Although he didn’t state it specifically in his November 2010 Washington Post op-ed formally justifying QE2, it was very clear that then-Fed Chairman Ben Bernanke intended it to work through lending and especially the bank channel. Though he doesn’t explain, nor has any official ever, why a second one was needed given that the first was “quantitatively” determined, Bernanke was unusually clear about what he expected to happen for it:

This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth.

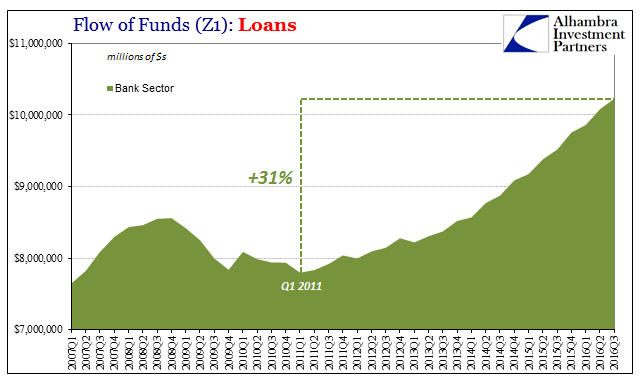

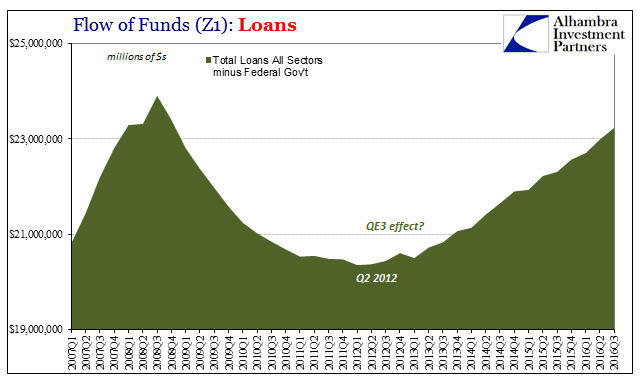

If one is of the mood to be hugely charitable toward QE, you can claim that judging from this narrow benchmark it worked. According to the Fed’s Z1 statistics, bank lending resumed steady growth in Q2 2011. Since that quarter, the total of loans on the books of depository institutions has increased by 31%. It is unclear if QE was the motivation for that change, or perhaps it was the 2011 crisis which might have convinced banks to get out of the money dealing business so as to at least get back to the lending business, but again if we are being purposefully favorable we can attribute it to the Fed’s signature monetary policy.

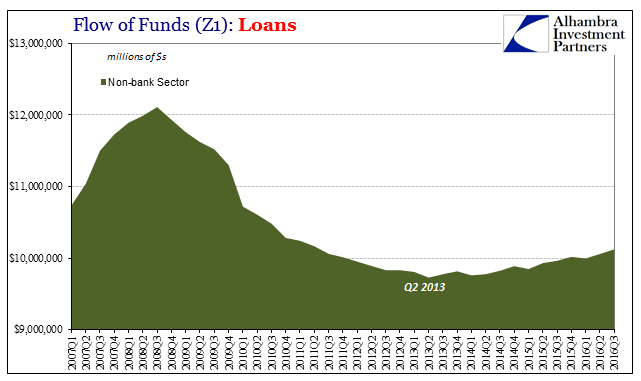

It took a little while longer, and another two QE’s, for the other financial sectors to follow what banks were doing. The non-bank sector, after shrinking precipitously after the panic (Q3 2008), finally resumed positive numbers in the middle of 2013. Like the bank sector, it isn’t clear what motivated the change as that time period like 2011 was characterized by not just additional QE’s but also a great deal of financial turmoil.

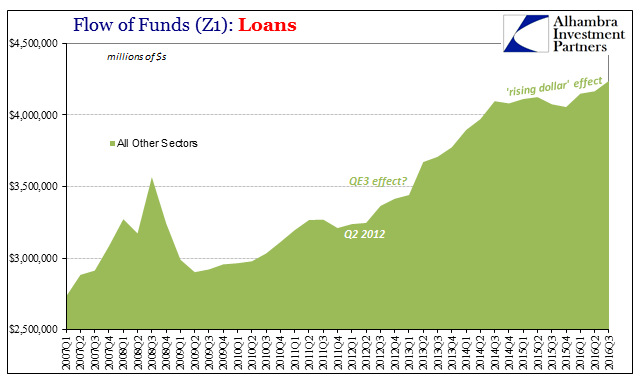

The rest of the economy contributed positive loan growth in greater appreciation, though once again the inflection coincides with a prospective QE as well as a great many economic and financial questions (maybe lending doesn’t work the way it is theorized?).

