Commentator Bill Kristol of the Weekly Standard reignited a fierce debate this week, though it seems like he correctly surmised at the time anonymity would have been preferable. Speaking with author Charles Murray, Kristol echoed a sentiment that has been underneath a lot of what passes for analysis these past few years of the “rising dollar.” Being one prominent Never-Trumper, the most prominent, in fact, there is a fair amount of disdain that is political more than pure economic interpretation. It was the disillusionment, after all, of the working classes who delivered Mr. Trump his current Pennsylvania Avenue address.

If you google “job openings” chances are very good that in almost every one of the news articles that comes up the words “skills mismatch” are prominently placed. It has become something of an obsession in official circles, to which Kristol is apart, because how could it be any different? After massive infusions of “stimulus”, the economy never caught fire even though it was supposed to at several points along the way. The JOLTS survey of BLS configured data has been at record highs for several years, surging in 2015 as the economy fell off. Therefore it must be something wrong with workers rather than the economy the “experts” worked tirelessly to bring about with the best-designed programs in history.

You can make a case that America has been great because every — I think John Adams said this — basically if you are in free society, a capitalist society, after two or three generations of hard work, everyone becomes kind of decadent, lazy, spoiled — whatever.

Then, luckily, you have these waves of people coming in from Italy, Ireland, Russia, and now Mexico, who really want to work hard and really want to succeed and really want their kids to live better lives than them and aren’t sort of clipping coupons or hoping that they can hang on and meanwhile grew up as spoiled kids and so forth. In that respect, I don’t know how this moment is that different from the early 20th Century.

This is the same, or nearly the same, argument that was raised by Kevin Williamson at National Review in March 2016. Creating enormous controversy, and coming from an all-too-similar perspective, Williamson was far more blunt about how these Trump-supporting communities actually “deserved to die.”

It is immoral because it perpetuates a lie: that the white working class that finds itself attracted to Trump has been victimized by outside forces. It hasn’t. The white middle class may like the idea of Trump as a giant pulsing humanoid middle finger held up in the face of the Cathedral, they may sing hymns to Trump the destroyer and whisper darkly about “globalists” and — odious, stupid term — “the Establishment,” but nobody did this to them. They failed themselves.

If you spend time in hardscrabble, white upstate New York, or eastern Kentucky, or my own native West Texas, and you take an honest look at the welfare dependency, the drug and alcohol addiction, the family anarchy — which is to say, the whelping of human children with all the respect and wisdom of a stray dog — you will come to an awful realization. It wasn’t Beijing. It wasn’t even Washington, as bad as Washington can be. It wasn’t immigrants from Mexico, excessive and problematic as our current immigration levels are. It wasn’t any of that.

Nothing happened to them. There wasn’t some awful disaster. There wasn’t a war or a famine or a plague or a foreign occupation. Even the economic changes of the past few decades do very little to explain the dysfunction and negligence — and the incomprehensible malice — of poor white America. So the gypsum business in Garbutt ain’t what it used to be. There is more to life in the 21st century than wallboard and cheap sentimentality about how the Man closed the factories down.

The truth about these dysfunctional, downscale communities is that they deserve to die.

His argument is basically that the global economy changed, for the better in the aggregate, and those left behind should have instead gone back to school, rented a moving truck and moved to their better life waiting for them elsewhere. They were just stupid and drug addled to realize it. That they won’t do it, and now lash out politically, is deserving of worse than scorn because it is, in his view, holding us all back (their “immorality” as Williamson puts it).

As usual, there are surely some people who fall into this characterization. But it isn’t a true one overall, as the economic statistics bear out. This is really a simple analysis to make, as the relentless progress of rising living standards has always, always been messy. The perfect equivalent was those farm workers (and family farm owners) displaced in America’s industrialization. They surely did not want to participate in the Great Migration from rural to urban, but we, including they, were all better off that they did.

