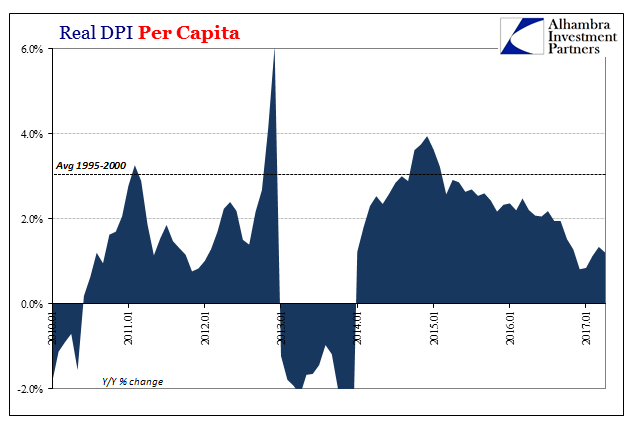

If economists are hoping for more than signs of wage acceleration, revisions to the Personal Income data series are going to make it that much harder to justify still seeing them. Income was revised lower across-the-board. The base effect of oil prices that had been supporting “reflation” may have had the opposite effect on consumers. In common sense terms, consumers don’t much like even a temporary burst of commodity pressure, no matter if it nothing more than comparisons to a trough.

In the real world, most people rather enjoyed ultra-low gasoline prices early last year. Though they are still much less than three years ago, prices in 2017 are significantly higher than 2016. Nominal incomes, however, have not budged. No matter how low the unemployment rate goes, there isn’t actually the slightest hint of “full employment” or the end of labor “slack.” Therefore, even a temporary burst of commodity base effects can be damaging.

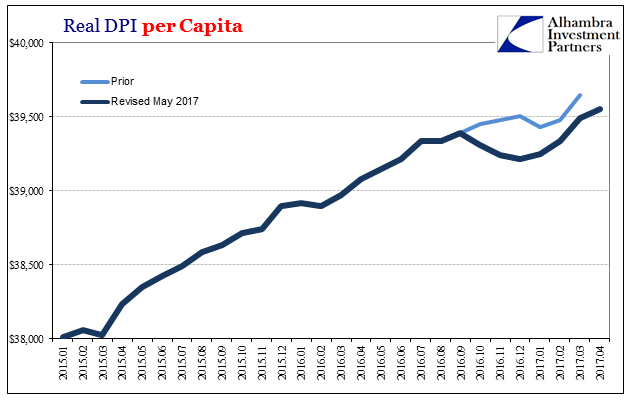

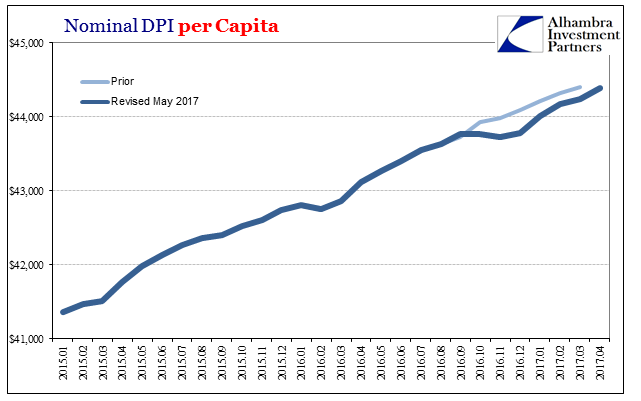

What was revised by the BEA was the level of that price pressure damage. Incomes in real terms were revised quite a bit lower from October 2016 forward – the period when oil price pressures were entering their maximum effect.

Revisions were not strictly oil price artifacts, however. Nominal incomes were reduced, as well, likely in response to what is surely the persistently slowing labor market. Again, the unemployment rate is misleading as both a longer-term indicator of economic standing as well as a short-term one about the current state or direction of employment.

