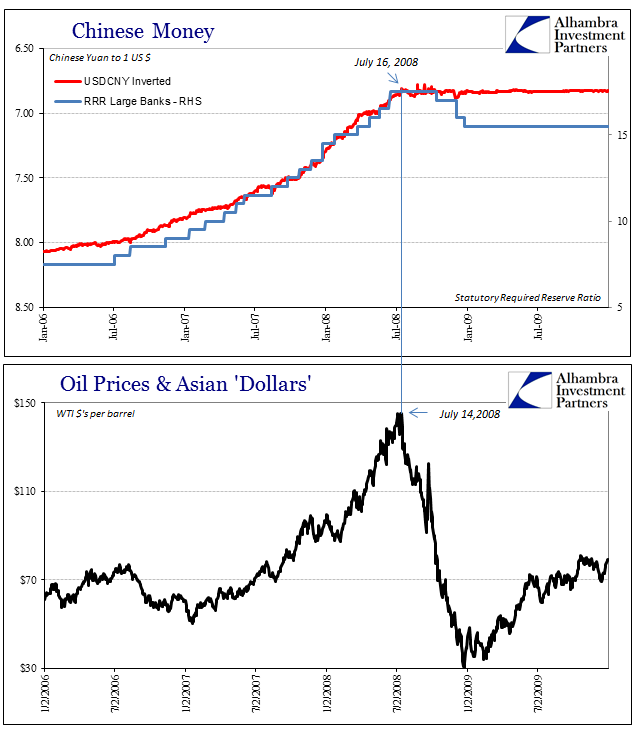

If more people desire a certain thing, in a free market the price of that certain thing will go up regardless of any possible inherent value. Indeed, that is how market consensus is supposed to work, the backbone of efficient markets. I don’t believe that markets are or ever can be perfectly efficient, especially in the current age where assumptions are passed around as gospel with nary a challenge whispered or otherwise. What were, for example, oil investors thinking in early July 2008? Whatever it was, it was clearly wrong.

John Maynard Keynes wrote about liquidity preferences in his General Theory, assigned to consumers as an answer for why they might “hoard” money or currency. There were, Keynes presumed, three structural parameters that governed their choices, each with a specific rationale or tradeoff to be assumed. Among them was opportunity, meaning that consumers will hold cash for a better future opportunity unless the perceived return on current opportunity can overcome that preference.

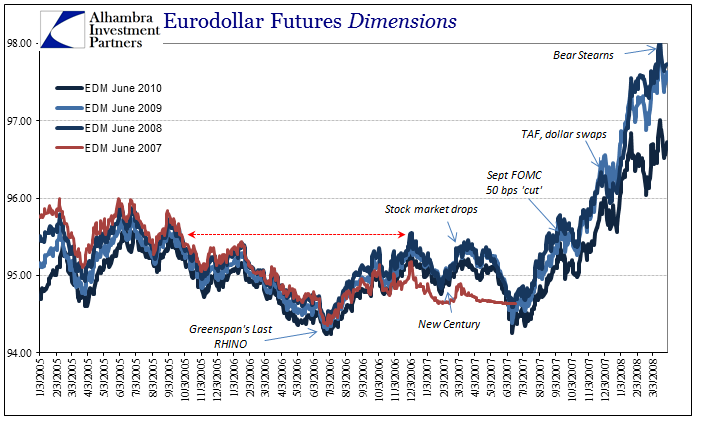

What oil investors in the first half of 2008 missed was, I believe, liquidity preferences, but not those of consumers. They were not alone, of course, as almost everyone did, too, including people like Ben Bernanke who by all rights should have known better (that was his whole job). The eurodollar futures market, for one, had been warning monetary officials for more than a year and a half by the time oil prices crashed (the first time).

Absent opportunity the paradigm shifts, and past a certain critical threshold shifts dramatically and dangerously. There is a balance to where opportunity and risk rebalance entirely from one to the other. It is long before that point where central banks not only are supposed to intervene but had claimed for decades that they would without question.

In the middle of 2008, the desire for liquidity turned truly desperate to the point of panic largely upon the point that oil investors did not foresee – the Fed did not know what it was doing. Markets being forgiving, however, the Fed was given another chance only to similarly squander it. Thus, for liquidity preferences, 2008 was panicked doubt whereas 2011 was resignation. The difference in liquidity preferences between them was merely time.

Having first been shown the error, they then compounded it. Part of it related to the mythical Greenspan put, the idea that if exponential growth didn’t provide sufficient liquidity for exponential growth (this circular reasoning was a core principle) then the Fed would. There were suspicions this wasn’t true throughout 2007 and early 2008, even after Bear Stearns fell, but in July 2008 they found out the hard way it wasn’t ever true…

