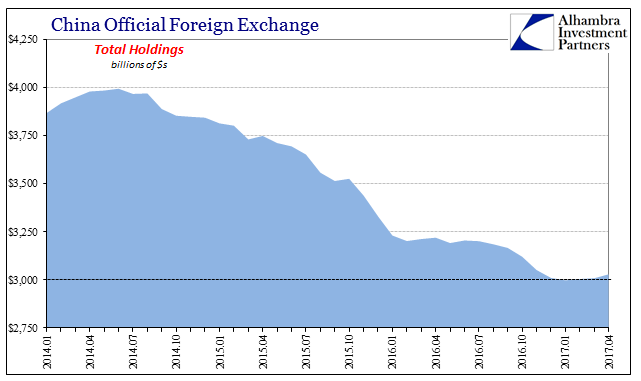

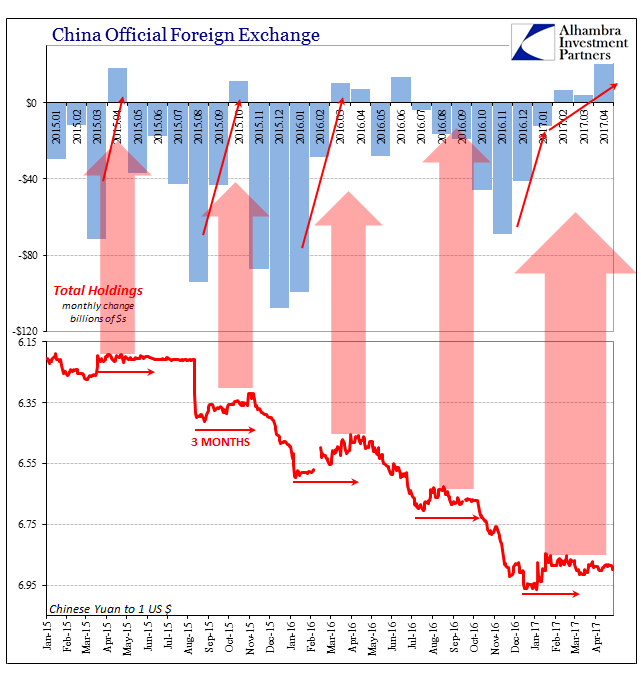

Earlier this month, China’s State Administration of Foreign Exchange (SAFE) reported a large increase in official reserve holdings. The biggest “inflows” in several years has, as you would expect, led to much optimistic commentary suggesting if not outright stating that the currency problems are no more. It is not the first time such claims have been made, as this has become as regular a feature as CNY “devaluation.”

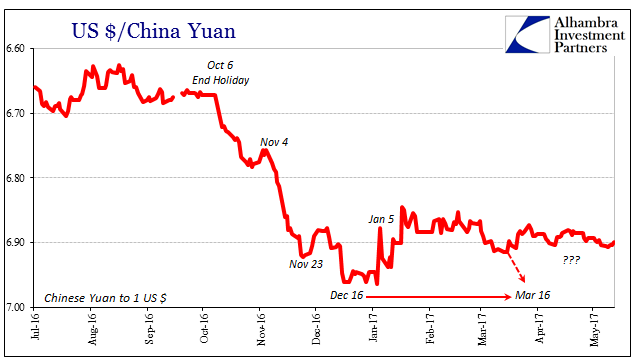

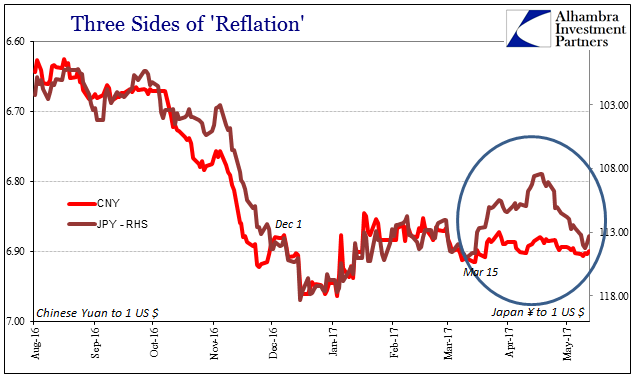

Except in the more recent case, the Chinese yuan has stuck to its level around 6.89 – 6.90 for already two months longer than the “ticking clock” had otherwise proposed. Though it is difficult to say for sure when the clock last started its countdown, it was in all likelihood around December 15/16.

