Writing earlier this year on the topic of the Fed’s future balance sheet reductions, Ben Bernanke had occasion to recount his experience from 2013. It was a stressful time for the Fed after they panicked into QE3 (and then QE4) and then almost panicked right out of it. The then-Fed Chairman stressed from his experience the importance of communications as a means to, as he sees it, maintain control.

When, as Fed chair, I indicated in testimony in 2013 that the FOMC was considering slowing asset purchases if economic conditions improved sufficiently, the markets responded with a “taper tantrum” that included sharp increases in volatility and a rise in longer-term rates. Much of this response came through the signaling channel, as some market participants inferred that slower asset purchases also implied a more-rapid increase in short-term interest rates. The taper tantrum calmed after FOMC members pushed back on that incorrect inference, emphasizing that short-term rates would remain low well after asset purchases were phased out.

This is demonstrably false. Interest rates as well as yield curve flattening continued right on through with actual tapering, and then did even more so for nearly two years after the last balance sheet expansion purchases were conducted in October 2014. In other words, the bond market did more of what he calls “stimulus” without it than with it. Therefore, his explanation for how interest rates unfolded in that period just doesn’t hold up.

What the bond market initially reacted to was what he said only in passing; “if economic conditions improved.” In the middle of 2013, it appeared then, as now, as if the US economy had weathered the 2012 slowdown and with the assistance of QE3 might have been put right onto the path of, for financial markets, normalization. That the Fed was even thinking about tapering a mere seven month into what was supposed to be open ended raised the possibility that at least officials were seeing meaningful improvement on that count. It was the view held by both the stock market as well as bonds.

Before the calendar page ever turned from 2013, however, bonds and stocks departed company, so that the year 2014 was a good one for both so-called bulls and bears. We have again arrived at this same point of departure.

Markets are handing rosy returns to optimists as well as pessimists. History tells us it ain’t going to last.

The march higher in global stocks this year is being tracked by rallies in gold, the yen and bonds — traditional haven assets. There are plenty of reasons being cautious is paying off: politics in Washington is fractured, tension on the Korean peninsula is rising and worries have revived about low U.S. inflation. That’s not been in the way of equity bulls who have driven up the value of stocks worldwide by more than $10 trillion in the past year.

I am often asked how this can occur, could ever occur, where bonds signal greater distress while stocks signal the exact opposite case. How can markets come to such drastically different conclusions about the state of the world in the close on future?

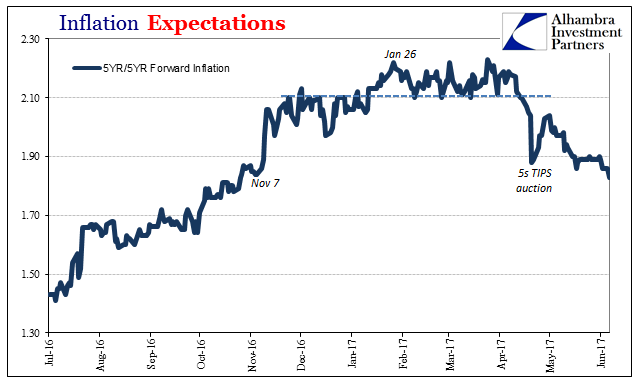

For the first part, what the Bloomberg article describes as reasons for caution are as usual off-the-mark by more than a little. The way it reads, intentionally I’m sure, is that stocks are pegging the economy while bonds are worried about mostly non-economic risks to it. I think this is almost completely backward. The one exception in the article’s catalog is inflation concerns, which means one measure of the basis for any potential sustained economic advance.

The economy of QE3 never lived up to the hype; the “rising dollar” saw to that. Meanwhile, it was the bond market, along with other markets like interest rate swaps and eurodollar futures, that were already trading, contrary to Benanke’s self-referential explanation, in anticipation of monetary trouble ahead. His successor Janet Yellen as well as economists began to talk more about “overheating” while bonds were trading for illiquidity and more so the downstream implications of another bout of it – which, incidentally, did happen.

