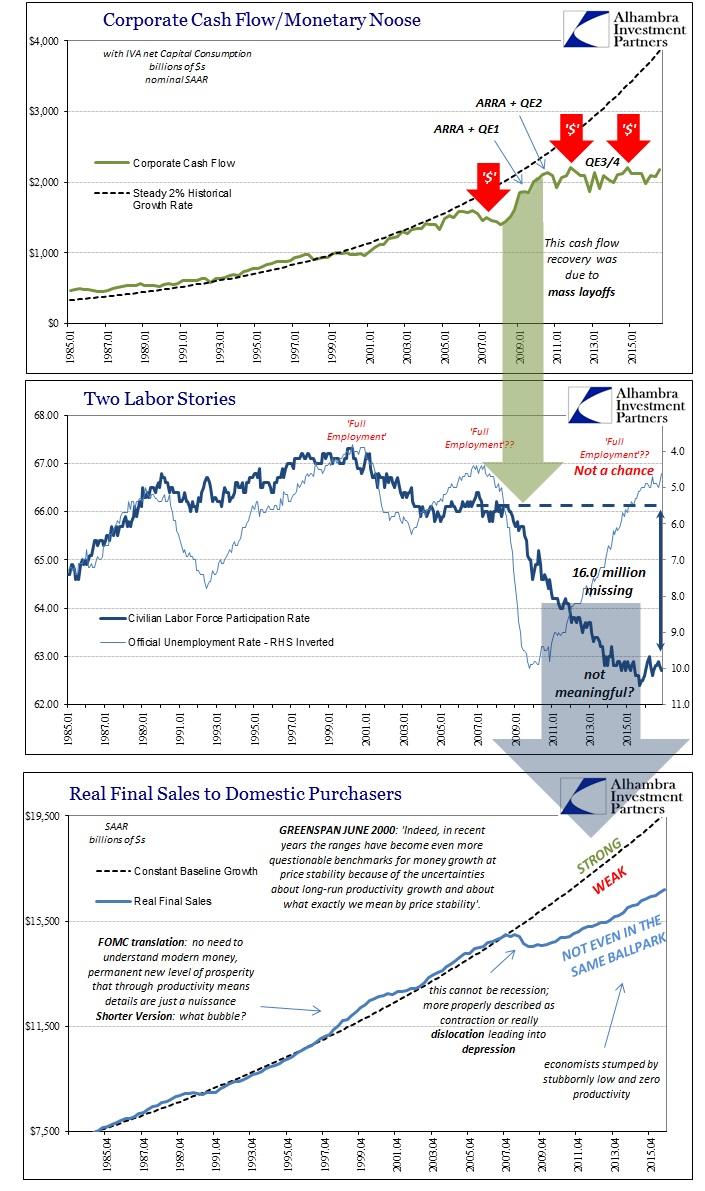

Wages and slack have been at the center of the economic discussion for almost three years now. The massive shedding of employees that took place during the Great “Recession” left behind a huge pool of potential labor for the economy to work through as it was expected to recover. That never happened. So instead, economists have been working backward to decide whether or not the fact that it didn’t happen was significant and meaningful.

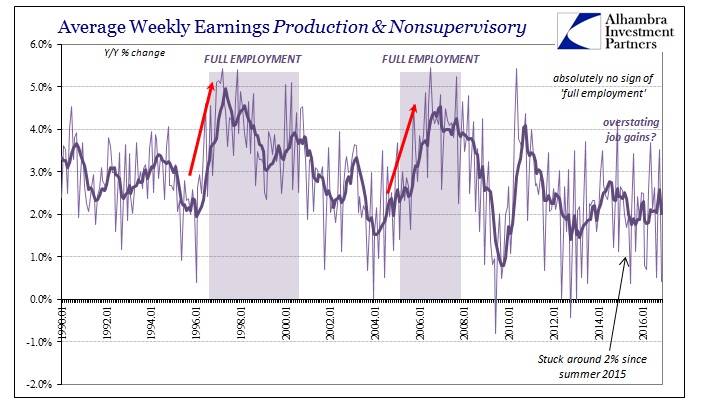

You can tell from their predictions and comments that they still don’t think it is despite common sense. The unemployment rate fell far and fast, which in normal times indicates normal times (tautology intended). Thus, slack is left as the arbiter of significance. If wages start to rise as the unemployment rate falls toward and near full employment, then that would prove the unemployment rate correct. At less than 5% currently, that would be very good news.

As the ratio dropped especially in 2014, thus began the chorus of wage and slack pronouncements almost always favorable to the recovery narrative (QE just had to work, especially since there was so much of it for so long). In May 2014, just a few months into Yellen’s tenure, economists were seeing nothing but wage gains:

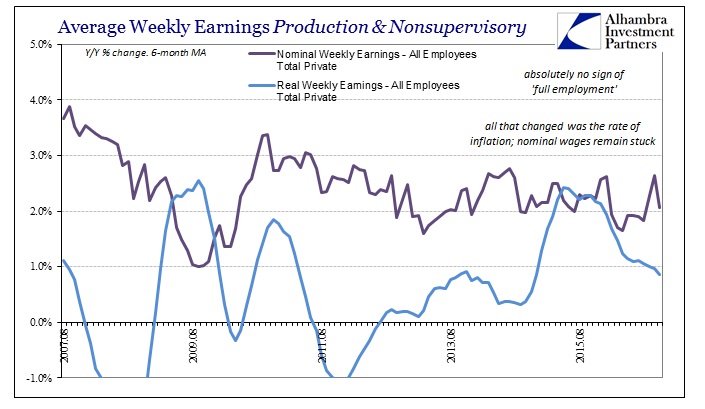

“The trend is certainly not the Fed’s friend,” said [Torsten] Slok, Deutsche’s chief international economist in New York. He cited a speed-up in pay of production workers, which rose to a year-on-year rate of 2.3 percent in April from 1.3 percent in October 2012…

“We’re starting to see some wage inflation,” M. Keith Waddell, president of Menlo Park, California-based staffing company Robert Half International Inc., told analysts on April 23. “We saw rising pay rates for our temporary staff.”