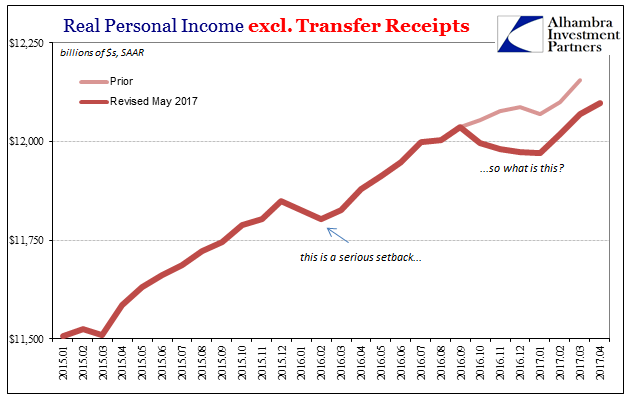

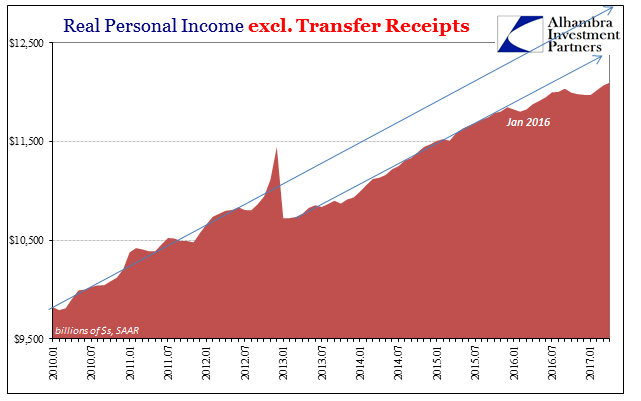

While the revisions overall are not huge, they are significant as further indicating the persisting economic weaknesses in 2017. The problem is best illustrated by Real Personal Income excluding Transfer Receipts (RPIX). As noted in the past, this is one of the four major data points the NBER uses outside of GDP to analyze potential cyclical peaks. And while no recession may yet be indicated in this data series, the revisions to it suggest far too much in that direction.

Starting in January 2016, right at the worst of “global turmoil” elicited by the “rising dollar”, RPIX for two straight months dropped in seasonally-adjusted terms. Such declines are rare and suggested at the time the seriousness of the downturn then in effect; if the “rising dollar” was producing that much of a negative effect on the global economy so as to disturb the trend in RPIX, then though it might not have been recession the period was visited by something a little like it.

As you can see above, however, revisions to the data show that starting in October 2016, just as the world was in full throat over “reflation”, the deviation was even worse this second time than the first during near-recession. Undoubtedly that was/is due to the subsequent combination of slowing labor utilization produced by the downturn plus the inconvenient base effects in real terms of oil prices.

The real problem with these deviations is that unlike past experience they become cumulative. For workers, and therefore consumers, incomes were knocked off-track by that downturn and then never recovered; just as incomes had never recovered from the dislocation of late 2012 (which was only partially about the tax code). Starting October 2016, RPIX shows income growth as becoming worse still, further away from either trend-line, and thus an even greater effect on consumer prospects (likely explaining weakness in sectors like autos).

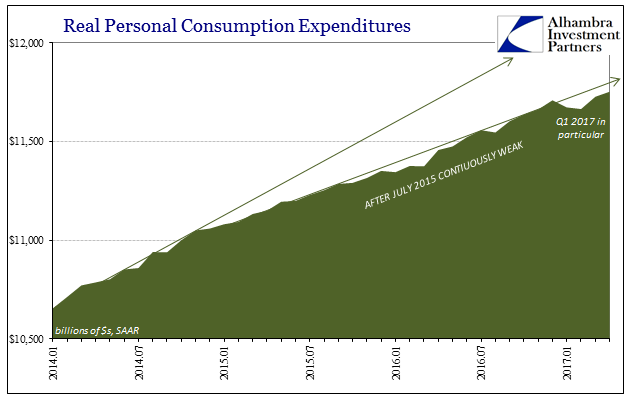

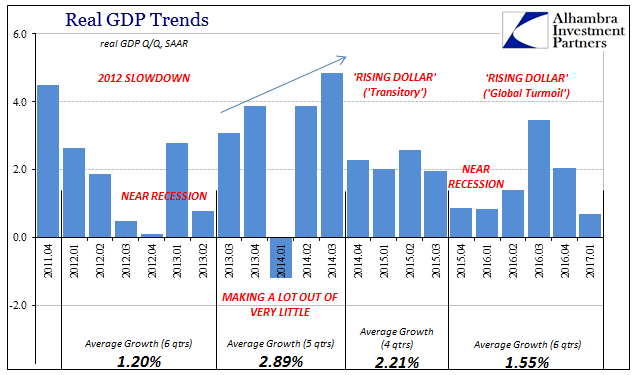

In this particular case, we can observe at the margins the feedback mechanisms involved in something like the “rising dollar.” Consumers cut back on spending when it first appeared and then they became (after July 2015) more erratic while doing so. It should have then been of little surprise that the labor market at least started to slow with that noticeably more cautious consumer environment. By Q1 2017, the confluence of these trends produced yet another weak quarter that somehow shocked the mainstream as if all these conditions were unknown at the time (these latest revisions didn’t reveal so much as highlight them).