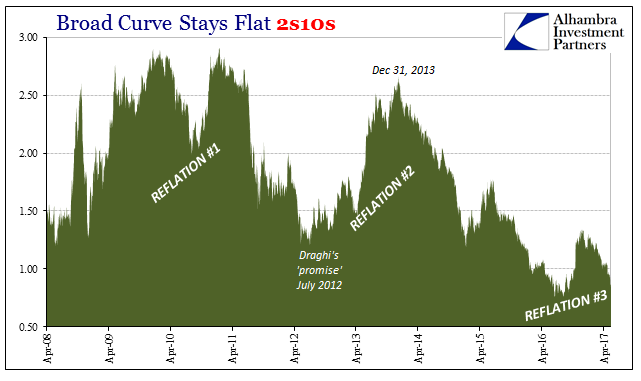

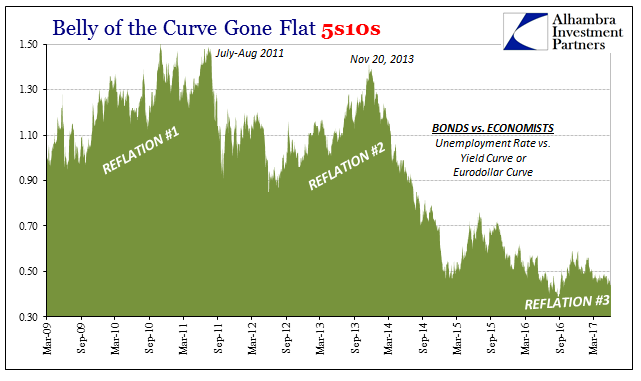

The lack of any inflation acceleration, particularly through the wage channel as the unemployment rate drops, is a crucial indication that monetary conditions though relatively better are overall mostly unchanged. This would not be unanticipated by these markets, as any comparison of the yield curve, swap spreads, or eurodollar futures plainly shows much more starting pessimism under “reflation.” We cannot ignore this plain difference of degree though repeating as it might be in pattern. I wrote back in December:

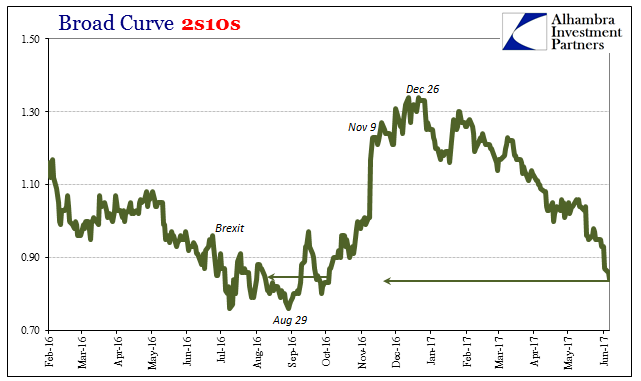

This latest market, by contrast, comes up seriously short in all those respects. Not only has the entire UST curve shrunk due to the monetary eurodollar tightening under the “rising dollar”, even in this latest selloff nominal yields are rising but the curve isn’t steepening let alone exploding. The further out you go, where the real economy is far more of a factor, the less vibrancy is indicated as to what might be beyond the short run. The 5s10s, perhaps the most important part of the yield curve overall, isn’t any steeper today than it was to start the year amidst obvious global financial, economic, and monetary turmoil.

Indeed, the yield curve across its segments has in the almost half year since collapsed back to levels last seen at the extreme lows of last summer. Nominally related prices, like eurodollar futures, aren’t quite reset to those levels, yet, but are moving noticeably in that same direction, paying off once again for, as Bloomberg notes, pessimists.

The stock market, I believe, is justifying that same QE3 delivery fro 2014, only without a QE3 this time. It seems to me sheer rationalization that because conditions have been so atrocious economically for so long that things must go right at some point even if by random chance. That appears the basis in 2017 without even the “stimulus” excuse provided by economists and policymakers (the latter no longer sees even modest expansion, let alone overheating). Since the world is stuck so bad right now, what would a rally look like if it suddenly changed toward a truly positive condition? Better to get ahead of even an inexplicable burst of economy on the inappropriate amplification of the most flimsy evidence than to miss out if waiting for it to be confirmed by legitimate improvement (FOMO).

For anyone who remembers, this is eerily reminiscent of the late 1990’s, only shifted downward by ten years of depression. Stocks in the late dot-com era were rationalized at similarly extreme valuations based on perceptions of a new plateau of prosperity that supposedly Alan Greenspan’s Fed had conjured out of minor fine-tuning of the federal funds rate. There was then only conjecture about that future economic condition, too, so every small positive was taken to be evidence that you shouldn’t wait or else risk missing the big rally as the economy shifted from merely good to permanently awesome. Thus, the market created the rally in anticipation of an economic shift that wasn’t coming (and was, in fact, quite ridiculous).

Those incorrect assumptions were eventually corrected by the dot-com bust. The stock market in 2015 and early 2016 was presented the same debunking about the QE3 mythology, though in far more minor dimensions. That rally ended in the “rising dollar” (and aggregate earnings that are still almost three years later less than that point of departure) not in rebirthed prosperity, as the bond market and eurodollar futures warned. That we are now back at much the same crossroads isn’t all that surprising. History rhymes repeatedly.

Stay In Touch