Dean Maki, chief U.S. economist at Barclays Plc in New York, forecast that core inflation will rise above 2 percent by the middle of 2015 as pay picks up.

Yellen, to her credit, was outwardly far more cautious. In Congressional testimony also in May 2014, she noted that wages were rising but from a very low rate the year before and that the slow acceleration indicated a large amount of remaining “slack.” At that time Yellen said 3% to 4% for wage growth “would be normal.”

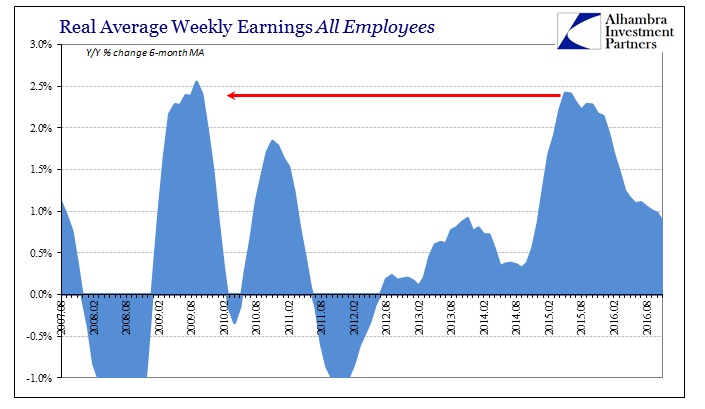

For a time, that appeared to be the case or at least the direction as it related to inflation-adjusted earnings. When GDP was accelerating in the middle of 2014, so, too, were real weekly earnings, a general measure of wage growth. This was one of the reasons that especially in early 2015 economists had suddenly turned positive as to the oil price crash. Lower inflation meant more real income which could be spent in other places besides the gas pump. In terms of economy and slack, it was thought to be a win-win.

But as oil prices have come back up, so real wages head back down. In the latest update today, the BLS estimates that real average weekly earnings actually fell 0.4% from October. That was due to both week nominal growth as well as the CPI. Year-over-year, real earnings were up just 0.5%, the lowest since July 2014 and erasing all those purported gains from that time.

That is because wages haven’t really changed at all, though interpretations of them clearly have. In nominal terms, wages remain stuck around 2%, and nowhere near the 3% to 4% that Janet Yellen suggested two and a half years ago would identify full success and a return to normalcy.

Despite the lack of wage acceleration, she has changed her stance on slack anyway. In a speech given in June this year, she told an audience in Philadelphia that, “In particular, the job market has strengthened substantially, and I believe we are now close to eliminating the slack that has weighed on the labor market since the recession.” And in her latest press conference yesterday, she declared that end:

“If we look at larger broader measures of slack, like the U6 measure that includes involuntary part time employment, and those who are marginally attached to the labor force, they are slightly higher than prerecession levels, but they have come down considerably. We look at a broad array of indicators of the labor market, and if you look at job openings or the hires rate or the quick [SIC; quit] rate or difficulty of hiring workers as reported in business surveys, you know, I would say the labor market looks a lot like the way it did before the recession, that it’s – we are roughly comparable to 2007 levels when we thought there was a normal amount of slack in the labor market.”

So where are the wages? If slack is normal, why aren’t nominal wages, and thus real wages, gaining the 3% to 4% that they had in every situation in the past described by “full employment?” The answer, for the Fed, is as I suggested yesterday. The FOMC has thrown in the towel for all of it. We are at full employment, they have declared, and that means whatever you see today is it. There is no further recovery coming; it’s all over and done with, even if that means the most basic tradeoffs once the bedrock of economic associations are all shrunk.

To the Fed, the economic problems aren’t really economic so much as structural; Baby Boomers retiring being the primary one that they can actually point to as plausible. In her prepared remarks yesterday, she said:

Broader measures of labor market slack have also moved lower, and participation in the labor force has been little changed on net for about two years now, a further sign of improved conditions in the labor market given the underlying downward trend in participation stemming largely from the aging of the U.S. population.

In other words, the lack of people in the denominator of the unemployment rate is, to economists, due to “aging.” It is, of course, utter nonsense, but what more might we have expected from Janet Yellen even several months after admitting that maybe economists really don’t know what they are doing? Despite the fact that she and the FOMC have all but confessed that QE didn’t work it doesn’t automatically lead them to the correct answers. It’s altogether much easier to suggest that if the several QE’s failed, it was through no fault of those who designed, created, and repeatedly voted for them. Similarly, if Donald Trump’s first act as President is to relieve Yellen from her position, who might replace her that isn’t of the same temperament and persuasion?

The country needs wages, but the Fed says there are no more to be had. So long as that remains the balance nothing will change. There is no “reflation” here, and that determination applies to much more than just the earnings statistics.

Stay In Touch