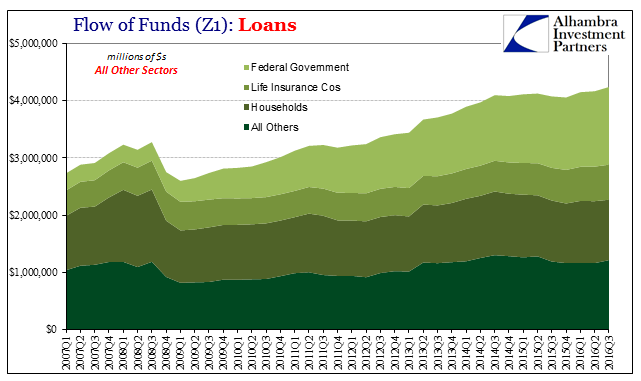

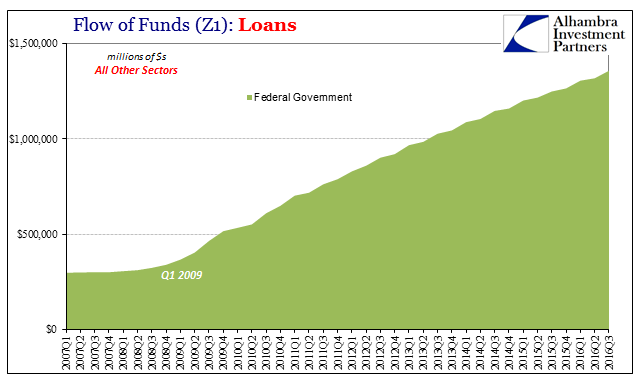

Overall, then, loan growth has been restored and chiefly in total around the middle of 2012. We need only make one further adjustment so as to potentially give Mr. Bernanke as much credit as humanly possible. Though it is conventional wisdom to cite the end of fiscal “stimulus” being the end of the ARRA, the federal government has been heavily involved this entire time if through an unexpected method. The amount of loans, primarily student loans, possessed by the various responsible agencies has been steadily growing all throughout. According to Z1 statistics, the feds as of Q3 2016 have issued and still hold about $1.36 trillion in loans.

Though that can’t be credited to Bernanke’s ledger, even if we back out this fiscal “stimulus” we find a hard inflection in the rest of total lending right in 2012.

While all orthodox expectations posit a positive relationship between credit growth and economic growth, in this instance that has clearly not been the case. In other words, the moment in which Bernanke was possibly the most successful with QE is the very moment the US and global economy slowed down considerably, and from that slowdown it has yet to emerge almost five years later.

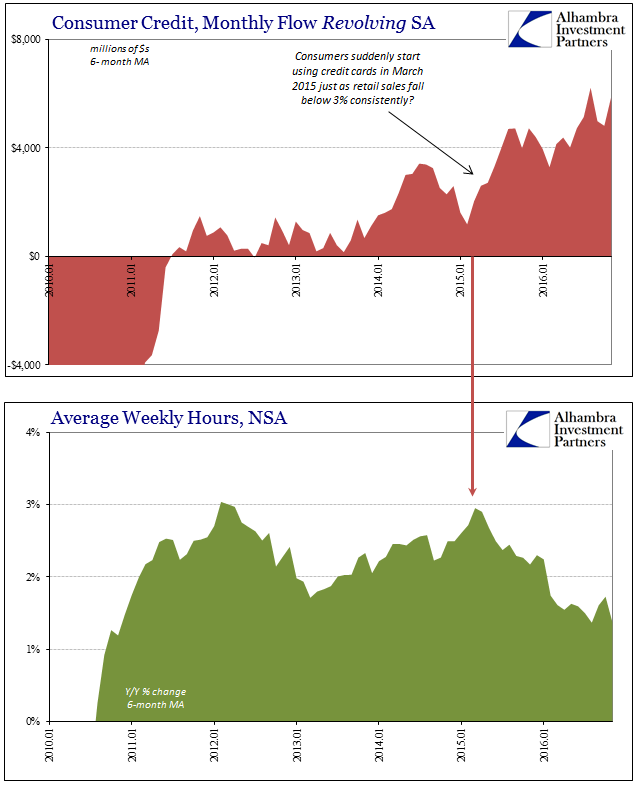

Obviously, there have to be considerations about the distribution of all this new lending, and therefore in the new proportions that have been established it is quite likely that the slowdown is explained or at least consistent (leveraged loans to oil exploration companies vs. subprime mortgages, for example; the economic effects between them will be drastically different). But even since early 2015 we find consumers renewed love affair with credit cards coincident to an even further slowdown beyond the one that took hold in 2012.