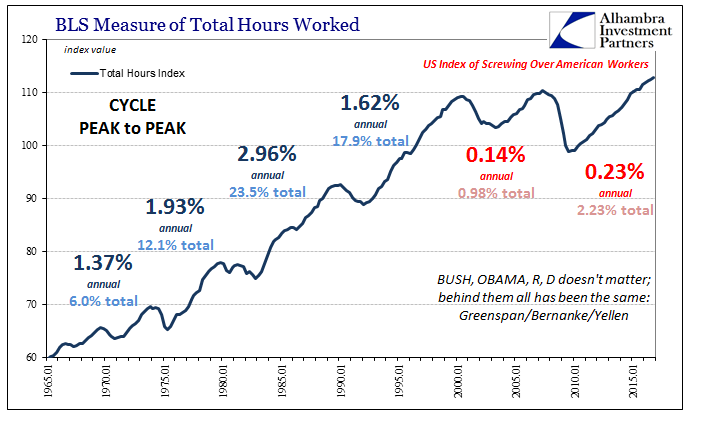

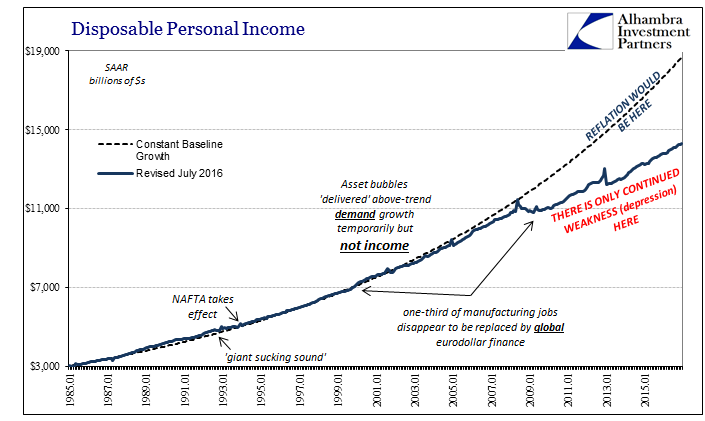

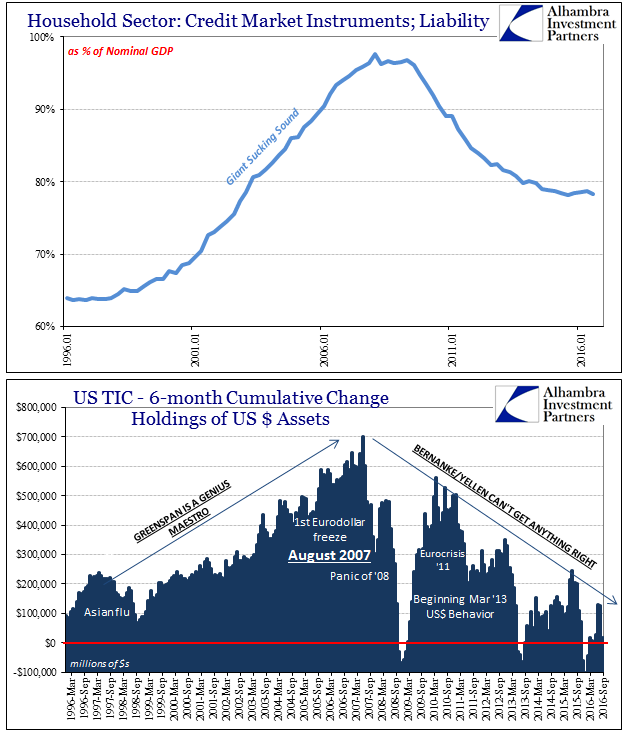

There is nothing like that going on here (see above), and if there was I would agree wholeheartedly with both Williamson and Kristol. The American economy was transformed, but it did so where opportunity elsewhere did not replace the prior middle class with some other form of middle class, what did was FIRE under the eurodollar. We substituted middle class jobs for eurodollar-driven credit; now that there aren’t as many eurodollars, the economy obtains neither credit nor jobs.

This is all well-traveled ground, including for myself in just the past few days. What I think is more interesting is that using the FOMC transcripts from 2011 as well as other sources, it is clear that monetary officials, at least, held quite different views about this “skills mismatch” or Baby Boomer retirement then as they might now. Some of that related to more optimism about a full recovery, which actually plays into the changed structure of current analysis.

From December 2011:

MS. RASKIN. The rest of the improvement is pretty paltry for a recovery. Two and a half years into the recovery, there are still 24 million underemployed people. I think the decline in the unemployment rate exaggerates the improvement in underlying conditions, and I wouldn’t be surprised if the rate moves back up a bit in December. At the current pace of improvement, it will be years before the labor market can be described in positive terms, and by that time we might well have started to see a loss of skills and networks among the unemployed and underemployed, which could cause a long-run erosion of the economy’s productive potential, an outcome that we should all want to avoid.