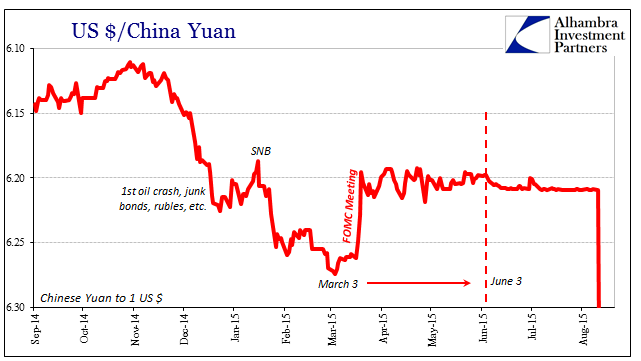

It is not the first time the PBOC has pushed past into overtime, as it were, having done so first in early 2015 and creating some of the most interesting (to put it mildly) interim conditions of the whole “rising dollar” period. Exactly what China’s central bank is doing in the “dollar” markets during these extra sessions is not known, and likely never will be known.

While we may struggle with the lack of relevant information, we can, however, reasonably speculate as to the central bank’s motivations. Then as now the PBOC had great interest as well as what appeared to have been (and appears to be today) an open invitation to try to manipulate conditions into seemingly calm markets. That is especially true of CNY, where a stable currency coupled with “reflation” in this case and “transitory” in that prior one could plausibly (though not really) have signaled a way out of the economic as well as financial mess.

The central bank like many others like it react to round numbers and even levels just as market participants often do, and in the case of Chinese “reserves” the PBOC may have had additional motivation for its additional “dollar” intervention (forward, not traditional) these past two months. In early March, SAFE had reported that official “reserves” fell below $3 trillion for the first time, an added psychological pressure published just as the “ticking clock” approached.

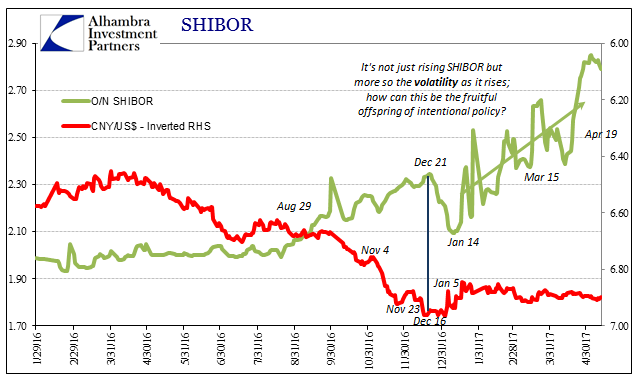

With China’s economy at least appearing more stable, the last thing authorities needed was more pressure on it due to resuming CNY fluctuations. But for every action there is a reaction, including potentially heightening “dollar” pressure once those December 16 forwards (or whatever they were; term repos, perhaps multi-leg swaps) expired around March 16. In RMB markets, we see the pressure as exploding SHIBOR and repo rates (which the media attributes, as always, to intentional PBOC “tightening”).

