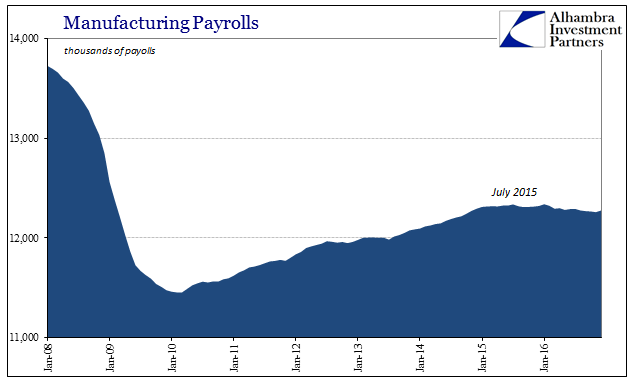

There are a few parts of the payroll reports that do make sense without requiring alternative interpretation. Among these face value statistics is the estimate for manufacturing payrolls. The BLS figures that employment in the manufacturing sector peaked in July 2015 and has been declining ever so gently since then. Total job losses are just 61k over that year and a half, but compared to the employment estimates in other industries (retail and wholesale, prime examples) it is at least what is surely the correct sign.

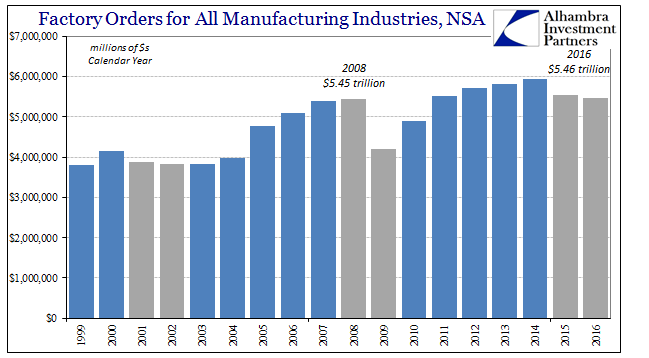

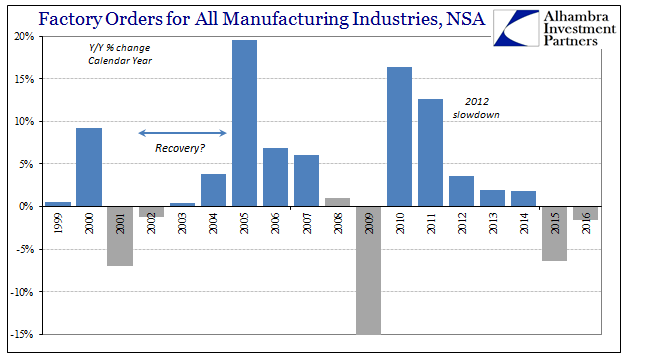

The total for manufacturing payrolls at the end of 2016 is thus slightly less than the total at the end of 2008. That comparison, too, is consistent with other figures, such as factory orders. Though the latest update for factory orders includes estimates only through November, if we assume December’s approximation as equal to December 2015, a reasonable enough guess given the trajectory of late, that would mean total factory orders for the year were about $5.46 trillion. It would be a decrease of 1.2% from 2015, and equal to the $5.45 trillion estimated for calendar year 2008.

That’s an incredible time period of futility, especially considering that we haven’t considered any inflation in the factory orders set, no matter how low. The only other time where the factory sector was so unused was in the aftermath of the dot-com recession. For many, with good reason, that recovery was itself substandard so much that it so easily and quickly attained the label of “jobless recovery.” A good part of the reason for that was the manufacturing industry.

At the peak in 2000, calendar year factory orders were $4.16 trillion. Three years into supposed recovery, factory orders in 2004 were still less than $4 trillion. It wasn’t until the sharp rise in 2005 that the factory sector finally appeared to put what was really a mild recession behind. But manufacturing in the US wasn’t ever the same.