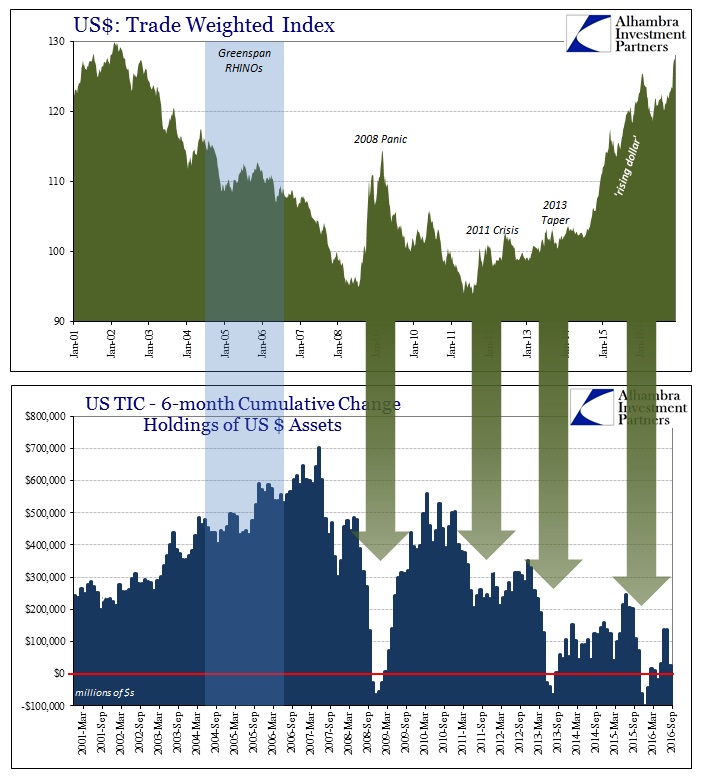

The entire monetary paradigm had been reversed, put upside down. Rapid growth before 2007 was all reward with no assumed risk; lack of growth after 2007 was all risk and increasingly no opportunity for reward. Liquidity preferences redefined, global banks which once only grew by leaps and bounds in the shortest of time frames now shrink at the drop of a hat, the slightest breeze of expected vol.

Two periods in history stand out for those hat drops. The first was, obviously, 2011 and the final confirmation of what was suspected in 2008 (the Fed did not possess a printing press, therefore global liquidity was stuck to be whatever it was). The second was 2014 and that which we refer to as the “rising dollar.”

As stated at the outset, the more people demand something the more it will cost. If that demand is for liquidity as a matter of imbalance against perceived opportunity then the cost or price for liquidity will rise regardless of the fundamental (so to speak) value of whatever instrument that might be best able provide it. The “rising dollar” itself is very much like a short squeeze in exactly the manner described here.

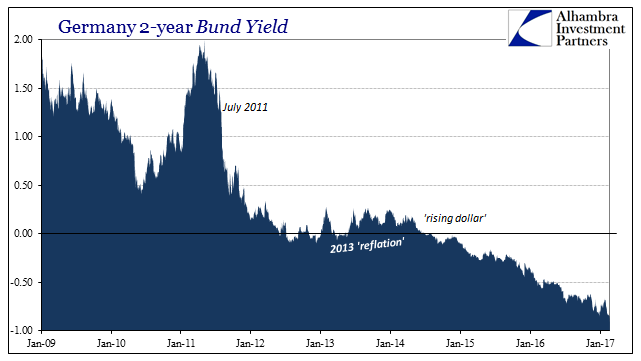

Further, the ability of whatever specific instruments to provide for liquidity preferences will be directly tied to the premium paid for it. That means we can easily observe for any security that meets this criteria how it will be those boosted in price far above its “fair value.” Such as:

Despite “reflation” of late, German 2-year federal paper has kept marching along in nearly a straight line down that goes back in time to the middle of 2014. It is all the more compelling since nothing in finance no matter how well-established and intense ever moves in such a regular fashion. As such, there is absolutely no value in receiving -0.92% in “yield” for holding this instrument, the record low “yield” achieved at yesterday’s close. The value or motive for doing so is derived from other considerations (and not the ECB buying them in QE), considerations put right out in the open on the post-crisis chart for the German 2s.

As I wrote this morning (subscription required):

What you see above is pure liquidity preferences being carried out in a most extreme manner. Financial participants, mostly banks, are buying shorter bunds not because the ECB is or because they are worried about populism, but rather because they know all-too-well why populism has taken root. It is all right there in that chart, going back to July 2011 when everything changed. It is practically the same chart, if obverse, as the pattern we find in eurodollar futures that shows us exactly the same behavior with slightly different proportions and irregularity along the way.

If the euro breaks up it won’t be because of Marine Le Pen in France or Brexit spreading to other nations. The risks to the euro are risks because the global economy has failed, and further authorities have displayed only a determined unwillingness to do anything (of substance) about it. Banks hoard liquidity, driving up its price long past fundamental value, because they are faced with a paradigm of all risk and no opportunity. This perception was driven home in the middle of 2014 in a way that should have been universally recognizable, but still to this day remains obscured by politics most of all (including the politics of Economics).

The possible breakup of the euro is a symptom of the same cause as the growing appeal of populism, which is the same as you see in Chinese money rates. The global economy doesn’t work, the prime element behind those, as a symptom of the still larger cause of an unstable global currency regime that is more unstable and illiquid today than last year.

Therefore, “reflation” should actually be renamed as it is not in the post-2011 paradigm that. Prior to 2011 it was the greater possibility of normal, of overcoming liquidity preferences and not following Japan into a lost decade. After 2011, it has been instead the market giving up on the current decade, recognizing that it will be lost, as it has been, and working out what that might mean for the next one – just how lost will the second be, because it is by these prices all but certain. In the case of German federal yields, it might seem risk to the euro, but in reality it is the risk driven home by the eurodollar.

Stay In Touch