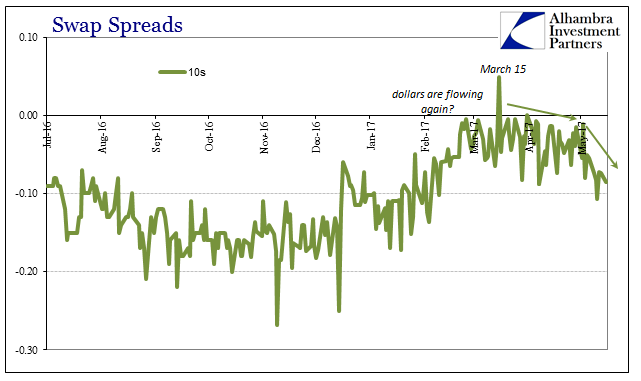

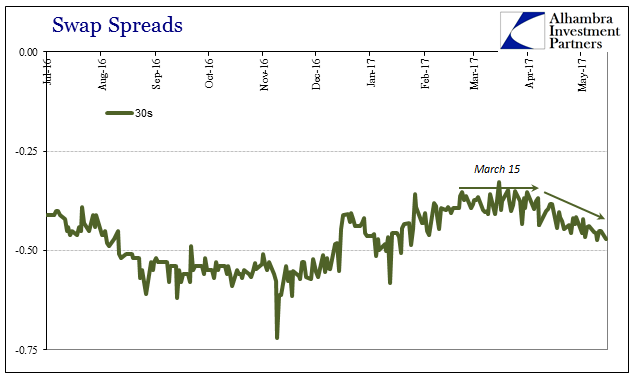

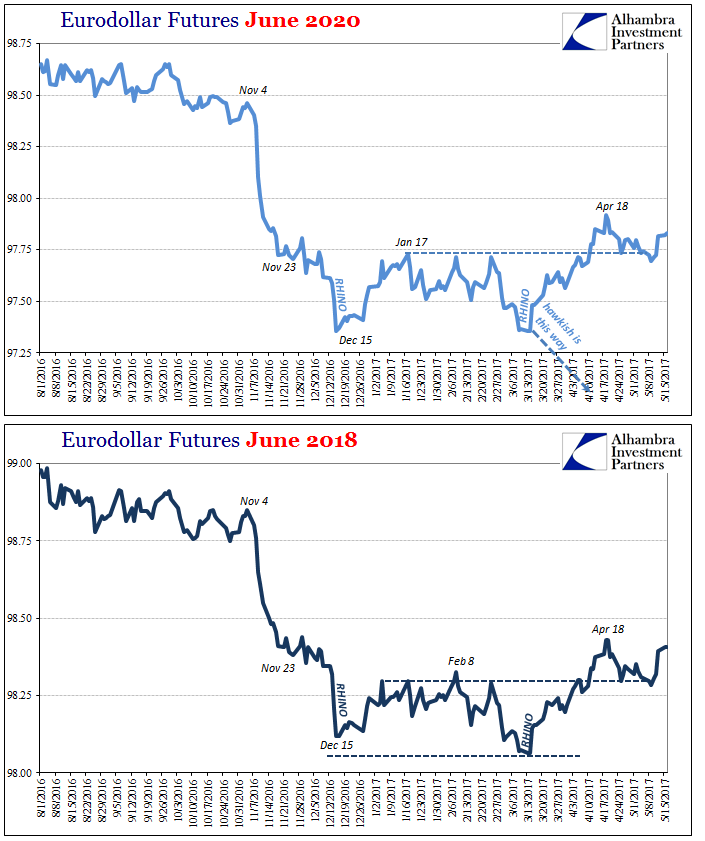

There is some potential for confusion given these specific dates, December 15/16 as well as March 15/16. Not only do they relate to CNY movements, they are close to each of the last two RHINO’s (rate hikes in name only). Therefore, it under more traditional (and inappropriate) understanding might propose that the “dollar” tightening (balance sheet capacity) suggested by swap spreads since mid-March is merely the derivative market’s corresponding response to the increase in the federal funds range that is still referred to as “tightening” of US monetary policy.

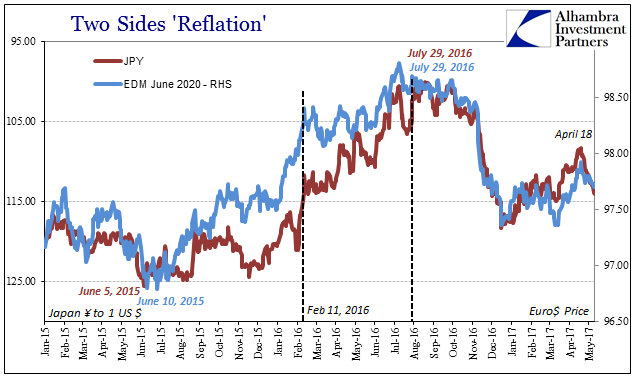

But we know through other markets like eurodollar futures that is not the case, as no matter how “hawkish” policymakers make themselves appear to be on any given day that market in particular has traded in the opposite direction. In other words, it has been more like 2015 again if in a much smaller dose (to this point), where swap spreads suggest private “dollar” tightening in balance sheet capacity and eurodollar futures the corresponding negative future consequences of it, all wholly unrelated to the Federal Reserve.

Again, it is action/reaction which for a time in 2016 and up to early 2017 seemed to have put JPY in the center of all market liquidity (especially after BoJ’s dollar intervention on July 29). Since around March 15 this year, the relationship remains but has been severely tested, particularly the last few weeks where JPY has dropped once more (“reflation”) but UST yields, eurodollar futures, and swap spreads have almost completely resisted the direction.

Faking “dollar” calm can only happen with great cost, costs that aren’t necessarily directly related to the manner in which the intervention is being conducted. In other words, at some point these costs have to be accepted by often markets and parts of markets unrelated to the origin. It might regularly fool the media, but it doesn’t fool these markets. “Reflation” may have seemed like a good opportunity, but like the “transitory” months of spring and early summer 2015 it really wasn’t.

From time to time things appear to be different, but they seem different only in the same kind of ways they looked different before; meaning that they aren’t actually different, just repeating the same everything over and over. Short-term noise aside, over the long run the noose (or ratchet) only tightens.

Stay In Touch