It’s not recession but far worse. In a business cycle weakness gives way eventually to strength; in this economy weakness produces further weakness. Economists and the media keep expecting the former while in reality there is only the latter.

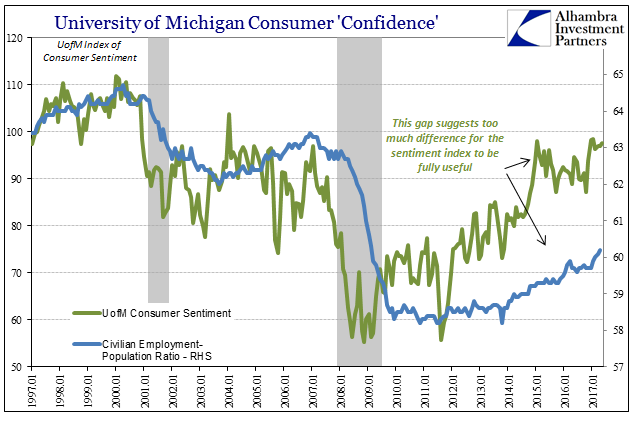

These results contradict a lot of mainstream theory about expectations and the potential for managing them (largely by monetary policy). Since 2014, measured consumer confidence has twice exploded higher. The first instance occurred that year as the unemployment rate fell, but so did the trajectory of Real PCE. The second was the Trump/”reflation” burst of late 2016 that occurred again as marginal spending went the opposite way. Consumers quite rationally grow cautious while stating the opposite about “confidence.”

This is the legacy of the “maestro”, where “we” can’t make sense of where we are because it just doesn’t seem possible. There is no way that the Federal Reserve, once the standard for all technocratic excellence, could let this happen. Even the QE’s to some degree fall under this cultish existence, for trillions in money printing have to show up somewhere at some point. It can’t be that all the worst cases merge together; that the Fed could totally strike out like that, and the economy stuck without expansion for a decade and more. Who ever heard of an economy that just shrunk?

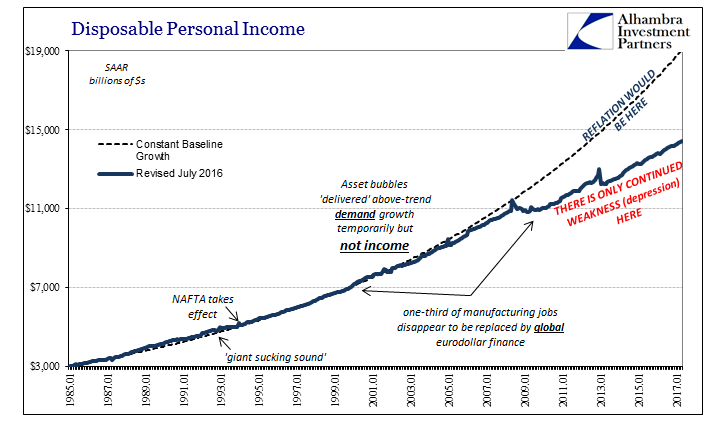

We are stilling dealing with the effects of the Great “Recession” because it wasn’t ever a recession. In describing it like one, however, people get the sense that eventually the economy might start acting like it was; even if it takes ten years or more to realize the full cycle. It’s dissonance only in the respect of expectations, as consumers, at the margins, clearly act very differently than they claim to survey takers. With these income revisions, we can appreciate why because that part at least has been rational. Had the Great “Recession” actually been one Disposable Personal Income would have been for the first time $19 trillion in April 2017; it was instead just $14.4 trillion. Americans may not be completely aware of that difference, but they do act on notice of the $4.6 trillion that has been lost.

Stay In Touch