In the early trading on Friday, it looked as if “reflation” might break down entirely. The flurry of information seemed to be uniformly bad, from Syria to payrolls there wasn’t much for optimism to remain relevant. All of a sudden, however, it all reversed so that trading in the latter part of the day was as if related to an entirely differently world.

Such trading reversals are not unheard of, and usually they are a sign that a trend or established intermediate direction might be ready to go back the other way. Whether buying or selling, an intraday capitulation can be a signal of a temporary end.

Though that is how it worked out in the raw data streams of eurodollars, bond yields, and most especially the Japanese yen, there was something different about it all that to my view suggested not a meaningful intraday reversal but instead an artificial intrusion (subscription required).

Thus, if “reflation” breaks down more completely, it would be China that might experience the most in the backlash from it. Not to depart into the realm of conspiracy, but who might have had motive to intervene in “dollars” on Friday? It might have been the market all on its own deciding to toggle risk despite all the breakdowns being presented at that moment, or maybe it was the hint of “somebody” trying to keep alive at least the balance that has persisted since December because if nothing else volatility is everyone’s enemy (except bond bulls and eurodollar longs).

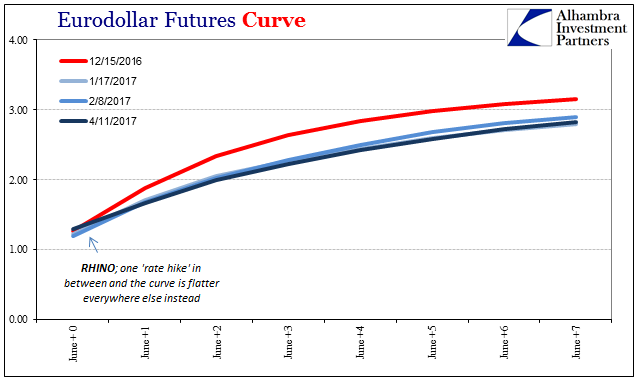

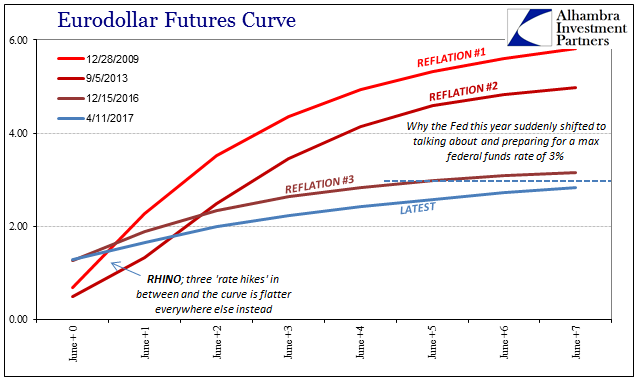

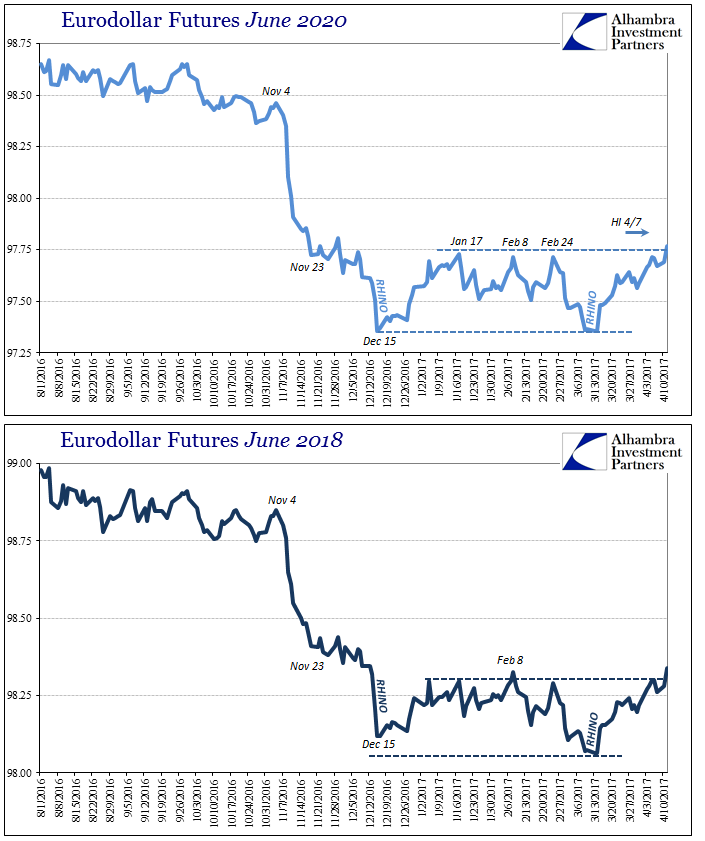

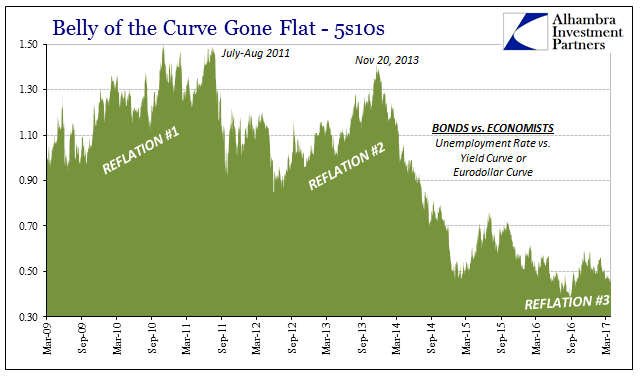

It turned out to be (so far) just a one-day reprieve, as yesterday trading slid back against “reflation” before today’s session put the exclamation point on it. Eurodollar futures are up across the board, including more contracts toward the front end. Most of the buying attention is still focused on 2019-2022, the very maturities that define best longer run expectations. Since mid-March, significant flattening all over again.

The latest curve, despite an additional “rate hike” in between, has submerged below the last flat point on February 8. The current price of the June 2020’s is today only slightly less than the intraday high on Friday, again suggesting the breakdown of “reflation” and therefore whatever little topside probability was included in it.

This latest move dates back to the last RHINO, which for many is “wrong” or a “distraction” because these markets, they say, don’t understand that the FOMC is more “hawkish” than they might be taken for. These same people seem unable to appreciate that these markets don’t really care all that much one way or the other. As I wrote last week:

What drives UST yields or eurodollar futures prices is therefore not “hawkishness” or “dovishness”, but rather perceptions about whether “hawkishness”, “dovishness”, Trump, or even Paul Krugman’s fake alien invasion scenario will amount to anything positive and the significance of it. It is the translation of current conditions into considerations about the future, captured in prices and yields – the actual discounting of information, of which monetary policy is only a (variable) part.

The Fed’s “hawkishness” is in a way working against “reflation.” What it truly says is nothing about the economy, for they aren’t “raising rates” because conditions are actually improving (what used to be called risks of “overheating”). The FOMC has voted three times now to get out of the economy business simply because they finally realize there is nothing left that monetary policy can actually accomplish. If you really listen to what Fed officials are saying, they dance around it but even Janet Yellen at her last press conference at one point more directly stated this is the pitiful economy we have.

