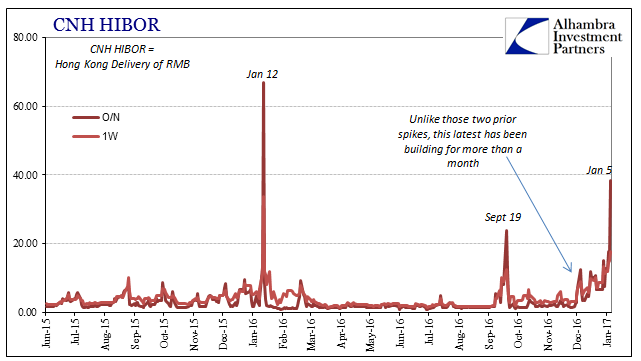

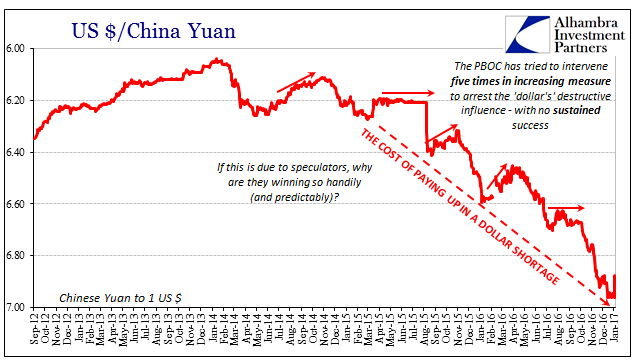

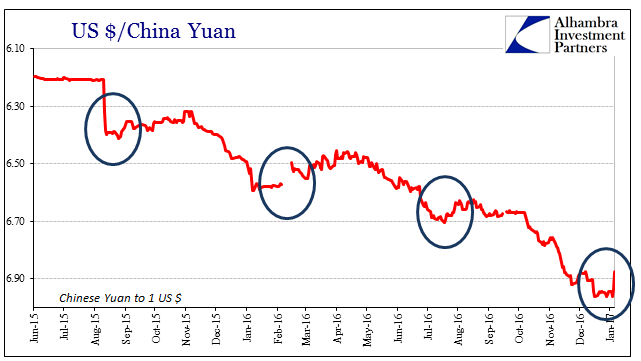

There are times when the illusion is understandable, if still an illusion. On days like today, it surely seems like the PBOC’s power and influence has been established and displayed. The overnight HIBOR rate (CNH) was pushed to a ridiculous 38.335%, the second highest on record. And given that “drain” of RMB from offshore Hong Kong, sure enough CNY rose sharply. Where last week the PBOC was very publicly denying it had ever fallen below 7 to the dollar, today it was as high as 6.8711 (no word yet on whether the PBOC will refute that the currency could trade that far that fast, if in the other direction).

Moreover, we live in a financial world dominated by the random walk and statistics; the idea that prices today are completely renewed, divorced clean from what happened yesterday – or a year ago. If this is the second early January in a row to feature such sharp illiquidity in offshore CNH, is it really that easy to delink one from the other?

If the PBOC was punishing speculators in January 2016, it is, after all, ,perfectly logical to ask why they are still doing so in January 2017. They don’t seem to be very good at defeating them, otherwise they wouldn’t have reacted so childishly last week to the flash crash. A central bank in the modern sense is nothing if not credibility, so if the media and mainstream wish to keep deferring in that respect there is truly no reason but convention to follow. The problem with convention is the old adage about things working…until they don’t.

What is really at issue here is the bigger picture. The Chinese have had currency problems now for more than three years in a row, plenty of time for the vaunted PBOC to get its house in order; surely more than enough to take out the puny sharks circling in small groups just outside its front door. That it hasn’t been able to starts to point fingers at some other dark force that can’t be so puny. A glance inside China might make it seem as if China’s difficulties are its own, but that contention would also deny how China was made in the first place.

To convention, this just cannot be because the Federal Reserve has “printed money”, swelling its balance sheet to $4.5 trillion. With so much monetary effort, any sort of dollar problem is taken immediately off the table, editorially excised from article and thought no matter how much more sense, and consistent sense, it makes. That is why whatever goes wrong, and a lot has the past few years, it must be something else; from an oil supply glut, to the PBOC embracing CNY devaluation by intentionally enacting export stimulus, to 2a7 money market reform, a second FOMC rate hike that is being treated, somehow, totally different than the first, and, as always, patrolling for speculators (now in the other direction). It is all increasingly absurd based on that one single premise, though it is a big one.

In one of his last interviews given just before his death in 2006, Milton Friedman explained succinctly this whole phenomenon.

I think what was most important was a chapter in the Monetary History that dealt with the Great Depression. The difficulty of having people understand monetary theory is very simple—the central banks are good at press relations. The central banks hire people and the central banks employ a large fraction of all economists so there is a bias to tell the case—the story—in a way that is favorable to the central banks.

Einstein supposedly defined insanity as repeating the same thing and expecting different results. This may have to be modified for modern monetary theory incorporating the random walk, to where insanity is treated instead as even bothering to realize the repetition. The PBOC is in perfect control, speculators are the target, and there is no global “dollar” problem. So says the press relations.

Stay In Touch