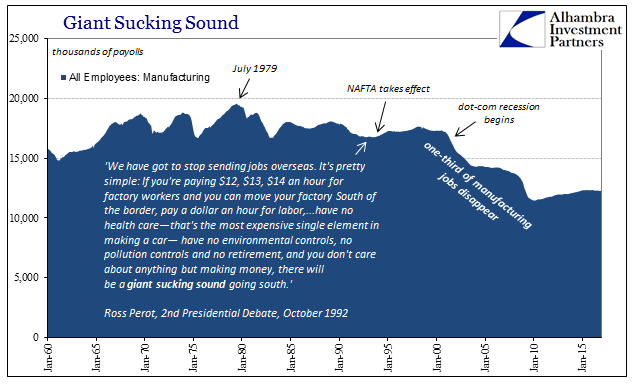

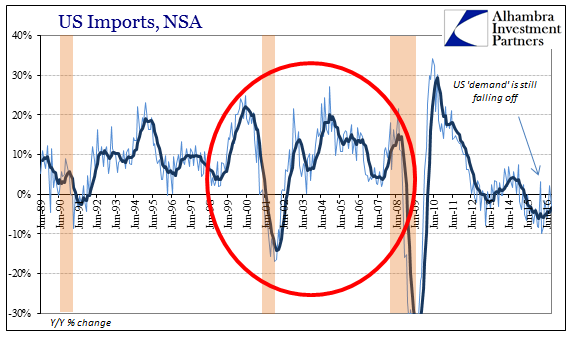

While the US economy was ostensibly in recovery 2002, 2003 and 2004, it was mostly if not all from the “demand” side of the equation. It was during those years where the largest exodus of manufacturing jobs in history was witnessed. Whether or not you believe Ross Perot was correct in his “giant sucking sound” prophecy, there is no doubt that there was some good correlation between the loss of those jobs during those years and what to many was not a recovery; and even in economics, there was a great deal of agreement that economic function during that time was highly unusual.

That is what led policymakers toward embracing the lunacy of the housing bubble in its final stage. In one sense the one led to the other, or at least allowed it to happen. By that I mean the huge buildup in debt was that “demand” side that essentially paid, at the margins, for those goods to be produced overseas. It was the substitution of finance for income; mortgage and consumer debt for the labor lost in manufacturing jobs and production.

This is where the “free trade” mantra espoused by economists loses, completely discredited. If there was an organic trend of efficient resource calculation that led low skill jobs elsewhere to be replaced by better jobs here, then the Ricardian equivalence holds. But that isn’t what happened. Those jobs left, and not just the immediate jobs that already existed but in addition all future growth in jobs and investment that were, again, replaced by mostly finance. In this case, as all others, that means the eurodollar.

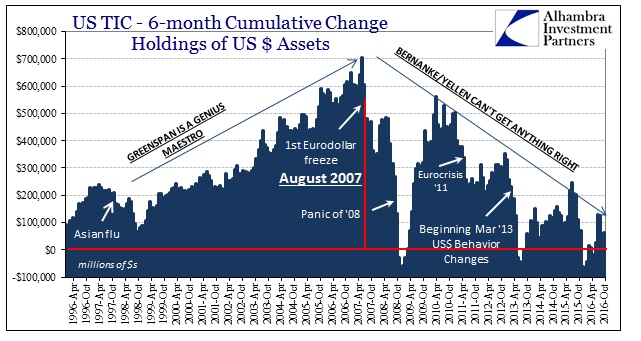

Globalization is the eurodollar, or at least was. Without its ability to stream channels of funds, denominated in dollars (“global savings glut”), from all over the world to these various far-flung locales, the cheap labor would have remained idle in all those places. You can have an ocean of potential unskilled labor, but without the monetary/financial backing and capabilities it will remain idle. You have to finance construction of new facilities, move logistical capabilities, engage in sufficient graft, and then obtain raw material and other components on global markets. All that takes enormous amounts of fluid, fungible “dollars.”