The Baby Boomer retirement excuse didn’t get a lot of currency (pardon the pun) back then (April 2011), either:

MR. TARULLO. But reading the seasonally adjusted household numbers over the last year or so, one sees something at odds with the trend explanation. In each of the prime working decades of 25- to 34-year-olds, 35- to 44-year-olds, and 45- to 54-year-olds, the numbers of unemployed have been falling, but in each cohort, the number of employed workers has risen by less than the amount by which the unemployed have fallen. Indeed, if we look at 35- to 44-year-olds, whose participation rate is historically the highest among any age group, we see that the number of both employed and unemployed has fallen. So there are fewer people in that age cohort employed today than one quarter ago, two quarters ago, and three quarters ago. Significant numbers of this group have obviously left the labor market.

August 2011:

MR. PLOSSER. Just to follow up with that a little bit. In terms of the people who are dropping out of the labor force, you mentioned teenagers. What about the 55- to 65-year-olds? Are there people who have lost their jobs, with a large fraction of them just saying, “Well, I’m never going to get another job. I’m going to go ahead and take retirement and move out”?

MR. WASCHER. For that group, the participation rate has actually edged up, I think, a little bit.

MR. PLOSSER. Oh, is that right?

MR. WASCHER. That effect could be going on, and some people might just get discouraged and take early retirement. I’m sure that’s true for many people. But there are others who have lost a lot of wealth, for example, in their 401(k) retirement plans, and they can’t afford to do it, so they’re staying in. And more generally, in terms of the longer-term trends, older people are healthier and, I think, more generally likely to stay in the labor market longer.

In June 2011, Minneapolis Fed President Narayana Kocherlakota spelled out essentially how economic interpretation would evolve in exactly these terms.

MR. KOCHERLAKOTA. I fear these recent data are reflective of longer-term uncertainties. Like most of you, I believe that the unemployment rate will fall back to between 5 and 6 percent by 2016, and in that sense, I do think labor market slack will normalize, but I am highly uncertain about how that reduction will be accomplished. Will the unemployed find jobs or will they leave the labor force permanently? The answer to this question is a critical one for the United States economy and for our thinking about monetary policy because it really will shape the longer-run behavior of what we consider to be potential output.

There are numerous other examples. In 2011, the Fed overall was less likely to give much emphasis to Baby Boomer retirement and skills mismatch. Though we will have to wait several years to confirm, where this all changed was likely 2015 under the “global turmoil” of the “rising dollar.” In February 2013, for example, Janet Yellen was still talking about full recovery, and therefore none of this nonsense:

This question is frequently discussed by the FOMC. I cannot speak for the Committee or my colleagues, some of whom have publicly related their own conclusions on this topic. However, I see the evidence as consistent with the view that the increase in unemployment since the onset of the Great Recession has been largely cyclical and not structural.

Now after several more years of economic hardship, the “experts” now consider it more so lazy Americans whose communities deserve to die. To be fair, Fed officials have never expressed it in these terms, nor would I expect that they ever would. However, their analysis is in keeping with the basis for those unfortunate sentiments. Everything was supposed to be normal by now, but it isn’t. The Great “Recession” was supposed to have been a recession, but it wasn’t. What failed? The experts…or you?

Even if there wasn’t self-interest on the part of Fed officials to answer that question, as noted earlier today monetary neutrality leaves even credible and intelligent Fed members (like Tarullo, actually) to have to attribute the lack of recovery to the same absurdity of Baby Boomer retirement and skills mismatch that they rightly rejected in 2011 and after. They are prevented from arriving at common sense because common sense was renormalized out of the math, and thus out of official analysis that gets parroted by the rest of the “experts” in deciding what they will proclaim has been going on.

Populism isn’t a dismissal of the necessary messiness of rising living standards, it realizes far more that living standards aren’t doing anything like that, where one symptom is the utter and obvious lack of opportunity. It has demonized the globalization of so-called free trade because it is the rejection of “experts” who have no idea what they are talking about. These are the same experts who make sweeping generalizations based on sophistry rather than data, the very deficiency they believe of us. As I wrote last year, we are not the barbarians. We may not have advanced degrees, but we don’t need them to know exactly who it was that has been incompetent. If the Great “Recession” wasn’t a recession, and that is now the general consensus, admitted publicly or not, it’s not my fault for being a little more than upset about it, and directing that ire at those who for years said it was, and more than that said first it wasn’t ever even possible.

Stay In Touch