Debt is back, deleveraging dead, but it has contributed absolutely no positive difference. There must be something missing from all this whereby QE could have been successful in fostering the restoration of lending but not recovery. This failure applies equally to the federal government’s student loan experimentation, as well, if not more so since it has doomed students captured by it to a great deal of debt with little opportunity to get out from under it (recognizing still the freedom of prospective students to choose another way).

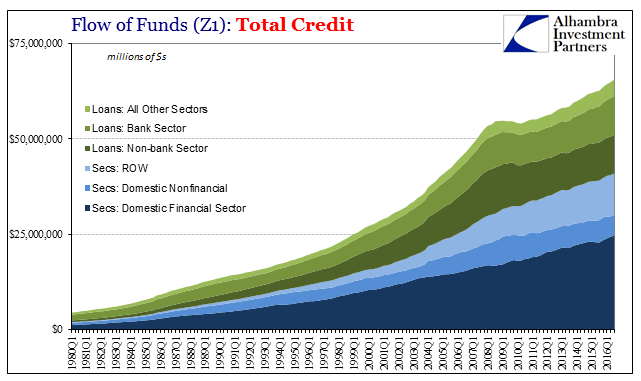

Since the level of debt securities has, too, been rising the total injection through all credit channels in the US economy is perfectly clear. In that way, we can attribute record debt of all kinds (acknowledging that mixing securities with loans double counts some items) to all monetary “accommodation” including ZIRP and continued low interest rates, and it still misses “something” big.

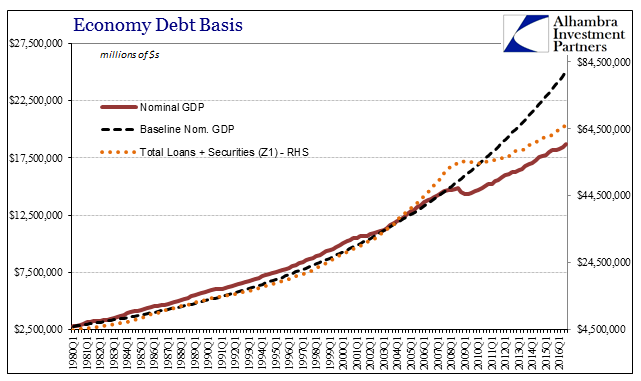

The answer is, of course, that rising debt is not the same as restored debt. Though it may be growing, it is not anywhere near what would have been necessary to create a recovery in this same economic format. For that we can thank only what I noted yesterday was clearly yesterday in delineating linearity from non-linearity – the eurodollar basis that provided the means for pre-crisis rates of debt growth. Therefore the rupture in total debt of all forms is as the rupture in economy, almost perfectly illustrated below:

What we see by this exhibit is that no matter what Bernanke did or how successful (arguably) he might have been in doing it, it was never going to be enough. There was a factor bigger than one the Federal Reserve or all the world’s central banks could ever overcome. It all simply proves that credit without global money just equals depression even at record levels and seemingly robust rates of growth. Maybe “stimulus” stimulated lending and debt, but that just isn’t the same thing as a complete economic process. As I wrote in early February:

The fatal [eurodollar] flaw that was considered in 2007 (rather than LTCM 1997) but proven beyond doubt in 2011 was that so long as whatever bank liability any eurodollar bank might create was considered currency, further balance sheet expansion would thus create all the “dollars” necessary to fund it. Thus, that fatal flaw was its circular reasoning, that balance sheet expansion created “dollars” which funded balance sheet expansion, creating more “dollars” and so on. Remove the expansion and the inconsistencies, risk primarily, implode the whole intent.

Ben Bernanke’s intent was to rebuild the system through debt so that the economy would look like it did in 2005 minus the housing bubble (which authorities believed they could take care of with “macroprudential” policies). The clash of Bernanke’s intent with the eurodollar system’s has been settled, just not in the way he or any economist expected. Rather than appreciate these opposing forces for what they were and are, economists instead have decided that heroin addicts and retirees (not mutually exclusive) were instead to blame all along. So long as that belief persists, this same opposing dynamic will continue where record debt will be added (globally) further to an economy (globally) increasingly unable to support it.

Stay In Touch