Is it any wonder, then, that the world has turned so much against “globalization” the past few years? At least in the late 1990’s and 2000’s there was abroad these seeming economic “miracles” where after the flow of “dollars” followed what looked very much like prosperity. Even here (as well as Europe) it appeared as if the US economy was still moving forward despite Mr. Perot’s warning come true. It was fairly common for economists to claim that we didn’t need a manufacturing base.

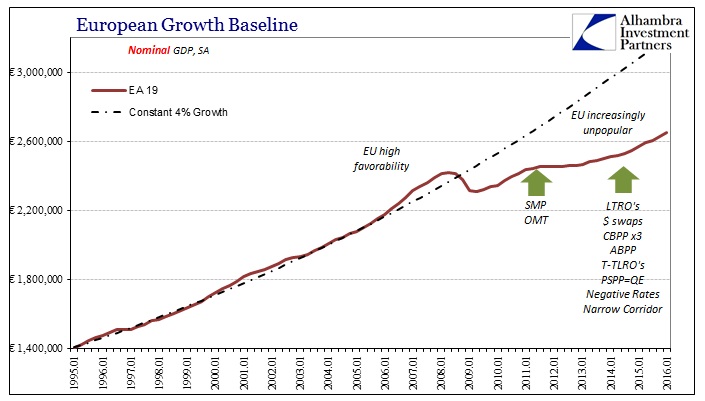

Early last month, Mark Carney, the Governor of the Bank of England, despaired that the world was facing its first lost decade since, in his opinion, the 1860’s. He made that statement about the next decade rather than the last ten years which to far too many already amounts to one. What concerns Carney now is populism, or the more recent tide against “globalism” that has found favor is several different political and social formats (Bernie Sanders being a prime alternate example).

Trump isn’t right to favor more protectionist policies in response to globalization, Carney said in a television interview broadcast after his speech. The answer is to “redistribute some of the benefits of trade” and ensure that workers are able to acquire new skills.

This is a variation on the theme expressed by US officials, who now conceding that the recovery is never coming are nonetheless still at a loss to explain why. They have presented several theories, the most ridiculous being Baby Boomer retirement (as if that generation held a single webcast in early 2008 and decided all at once that year and the next would be the perfect time to realize everyone’s Golden Age dreams). A related excuse, as it’s not really an explanation, is some undefined skills mismatch among the labor force of the developed world.

It’s as plausible sounding as anything else offered, which isn’t saying very much. After all, the jobs that were lost were primarily unskilled manufacturing jobs, therefore it seems reasonable to assume the workers that have been dislodged were/are unskilled manufacturing labor. In all the economic history of the world but especially the United States, economists don’t say why Americans picked the 2000’s with which to make a clean break from the whole consistent past where labor flexibility was one of the true economic strengths of this nation. Even in the industrialization of the late 19th and early 20th centuries, workers displaced from agricultural pursuits by capital efficiency (and productive deflation) were faced with some “skills mismatch” as they shifted by the millions anyway to industrial work.

What is lacking is not labor flexibility, but rather labor opportunity. There is, in the 21st century, no place for workers to go. For some few years, there was debt, but all that did was increase the so-called inequality that the purveyors of it are now lamenting. The eurodollar/globalization system is exceedingly simple, which is why it escapes the grasp of economists and central bankers. Without the massive flow of “dollars” all over the world, there isn’t even anything much to “redistribute” as Carney would like to do. One follows the other, just as in this country the inorganic loss of industry is followed by stagnation, malaise, and constant depression (that occasionally “we” feel better about when something appears to maybe be different).

The rising rejection of globalization is the inevitable end of an unstable arrangement. Nothing will work for long that requires so much steady and massive growth, particularly monetary in form. Thus, as factory orders decrease for a second year in a row in the US, that signals this time not just lack of traditional recovery like it did in the middle 2000’s, but economic pain the whole world round. In 2017, “dollars” are increasingly difficult to come by, and so there aren’t manufacturing jobs anywhere.

Stay In Touch