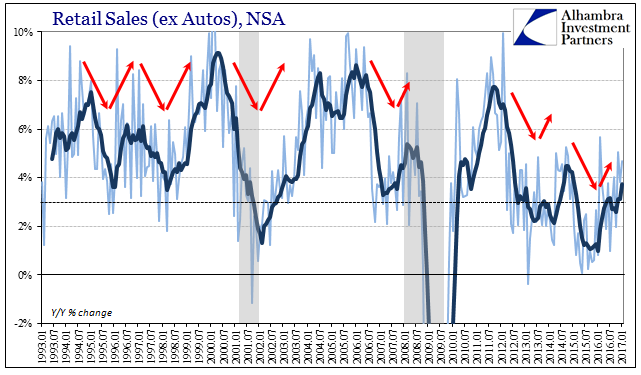

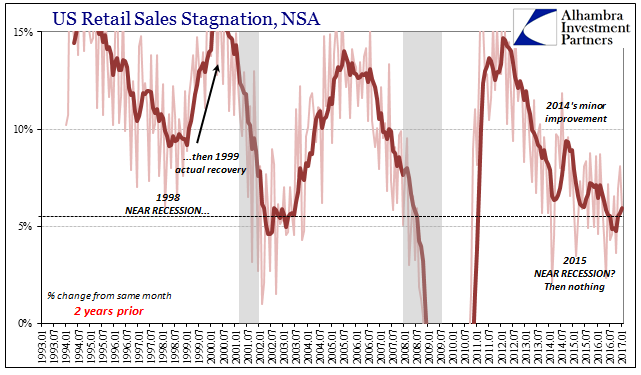

Retail sales grew by 4.92% year-over-year in January 2017, the third consecutive month of gains around 5%. It was the first time for three months near that level since 2014. Given the behavior of the economy in the second half of last year it is almost eerie the similarity in behavior to the 2013-14 period. The statistics for neither period actually indicate recovery and it isn’t actually growth, for if it was it would have been three straight months of 10% or 12% rather than 5%. What is suggested instead is a repeating process of positive numbers.

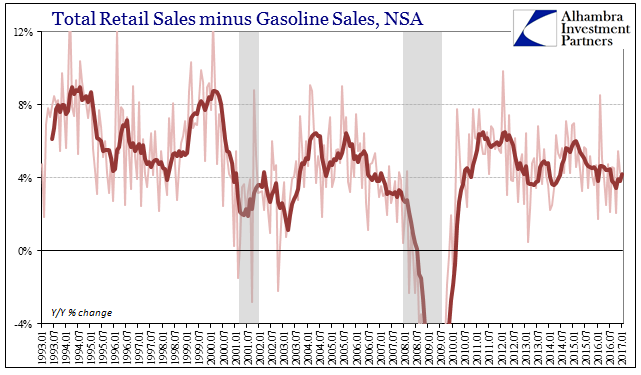

Most of the improvement in the top level retail sales figures is due to gasoline sales (really retail sales of all goods at gasoline outlets, the majority of which relate to the sale of gas). After contracting for 28 months, gasoline sales have been up year-over-year in the last four. For January 2017, sales were +13.9%. If you take out gasoline, retail sales don’t even match up to 2014, still scraping along the bottom of the range that has prevailed in this elongated period after the Great “Recession.”

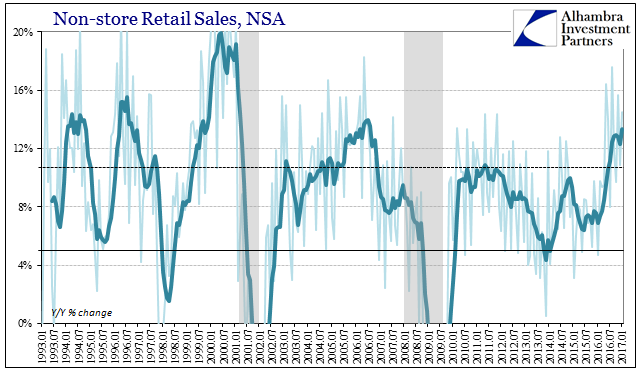

I continue to believe that is why retail sales at nonstore retail outlets (online) have been booming since early last year. In the latest month, growth was 14.5%, the eighth month at double digits of the last ten. The 6-month average rate is now 13.4%, the highest average growth since 2006 when online shopping was still young and smartphones still more of an idea than a reality.