Therefore, the eurodollar futures market is left to consider what that might mean in terms of future conditions, where the Federal Reserve satisfying no one or nothing but their own models of the output gap sees no gain for future “stimulus.” Some part of “reflation” may have begun last summer on the hopes that with central bankers finally getting it on QE they might move on to something with an actual chance of success. “Hawkishness”, then, categorizes the Federal Reserve as one central bank that won’t be trying anything else, different or not.

That leaves hope drawn from either foreign central banks doing different, or Trump. As to the former, there isn’t much to go on there even though unlike the Fed the ECB, BoJ, and PBOC are all still quite busy. As far as American fiscal transformations, the Trump agenda, so to speak, remains still unspecified with a much tougher road ahead than perhaps most realized when Mr. Trump was first elected. There is a very real possibility dawning that not much will get done at all, and therefore nothing much will really change in 2017 and beyond.

It was the payroll report on Friday that really hit home in this one important aspect. If nothing changes as far as policy at either end, then the economy truly will be left in this decrepit, paralyzing state. Economic statistics are marginally better so far this year than last year, but not emphatically so which is itself saying something given that the base comparison for last year was pretty close to recessionary conditions. A weak payroll report is by itself nothing but noise, though in this case it was actually consistent with this current and chronic weak state.

Despite all of this and the harmony from economic statistics to market prices, including eurodollars and UST’s, the two deepest and most functional markets in history, the idea that “interest rates have nowhere to go but up” persists.

In overseas markets, more than $3 trillion of negative-yielding government bonds — which all but guarantee losses for buy-and-hold investors — have turned positive in recent months. And analysts say that number may grow over the next few years as brighter economic prospects and shifts in monetary policy lift trillions more out of sub-zero levels in Europe and Japan.

Forgive us all if we don’t immediately run blindly toward “brighter economic prospects.” The burden of proof long ago shifted squarely onto these kinds of people still in 2017 making these same kinds of naked, unsubstantiated claims. I wrote back in September 2014 about the then-obsession with similar non-specific brightening:

Someday there may indeed be a pick-up in global growth, though we will probably need all our fingers (and some toes) to count how many “unexpected” occurrences disrupted that “pick-up” over the years to come. And when it does come, there will be no need at all for vagueness about its features, as it will be obvious and unmistakable. Until then, these poor attempts at rational expectations manipulation should have been curtailed by now by even a modestly curious media that is sick of writing the same lines over and over. In other words, when global growth actually does happen it won’t be much talked about, and certainly not to the unceasing degree of the past seven years.

The reason no one will talk much about it is because when it actually happens pointing it out won’t be a requirement. That’s what ails “reflation” over time, for the longer it goes where “brighter” prospects are still implied rather than widely observed the more likely it is “reflation” deserves one more time the quotation marks. And in 2017, unlike 2014, not even the Fed, the most optimistic of optimists, believes there is much of a better economy coming.

Stay In Touch