those in Asia, is not US interest rates but the inevitable result of “less dollars” drawn from balance sheets that are too sensitive to changes – the result of the overall baseline shrinking of total capacity.

This is what I have tried to describe as the “nightmare” scenario since the liquidations last year. What became clear to me was that after being “tested” by August 2015 by then in both directions (bond market selloff in 2013; risk asset selloff into 2015) was that there really was no way out, no escape. The overriding problem of the global “dollar” short is not the “dollar” but the short; that is the nightmare problem, because like Freddie Krueger, Jason, or whomever 1980’s horror movie figure, you can’t kill it until the deus ex machina at the end of the movie.

Unfortunately for the “dollar”, no such thing exists. No matter which way the world would like to go, it always ends in “less dollars.” Therefore, to be perpetually short of “dollars” means you always lose because you have to pay more than your economy can afford in each of these periods beyond the small margins of functionality. This is the eurodollar’s one-way decay. Because it is confusing and exhaustingly confounding, it is easier to just give up and fall back on cliché; though that will just mean everything will remain “unexpected.”

Stay In Touch