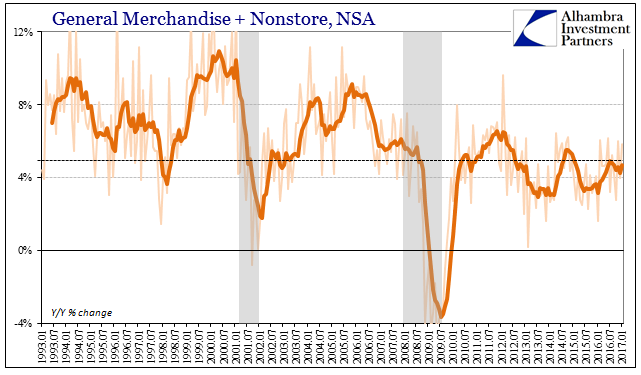

It suggests, strongly, that in 2016 pricing mattered more than being able to physically shop for the first time in this part of the communications evolutionary era. For every dollar gained, or close to it, one is lost at traditional “brick and mortar” outlets. Department Store sales continued their sharp decline, down nearly 6% in January after dropping 7.4% in December. Notably, for the first time in the series total sales are less than $10 billion (NSA) for a single month. General Merchandise retail sales, which include those of Department Stores, were down 1.4% to start 2017. It was the seventh consecutive month of contraction, and eight of the last nine.

The acceleration of structural trends in retailing doesn’t appear to be related to consumer preferences so much as spending ability.

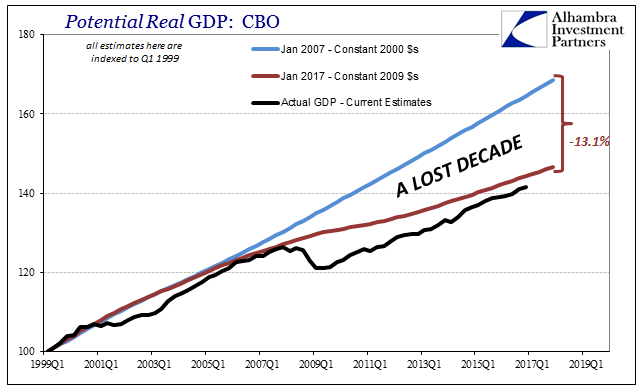

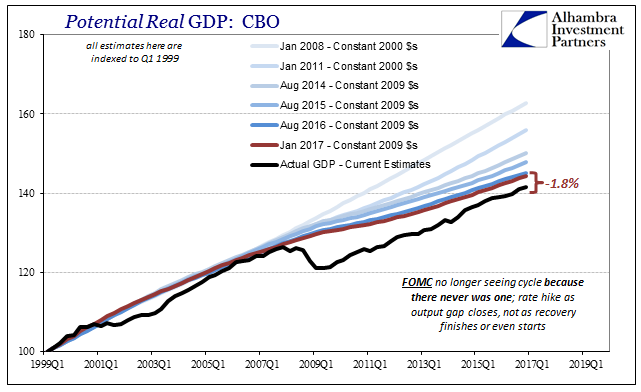

Though there may seem a vast difference between January 2016 and January 2017, where in the former the economy was teetering on the edge of what looked like recession, even without that threat in latter month not much has really changed, at least meaningfully. I don’t know if that was ever truly a possibility, at least not in the traditional framework of the business cycle. The improvement in later 2016, relatively speaking, might actually suggest that it wasn’t. What might be indicated by the repeating of 2013-14 is the same low amplitude economy that reflects the reasons the FOMC might be “raising rates.”

In other words, just as the economy never actually recovers, it doesn’t actually recess, either. It merely swings from variable conditions of malfunction and stagnation; from bad to really bad and back again, never leaving some classification of insufficient. Positive numbers do not measure growth.

Stay In Touch